Check For Updates To Your Credit Report

Updates to your affected credit reports may take some time to appear. It can depend on the specific credit bureaus update cycle and when the furnisher sends the new information to the credit bureau.

If the update doesnt appear on your credit reports within several months, contact the credit bureaus and the furnisher to verify its reporting your account information to the bureaus.

Call Up The Credit Bureaus

If the lenders are of no help, its time to call the credit bureaus and let them know directly.

Come prepared and understand the following:

Ask them, point-blank, about every single item of concern on your credit report. If they think it was done in error, they will be able to open a dispute.

A dispute happens when an item on your credit report is thought to be in question. Employees of the credit bureau will look into it and determine whether or not they deem it legitimate.

Ways To Dispute Information On Your Credit Report

TransUnion and Equifax have their own processes for disputing credit reports, but Experian provides three methods for submitting disputes:

- Online: Get access to your Experian credit report and initiate a dispute at the Experian Dispute Center . There is no cost to you for using this service.

- : To initiate a dispute by phone, you’ll call the number displayed on your Experian credit report. If you’d like to have a copy of your credit report delivered to you by mail, call 866-200-6020.

- : You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. .

Read Also: Does Speedy Cash Report To Credit Bureaus

There Is Information On My Credit Report That I Believe Is Incorrect What Can I Do About It

Sometimes referred to as filing a dispute, there are important things to know about disputing information on your credit report. By law, you are allowed to dispute inaccurate information on your credit report, and there is no fee for filing a dispute. You may submit your dispute to the business that provided the information to the credit reporting agency and/or to the credit reporting agency that included the information on your credit report.

Why Check Your Credit Report

Your credit report is a record of how well you manage credit. Errors on your credit report can give lenders the wrong impression. If there’s an error on your credit report, a lender may turn you down for credit cards or loans, or charge you a higher interest rate. You may also not be able to rent a house or apartment or get a job.

Errors can also be a sign that someone is trying to steal your identity. They may be trying to open credit cards, mortgages or other loans under your name.

Take a close look at your credit report at least once a year to see if there are any errors.

Read Also: Can Public Records Be Removed From Credit Report

What Happens After You Submit Your Dispute

After you’ve submitted a dispute, Experian goes to work to resolve the issue. The data furnisher will be asked to check their records. Then one of three things will happen:

- Incorrect information will be corrected.

- Information that cannot be verified will be updated or deleted.

- Information verified as accurate will remain intact on your credit report.

Will A Collection Dispute Reset The Clock On The Statute Of Limitations On Your Debt

No, disputing collections doesnt reset the clock on your debt unless you admit that its yours. Debt collectors can restart the clock if you also make a partial payment or agree to a settlement. Old debts will be removed from your report when they reach the statute of limitations even when you didnt pay them.

Read Also: 626 Credit Score

Some Words Of Advice: How To Dispute Credit Report And Win

Wondering does disputing credit work? Unfortunately, its not always that simplebut there are certainly some things you can do to increase your odds. If you do file disputes with the credit bureaus, you should think about how to word your letter. Im not sure Id go so far as to tell them you want accurate information removed. Id simply ask that they verify whats already being reported.

After you file your dispute, the credit bureaus will contact the furnishing party, normally a lender or a collection agency. These parties are formally referred to as data furnishers or furnishers for short.

Its their responsibility to investigate your claim and get back to the credit bureaus, normally within 30 days, but there are some scenarios when it can take 45 days.

If they confirm the accuracy of the credit reporting, then youll likely have to live with it until the credit bureaus have to remove the item, which normally takes 7 years for the bad stuff.

How We Make Money

We are an independent publisher. Our advertisers do not direct our editorial content. Any opinions, analyses, reviews, or recommendations expressed in editorial content are those of the authors alone, and have not been reviewed, approved, or otherwise endorsed by the advertiser.

To support our work, we are paid in different ways for providing advertising services. For example, some advertisers pay us to display ads, others pay us when you click on certain links, and others pay us when you submit your information to request a quote or other offer details. CNETs compensation is never tied to whether you purchase an insurance product. We dont charge you for our services. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear.

Our insurance content may include references to or advertisements by our corporate affiliate HomeInsurance.com LLC, a licensed insurance producer . And HomeInsurance.com LLC may receive compensation from third parties if you choose to visit and transact on their website. However, all CNET editorial content is independently researched and developed without regard to our corporate relationship to HomeInsurance.com LLC or its advertiser relationships.

Recommended Reading: What Credit Bureau Does Affirm Use

Check Your Credit Report For Fraud

Look for accounts that don’t belong to you on your credit report. Accounts that you don’t recognize could mean that someone has applied for a credit card, line of credit, mortgage or other loan under your name. It could also just be an administrative error. Make sure it’s not fraud or identity theft by taking the steps to have it corrected.

If you find an error on your credit report, contact lenders and any other organizations that could be affected. Tell them about the potential fraud.

If it’s fraud, you should:

- report it to the Canadian Anti-fraud Centre

The Canadian Anti-Fraud Centre is the central agency in Canada that collects information and criminal intelligence on fraud and identity theft.

Are Your Finances In Good Shape

Check your credit report to make sure you’re in good shape to apply for loans, credit cards, overdrafts, mortgages and mobile phone contracts

This, in turn, will affect how likely that person is to receive credit and be accepted for a variety of products such as , mortgages, loans, bank accounts and even mobile phone and gas and electricity contracts.

However, there are times when your credit report will display something that doesn’t seem right or incorrect information on your credit report. Such as a missed bill payment that you actually paid on time, or a technical error by the bank, that made it look like you were going too far into your overdraft.

Recommended Reading: Opensky Credit Card Delivery

What Can I Dispute On My Credit Report

Consumer credit reports can vary in the way they look and the order information is listed depending on which of the three major national credit-reporting bureaus provided the report. Consumers can obtain their free credit reports once every 12 months at www.annualcreditreport.com. If you believe that there is inaccurate information on your credit report, its important to know what you can dispute and the steps to take.

Review Your Credit Reports:

Start by getting a highlighter and a pen out and go through your credit report item by item, page by page highlight the items that are reporting incorrectly and make a note next to the item to help you in the dispute process following these guidelines:

Dispute Inaccuracies:

You may write to the credit reporting agencies with the information you have highlighted with a request for correction/deletion depending on your specific dispute. Mailing your letters certified or return receipt is recommended. Sample disputes letters can be found on page 113 of credit.orgs ebook, Consumer Guide to Good Credit, available for in English and Spanish. You may also dispute some items online at www.annualcreditreport.com.

Statute of Limitations for Reporting:

Negative entries on your credit report have different reporting limits. Typical retention periods are stated below, and may vary by state:

If you have questions, you can talk to a certified for free. Call us today or get started online.

Most Recent

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

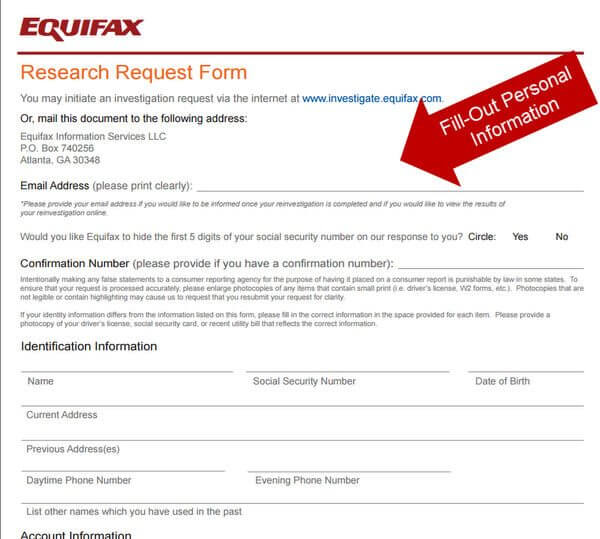

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

Also Check: Does Klarna Affect Your Credit Score

File A Dispute With The Credit Reporting Agency

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

How To Find And Evaluate Inquiries

You’re entitled to free credit reports direct from the three major credit bureaus at least once every 12 months. Request them by using AnnualCreditReport.com.

Look over the section labeled inquiries. Youre concerned with hard inquiries, the kind that happen when you apply for credit. Those can cause a small, temporary drop in your score. Soft inquiries, such as when you check your own credit or a marketer screens you for a pre-approved offer, dont affect your score.

Each credit bureau or website presents information in its own way, but all will label any inquiries that might affect your score. If you dont recognize something, its worth investigating. Reasons you might not recognize the entry range from benign to worrisome:

-

A store credit card you applied for may be issued through a financial institution with a different name.

-

Your car loan application may have gone to multiple lenders .

-

Debt collectors are allowed to check credit under the Fair Credit Reporting Act, although most often these are soft inquiries.

-

You may have fallen victim to identity theft and someone is opening fraudulent accounts in your name.

Read Also: 676 Credit Score Good Or Bad

Dispute The Information With The Credit Reporting Company

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

The Creditor’s Obligations When You Dispute Information

Under the Fair Credit Reporting Act , a creditor who furnishes information to credit reporting agencies must:

- reinvestigate when you dispute reported information

- not report incorrect information once it learns or has a reasonable basis to believe that the information is, in fact, incorrect

- promptly provide credit reporting agencies with correct, complete information when it learns that the information it has been reporting is incorrect or incomplete

- notify credit reporting agencies when a consumer disputes information

- note when accounts are “closed by the consumer”

- provide credit reporting agencies with the month and year of the delinquency of all accounts placed for collection, charged off, or similarly treated, and

- finish its investigation of a consumer dispute within the 30- or 45-day periods in which the credit reporting agency must complete its investigation.

Don’t Miss: Does Loan Me Report To Credit Bureaus

What Are Common Credit Report Errors

When reviewing your credit reports, its a good idea to request copies from both credit reporting agencies, as Equifax and TransUnion may have different information on file about you.

Information commonly disputed includes information related to items being paid, no knowledge of the debt and updating accounts to show they were part of a debt repayment program, such as bankruptcy, Blumberg says.

Heres a recap of common credit report errors to watch out for:

- Personal information mistakes, such as outdated mailing addresses or an incorrect date of birth.

- Incorrect payment information, such as on-time payments showing as late.

- Negative information that remains on your credit report beyond the maximum seven years .

- or for someone who has fraudulently used your identity.

What Happens After You Dispute Information On Your Credit Report

Tip

If you suspect that the error on your report is a result of identity theft, visit IdentityTheft.gov, the federal governments one-stop resource to help you report and recover from identity theft.

If the furnisher corrects your information after your dispute, it must notify all of the credit reporting companies it sent the inaccurate information to, so they can update their reports with the correct information.

If the furnisher determines that the information is accurate and does not update or remove the information, you can request the credit reporting company to include a statement explaining the dispute in your credit file. This statement will be included in future reports and provided to whoever requests your credit report.

Also Check: How To Remove Repossession From Credit Report

Disputes Related To Your Personal Information Or An Inquiry

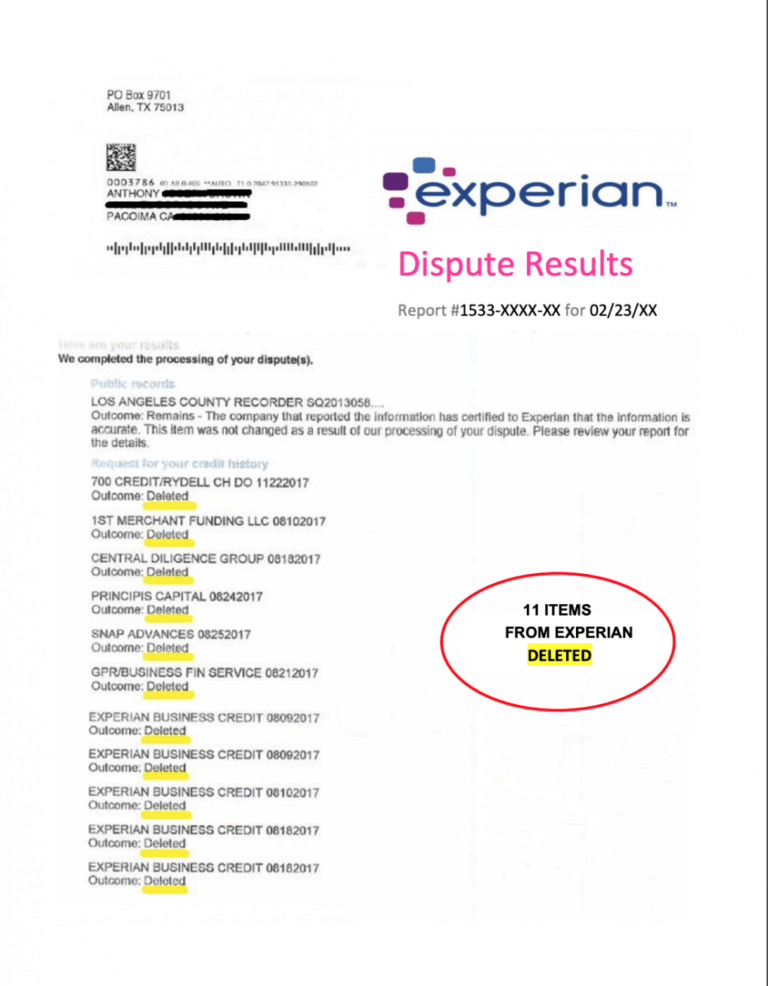

- Added: This item was added to your credit report.

- Address Updated: This may appear to you as Deleted, as your address is updated to the current address.

- Deleted: The item was removed from your credit report.

- Processed: The item was either updated or deleted.

- Remains: The company reporting the information has certified to Experian that the information is accurate, so the item has not changed.

You Can Ask To Fix Mistakes On Your Credit Report For Free Heres How:

- Ask the credit reporting agency for a dispute form or submit your dispute in writing along with copies of any supporting documents. Keep a copy of what you send for your records.

- Clearly identify each item in your report that you think is wrong, explain why you disagree with the information, and request a reinvestigation.

- If the credit bureau investigation changes your credit report, the credit bureau must give you the results in writing and a free copy of your report.

- Ask that a corrected version of the report be sent to anyone who got your report within the past six months. Job applicants can have corrected reports sent to anyone who got a copy for employment reasons in the past two years.

- The credit bureau cannot put the disputed information back in your file unless the creditor verifies the information. If that happens, the credit bureau must write to you and give you the name, address and phone number of the creditor.

- You can dispute the information with the creditor in writing. Many creditors, like credit card companies or banks, have an address where you can send your dispute. If the creditor reports the information to the credit bureau, it must tell them that you dispute it.

- If the reinvestigation doesnt fix the problem, have the credit bureau include your version of the dispute in your file and in future reports.

Read Also: How To Check Credit Score Without Social Security Number