How To Build Your Credit

If you want to build and maintain good credit over time, all you have to do is use the five factors that your credit score is made up of as guiding principles. Through these principles, you learn to make regular payments, keep debts down, maintain a healthy credit utilization ratio and have diverse credit. Some factors, such as your credit history length, are out of your control and just require patience.

Don’t let an inaccurate credit score keep you from your dreams work to repair your credit with Lexington Law instead

What Can You Get With A 650 Credit Score

Despite some of the challenges, there are still ways to obtain financial products with a 650 score.

Getting A Personal Loan With A 650 Credit Score

Banks will still consider lending you a personal loan with a 650 credit score. But, you might not get the most favourable rates. For example, with an interest rate 2% higher than normal, you could end up paying a couple of hundred dollars extra in interest. Its important to consider how much you need the loan, as it might not be worth it if you have to pay an exorbitant amount of interest. If your credit score were higher, you would be more likely to receive a larger loan amount and lower interest rates.

If you dont want to, or cant borrow from a bank with a 650 credit score, there are still other options. Alternative lenders and bad credit lenders will also consider lending to someone with lower credit scores. However, despite qualifying, youll be subject to high-interest fees and could be required to put up collateral or have a co-signer.

Getting A Credit Card With A 650 Credit Score

Most credit card providers require you to have a credit score of at least 660 before offering you a credit card product. For highly desirable cards, like credit cards with cash back or generous rewards, youll need good credit. With a credit score of 650, you are more limited in the amount of credit card options available to you.

Getting A Mortgage With A 650 Credit Score

Getting A Car Loan With A 650 Credit Score

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

You May Like: Does Qvc Do A Credit Check

How To Boost Your Credit Score To 650

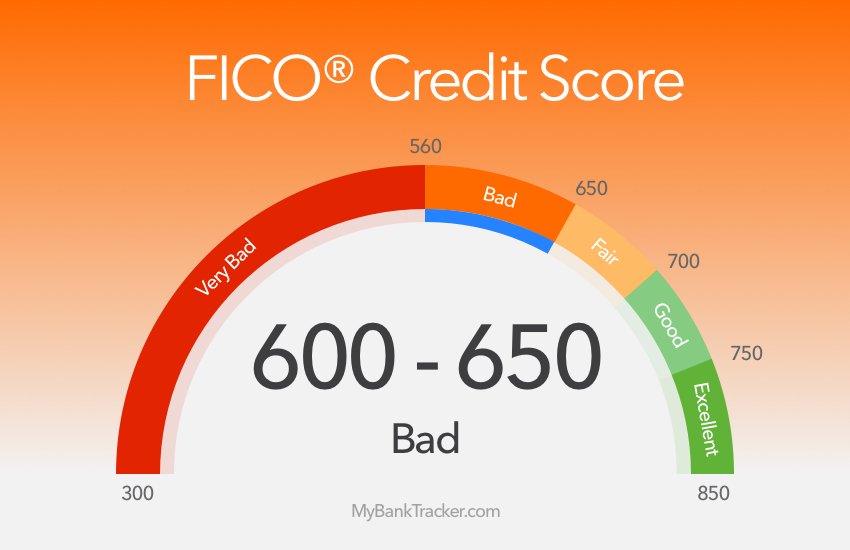

The average FICO® Score is 704, which is substantially higher than your 650, indicating that you have a lot of potential for improvement.

Furthermore, the 650 of 670-739. With effort, you can be able to improve the score range, allowing you to gain a wider range of credit and loan offers at lower interest rates.

Checking your FICO® Score is the perfect way to start raising your credit score. Information from your unique credit profile can be included in the report that comes with the score to recommend ways to improve the score. You can see gradual score increases and the greater access to credit that comes with them if you work on the problems outlined in the study and follow behaviors that foster positive credit scores.

Why Fair Credit Isnt Good Credit

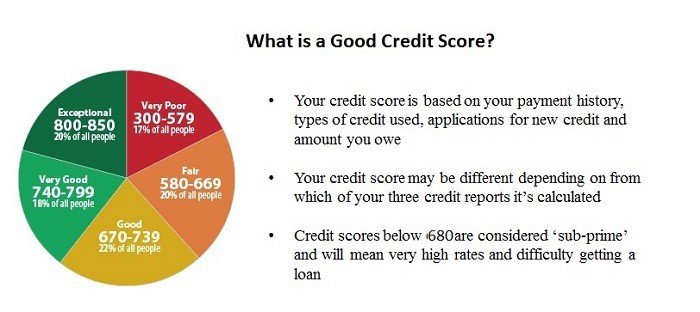

650 isnt considered good for a few reasons. In fact, anything between 580 and 669 indicates issues because it shows a damaged credit history. Within this score range, your record will indicate some late payments to most lenders.

At times, your account may hold a default status and you may suffer from future credit denial.

This is why improving your credit score will ensure lower interest rates and allow you acceptance with better .

Ideally, youd want a very good to exceptional credit score which has a range between 740 to 850.

- >

Read Also: Centurylink Collections Agency

How To Improve Your Credit Score Before Applying For A Mortgage

While a FICO® Score of 650 may be sufficient to get you a mortgage, you may be able to improve your credit profile as preparation for a mortgage application within as little as six months to a year. Taking steps to increase your credit scores could help you qualify for lower interest rates, saving you many thousands of dollars over the life of a mortgage loan.

Measures to consider for improving your credit score include:

A 650 credit score can be a solid platform for getting the house you need. It can help you qualify for a mortgage, but it’ll likely be one that carries a fairly steep interest rate. It’s also a score you can build on to help you get a more affordable loan, today or in the future, when you refinance or buy a new home.

What Is The Fastest Way To Fix A Fair Credit Score

The good news about having a fair credit score is that youre only a few points away from a good credit score. If youre smart with your finances, you can improve your credit score relatively quickly.

The first step to improving your credit score is making all your payments on time and in full. This shows the credit bureaus you can be trusted with credit.

Next, youll want to check your credit report for any inaccurate items that may be dragging your score down. If you find any, you can dispute them and potentially see a significant increase in your credit score.

Lastly, you must understand the five factors that affect your credit. When researching the five factors, youll learn which factor affects your credit the most. Understanding the five factors will teach you to:

- Keep your credit utilization below 30%

- Avoid opening several new accounts all at once

- Avoid multiple hard inquiries at once

You May Like: Speedy Cash Collection Agency

What Additional Factors Affect Your Mortgage Rates

Other factors that influence the interest rates lenders charge include:

- Debt-to-income ratio: Mortgage lenders typically require proof of income in the form of pay stubs or tax returns, and they also pay close attention to your outstanding debts and the amount you pay creditors each month. Debt-to-income ratio, the percentage of your monthly pretax income that goes toward debt payments, is an important gauge of your ability to cover new debts. As your DTI ratio increases, so does your perceived risk higher DTI ratios may therefore bring higher interest charges.

- Down payment: Conventional mortgage lenders prefer a down payment of 20% of the home’s purchase price, but many lenders allow you to make a lower down payment. They typically charge higher interest rates as a tradeoff, and also require you to purchase private mortgage insurance to protect them against financial loss in case you fail to repay the loan. Conversely, if you can put down more than 20% of the purchase price up front, you may be able to negotiate a lower interest rate.

- Loan term: In general, you can get a lower interest rate if you seek a loan with a shorter repayment terma 15-year mortgage instead of a 30-year one, for instance. For any given loan amount, a shorter-term loan will bring higher monthly payments but lower total interest costs.

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Recommended Reading: Reporting Death To Credit Bureaus

Pay Your Bills On Time

This step is essential yet straightforward when it comes to improving FICO scores. Do not ever miss a repayment schedule. You always have to pay in full and on time. To ensure that you never miss any repayment schedule, you can choose to apply for an auto-deduction from your bank account.

Note that your payment history plays a massive role in the computation of your score. If you missed a single repayment schedule, it would reflect poorly on your record. Do this on all of your credit accounts. It would help if you did not allow a single account to have an unpaid bill.

Auto Loan Rates For Fair Credit

Theres no single minimum credit score needed for a car loan. But generally speaking, credit scores in the fair range may limit your options to loans with higher rates and less favorable terms.

Building your credit over time is a good way to potentially get access to better terms, but thats not an overnight process. If youre on a shorter time frame, there are a few things you can do to help.

Compare car loans on Credit Karma to see your options.

Also Check: How Many Points Does A Repo Affect Your Credit Score

Interest Rates And Your Credit Score

While theres no specific formula, your credit score affects the interest rate you pay on your mortgage. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount of interest you pay over the life of the loan. Heres an example: Let’s say you get a 30-year fixed-rate mortgage for $200,000. If you have a high FICO credit scorefor example, 760you might get an interest rate of 3.612%. At that rate, your monthly payment would be $910.64, and youd end up paying $127,830 in interest over the 30 years.

Take the same loan, but now you have a lower credit scoresay, 635. Your interest rate jumps to 5.201%, which might not sound like a big differenceuntil you crunch the numbers. Now, your monthly payment is $1,098.35 , and your total interest for the loan is $195,406, or $67,576 more than the loan with the higher credit score. A mortgage calculator can show you the impact of different rates on your monthly payment.

Credit Score Auto Loan Interest Rate Tips:

As mentioned previously, at 650, loan providers will tend to view you as somewhat risky. However, loans will still be approved at higher interest rates. Below are a few ways to save money on interest payments:

- Make a larger down payment: Making a larger down payment will decrease how much is paid in interest overtime. Typically, a 20% down payment is ideal for a new car and 10% is acceptable for a used vehicle. Of course, youll borrow less if you exceed those amounts.

- Pay every two weeks as opposed to monthly: Youll increase the annual payments you make on your auto loan to 13 as opposed to 12. Just pay half the monthly balance every two weeks vs monthly.

- Ask to pay extra on the principal of the loan: If you can pay extra each month, youll save more money. For instance, if you make an extra $50 payment on a $20,000 loan with 10% interest rate , youd save $761.

- Its worth exploring and comparing offers: The fastest way to compare auto lending offers is by searching online databases. Youll be able to easily explore and compare rates before purchasing a vehicle.

Read Also: Carmax Minimum Down Payment

Credit Score Credit Card Options

An individual with a 650 credit score will typically receive a of between 20.5 and 16.5 percent. In comparison, someone with excellent credit can receive an average credit card interest rate of 13.5 percent. Thats a big difference in interest, and if you make a habit of carrying a balance on your credit card, it could add up to hundreds of dollars in interest annually.

You should be able to get approved for a credit card with a 650 credit scoreyoull just probably be given an interest rate around 20 percent. If you cant seem to get approved for a traditional unsecured credit card, you can opt for a secured credit card instead.

Can I Buy A House With A 650 Credit Score

Yes, it is possible. Several possible loan options are VA Loans, FHA Loans and USDA Loans.For Federal Housing Administration loans, you must have at least a 580 FICO credit score but most financial institutions wont approve the loan below 620. Conventional loans typically require a score above 650 unless there is a down payment of greater than 5%. So, obtaining a mortgage with a 650credit score is very possible as well as a credit card.However, your objective should be to improve your credit score. A higher credit score will guarantee more attractive loan terms and rates. This applies to credit cards, mortgages and loans.

Recommended Reading: Which Credit Score Matters Most

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

What Credit Score Do You Need To Buy A Home

Modified date: Nov. 16, 2021

Editor’s note –

When it comes to mortgages and credit scores, there are two really important questions to ask:

- What credit score do I need to qualify for a mortgage?

- What credit score do I need to get the lowest interest rate on a mortgage?

These different, but related, questions are important if you are looking to buy a home. And the second question is particularly important. With a high FICO® score, you can literally save tens of thousands of dollars in interest over the life of a home loan.

So, lets take a look at both questions. And if you dont know your score, be sure to get your free credit score with myFICO.

Don’t Miss: Paypal Credit Card Credit Score

How Does It Work

Although there are many different , your main FICO score is the gold standard that financial institutions use in deciding whether to lend money or issue a credit card to consumers. Your FICO score isnt actually a single score. You have one from each of the three credit reporting agenciesExperian, TransUnion, and Equifax. Each FICO score is based exclusively on the report from that credit bureau.

The score that FICO reports to lenders could be from any one of its 50 different scoring models, but your main score is the middle score from the three credit bureaus, which may have slightly different data. If you have scores of 720, 750, and 770, you have a FICO score of 750.

A perfect score of 850 will give you bragging rights, but any score of 800 or up is considered exceptional and will give you access to the best rates on credit cards, auto loans, and any other loans.

Can You Get A Credit Card With A 650 Credit Score

Credit card applicants with a credit score in this range may be required to put down a security deposit. Applying for a secured credit card is probably your best option. However, they often require deposits of $500 $1,000. You may also be able to get a starter credit card from a credit union that comes with a low credit limit and high interest rate.

If you are able to get approved for a credit card, it is vital that you make your payments on time and keep your balance below 30% of your credit limit.

See also:7 Best Secured Credit Cards

Don’t Miss: When Does Capital One Report To Credit Bureaus 2020