Apply For A Credit Builder Loan

What if youre starting from scratch? If you have no credit history at all, you may want to consider a credit builder loan.

When you open a credit builder account, the lender moves the loan amount into a locked savings account. You make installment payments toward the lender over a period of six to 24 months. As you make payments, the lender reports your activity to the credit bureau. At the end of the loan term, the lender releases the funds to you.

Just keep in mind that making payments late can hurt your credit even further, as late or missed payments are reported to the credit bureaus, too.

According to the CFPB, participants that didnt have existing debt when they took out the loan saw their credit scores rise by 60 points enough of an improvement that a borrower could enter a better score range. For example, someone with a 620 score could rise to 680 , helping them qualify for better rates.

Ways To Boost Your Credit Score Fast

Your financial security might soon depend upon the strength of your credit score.

Like it or not, your credit score dictates everything from whether youre approved for a credit card to what interest rate youre offered on a mortgage or other loan.

So, you would be wise to get your credit score in tip-top shape ASAP. Your financial security might soon depend upon the strength of your score.

Here are some of the fastest ways to increase your credit score.

Joining The Electoral Roll

Joining the electoral roll offers more than just the ability to vote, it actually provides answers for many more aspects of life. The electoral roll is a long list of information regarding every single person who has registered to vote in the UK. This includes full names and addresses. Relating this to boosting your credit score, if the requirements are met through the FCA, credit agencies can purchase the electoral roll. This way, when you apply for any kind of credit, lenders are able to identify your eligibility in order to get an idea as to whether or not you are a risk. If you are on the register, lenders will view this as a benefit, as theyre able to confirm your identity.

Don’t Miss: Does Qvc Do A Credit Check

Need To Boost Your Credit Score Quickly Use These 5 Tips

Having bad credit can negatively impact your financial wellness in a variety of ways, but these five tips can help you improve your FICO score quickly.

Having bad credit can negatively impact your financial wellness in a variety of ways. It can prohibit you from saving money on monthly loan payments due to high interest rates, and it can also keep you from drawing a line of credit for loans like a mortgage, auto loan, personal loan, credit card, or student loan.

To check your rates and see what rates you could get on a personal loan, visit Credible to get prequalified in minutes.

Use Experian Boost to instantly add points

Experian Boost allows Americans to share their bank accounts with the credit bureau in exchange for an increase in their score when Experian reports their positive payment history. The credit bureau adds that payment history to your report, which will subsequently increase your FICO score, VantageScore and other credit scores.

This can help improve your credit score and get you closer to achieving excellent credit. It can also establish a credit history for the credit invisible, those who have never used credit and therefore have no score.

Open a secured credit account

Become an authorized user

Have your rent reported

Check And Understand Your Credit Score

Its important to know that not all credit scores are the same, and that they fluctuate from month to month, depending on which credit bureaus lenders use and how often lenders report account activity. So, while you shouldnt worry if you see your scores rise or fall by a few points, you should take note when a big change occurs.

The two main consumer credit scoring models are the FICO Score and VantageScore. Here are the factors that comprise your FICO Score and how much each factor is weighed:

- Payment history

- Amounts owed

- Length of credit history

- New credit

Here are the factors influencing your VantageScore:

- Total credit usage, balance and available credit

- Payment history

- Age of credit history

- New accounts

There are a variety of options for checking your credit score for free.

For example, consumers can get a free FICO Score from the Discover Credit Scorecard even without having a Discover credit card, and a free VantageScore by creating a LendingTree account. American Express and Capital One also offer free credit scores to both card account holders and the general public, though many other card issuers offer free access only to their cardholders.

Here are the tiers that credit scores can fall into, according to FICO:

| FICO Score tiers |

| Poor credit |

You May Like: Repo On Credit Report

How To Increase Your Credit Score In 30 Days

Most of our tips above for how to build credit fast will show results within 30 days. For example, improving your utilization rate or becoming an authorized user will impact your credit as soon as the credit card company updates your account with the credit bureau. This typically happens once a month.

Rebuilding bad credit or establishing credit for the first time, however, can take longer. Creditors prefer to see at least six months of positive payment history after a missed payment, for example. It can also take up to six months of new credit history to qualify for your first credit score.

Sign Up For Free Credit Monitoring

Whether its with Credit Karma or someone else, keeping a close eye on your credit is essential. Signing up for credit monitoring can help alert you to important changes in your credit, so that you can check for suspicious activity. Fraudulent activity can weigh down what could be an otherwise good credit score, so its important to dispute any details you identify as inaccurate. If the credit bureau rules in your favor, the fraudulent activity will be removed from your credit report, which can help raise your credit scores.

Also Check: Can I Buy A House With A 588 Credit Score

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

% Comes From Payment History

Are you late on your payments? Are you not even paying your minimums by the due dates? This will definitely negatively impact your credit score.

Tip #1: Pay your bills on time. Paying the minimum is a must, but paying in full every time is highly recommended and much better for your long term finances. By doing this, you will avoid having to pay interest on any money borrowed.

Also Check: Does Opensky Report To Credit Bureaus

Recommended Reading: How To Report To Credit Bureaus On Tenants

Tips For Lowering Your Credit Utilization

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit utilization is simply the portion of your available credit you use, expressed as a percentage. It is the total of balances on all your credit cards divided by the total of all your credit limits. This number is a big factor in your credit score the less available credit you use, the better it is for your score.

Paying your balances on time and in full every month is the best way to keep your score intact or build it. On the other hand, using a larger portion of your credit limit could do damage.

But if a financial crisis means you have to lean on credit cards, take heart: once you’re able to lower your utilization.

These tactics can help you keep your utilization low.

Try To Keep Most Of Your Credit Limit Available

is credit-speak for the percentage of your credit limit youre using. The amount you use has a powerful effect on your credit score only paying on time matters more.

Most experts recommend going no higher than 30% of the limit on any card, and lower is better for your score. Check the credit utilization for all your credit cards and focus on bringing down the highest ones. As soon as your credit card issuer reports a lower balance to the credit bureaus, your score can benefit. Your score will not be hurt by past high credit utilization once youve brought balances down.

Also Check: How To Get Repo Off Credit

How To Improve Your Credit Score After A Late Payment

Here is the bad news. Once you have a late payment on your credit report, there is nothing you can do about it. There used to be a trick where you would dispute all of the bad information on your credit report, like a delinquent payment, and your credit score would go up fast, because they wouldnt count it while it was being disputed. FICO isnt run by a bunch of dummies. As soon as they saw what was happening, they started tweaking the formula and adding special flags about how many accounts you are disputing. Lets just say a 720 credit score with 14 disputes isnt going to qualify for the best interest rates.

So, how do you improve your credit score after a late payment? By making on-time payments. The credit score formula is not 800 minus your bad stuff. To get to an 800 credit score you have to have a bunch of plus stuff. The more plus stuff you have, the higher your credit score. Yes, that late payment is a drag, but four on-time accounts and one past due payment is a much higher credit score than one on-time account and one late account. In other words, every on-time payment you make helps boost your score. Bury that late payment in good credit score stuff.

How Can I Check And Monitor My Credit

You can check your own credit it doesn’t hurt your score and know what the lender is likely to see.

You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0.

It’s important to use the same score every time you check. Doing otherwise is like trying to monitor your weight on different scales or possibly switching between pounds and kilograms. So, pick a score and get a game plan to monitor your credit. Changes measured by one score will likely be reflected in the others.

Remember that, like weight, scores fluctuate. As long as you keep it in a healthy range, those variations wont have an impact on your financial well-being.

You May Like: Report Death To Experian

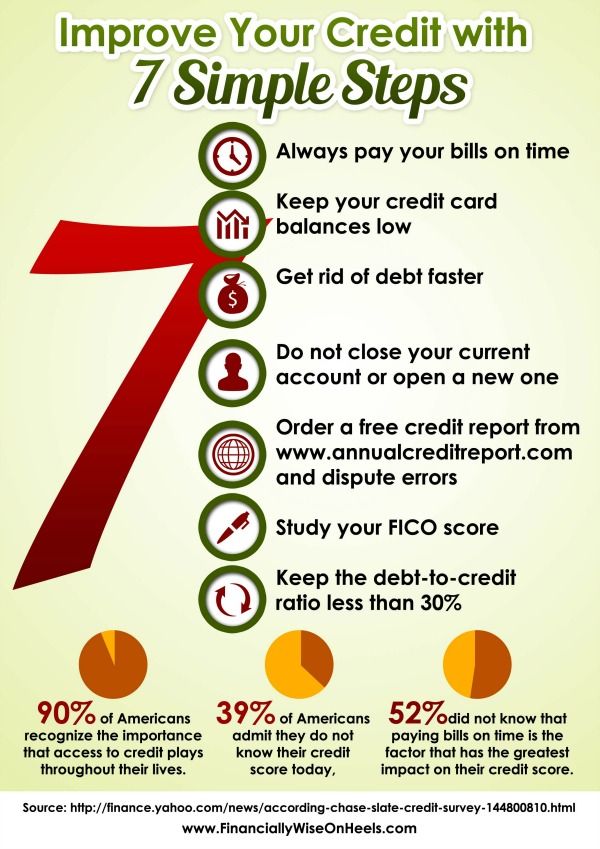

How To Improve Your Credit

The factors that go into your score point out ways to build up your score:

-

Pay all bills on time.

-

Keep credit card balances under 30% of their limits, and ideally much lower.

-

Keep older credit cards open to protect the average age of your accounts, and consider having a mix of credit cards and installment loans. Space out credit applications instead of applying for a lot in a short time.

There are several ways to build credit when you’re just starting out, and ways to bump up your score once it’s established.

Keep Old Accounts Open And Deal With Delinquencies

The age-of-credit portion of your credit score looks at how long youve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts that youre not using, dont close them. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. That wont erase the late payments but can improve your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsand bankruptcies for 10 years.

Recommended Reading: Wells Fargo Authorized User Credit Report

Lower Your Credit Utilization Rate

The fastest way to get a credit score boost is to lower the amount of revolving debt youre carrying.

The typical guidance from personal finance experts is to use no more than 30% of your credit limit, which applies both to individual cards and across all cards. For example:

- On a card with a $500 credit limit, spend no more than $150.

- On a card with a $700 credit limit, spend no more than $210.

- On both cards , spend no more than $360.

How much will this action impact your credit score?

Reducing your balances is the single most effective way to boost your credit score. Provided you have no derogatory marks on your credit reports, such as late payments or delinquencies, you are guaranteed to see a big jump in your scores quickly if you knock down your balances to $0 or close to zero.

Still, if your utilization is currently over 30%, and simply paying the debt off immediately isnt a viable option, there are a few other ways to lower your credit utilization rate.

What Is The Difference Between Fico Score And Vantagescore

Two companies dominate credit scoring. The FICO score is the most widely known score. Its main competitor is the VantageScore. Generally, they both use a credit score range of 300 to 850.

FICO and VantageScore pull from the same data, weighting the information slightly differently. They tend to move in tandem: If you have an excellent VantageScore, your FICO is likely to be high as well.

Also Check: Is Creditwise Transunion

What Is In Your Credit Score

Lets start from the beginning. What is in your credit score?

Your credit score comes from the information in your credit report. If you are wondering how information gets on your credit report, your creditors are snitches. Each money, they report data to the credit bureaus about what accounts you have with them, how long you have had the account, how much money you owe, how much credit you have available, and if your payment was on-time, late, or never paid. How are they allowed to do that? Easy. When you signed up, it was buried in that agreement you never read. Besides, if its true, then there is nothing you can do about it. People are allowed to say true things about you.

Your credit score is made up of four main things

- Your Payment History

- The Length of Your Credit History

- Your Credit Mix

- New Credit

Obviously, you already knew about the first one. Paying on time is good. Paying late is bad. The second one you cant do anything about. It is a timer. It starts when you first get credit. The third one is odd to people outside of the credit industry. Basically, creditors like it if you have different types of accounts like a credit card, a car loan, and a mortgage. This is one of the ways you can improve your credit score fast. Finally, there is new credit. The idea is that if you are opening a bunch of accounts, it might be because you are in trouble and about to have a hard time repaying your credit.

Check Your Credit Reports

You may find it surprising to learn that you dont have just one credit score. You dont have just three credit scores either one from each credit bureau. Instead, hundreds of credit scores are commercially available.

You cant control which credit score a lender uses to grade and assess your credit report. Yet, you can exercise some control over your credit reports, which your credit score is based on. There are many credit scores, but you have only three credit reports.

Its important to check your credit reports from Equifax, TransUnion and Experian. Fraud and credit reporting mistakes are known to happen. If errors occur, you might pay the price in the form of a lower credit score and all of the issues that can come along with it.

However, if you discover a credit reporting error, federal law lets you dispute the mistake with the appropriate credit reporting agency. If you dispute an incorrect, negative account and a credit bureau deletes it from your report, your credit score might improve as a result.

Also Check: Navy Federal Credit Score For Auto Loan