Pay All Your Bills On

This should be completely obvious, but it bears repeating. A single late payment could drop your credit score 20 or 30 points. That can drop you from average to fair credit in a matter of weeks. Its not just about repaying your creditors on time either. If you get behind with a utility company or a landlord, they may report the unpaid balance to the credit bureaus. That will also drop your credit score. This is why its critical to pay all bills on time, all the time.

Is 680 A Good Credit Score

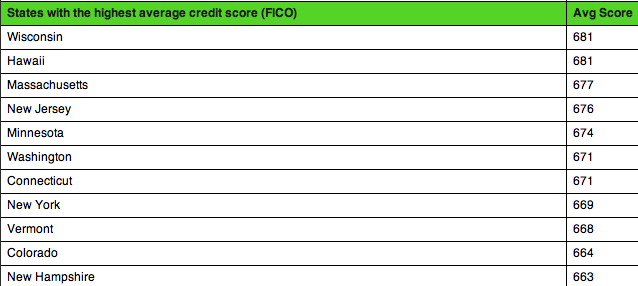

FICO puts a 680 credit score in the good range. That means a 680 credit score is high enough to qualify you for most loans.

However, while 680 is a good credit score, its not the most competitive one.

What do we mean by that?

Well, in the second quarter of 2020, the median credit score for new mortgages was 786. Only 25% of mortgage borrowers qualified for a home loan between April and June had credit scores below. Furthermore, only 10% had credit scores less than 687, according to the data.

So when mortgage lenders are looking at a 680 credit score, theyll typically see it as good enough to qualify you for a loan but not high enough to offer lower interest rates.

That means its extra important to shop around with a few different lenders before deciding on a mortgage loan.

All lenders evaluate credit a little differently, and some are specifically geared toward borrowers with moderate credit scores.

One of these companies will be able to offer you a lower rate than a lender that prefers borrowers with scores in the mid to high700s.

Get Started Today With A Free Online Credit Report Consultation

- FREE Credit Score

loading…

By clicking “Submit” I agree by electronic signature to: be contacted about credit repair or credit repair marketing by a live agent, artificial or prerecorded voice and SMS text at my residential or cellular number, dialed manually or by autodialer, and by email and the Privacy Policy and Terms of Use .

Also Check: Experian Temporary Unlock

What Affects Your Credit Score

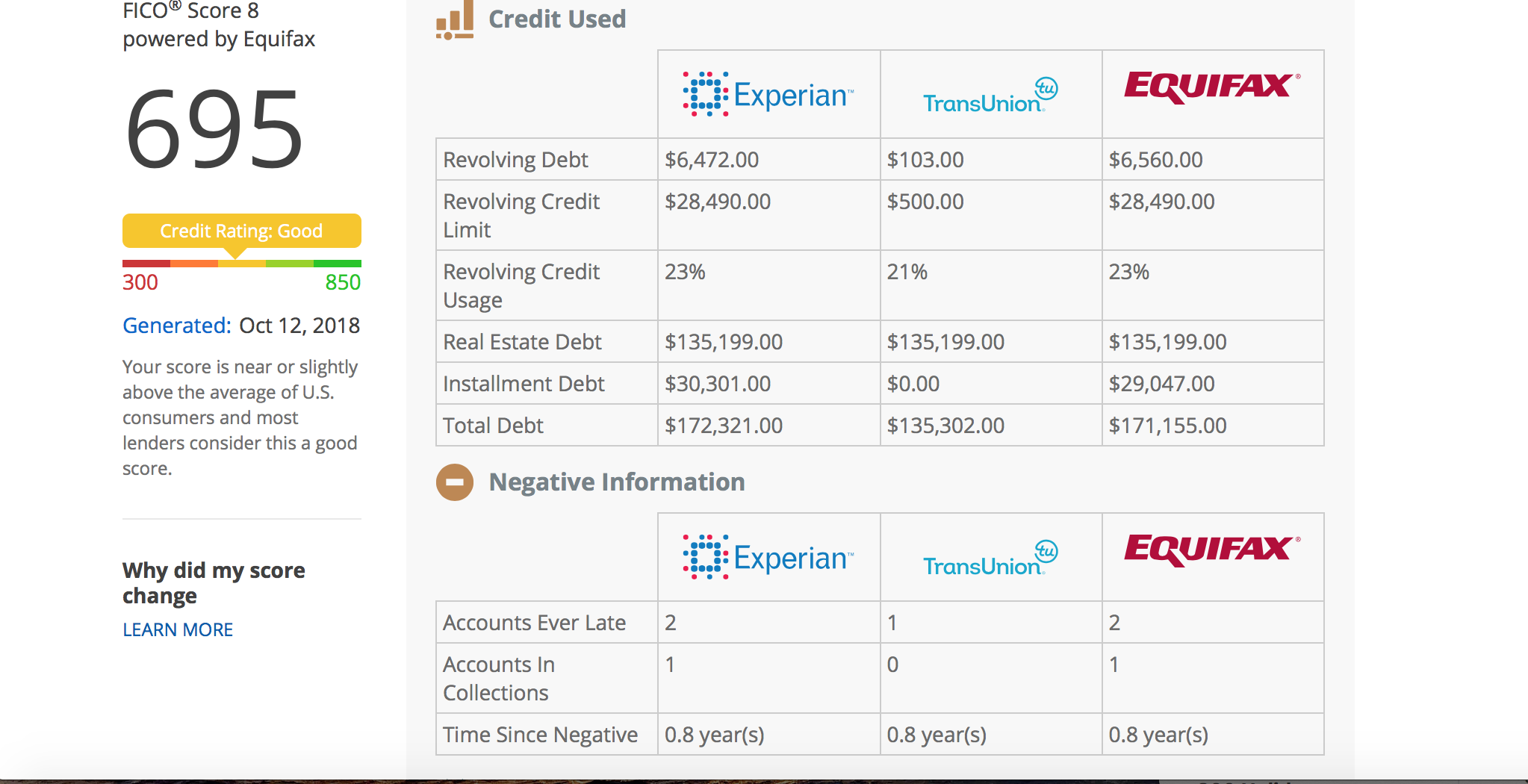

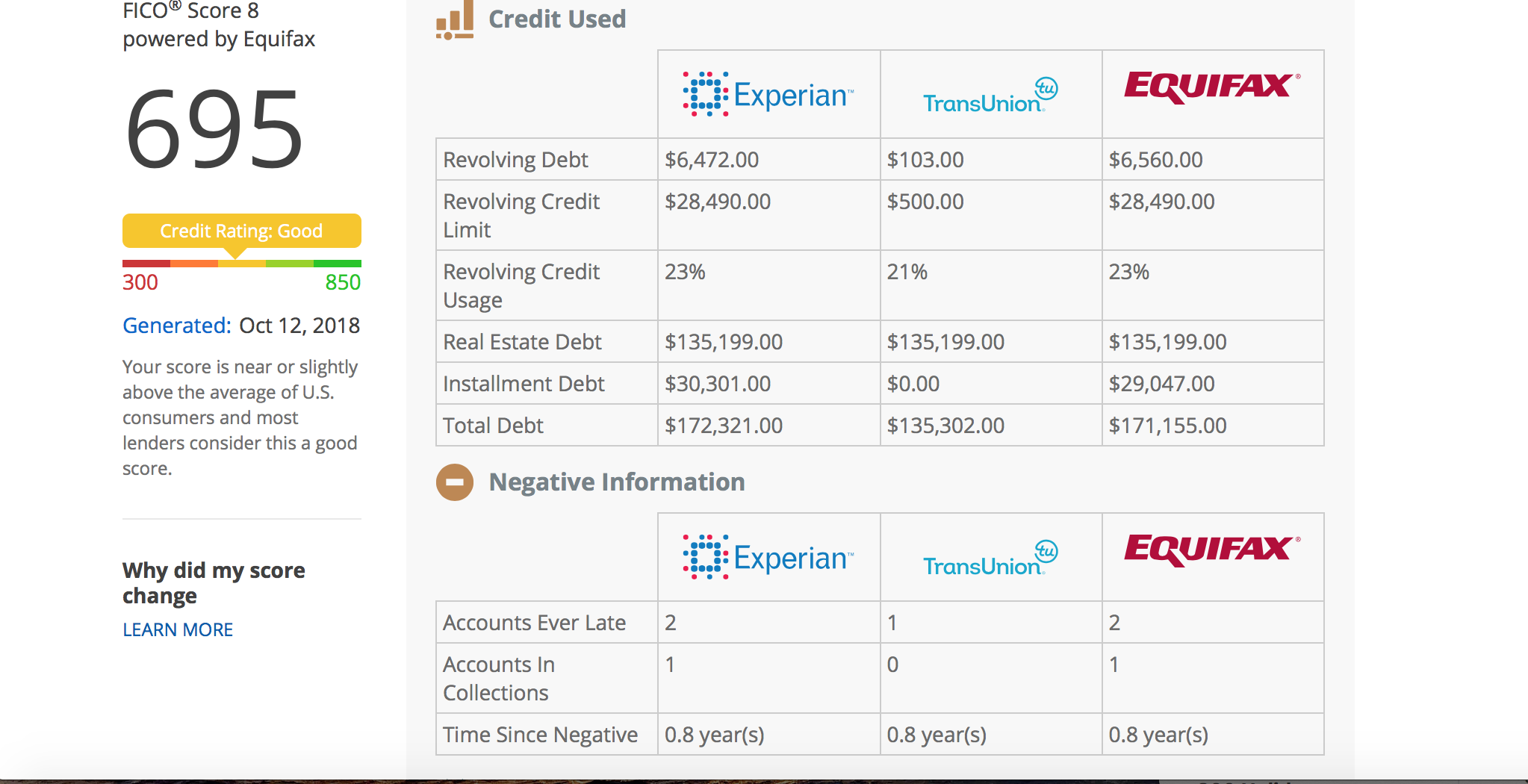

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

How A 680 Credit Score Affects Mortgage Rates

Conventional loan mortgage rates vary widely based on a borrowers credit score.

Prime mortgage borrowers those with 20% down and a credit score above 720 get access to the best and lowest mortgage rates you see advertised online and in print. Everyone else gets access to something different.

When it comes to setting rates, 680 is right in the middle of the line.Take a look at a snapshot of FICOs MyFICO mortgage rate tool, which shows how rates vary based on credit score:

| 3.717% | $1,478 |

1APR refers to the “effective interest rate” youll pay each year after the mortgage rate and loan fees are combined

2This rate snapshot was taken on November 8, 2021, and is for sample purposes only. It assumes a loan amount of $300,000. Your own interest rate and monthly payment will vary. Get a custom mortgage rate estimate here

In this example, the borrower with a 680 credit score has a mortgage payment thats $64 more per month than someone with a 760 credit score.

That might sound like a small difference. But it adds up to $768 more per year, and an extra $23,040 over the 30year life of the loan.

This is why experts recommend getting your credit score up as much as possible before applying for a home loan. Small differences in the short term can mean big savings in the long run.

Recommended Reading: Syncb Qvc

Interest Rates And Your Credit Score

While theres no specific formula, your credit score affects the interest rate you pay on your mortgage. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount of interest you pay over the life of the loan. Heres an example: Let’s say you get a 30-year fixed-rate mortgage for $200,000. If you have a high FICO credit scorefor example, 760you might get an interest rate of 3.612%. At that rate, your monthly payment would be $910.64, and youd end up paying $127,830 in interest over the 30 years.

Take the same loan, but now you have a lower credit scoresay, 635. Your interest rate jumps to 5.201%, which might not sound like a big differenceuntil you crunch the numbers. Now, your monthly payment is $1,098.35 , and your total interest for the loan is $195,406, or $67,576 more than the loan with the higher credit score. A mortgage calculator can show you the impact of different rates on your monthly payment.

Dont Take Out New Credit Accounts Or Loans

Whether youre a firsttime homebuyer or a homeowner on your third purchase, when it comes to debt, less is always best especially when youre looking to qualify for a new home loan.

Opening new credit accounts or any other type of loan will not only have a negative impact on your debttoincome ratio, but the hard inquiries required to qualify for a loan can lower your credit score by several points each.

Similarly, avoid closing existing lines of credit, like credit cards, to keep your available credit limit higher. his is beneficial to your overall credit utilization ratio. Plus, the average age of your credit is also a factor in determining your credit score range.

Also Check: Section 611 Fcra Rapid Rescore

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

How Long Does It Take To Get A 676 Credit Score

It depends where you started out.

If you had fair credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Read Also: Credit Score Of 611

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

What Does Not Count Towards Your 676 Credit Score

There are many things that people assume go into their 676 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Recommended Reading: Carmax Credit Approval

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 676

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Also Check: Aargon Debt Collector

You Need A Mortgage Loan

You definitely dont need a mortgage loan to have good credit. However, if you want to max out your credit score, having a mortgage loan with good payment history is a must.

Since a mortgage loan is usually a relatively large loan and more difficult to get than other installment loans such as an auto loan, a mortgage shows creditors you have been responsible enough with your credit to get the mortgage in the first place.

Fair Isaac Corporation, which provides the FICO score, recommends you have a mix of different types of credit accounts. So along with credit cards and installment loans, a mortgage loan is the last piece of the pie to round off your credit mix.

I also want to note I didnt start seeing my credit score go up because of the mortgage loan until about a year later, so it definitely takes some time.

You obviously shouldnt take out a mortgage loan just to get a perfect credit score. But a mortgage loan is normally considered to be good debt, in that interest rates are relatively low and youre financing something that usually appreciates in value.

If you dont already have a mortgage, be sure to fix up your credit report before applying for a mortgage assuming youre ready for homeownership.

Can I Get A Mortgage & Home Loan W/ A 676 Credit Score

Getting a mortgage and home loan with a 676 credit score shouldn’t be very difficult. Your current score is a mid-to-high credit rating.

The #1 way to get a home loan with a 676 score is to complete minimal credit repair, and simply apply and wait for approval.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Also Check: Carmax Interest Rate

What Does A 676 Credit Score Mean

A credit score of 676 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that youre a low-risk borrower. In FICO and VantageScore, the main scoring models used by US credit bureaus, 676 is classed as a good credit score.

Although a 676 credit score is much higher than the lowest credit score of 300, its still far from the highest credit score of 850, and its below the current nationwide average.

| Your Rating |

|---|

| 688 |

What Is A Good Vantagescore

FICO’s competitor, VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

Recommended Reading: How Do I Unlock My Equifax Account

How Does A 676 Credit Score Rate

Most authentic credit scoring models like FICO and VantageScore use credit score range from 300-850. Even though the range seems broad but let me tell you that there are different categories within this range that starts from Very Poor to Excellent. If your score is near to the higher limit then it indicates the lower credit risk as well, likewise the lower credit score point to higher credit risk.

To help you in better understanding the ranges and the relative categories they fall in are explained below:

- Excellent Credit: 750 850

- Very Poor: 549 & Below

What Is The Fastest Way To Improve A Good Credit Score

You can work to improve your good credit score and upgrade to the next credit range. First, its very beneficial to know the five factors that impact your credit in order of what affects your credit the most. Those factors and their weighted importance are:

Next, always pay your payments on time and in full. This is what lenders want to see mostthat if they give you access to credit, youre responsible and pay it back reliably. You can make sure you never miss a payment by signing up for automatic payments whenever possible.

Lastly, take advantage of the free credit report youre entitled to annually from each national credit bureaus. In 2020, more than 280,000 consumers filed complaints about mistakes on their credit reports, and many more Americans have errors on their credit reports they arent aware of. Inaccurate or unsubstantiated negative items on your report could be drastically dragging down your credit score, so always review your credit report and file a dispute for any errors found.

If you dont have time to check your report yourself, you can hire credit repair services. Lexington Law provides professional credit repair services, taking all the hassle out of filing disputes out of your hands.

Also Check: Vantage Score Definition

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Understand The Benefits Of A Good Credit Score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments appear in the credit reports of 36% of people with FICO® Scores of 676.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

Read Also: When Does Collections Fall Off Credit