Why Your Credit Score Is 660

Every credit score is a combination of many different financial factors. These are unique to each individual, which means your credit score represents a one-of-a-kind combination of financial considerations.

This makes it impossible to specifically break down each score in a straightforward manner. However, that doesnt change the fact that many of the same elements are involved in the scoring method.

These are included below. Review each category and compare it against your own financial track record. This should begin to reveal what areas of activity are aiding your score and which ones are dragging it down.

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

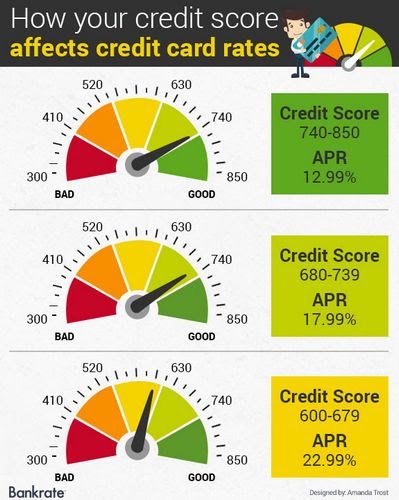

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

How Long Does It Take To Get A Good Credit Score

To build a credit score from scratch, you first need to use credit, such as by opening and using a credit card or paying back a loan. It will take about six months of credit activity to establish enough history for a FICO credit score, which is used in 90% of lending decisions. FICO credit scores range from 300 to 850, and a score of over 700 is considered a good credit score. Scores over 800 are considered excellent.

Dont expect a spectacular number right off the bat. While you can build up enough credit history in less than a year to generate a score, it takes years of smart credit use to get a good or excellent credit score.

VantageScore, another type of credit score, can be generated sooner than your FICO scores. Your FICO credit score is the one to watch over the long term. However, to make sure you are on the right track when starting, your VantageScore can indicate how your actions reflect on your new credit history.

Also Check: Can A Closed Account Be Reopened On My Credit Report

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Credit Score Credit Card & Loan Options

Some lenders choose not to lend to borrowers with scores in the Fair range. As a result, your financing options are going to be somewhat limited. With a score of 660, your focus should be on building your credit and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

Read Also: Sample Notification Of Death Letter To Credit Reporting Agencies

Heres How To Improve A 664 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

What Is My Experian Credit Score

Category: Credit 1. Free Credit Score No Credit Card Required Experian Raise your FICO® Score instantly for free with Experian Boost Get credit for your phone and utility bills by adding positive payments to your Experian credit Experian offers free credit reports, credit scores, and daily monitoring. Check

Don’t Miss: Cbc Innovis Credit Inquiry

Why Do I Have A 660 Credit Score

As with most of the credit score reviews, theres usually one of two reasons why you have a 660 credit score.

- Youre a younger borrower with only a year or two credit history or you havent used credit regularly. There just isnt much on your report to score.

- Youve destroyed your credit score by missing payments or defaulting on a loan. Weve all been there and actually a 660 credit score isnt that bad so you might have only been late on a few payments.

A credit score can fall as much as 50 points just from being late more than 30 days on a credit card bill. Its totally unfair that you can spend years building a good credit score only to see it wrecked in a couple of months but thats how the system works.

Let a loan go to collections or default and it could push your FICO down almost 100 points. Thats enough to put even the best credit borrowers into a bad credit nightmare.

How To Increase Your Credit Score

Now that you know a little bit more about credit scores, you might be motivated to increase yours. Luckily, there are many ways that you can work to improve your score. Dont be discouraged if youre unable to increase your credit score overnight. It will take some time, but it will happen with intentional steps.

Read Also: Qvc Card Credit Score

Is 664 A Good Credit Score

- Standard Definition: Yes A lot of people think good credit starts at a score of 660 and ends at a score of 719.

- WalletHubs Rating: No Based on the rate at which people with 664 credit scores get approved for credit cards that require “good credit” or better, we believe you actually need a credit score of 700-749 to have good credit.

Of course, lenders always have the last word. And they neither define good credit the same way, nor disclose exactly what they consider it to be. So even if your 664 credit score does count as good credit by in some cases, it wont in others. And thats reason enough to improve your credit score so as to erase all doubt.

Below, you can learn more about what your 664 credit score means as well as what you can do to take it to the next level.

A 660 Credit Score Isnt Yet Considered Good Credit But All You Need Is A Little More To Ditch That Bad Credit Forever

Ive done a lot of these credit score reviews around different FICO scores but Ive gotta say, Im really excited about talking about the 660 credit score.

Thats because at a 660 FICO, youre on the edge of having the entire financial world open up. Adding just 20 points to your score, something well cover later in the article, youll start seeing loans approved and at the best rates available.

Whether you havent used credit much or are fighting back from a bad credit report, youre on the way to getting the money you need and at rates you can afford.

You May Like: What Collection Agency Does Usaa Use

Buying A Car With Bad Credit

Generally, youâll need a minimum credit score of 500 to qualify for an auto loan. Though there are exceptions to this. Itâs possible to get financing from alternate sources like a buy here, pay here dealership or other private lenders. But these loans usually have high interest rates.

You can still qualify for a car loan with a low credit score or a bad credit score, but youâll end up paying a lot more for the car than someone with a good credit score. Your interest rate will be significantly higher and you may have to come up with a large down payment. The lender may require a cosigner or you may want to get a cosigner to improve your odds of qualifying for the car loan.

Given that youâre financing your vehicle, the lender will likely require full auto coverage to protect their investment. Depending on your state insurance laws, having a low credit score can cause you to pay even higher car insurance premiums on top of already having to pay for full coverage.

Can You Get A Credit Card With A 660 Credit Score

Credit card applicants with a credit score in this range may be required to put down a security deposit. Applying for a secured credit card is probably your best option. However, they often require deposits of $500 $1,000. You may also be able to get a starter credit card from a credit union that comes with a low credit limit and high interest rate.

If you are able to get approved for a credit card, it is vital that you make your payments on time and keep your balance below 30% of your credit limit.

See also:7 Best Secured Credit Cards

You May Like: How To Report To Credit Bureau As Landlord

Become An Authorized User On Someone Elses Card

While you might not be approved for a regular credit card, you could become an authorized user on someone elses account, like your parents or spouses account.

If you go this route, the account needs to be in good standing, with a low balance and a history of on-time payments. If not, being an authorized user wont help you build a good credit score.

Becoming an authorized user is a way to jump-start credit score growth and is not a long-term fix. Real credit score growth will come from building your credit history, not piggybacking on someone elses. Think of this option as a stepping-stone to get you to your next credit tool, whether thats your credit card or a small personal loan.

What Is A Good Credit Score For A Mortgage In Canada

There is no minimum credit score requirement in Canada for getting a mortgage. But with a bad credit score, you may face challenges in finding a lender and also pay a higher interest rate. Below are indicative credit score ranges that can help you understand the available mortgage options.

- 660-712: This is considered an acceptable credit score. You can find a mortgage but, the interest rates may be high.

- 713-740: This is a good credit score with which you can find a variety of lenders and low-interest rates.

- Over 741: This is an excellent credit score with which you can find the best mortgage interest rates.

If your credit score is less than 640, it will be difficult for you to find a regular mortgage or a lender. Also, if your credit score is between 300 and 574, you are considered a high-risk borrower. If you can find a lender, they may charge you a very high interest rate.

You May Like: Does Carmax Accept Bad Credit

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

You May Like: Itin Credit Report

Understanding Your Credit Score

Your credit report is an essential part of getting your credit score, as it details your credit history. Any mistake on this document could lower your score. Its easy to check your credit score, and youre entitled to a free credit report from all three major credit reporting agencies once a year.

Its good practice to stay on top of your credit score and check it often for any errors to ensure youre in the best possible position. From there, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Don’t Miss: Usaa Free Credit Score

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Can You Buy A Car With 650 Credit Score

While 650 is considered a fair credit score, it is very close to being considered a poor rating. Even dropping a single point will put you in the poor category. As a result, lenders may be a little jumpy when offering you a loan for a car. That said, you shouldn’t have a hard time getting some loan from most lenders.

Don’t Miss: Carmax Finance Rates 2015

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.