Percentage Of Credit Used

The amount of credit you usealso known as your credit utilizationis another very important factor in calculating your credit. Remember: just because your credit card has a $10,000 limit doesn’t mean you should use all of it. VantageScore recommends keeping your balances under 30 percent of your total credit limit.

What Is A Business Credit Score

Now that we see how important business credit scores are, lets define them: A business credit score is a number, representing the likelihood your business will be approved for funding.

This is similar to, but not the same as, a personal credit score or personal FICO score. Most people are familiar with the concept of personal credit scores. There are a few key differences between these and business credit scores. For personal credit scores, the ratings range from 300 to 850, with most lenders requiring a minimum score of at least 600 for a personal loan.

Business credit scores range from zero to 100 and most small business lending companies require aminimum business credit score of 75. The Small Business Administration , banks, suppliers and other business lenders rely heavily on business credit scores and FICO scores when providing lines of credit or extended payment terms.

How To Get Excellent Credit: 5 Expert Tips

1. Always pay on time. Always.

Payment history heavily influences your credit score. In fact, it is the most influential factor for FICO and VantageScore.1 To stay on top of your payments, set up a calendar reminder or enroll in automatic payments. The on-time payment goal applies to all your bills, including utilities, rent and cell phone service.

What if you were late on a payment a few years ago? While late or missed payments can stay on your credit report for seven years, the impact on your credit score decreases over time. Most negative items have little impact on your score after two years2 so be patient, keep making timely payments, and youll soon be on your way to an excellent credit score.

2. Optimize your credit utilization ratio.

is another key piece of your credit score puzzle. Credit utilization measures the balances you owe on your credit cards relative to your cards credit limits. Its calculated on an overall basis .

The general rule of thumb with credit utilization is to stay below 30%.3 This applies to each individual card and your total credit utilization ratio. Strategies for improving your credit utilization ratio focus on reducing the numerator and managing the denominator .

Try one of these techniques to improve your credit utilization ratio:

3. Regularly monitor your credit scores for inaccuracies.

4. Be strategic about taking on new debt and closing accounts.

5. Consider your credit mix.

You May Like: How To Remove Inquiries Off Credit

How To Get An Excellent Credit Score

If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score.

- Make on-time payments. Payment history is the most important factor in your credit score, so its key to always pay on time. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. .

- Dont open too many accounts at once. Each time you apply for credit, whether its a credit card or loan, and regardless if youre denied or approved, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Try to limit applications and shop around with prequalification tools that dont hurt your credit score.

Using Business Credit Scores

Although most start-up businesses must rely on personal credit for initial financing and use personal assets like homes for collateral, it is a good idea to establish a business credit score as quickly as possible to limit personal exposure. Create a business credit profile by separating your business credit from your personal credit.

Use only business credit cards for business expenses and do not mix personal and business credit cards. Keep your financial records, tax information and insurance coverages separate and you may even want to consider using separate banks.

If your business is just getting off the ground, youre probably lending money to your business from your personal finances and recording it as “loans from officers.” Once you have been in business for a while you will want to establish separate credit for your business. This can limit your personal liability and improve your ability to secure a business loan.

Recommended Reading: Aargon Agency Settlement

Length Of Credit History: 15%

Your credit score also takes into account how long you have been using credit. For how many years have you had obligations? How old is your oldest account and what is the average age of all your accounts?

Long is helpful , but a short history can be fine too as long as you’ve made your payments on time and don’t owe too much.

This is why personal finance experts always recommend leaving credit card accounts open, even if you dont use them anymore. The accounts age by itself will help boost your score. Close your oldest account and you could see your overall score decline.

Habits Of People With Excellent Credit Scores

Want to improve your credit score? Take a page from the best. People with excellent scores know that following a few basic rules is the key to success. Adopting their habits could boost your score into the stratosphere, opening the door to the best interest rates and terms on loans. And capturing the lowest loan rates can save you a bundle of money in the long run.

The two big consumer credit scoring companies are FICO, whose scores are most commonly used in lending decisions, and VantageScore, a company created by the three major credit bureaus whose scores have been gaining ground among lenders. The latest models of both scores operate on a scale of 300 to 850. Generally, a score of 750 or higher is considered excellent.

Once you know your score, you can start taking steps to raise it by following these seven habits of people with excellent credit scores.

1. They Pay Bills on Time

The most influential factor in your credit score is your payment history, so staying on top of bills is crucial. Just one late payment can damage your score. FICO recently reviewed the profiles of consumers it calls high achievers and found that 72% of those with scores from 750 to 799and 95% of those with scores of 800 or higherhad no late payments on their credit reports.

2. They Watch Their “Utilization Ratio”

3. Keep Balances Low

4. Give It Time

5. Apply for Credit Sparingly

6. Choose the Right Credit Cards

7. Monitor Your Scores and Credit Reports

You May Like: What Score Do You Need For Care Credit

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

B See Where You Stand

Once youve learned that your credit reports are accurate the next step is to get your credit score assuming you dont already have it. The only place you can get your true FICO score is on the website www.myfico.com but it will cost you as you will be required to sign up for its monitoring service at $19.95 a month. But its not critical that you get your FICO score. You could get your score free at sites such as CreditKarma.com and CreditSesame.com. And no, neither of these will be your true FICO score but they will be close enough for you to know where you stand.

Also Check: What Credit Score Does Carmax Use

Age And Type Of Credit

Not all credit is created equal: having different types of accountslike auto or student loans, credit cards, and home mortgagescan work in your favor. Having accounts that have been open for a long time can also help. In fact, VantageScore ranks the age and diversity of your credit as the second-most-important factor in calculating your score.

With that in mind, it may be worthwhile to keep your old accounts open, even if you aren’t using them. Their age could improve your score.

If I Have A Bad Credit Score Should I Just Not Get A Loan

Not necessarily. After all, you might need a car for a job that will pay you enough to pay off your debt, and a college loan might also be the sort of financial boon that can help your financial situation in the long term. Just be careful, because unscrupulous lenders often target people with poor credit scores, and saddle them with outrageous or unfair loans. Fortunately, we compiled a list of lenders who will work with people with poor credit scores.

Read Also: 739 Credit Score Good Or Bad

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Read Also: Aargon Collection Agency Bbb

Understanding Business Credit Scores

Before we dive into the details about business credit scores, how they are used, and how to keep track of them, its important to understand why they are so important, and why this is such a difficult topic for so many. Even highly educated business owners find business credit difficult to understand. There are a lot of reasons that make it complicated…and very important.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Does Speedy Cash Report To Credit Bureaus

How Can I Get The Highest Credit Scores Possible

Theres no magic formula for achieving the highest score. A perfect credit score based on one scoring model and one credit report may not translate into a perfect score with another because of the different weighting formulas and algorithms.

That said, there are definitely steps you can take to get the best credit scores possible.

Read Also: Does Speedy Cash Report To Credit Bureaus

Tip : Dont Get Discouraged

Even if you never reach 850, merely having excellent credit is an amazing achievement. It will save you boatloads of money over the course of your life. And it wont ever stand in your way like a bad score. Plus, you may find consolation in the fact that having excellent credit means your score is higher than over 60% of people, according to WalletHub data.

For more tips and info, check out WalletHubs Guide to Building Credit.

Don’t Miss: What Credit Score Does Carmax Use

Dont Cancel Cards Needlessly

As you can see, both models look favorably on consumers who have longer credit histories and lower credit utilization ratios.

Unfortunately, you cant magically create 10 years of credit history. What you can do is choose one or two credit cards to keep active and never cancel. Not only will this help you build a longer credit history, but it can also help you keep your credit utilization rate low, since more active credit cards in your name means more available credit.

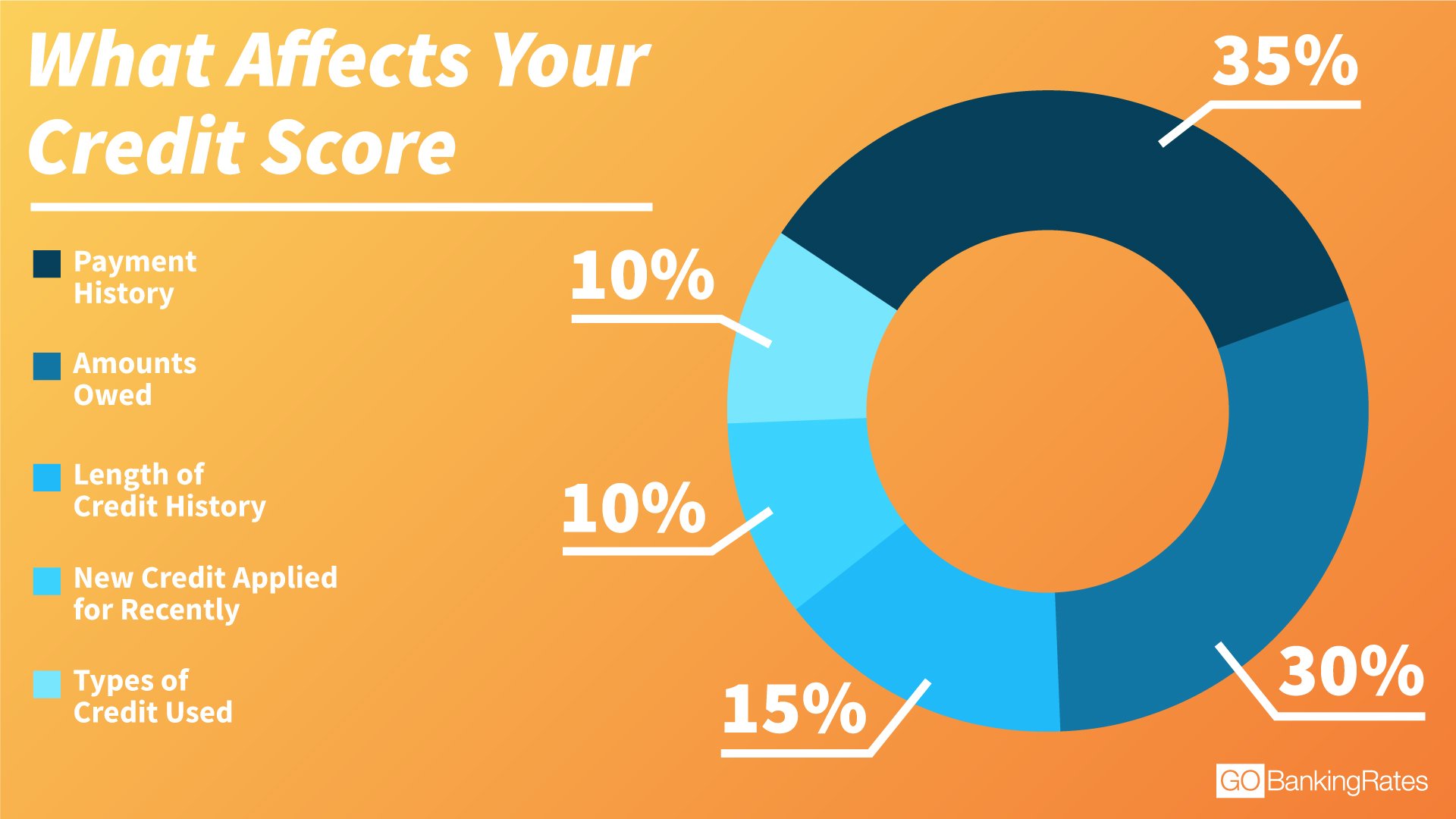

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Recommended Reading: What Credit Score Does Carmax Use

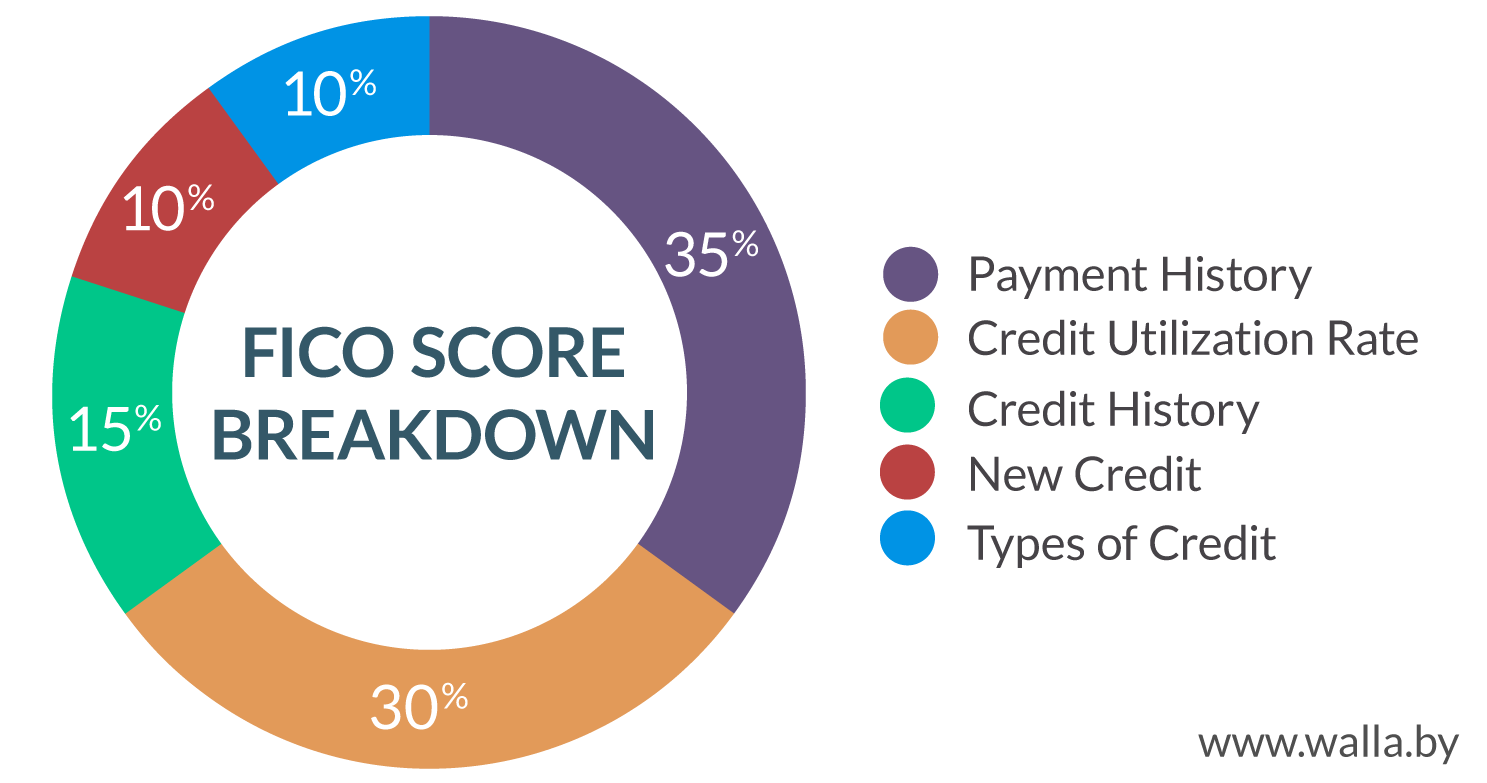

What Counts Toward Your Score

Your credit score shows whether or not you have a history of financial stability and responsible . The score can range from 300 to 850. Based on the information in your credit file, major credit agencies compile this score, also known as the FICO score. Here are the elements that make up your score and how much weight each aspect carries.

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Also Check: What Is Syncb/ppc

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

Youll Never Know All Of Your Credit Scores

If you like to be in the know, you might want to find out what all of your different credit scores are. While itâs vital to have a clear understanding of whether you have good or bad credit â lower than 650 is typically bad news and higher than 700 is considered good â itâs not feasible to find out every score you have. âConsumers will see slight differences between their FICO, Vantage or any other score â each consumer has over 1,000,â WalletHub analyst Jill Gonzalez said in an email.

While you can easily get some scores from free services and your card issuers, there are some scores youâll never know. Thatâs because lenders typically keep their own formulas a tightly held secret and wonât share how theyâve scored you.

âThe credit scores a lender will use will most likely differ from any score you can get yourself,â Hardeman said. âSome credit scores are not sold or available to the public.â

Also Check: Does Les Schwab Report To Credit Bureaus