How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that youhave undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

Recommended Reading: Is 524 A Good Credit Score

Auto Loans For Good Credit

The best rates for auto loans are typically available to people with good-to-excellent credit, but what good credit means to auto lenders can vary. Beyond the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores.

Even though you may not know which specific score a lender will use, its still a good idea to have an understanding of your overall credit health when shopping around. You can check your credit from Equifax and TransUnion for free on . You can also periodically get a free credit report from each of the three main consumer credit bureaus from annualcreditreport.com.

And yes, its important to shop around! Take some time to compare offers to find the best terms that could be available to you. In particular, the rates offered at car dealerships may be higher than rates you might be able to find at a bank or credit union, or with an online lender.

If youre shopping around for auto loan rates, consider getting preapproved to boost your negotiating power when youre at the dealership. A preapproval letter can be a great way to show car dealers youve done your homework and wont accept a subpar financing offer. Just be aware that it can result in a hard inquiry, which can temporarily ding your credit.

And if you already have a car loan but youve improved your credit since you first got it, you might be able to find a better rate by refinancing.

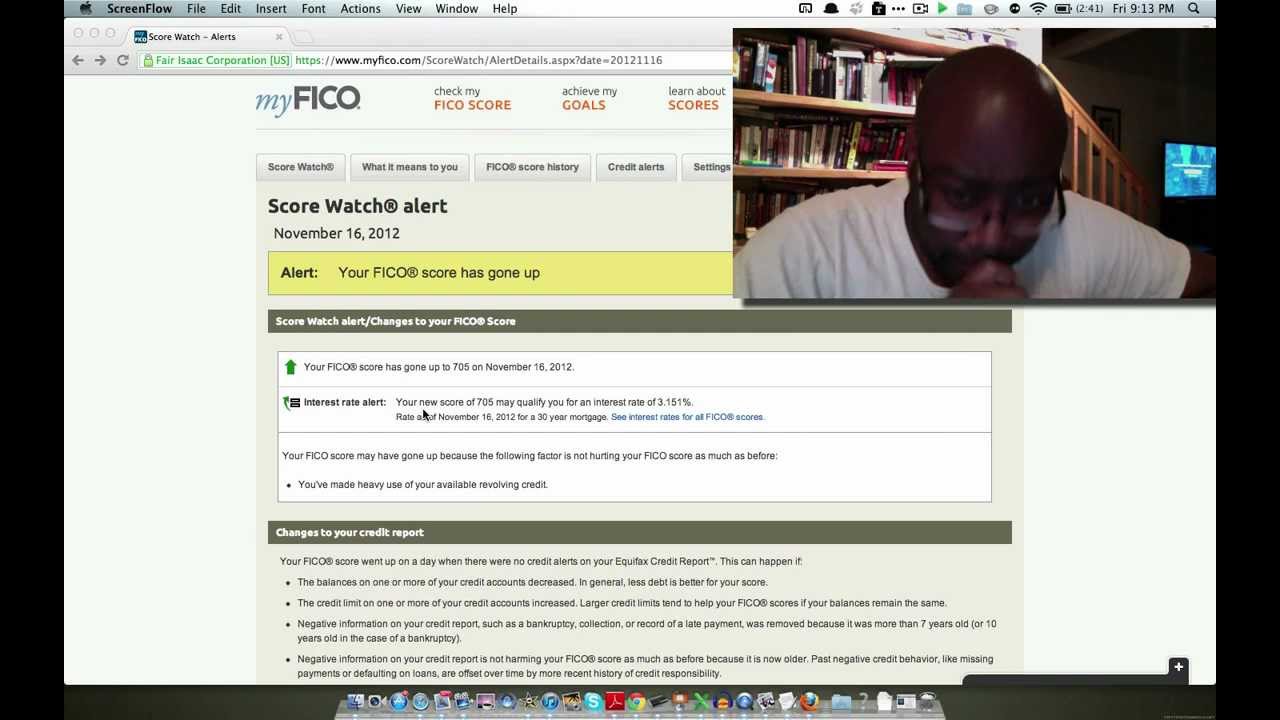

What A 705 Credit Score Will Get You

According to Experion, having a 705 credit score is considered a good score. A 705 credit score is typically good enough for people to qualify for decent interest rates on loans, home mortgages, and car loans. However, you could still have some difficulty getting approved for commercial or business financing.

Don’t Miss: Does Titlemax Report To Credit Agencies

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

Credit Score Mortgage Interest Rate

A good credit score, like a 705, gives more options and better interest rates on mortgages. Since lenders see you as less risky, you’re looking at rates between 3.75%-4.12%. If you’re looking to improve your score for great deals on a mortgage, Credit Glory can help. They identify and remove errors from your credit report , so you qualify for a great deal on your mortgage.

Also Check: How To Unlock My Experian Credit Report

Can I Get A Mortgage With A Low Credit Score

It is possible to get a mortgage with a low credit score, but youll pay higher interest rates and higher monthly payments. Lenders may be more stringent about other aspects of your finances, such as how much debt you have, if your credit is tarnished.

Keep in mind that credit requirements vary from lender to lender. Shop around with multiple lenders to find one that will work with you.

Length Of Credit History

The credit bureaus reward a long credit history with extra points, especially if you have been responsible for your credit usage. Some people with fairly new credit histories have lower scores simply because their accounts arent old enough yet.

The length of your credit history is 15% of your credit score, and its influenced by everything from the length of your oldest account to how long its been since you used an account. Keeping your accounts in good standing will increase your score as time goes on.

You May Like: Carmax Prequalify

What Does Not Count Towards Your 705 Credit Score

There are many things that people assume go into their 705 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Can You Get A Personal Loan With A Credit Score Of 705

Most lenders will approve you for a personal loan with a 705 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

Read Also: How To Unlock My Experian Credit Report

How Can I Check My Credit Score

Checking your credit score is quick and easy. The National Credit Act entitles you to one mahala credit report a year, which can be obtained from the following credit bureaus:

You will pay a minor administration fee per credit report if you want to check it again in the same year. While not all credit bureaus offer a free monthly report, ClearScore does, its a good and free service you can use to check your score more regularly.

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 705 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

You May Like: Paydex Score Chart

What To Do If You Dont Like What You See

If you disagree with something on your credit report or want it amended or erased, you should contact the credit agency where you got your rating, fill out an application form, and submit to the bureau the required signed papers and evidence as soon as possible. After that, your matter will be investigated. If you are dissatisfied with the results of the bureau’s investigation, you can contact the Credit Ombud, who will provide you with free assistance to the extent possible.

What Can You Do With A 705 Credit Score

A credit score of 705 is within the average range for most U.S. consumers, and considered acceptable by the majority of lenders.

This means youll typically qualify for most types of credit, including credit cards, mortgages, and auto loans, provided you meet the lenders additional criteria, including minimum income level, employment history, and down payment amount.

That said, because 705 is only considered a good score, and not Very Good or Excellent, its likely youll have to pay higher interest rates than the most qualified customers.

Other things you can expect with a 705 credit score include:

- Approval for most credit cards, including store cards, most rewards cards, and some 0% introductory interest cards.

- You may not get the most favorable interest rate or highest limits, which can affect your rewards earning potential.

- You may have limited access to the most generous sign-on bonuses, as well.

Recommended Reading: Does Removing An Authorized User Hurt Their Credit Score

Is 735 A Good Credit Score To Buy A House

Your credit score plays a big factor in what kind of interest rate you get on a mortgage. A 735 credit score shows lenders you have excellent credit, helping you qualify for low-interest rates between 3.75%-4.12%. If you’re looking to improve your credit score, Credit Glory can help. By identifying and removing errors on your credit report, they help you boost your score and get a great deal on your mortgage.

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

Also Check: How Can Personal Responsibility Affect Credit Reports

Saw Major Changes In Average Credit Scores But 2021 Could See An Even Bigger Change

The global pandemic and the government response to COVID-19 enabled millions of Americans to pay down debt, stay current on payments, and take more significant strides in improving their credit health than at any time in recent history.

However, millions of Americans have still been left behind even as average credit scores improved. If President Biden is successful in shifting the way in which credit data is collected, this could be one of the most significant shifts in the history of the U.S. financial system due to the outsized role that credit scoring plays in all consumer transactions.

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

Read Also: How To Unlock My Experian Credit Report

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Can I Get A Personal Loan Or Credit Card W/ A 705 Credit Score

Like home and car loans, a personal loan and credit card isn’t very difficult to get with a 705 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 705 score means you likely have a few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

You May Like: What Is Factual Data On Credit Report

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.