Alternative Loan Options For Fair Credit

If youre unable to take out a personal loan due to your fair credit, you may want to look at other options.

- While you usually have to join a before taking out a personal loan, they tend to be more forgiving to those with fair credit. Talk to your local credit union about what you need to qualify.

- 0 percent APR credit card balance transfer: If youre looking to pay off credit card debt, consider getting a credit card with a 0 percent APR introductory offer. That way, you can move your balance over and keep interest from adding up. Keep in mind that you might not qualify for the full balance to be moved over, so theres a chance that youll end up paying off your new card while still making payments on your old one.

- Home equity loan or line of credit: If you have a home, you may be able to use that as collateral and take out a home equity loan or home equity line of credit . Remember, your home is used to secure the loan, so if you miss payments, the house could be subject to foreclosure.

Use Your Credit Card But Never Max It Out

Im not the type of person who buys everything on my credit card. I do use one of my credit cards a lot, however.

Ive found I need to use the credit card a lot to get the highest FICO score possible. The caveat is that you should never max out the card. In fact, I recommend you pay it down every month and never get even close to the credit limit.

As a general rule, you should try to keep your . In other words, if you have a credit card with a total credit limit of $1,000, never rack up more than $250 worth of charges on the card.

This is why its also important to have a credit card with a high limit. For example, my main credit card has a credit limit of $30,000, and I never get even close to 25% utilization.

If you dont have a card with a high enough limit to keep you comfortably under 25% utilization, give the creditor a call and request that they up the credit limit.

The Basis For Your Credit Score

Here’s a more detailed breakdown of the specific factors that influence your FICO® Score:

Public Information: If bankruptcies or other public records appear on your credit report, they can have severe negative impacts on your credit score.

Among consumers with a FICO® Score of 588, the average credit card debt is $5,908.

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. It’s pretty straightforward, and it’s the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

. To determine your , add up the balances on your revolving credit accounts and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you “max out” your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

You May Like: Syncb Chevron

Excellent Credit Score: 750 850

The prime candidates, the goody-two-shoes, they are considered consistent and responsible when borrowing. They have no history of low balances or late payments. Borrowers in this credit range receive the lowest interest rates on loans, mortgages and credit lines as they pose a low risk to lenders.

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

You May Like: Speedy Cash Extension

Get Late Payments Removed

Before disputing late payments you should contact your creditors and tell them you have a late payment on your credit report on your account and you believe its inaccurate. They may remove it as an act of goodwill for customers who have been with them for awhile.

I had a creditor remove a late payment from my credit report by calling and coming up with an excuse for why it was late. They removed it as an act of goodwill because I had been a customer for several years. If that doesnt work, you can start disputing it with the three major credit reporting companies.

I had four late payments with two different creditors at one point. I contacted the creditors and got one removed and disputed the other 3 with the Credit Bureaus. I was able to get another one removed, and my credit score jumped up by 84 points.

Fico Score Vs Vantage Score

The three major credit bureaus created the Vantage Score back in 2006 to compete with Fair Isaac Corporations FICO credit score model. Since then Vantage Score has released several new credit score models, including Vantagescore 3.0 and 4.0.

While the Vantage Score has grown more popular and is easier to check, thanks to free credit monitoring services like Credit Sesame, both your FICO score and your Vantage Score work to reveal your credit behavior.

The credit score ranges are very similar, although Vantage Score does have a category for perfect credit .

If you earn an improvement within one of these credit score models, you will almost always see the same result with the other model, too especially if you have a shaky credit history and have a couple years of work to achieve a good credit score.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Lendingclub: Best For Availability In Most States

Overview: LendingClub offers personal loans of $1,000 to $40,000 for three- or five-year terms.

Why LendingClub is the best for availability in most states: While some lenders only operate in a limited number of states, LendingClub accepts applications from borrowers in every part of the United States.

Perks: You may qualify for a loan if you have a credit score of at least 600. The lender also allows a 15-day grace period on late monthly payments.

What to watch out for: It can take 48-hours from loan approval to funding. Youll also be subject to an origination fee of up to 6 percent.

| Lender |

|---|

Credit Score What Does It Mean & How To Improve It

Achieving and maintaining a good score is a perfect way of keeping your finances in check. By improving your 588 credit score, you will be able to take a loan when planning to make big purchases such as buying a car or a home or even starting a business. Thats why its important to understand if its good or bad. A good credit score also gives you negotiating power, banks will consider you a sure bet and give you low interest rates thus saving you money eventually.

Don’t Miss: Speedy Cash Loan Extension

Moving Past A Fair Credit Score

While everyone with a FICO® Score of 588 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 39% of Americans with a FICO® Score of 588 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

My Credit Score Is 588

11/16/2014 ·my credit score is 588. my credit score is 588. i started with no credit got a couple acconts open like fingerhut, etc. but i have no credit cards yet because of my score.. i just recently paid off a hospital bill that was sent to collections.. ..

Source:

Read Also: Does Bank Of America Report Authorized Users To Credit Bureaus

Getting Mortgages With A 588 Credit

Just like with personal loans, a credit score between 550 and 649 will provide you with sub-par rates and terms. In fact, with a 588 credit score, you may not even qualify for mortgages with many lenders. If you will you should anticipate interest rates ranging from five to six percent.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 588 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

What makes an impact on your credit?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

The third factor in play is your length of credit history, which assesses the average age of your accounts and how long its been since those accounts were actually used. The last two, smallest factors are how often you apply for new accounts and how diverse your credit portfolio is. In other words, opening multiple accounts at a time hurts your score, while having different types of accounts improves it.

Credit Score Mortgage Loan Steps

- Step 1: Visit the 588 credit score auto financing official website of the bank 588 credit score credit cards

- Step 2: Log into 588 credit score mortgage loan internet banking portal with your user ID and password.

- Step 3: Select Card Activation

- Step 4: Type in your credit card number, your date of birth, and the expiry date.

- Step 5: Select Submit

- Step 6: Enter your ATM PIN and choose Submit

- Step 7: You will get an OTP on your mobile phone

- Step 8: Enter the OTP and select Continue

Recommended Reading: How To Remove A Repossession From Your Credit Report

Fha Loan Credit Score Requirements For 2021

FHA loans may be particularly appealing to first-time home buyers who have a young credit history, as well as people with more experience but who might have bad credit. Part of the attraction can be attributed to the more lenient credit requirements associated with an FHA loan.

In this article, well go over what you need to know if youre considering an FHA loan to buy or refinance a home.

Learn Whats Considered A Fair Credit Score How Scores May Affect You And What You Can Do To Help Improve Average Credit Scores

There are multiple credit scores out there. And the most popular versions range from 300 to 850. But what exactly are fair credit scores? And where do fair credit scores fall in that range?

As with many things related to credit scores, the answers can vary. Keep reading to learn how to tell whether you have a fair credit score, why credit scores are important and what you can do to help improve yours.

Read Also: Disputing Old Addresses Credit Report

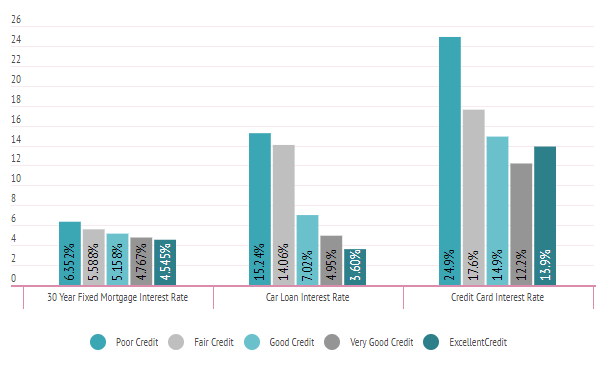

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Auto Loan Rates For Poor Credit

Theres no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, it could be difficult to get approved for a car loan. Even with the best auto loans for poor credit, watch out for high interest rates, which can make it very expensive to borrow money.

If you have time to build your credit before you apply for a car loan, you may be able to eventually get better rates. But if you dont have time to wait, there are some strategies that can help you get a car loan with bad credit.

- Consider a co-signer if you have a trusted family member or friend with good credit who is willing to share the responsibility of a car loan with you.

- Seek out alternative lenders, such as a credit union or an online lender.

- Ask the dealership if theres a financing department dedicated to working with people with poor credit.

- Use buy-here, pay-here financing only as a last resort.

If your credit could use some work, its especially important to shop around to find the best deal for you. Our auto loan calculator can help you estimate your monthly auto loan payment and understand how much interest you might pay based on the rates, terms and loan amount.

Compare car loans on Credit Karma.

Read Also: Is A 748 Credit Score Good

Errors In Your Credit Reports

Our credit reports contain valid information about where we live, our mode of paying bills-electronic or cash-, our police records and financial sensitivities like being sued, suing someone or declaring bankruptcy. This information is sold to insurance companies, credit lenders, employers and other businesses that use this data to gauge our insurance, credit, employment and housing applications. It is recommended by experts to review credit reports intermittently, some organizations follow this stringently.

Why is there a need to review our credit reports you ask? Simply because:

- The data in our reports affect our chances of being granted or rejected a loan and how much we are willing to pay for borrowing a loan.

- To verify that the information is accurate and up to date and complete. This will minimize complications when applying for loans or jobs or when purchasing houses or automobiles.

- To help protect us against identity theft which is basically when someone uses our personal information such as our name, Social Security number or credit card number to open up new credit accounts. Unpaid bills under this account get reported as ours on the credit record. Such inaccurate information can greatly minimize our chances of getting a credit.

Can I Get A Home Loan With A Credit Score Of 588

The minimum credit score is around 620 for most conventional lenders.

However, for those interested in applying for an FHA loan, applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10%. Those with a credit score of 580 can qualify for a down payment as low as 3.5%.

See also: 9 Best Mortgage Loans for Bad Credit

Recommended Reading: How To Report A Death To Credit Bureaus

Formulating A Plan To Improve Your 865 Credit Rating

First aid foremost, you need to understand that it takes time for you to build up your credit score. Dont expect it to be improved in the next week or the next month, even if you do everything necessary to improve it.

If you have any negative factors on your credit report right now, including a late payment, a bankruptcy, or an inquiry, you may want to pay the bills now and then wait. Remember that time is your ally, not your enemy. In the end, there is no quick fix for rebuilding a credit score. It takes time.

In formulating a plan to rebuild your credit rating, you need to understand how specific actions that you take will harm or hurt your credit score. For example, will working with your creditor to close an existing account in favor of rebuilding a new one with more favorable terms hurt or harm you?

Here are two factors for you to consider: a change to your credit report will affect your credit score , and your score is based entirely on the figures that are already in your report.

A major question that people have is how long it will take for them to improve their credit score. But heres what these people are missing: there isnt anything you can do to boost your actual score. Instead, you can do many things to rebuild your history of credit, and the healthier your credit history, the more elevated your credit score will be.