What Is A Bad Credit Score

A bad credit score means you might find it more difficult to get credit. Thats because its an indication to lenders of problematic financial behaviour, such as a history of being late with, or entirely missing repayments.

The three CRAs each have a different number that they consider to be a bad credit score:

Experian below 721

-

0 to 560 is considered very poor

-

561 to 720, poor

TransUnion below 566

-

0 to 550 is considered very poor

-

551 to 565, poor

-

604 to 627, good

-

628 to 710, excellent

The key thing to remember is your credit score is a constantly changing thing that can modify with certain types of financial behaviour and can be improved.

If you’re in a lot of debt

If youre in real financial difficulty and in serious debt, improving your score should not be your priority – first you should get out of debt.

There is plenty of free, impartial help available to you from debt charities like StepChange. Theres no need to go it alone.

Become An Authorized User On Someone Elses Account

If youre new to credit and cant qualify for your own credit card, becoming an on someone elses account can be a great way to get started. But its a double-edged sword: If the person who owns the account has healthy credit, it can help you establish a positive credit history over the long run. On the other hand, if they miss payments or carry high credit card balances, that could also reflect poorly on you. Thats why its important to pick someone you trust who has a longer credit history and higher credit scores than you do, and who overall has a positive credit history.

Uap Insurance Bags High Credit Score

UAP Insurance has received a high credit rating for its âinsurance claim payment abilityâ. The ratings were given out by Global Credit Ratings .

UAP has bagged an âAA – rating. The reputed agency that is based out of Johannesburg, is known for its impressive track record. The Insurance company has received a âstable outlookâ. Gaining recognition for its brand value and competitive positioning in the market, UAP has made a name for itself as one of the stable franchises in an industry that has been deemed highly competitive.

The provider is known to have a moderate to strong liquidity level and the credit rating agency expects the firm to maintain this stand in the days to come.

27 July 2018

Don’t Miss: Does Snap Finance Report To The Credit Bureau

How Long Does Information Stay On Your Credit Report

Positive information in your credit report stays indefinitely, from the time the report was created. Negative information such as late payments or defaults generally stays on your credit report for six years. However, some information may remain for a shorter or longer period of time. Learn more about the timelines for specific cases on the Financial Consumer Agency of Canada website.

About Arrive

Arrive is powered by RBC Ventures Inc, a subsidiary of Royal Bank of Canada. In collaboration with RBC, Arrive is dedicated to helping newcomers achieve their life, career, and financial goals in Canada. An important part of establishing your financial life in Canada is finding the right partner to invest in your financial success. RBC is the largest bank in Canada* and here to be your partner in all of your financial needs. RBC supports Arrive, and with a 150-year commitment to newcomer success in Canada, RBC goes the extra mile in support and funding to ensure that the Arrive newcomer platform is FREE to all. Working with RBC, Arrive can help you get your financial life in Canada started right now. Learn about your banking options in Canada and be prepared. .

* Based on market capitalization

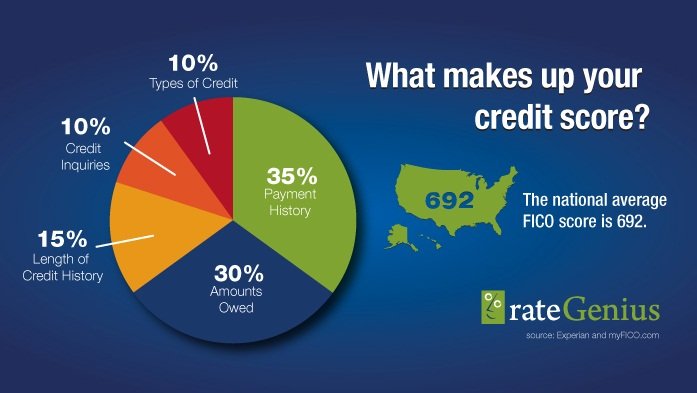

How Your Credit Score Is Determined

Before we look at the basics of credit card ownership, it’s important to understand how your credit score is calculated. This can help you determine whether you carry too many credit cards or the few that you have are enough. Here’s a quick review of the key components of your credit score vis-à-vis the amount of plastic you carry.

Adding too many new cards when you have a short credit history reduces the average age of your credit accounts, which can drag down your credit score.

Read Also: Does Paypal Credit Report To Credit Bureaus

How To Get Your Fico Score For Free

Understand the reasons that help or hurt your FICO® Score, including your payment history, how much credit you are using, as well as other factors that influence your overall credit.

- Which Debts Should I Pay Off First to Improve My Credit?: Prioritizing certain bills can be important when you’re trying to increase your credit scores.

- : Learn the truth and don’t get caught off guard.

Do Not Remove Old Accounts From Report

Some people tend to remove old accounts or deactivated accounts or accounts with negative history from their credit report to make it look good. Some even try to get their old debts removed from their reports once they pay them. This may not be a very smart thing to do. Agreed that negative things are bad for the score, but they are automatically removed from the credit report after a period of time. Getting old accounts removed may harm your score a lot as they may have a good repayment history. Also, if you have paid your debts, then you should keep them in your report as they will improve your score and also show your creditworthiness.

You May Like: Mailed Credit Report

Find Out More About How National Hunter Works

It works by looking for inconsistencies between your current application form and any past applications you’ve made, trying to spot factual errors. While it can’t block your application itself, it triggers a red warning flag to lenders, and this happens roughly 7% of the time. Lenders can then check the info, and ignore it or do further checks. They’re not allowed to reject you based on the National Hunter red flag alone.

Factors such as a number of applications in a few days can also trigger warnings, though generally that’s more acceptable with mortgages, where it’s more common, than with credit cards.

What to watch for

It’s crucial to be consistent, even over long periods, when you fill in application forms. If you have a number of job titles or phone numbers, try to use the same one on every application. Changes to guidance introduced in 2009 mean lenders are supposed to tell you if National Hunter has been a contributing reason for your rejection.

How to check your National Hunter file

To check the info it holds on you, you’ll need to make a subject access request, which is free thanks to the introduction of the General Data Protection Regulation in May 2018. This can also be a useful thing to do if you think you’re a victim of ID fraud.

Ways To Build Credit Fast

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If your credit score is lower than you’d like, there may be quick ways to bring it up. Depending on what’s holding it down, you may be able to tack on as many as 100 points relatively quickly.

Scores in the “fair” and “bad” areas of the could see dramatic results leading to more access to loans or credit cards, and at better terms.

You May Like: Does Removing An Authorized User Hurt Their Credit Score

Open A Store Credit Account

Many stores offer credit accounts. Most are reported as revolving credit, the same as a credit card. Home Depot offers project loans. Many local home improvement stores also offer credit accounts, and some are available with the payment of a deposit in lieu of good credit. Staples office supply store has several credit products, including a personal credit account administered by Citibank. Before applying for store credit, be sure the vendor reports to the credit bureaus.

Also, keep in mind that some are better than others for people with poor credit scores, while others can help individuals recover from poor credit.

How Does Your Bank Account Affect Your Credit Score

Bank accounts will affect your scores if you do things like switch banks too regularly or if you switch before you apply for a big loan, an overdraft or credit card when you dont need it.

As a new resident, you may end up with a bank account that wasnt exactly what you wanted to start off with. Once youve got yourself settled, shop around until you find the right bank or financial institution and then switch.

If you plan on switching bank accounts look for the seven-day switching service. This means that you are not stuck in limbo when switching bank accounts and if you forget to change a payment like your salary or direct debits and standing orders these will be transferred into your new account.

Recommended Reading: How To Unlock Experian Credit Report

Check Addresses On Old Accounts

This may sound bizarre, but a wrong address can have a disproportionate impact. If you had, for example, an old mobile phone contract or credit card that you don’t use any more, but is technically still listed as active on your credit reference files, then check the address is your current one.

If the account is still listed as open, and it lists you as being at a different address, this can stymie applications due to ID checks. Check your file and go through every active account’s address to ensure it’s up to date.

We’ve known people being rejected for mortgages because of this. Worse still, they didn’t know the exact reason why as that’s a nightmare to find out.

If You’ve Split Up Ensure You Financially De

If you split up with someone you’ve had joint finances with , once your finances are no longer linked, write to the credit reference agencies and ask for a notice of disassociation. You can also call up or find the forms online.

This will stop their credit history affecting yours in the future. However, the agencies say they can’t do this if you still have a joint account open with the ex. The account’ll need to be closed or transferred to an individual account before you can do it. For example, a joint loan would have to be paid off before a notice be given.

Tip Email

Read Also: Does Paypal Credit Report To Credit Bureaus

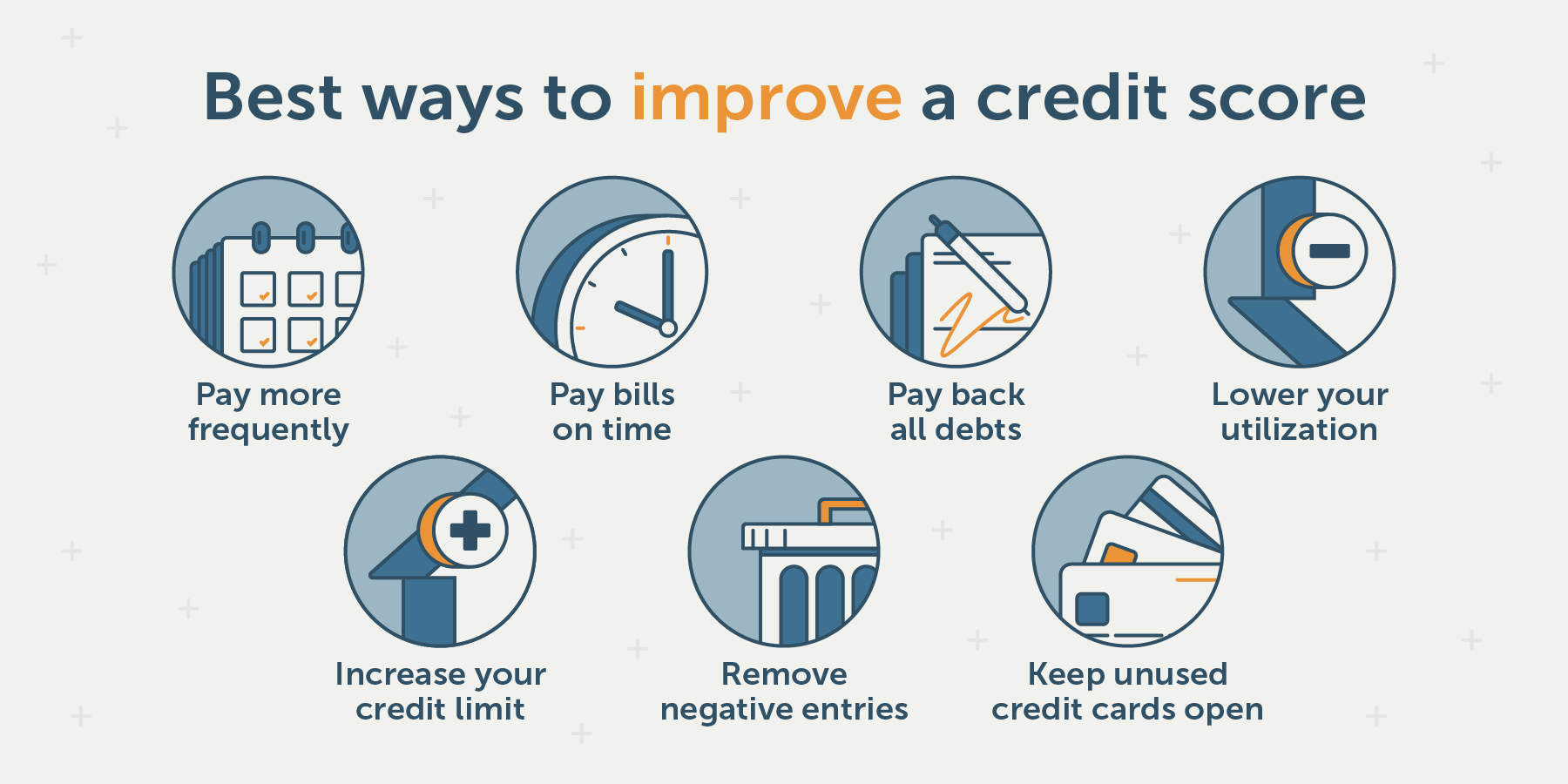

How To Repair Your Credit And Improve Your Fico Scores

You can improve your FICO Scores by first fixing errors in your credit history and then following these guidelines to maintain a consistent and good credit history. Repairing bad credit or building credit for the first time takes patience and discipline. There is no quick way to fix a credit score. In fact, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast.

The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you’ll need to repair your credit history before you see your credit score improve. The following steps will help you with that.

Establishing Or Building Your Credit Scores

Depending on your experience with credit, you might not have a credit report at all. Or, your credit report might not have enough information that credit scoring models are able to assign you a credit score.

With FICO® Scores, you need to have at least one account that’s six months old or older, and credit activity during the past six months. With VantageScore, a score may be calculated as soon as an account appears on your report.

When you don’t meet the criteria, the scoring model can’t score your credit reportin other words, you’re “credit invisible.” As a result, creditors won’t be able to check your credit scores, which could make it difficult to open new credit accounts.

Some people may be in a situation where they’ve only opened accounts with creditors that report to only one bureau. When this happens, they may only be scorable if a creditor requests a credit report and score from that bureau.

If you’re brand new to credit, or reestablishing your credit, revisit step one above.

Read Also: How To Get Credit Report With Itin Number

Fraud Scoring As Well As Credit Scoring Can Cause Rejection

When you apply for a product, it isn’t just a case of assessing whether you’re desirable, but also checking the application is legitimate. So, as well as the credit reference agencies, lenders also use completely separate anti-fraud agencies to try to weed out problems. For more information on ID fraud protection, see our Free ID Fraud Help guide, but here is how the two big agencies work:

National Hunter

This rarely mentioned system is much less factual, and so is prone to greater errors. However, it’s used by almost all major banks and building societies, receiving 96,000 applications a day, and has a real impact.

CIFAS: Lists confirmed past fraud

It is simply a record of known fraud, so if you’re on there, in general, you should know about it. It’s also the organisation to speak to if you think you’ve been a victim of ID fraud. Worryingly, any fraud committed at your address in the past could appear on your CIFAS file, even if it was nothing to do with you.

Ways To Improve Credit In 2021

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Coming out of a difficult year, it’s natural to evaluate where you’re at financially and consider how you want to regroup and prepare yourself for the year ahead. If the COVID-19 pandemic wreaked havoc on your finances in 2020, either through job cuts or other factors, you may need to lay out a new strategy for financial moves such as a home or car purchase, or readjust savings goals. But whether or not your finances have been affected, when considering financial moves for the year ahead, your credit score likely will come into play.

A good credit score is usually considered anything above 670 in the FICO® credit scoring model, and will allow you to access more loan and credit card options with more favorable interest rates. But the closer your score is to the maximum of 850, the better.

Keep in mind that you likely have many credit scores, due to the various ways scoring models weigh information. But the principle that higher scores indicate stronger credit generally holds true across the board.

Here are 21 strategies to get your credit score in tip-top shape, whether you’re building it from scratch or hoping to propel it into the highest tier.

Read Also: Does Opensky Report To Credit Bureaus

Can Student Loans Build Credit

Yes but only if you pay them off on time. All loans will build credit, especially big ones like student loans. However, dealing with this type of loan isnt easy, most of all for young people with low income. For example, secure loans and secured credit cards are much better for credit-building because they bear no risk, unlike student loans, which can be a headache to deal with.

Looking for a student loan? Check out the benefits of SoFi Lending, a popular student loan platform.

Pay On Time And Stay Within Your Limits

Lenders want to know they can rely on you to make regular repayments. A missed payment is likely to negatively impact your credit score.

Your payment history in the last 12 months will be most important to lenders. If you’ve missed payments in the past, but have since become more reliable, your credit score might not be affected as much as you think.

And spending near, or over, your every month is going to give the impression you’re struggling to manage your finances. So, try to keep within your limits.

Recommended Reading: Does Cashnetusa Report To Credit Bureaus

Become A Credit Card Authorized User

If you’re looking to quickly establish your credit history — and, thus, your credit score — being a could help. In some cases, becoming an authorized user on an older account can also help improve your credit even if you already have a credit history. Not everyone looking at how to build credit fast already has a credit history.

Basically, authorized users are people who are added to someone else’s credit card account. The authorized user gets a card in their name and can make purchases with the account. Unlike the primary cardholder, authorized users are not legally obligated to make payments on the account.

Many credit card issuers will report the credit card account activity to the credit bureaus for both the primary account holder and the authorized user. As the authorized user, your credit score may benefit from both the credit history of the account and the credit limit.

If you’re starting from nothing, this is a great option for how to build credit fast. The important thing to note is that this only works if the credit card account is in good shape. Late payments or high balances can hurt both the primary cardholder and any authorized users.

Smart Ways To Evaluate Your Credit Score

A credit score is a numeric representation of your creditworthiness. It is calculated by considering your credit history and repayment behaviour. A healthy credit score gives you a better chance to get quicker approval for loans, lower interest rates, higher credit limit on credit cards and so on. Your credit score is present in you credit report that has all the records of your loans and payments. The Reserve Bank of India has made it mandatory for all the credit bureaus in India to offer one free credit score to its consumers in a calendar year. A credit score of 750 and above is considered by generally considered as ideal by banks and NBFC. Once you get to know your credit score and if it is less than 750, you can evaluate it to know which are the areas you need to work on in order to improve it.

Here are some of the ways to evaluate your credit score

Keep all the aforementioned points in mind to maintain a healthy credit score.

12 July 2018

Read Also: Is 524 A Good Credit Score