What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one credit reporting agency it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

How Does A Hard Inquiry Affect Your Credit Score

One inquiry, as noted above, will only ding your score about five points. However, if you do something like apply for every credit card out there, you will find that your score will be more dramatically impacted. Thats because when you ask for new credit you are changing the status quo.

Questions like why do you want or need more credit, can you handle additional debt or what has changed in your life that you need new credit all create uncertainty. Adding new accounts changes the overall picture and your score will reflect new uncertainty until you have had the accounts long enough to show you can handle them. Your credit report is the indicator of how you handle the new credit you have been extended. If you manage it well, your report will reflect that and your score will reflect the reduced risk.

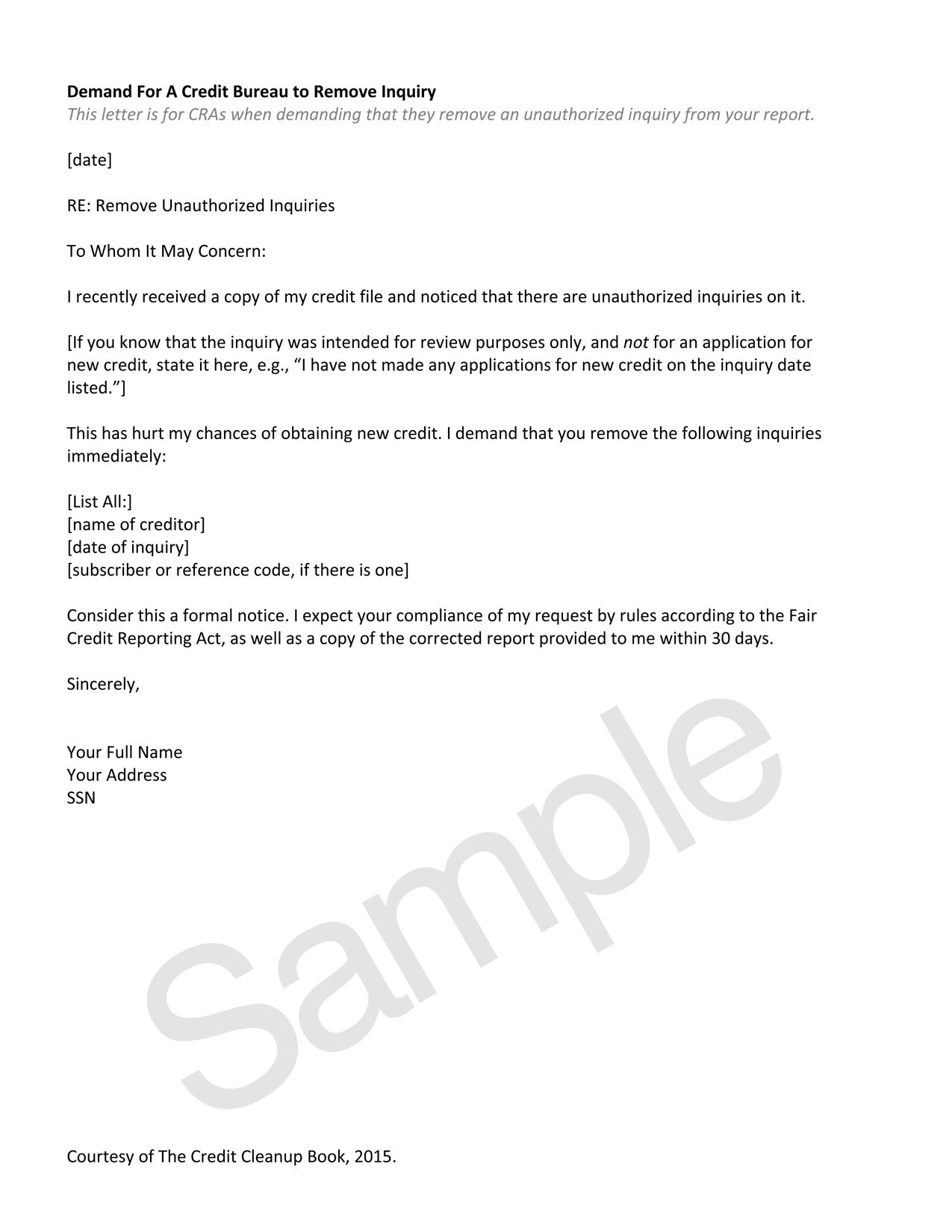

How To Write A Letter To Request The Removal Of A Credit Inquiry

Companies and people may make difficult questions that you did not approve of. In such situations, there is a method to eliminate the hard inquiry and, as a consequence, enhance your credit. A credit inquiry removal letter or a credit inquiry dispute letter is what it is.

Even if a hard credit query is questionable, and you are unsure whether you made it or not, you may contest it since the credit agencies and your creditors bear the burden of evidence.

We have created an example letter to submit to the credit agencies in order to seek an investigation into an illegal query on your credit report.

Read Also: Speedy Cash Extension

Carefully Plan Your Hard Inquiries

Dont start applying for credit until youre serious about it, then you can stick to this time frame.

If you are shopping around, youll start to have separate hard inquiries stack up on your credit reports when they are spread out over time. It always helps to have a financial goal with a deadline so you can plan your inquiries in advance.

If youre not applying for too many types of credit at the same time, then you probably wont have to worry about disputing inquiries you can just leave them alone.

However, if you have several different types of inquiries, you may want to consider disputing them because they can add up as lost points. And if your credit score is borderline between two scoring categories, then every few points can make a difference.

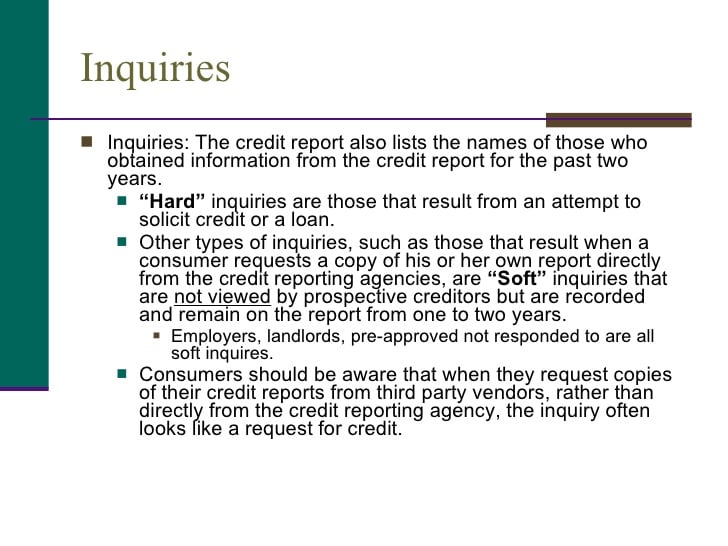

A Comparison Of Hard Versus Soft Credit Inquiries

While creditors and other entities can check your credit report and score through either a hard or a soft credit inquiry, there are some key differences between these types of credit pulls.

First, different information may be shown in a hard versus soft credit inquiry. For example, a creditor or other entity performing a soft credit pull for promotional or marketing purposes will only be able to view a limited report. To obtain your full credit file, theyd have to use a hard credit inquiry.

Also, hard credit inquiries can have a negative effect on your credit by lowering your credit score. Even though soft inquiries are still noted on your credit report, these cannot lower your credit score nor do they show up as a negative on your credit report.

Finally, for a lender or a creditor to conduct a hard inquiry, you must first have granted them permission to do so. Therefore, if you discover a hard credit inquiry was conducted without your knowledge or permission, you can often dispute it.

Recommended Reading: What Credit Bureau Does Paypal Use

How Do Hard Inquiries Affect Your Credit Score

You wont be penalized for a soft inquiry because it doesnt mean anything negative about you or your personal finances. Repeated hard inquiries, on the other hand, can indicate financial instability and damage your good credit.

Repeated hard inquiries in a short timespan can indicate youve been unsuccessful in securing a loan because of a bad credit score, or you are applying for more credit than you can afford to repay. In short, potential lenders see you as a financial risk, and your FICO score or VantageScore will reflect that belief.

That said, hard inquiries dont always hurt your credit score significantly. If youre shopping around for a mortgage or auto loan, different mortgage finance companies or auto dealerships may conduct hard pulls on your credit in a brief time period. As long as they all occur roughly within a 14-day window, theyll only appear on your credit score as a single inquiry.

Other hard inquiries that wont affect your credit score include credit checks conducted by utility companies, auto insurers and credit card companies to determine:

- If then need a security deposit from you

- How to set your premium

- Ways to market new products to you

In fact, applying for a credit card can affect your credit because it’s generally a hard inquiry. If you suspect you might be rejected or dont need the credit, it may be wise not to apply not just to avoid the hard pull, but because opening too many new credit accounts can hurt your credit, too.

Applying For Credit Hard Inquiries

When applying for new credit you will generally give your name, address, phone number and social security number. These are needed to accurately identify the correct credit record to pull.

Your credit application will require your signature, giving the lender or a financial consultant permission to access your credit file. You may be familiar with this approach if you have ever bought a car.

If you walk into the dealership, they will ask you to fill out a credit application before they allow you to test drive. You may be subject to multiple hard inquiries using this approach, as the dealership will shop around for the best deal for you. Events like this results in a hard pull.

After I bought my car from a national dealership, I viewed my credit report and saw eight entries. I immediately panicked because I was not aware that the dealers finance personnel petitioned that number of lenders.

After some research, I found that the FICO scoring models treated multiple inquiries for one type of loan as one inquiry, indicating that you were shopping around for the best rates. This method prevents your score from taking a complete nosedive.

How long do hard inquiries stay on your report? Hard inquiries impact your score for about a year, but generally fall off your report within 2 years.

Read Also: What Is Syncb Ntwk On Credit Report

When A Lender Or Creditor Requests Your Credit File This Is Recorded As A Credit Inquiry

While a single hard inquiry, sometimes called a hard pull, is unlikely to influence your eligibility for new credit products such as a new credit card, it may have a long-lasting effect on your credit ratings for up to two years.

When checking your credit reports for hard inquiries, you want to ensure that they are genuine. What does this imply exactly? Did you allow the creditor or lender to pull your credit for each hard inquiry line item? If you did, there is no need to take any more action.

However, when checking your credit reports, it is likely that you may notice instances of illegal hard queries. If you discover one of these, you should contact the credit bureau that produced the report and request that the bureau deletes the illegal inquiry.

Heres how to challenge inaccuracies on your credit reports about hard inquiries

Remove Credit Inquiries From Your Credit Reports

Credit inquiries are a hot topic in these days as it is widely known that it is possible to remove them from your credit reports. As you review your credit report, you will notice a section at the end of the report called “Credit Inquiries” or “Regular Inquiries.” These inquiries were made by companies who pulled your credit report, and these inquiries will remain on your credit report for two years. You may not recognize their names and you may have no idea why they pulled your credit so it may seem a bit unnerving. Fear not. We will show you how to remove unauthorized credit inquiries from your credit reports. And, we will let you know which credit inquires hurt your credit score and which ones don’t.

Read Also: Speedy Cash Collection Agency

How Long Do Hard Inquiries Stay On Your Credit

Hard inquiries stay on your credit reports for two years, but they only affect your FICO® Scores for one year.

The impact of a single hard inquiry is relatively small, usually dinging your FICO® Score five points or less. You can gain those points back over just a few months’ time, however, with positive credit habits such as paying down debt and making all your payments on time.

If you accrue several hard inquiries by applying for different types of credit within a short period of time, however, your scores may experience a bigger drop. Multiple applications can also hurt your chances of getting a new loan, since they indicate to lenders that you’re potentially taking on lots of new debt all at once. The exception is if you’re rate-shopping for a mortgage or car loan and multiple lenders request your report within a short period of time: Although you will see each individual inquiry listed on your report, most credit scoring models will only count them as one.

How To Minimize The Impact Of Hard Inquiries On Your Credit

It’s important to do some comparison shopping when you’re looking for a new credit card or loan. You may not be able to avoid new hard inquiries on your credit report, but there are a few ways to reduce the impact of shopping around:

- Time your applications strategically. If you’re shopping for a mortgage or an auto loan, make all of your applications within a 14-day window. If you stick within this timeframe, all of your applications will be calculated as just one hard inquiry.

- Apply selectively. Reduce the number of applications you submit by getting selective about where you apply. Compare rates and fees first, and see if the lender offers prequalification. Prequalification can allow you to get quotes on interest rates, fees and loan amounts without a hard inquiry.

- Practice good credit habits. Virtually all other credit activities have a bigger effect on your credit scores than hard inquiries. Even if you have to add multiple hard inquiries to your reports, you can keep your credit rating high by staying current on loan payments and keeping your credit card balances to a minimum.

Read Also: Does Paypal Credit Report To Credit Bureaus

Look For Unauthorized Or Incorrect Hard Inquiries

You can request to remove hard inquiries from your credit reports if

If you did apply for a credit account or authorize a hard inquiry, you cant remove it from your reports. It remains on your credit reports as part of an accurate representation of your credit history. If thats the case, it should fall off your reports after about two years.

Review Your Credit Reports For Free

Your first step in reviewing hard inquiries is to pull your own credit reports.

But dont worry, you wont be dinged for checking your credit because as a consumer you are entitled to a free report annually from each of the credit bureaus.

The three credit agencies are Equifax, Experian and TransUnion. But you can also visit MyFICO for obtaining your reports and your credit score.

Its tempting to not look at your credit too often, but trust me, knowledge is power!

Youre not only evaluating your current score, but youre confirming if the hard inquiries listed are legitimate.

Recommended Reading: Unlock Experian

How Do I Know If I Have Too Many Credit Inquiries

There is no concrete number of how many credit inquiries is too many. If youre concerned about the number of inquiries on your credit report, the first step is to get a free copy of your credit reports. Its not so much about the number of inquiries, but more so the time between them.

For example, if youve applied for five credit cards in a period of three months and have five hard inquiries as a result, its likely to be considered as a negative detail on your report. In contrast, having five hard credit inquiries listed over a period of five years will have far less of an impact or perhaps no impact at all.

What to do if you think you have too many inquiries on your credit report

If youve looked at your credit report and think the number of credit inquiries listed could have a negative impact on your credit score, you can start to improve your credit score in other ways.

How To Remove Hard Inquiries

Wondering how to remove hard inquiries from your credit report? Unlike most things in the world of credit, there actually is a simple formula to follow once you have identified a removable hard pull:

- Take note of the characteristics of the pull, including its date and source

- Write this information, along with an explanation of how it is mistaken, in a letter

- Submit the letter to the department of your financial institution dedicated to disputing hard credit inquiries

- Monitor your pending verdict if your argument is accepted, your institution will remove the hard inquiries you contested.

If you are unsuccessful in your attempt, it is typically for good reason. However, if the challenge youre submitting is really a mistake, then you are not out of options. Under the FCRA, you can submit an additional statement to supplement your original one. This acts as somewhat of an appeal. Your challenge will be reconsidered taking into account any new information you provide. However, because you are given a small limit on the number of words this appeal can contain, use them wisely. Concentrate on hard evidence that the mistake is not your fault.

Also Check: Does Carvana Report To Credit Bureaus

Do You Have Other Negative Information Affecting Your Credit

Do you have other negative marks on your credit reports? Or maybe you dont want to bother disputing inquiries on your own? If so, you can retain a credit repair company that can do the work more efficiently and effectively for you.

A professional performs these tasks hundreds of times a day. However, when investigating credit repair companies, be sure to look for a firm with many years of experience and many happy clients.

Check out our Lexington Law Firm Review to find out more about the company that has over 28 years of experience and hundreds of thousands of happy clients, or call for a free consultation to see how they can improve your credit score.

Hard Vs Soft Credit Inquiries

Hard inquiries are the only type of credit pull that can affect your credit score, and they’re the only ones that businesses will see on your credit report. Credit inquiries that don’t affect your score and don’t appear on your report are called soft pulls. Examples of soft inquiries include you checking your own report and a potential employer accessing it during a background check. And credit card issuers may do soft inquiries when they are preparing promotional card offers.

Credit inquiries carried out by insurance companies when you’re seeking quotes for various kinds of policies are considered soft inquiries and do not show up on your credit report.

Don’t Miss: Does Cashnetusa Report To Credit Bureaus

Therefore If You Suffer From Bad Credit And A Lot Of Hard Credit Inquiries Life May Get Tough

Various financial institutions, real estate agencies, and even potential employers use your credit score to make a final decision. So, what can someone do to help eliminate bad credit? Well, this is where hiring a credit repair firm like may come in handy, where professionals work with you to help to:

- save you money

Recommended Reading: What Is Cbcinnovis On My Credit Report

How To Remove A Credit Inquiry From Your Credit Reports

If you’re trying to improve your credit score, check your credit report. If there are incorrect hard inquiries on your credit report, you may be able to get them removed.

If youre wondering how to remove a credit inquiry from your credit report, there are a few points to think about before you start the process.

First, it helps to know there are two types of : hard and soft. Both types of inquiries will appear on your credit report, but hard and soft inquiries are different: Only hard inquiries can affect your credit score soft inquiries dont.

So, when you want to remove an inquiry from your credit report, its the hard inquiries youll be focused on.

Youll be looking for issues like reporting errors or unauthorized hard inquiries which can indicate an identity thief has used your Social Security number or other personal I.D. to determine if you can remove inquiries from your report and whether its worth doing so.

You can seek to remove inaccurate hard inquiries from your credit report by filing a dispute or a credit inquiry removal letter with the three major credit bureaus.

But you cant remove hard inquiries from your credit report if theyre accurate. In these cases, youll have to wait for any accurate information about hard inquiries to fall off your credit report, which usually occurs automatically after two years.

Recommended Reading: Credit Score 672