How Does It Affect Your Credit Score

Having hard inquiries on your credit report may affect your score. It depends on the type of inquiry and the frequency. A hard inquiry can drop your credit score roughly 5 to 10 points but may vary depending on your score prior to the inquiry. Inquiries are not inherently negative or bad, in the sense that they are required in order to determine your eligibility, as they are simply part of most processes. However, they can be troublesome or become a problem if your account suddenly reveals a lot of inquiries, suggesting to potential creditors or lenders that there may be something to watch out for. This might cause your score to drop significantly, impacting your buying ability and financial flexibility.

If You Suspect Fraud Act Quickly

But if a hard inquiry you didnt authorize is on your credit reports, it may be because

- Someone fraudulently applied for a credit account using your information

- A creditor pulled your credit even though it didnt have your permission

- The credit bureau mistakenly added the inquiry to your report

If an unauthorized hard inquiry was due to someone else applying for credit with your information, it could be an indication that your identity was stolen. You might want to take some additional steps as soon as you spot the suspicious activity to help prevent further misuse of your information, such as

- Putting a fraud alert on your credit reports

- You may even want to consider a or locking your credit

You should also continue to check your reports to see if a fraudulent account appears following an unauthorized inquiry. If a fraudulent account appears on your credit reports, youll want to contact the creditor to close the account.

If a creditor pulled your credit without your permission or a credit bureau mistakenly added an inquiry to your report, the incorrect hard inquiry could still harm your credit until you take action.

No matter how it got there, youll want to file a dispute with the credit bureau whose report shows the incorrect hard inquiry to request that the bureau remove it.

How Does A Credit Inquiry Work

Most lenders have strict policies and procedures regarding credit reports and how they use the information gathered from a report. While procedures may vary, most banks and lenders take the following three steps when making a credit inquiry:

You May Like: Syncb/ppc Credit Inquiry

What A Credit Card Issuer Or Lender Thinks When They See A Hard Inquiry On Your Credit Report

Hard inquiries fall under the “less influential” category when calculating credit scores using the VantageScore model, and they make up only 10% of a FICO score calculation. But they play a big part when it comes to credit card issuers and lenders assessing your potential risk.

Lenders pull your credit report to see how credit worthy you are, but finding a bunch of inquiries on your credit report will show them you may be financially stressed and a bigger risk for borrowing in the future.

According to FICO, “Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports.”

But while these hard inquiries do show risk, lenders also consider other factors when making approval decisions, such as your income and payment history.

How To Dispute A Hard Inquiry On Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youve checked your credit reports, you may have noticed youre not the only one taking a peek.

-

Utilities use them to decide whether to charge you a deposit.

-

Companies may check your credit standing so they can market products to you.

-

Potential landlords and employers may look to see how reliable you are.

Inquiries stay on your report for two years, but not all of them affect your score. Heres what you need to know about when and how to remove a hard inquiry from your credit report.

Don’t Miss: What Is Syncb Ntwk On Credit Report

How To Dispute A Hard Inquiry

Itâs frustrating that these errors hurt your credit score. Luckily, you have the opportunity to dispute a hard inquiry. A successful dispute will get it removed from your credit report.

If you have not reviewed your credit report, you can get a free one from AnnualCreditReport.com. When you see an error on a copy of your credit report, you should report it immediately. This can lead to a credit inquiry removal, where the inquiry gets taken off your record. Your credit report is not just used by credit card companies to consider whether to give you new credit or when you file a loan application. Many other corporations can file credit inquiries on you, such as employers, insurance companies, utility service companies and other businesses. So, itâs important to take steps to protect your own credit.

When filing a dispute, you will likely go through three major credit bureaus: Experian, Equifax and TransUnion. They compile your financial information by looking at your record with lines of credit, your car loan and other financial factors to create a credit report, which reflects your credit score.

These three bureaus gain information about your credit history through a few ways. Creditors will report data to Experian, Equifax and TransUnion. The credit bureaus also buy data from various databases. Finally, Experian, Equifax and TransUnion will all share information between each other.

What Is A Credit Inquiry And Who Can Make One

A credit inquiry is a formal request to see your credit report. Also known as a credit check, a credit inquiry is usually made by a financial institution such as a bank or credit card company. Employers, landlords and property managers can also check your credit. And you can inquire about your own credit as well.

The Fair Credit Reporting Act outlines your rights pertaining to your credit report and who can make a credit inquiry. It prohibits accessing your credit report unless there is a “permissible purpose” such as processing your application for a loan or insurance, or with your consent. The FCRA also lists the actions you can take if your rights are violated.

Also Check: Does Opensky Report To Credit Bureaus

How To Prevent Unauthorized Credit Inquiries

There are also ways you can prevent an unauthorized credit inquiry from even taking place, which means you hopefully wont have to remove an unauthorized inquiry in the future. One strategy is to make your credit report inaccessible to lenders and creditors with a credit freeze.

A will place a lock on your credit report. This means that a lender or creditor will not be able to access your credit report in order to view your information. Implementing a credit freeze can also help keep hackers and identity thieves from opening new credit and/or applying for loans in your name.

Hot Tip: It is important to note that when you have a credit freeze in place, it can hinder your own ability to obtain new credit. For this reason, you can temporarily lift a credit freeze. All 3 of the big credit bureaus have programs available for putting a freeze on your credit.

When Are Credit Inquiries Needed

- A bank or lender makes an inquiry. If you apply for a mortgage, you can expect the lender to make a credit inquiry. Your credit score and other details can influence the approval process as well as the interest rate for your mortgage. Lenders also make inquiries to review your existing accounts.

- An employer inquires about your credit. Many companies now require credit background checks for new employees. If you work in financial services or are applying for a government job, the odds of your employer making a credit inquiry are higher.

- You want to check your own credit. You’ll need to make a credit inquiry if you want to get a copy of your credit report.

- A court order is issued. A federal grand jury subpoena or court order may require a credit inquiry. In these cases, your permission may not be required, and an inquiry can legally occur without your consent.

You May Like: Does Paypal Credit Affect Credit

Dont Worry About The Rest

Legitimate hard inquiries can ding your credit score, but not by much and not for long. Hard inquiries … represent potential new debt that doesnt yet appear in the credit report as an account, says Rod Griffin, Experians director of public education.

Typically, any impact drops off dramatically after a month or two, Griffin says, either because you did not add the debt, so theres no risk, or you did open an account and its now wrapped into other credit factors.

Some companies say they can remove even legitimate inquiries from your report for a fee but NerdWallet advises against using them. As long as youre not continuing to pile up applications, time will repair any damage to your credit.

Griffin advises keeping perspective because other things influence your credit score more .

Hard inquiries alone will never be the reason a person is declined for credit, he says. Inquiries may be the proverbial straw that broke the camels back, but they will not be the entire bale of hay.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

How To Mask A Hard Inquiry From Your Credit Report

A hard inquiry cannot be removed but can be masked from appearing on your credit report by converting it to a soft inquiry. Soft inquiries cannot be removed, and they remain visible on your own report, but lenders can’t see them.

Unfortunately, there is no fast or easy way to mask a hard inquiry from your credit report. It takes time and there’s no guarantee you’ll succeed. Here are some things you can do to mask a hard inquiry:

Before you go through the final steps, consider these two things: First, attempting to mask a hard inquiry from your report requires time and effort. Second, remember hard inquiries only remain on your report for about two years.

Also Check: How Accurate Is Creditwise Credit Score

I Have A Hard Credit Check On My Report How Do I Remove It

You may have some hard credit checks on your record already, but did you know It is possible to remove inquiries from your credit card report? If you do have hard checks you can dispute the inquiry with a credit bureau or with your creditor. If you did not authorize the hard credit check, you may be able to have them remove the hard check from your record.

A high credit score is important, especially if you are looking to have lenders extend credit to you. Thats why it is important to avoid hard credit checks at all costs. If you follow those three basic steps your credit score should remain in good shape. If you do find that your score is low, it could be due to hard credit checks. I would recommend disputing the claim with a credit bureau or with your bank. Let them know that you did not authorize the transaction and in the future use applications that use soft checks to view your credit score. A high credit score is important, especially if you are looking to have lenders extend credit to you.

- 1share

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

Also Check: Does Paypal Credit Report To Credit Bureaus

How Long Do Hard Inquiries Stay On Your Credit Reports

Hard inquiries arent like other negative items on your credit history. Not only do they have less of an impact on your credit score, but they also dont remain on your history as long as major negative items, such as loans that have gone into collections or bankruptcies.

In contrast with late payments past 30 days overdue, for instance, which stay on your credit report for seven years, hard inquiries will only remain on your credit profile for two years. In addition, they will typically impact your credit score no longer than 12 months before becoming irrelevant and outdated.

Inquiries Arent A Major Factor In Your Credit Score

Examples of soft inquiries include when a utility company considers whether they need security deposit from you, when credit card companies decide what types of credit cards to market to you and for setting premiums on insurance. Additionally, when you pull a credit check on yourself through a credit monitoring service, itâs a soft inquiry. Since these credit inquiries do not deal with lending you money, but still provide valuable information about your credit history, it would be unfair if they counted against your credit score.

According to Experian, inquiries wonât affect you unless you also have other – more serious – issues impacting your credit score. Multiple credit inquiries are ultimately a reality of life. For example, when you are looking to buy a car and want the best auto loan rates, a dealership might engage in rate shopping, where they send your information to an array of lenders. Due to this issue, all inquiries related to an auto loan that are sent within 14 days will all count as one inquiry.

Additionally, there are even credit scoring systems that will not count a credit inquiry after more than one year. As noted above, hard inquiries will not remain on your credit report for more than two years. So over time, an individual inquiry counts less.

Read Also: What Is Syncb Ntwk On Credit Report

Review Your Credit Reports

You should make it a habit to regularly review your credit reports from the three major consumer credit bureaus Equifax, Experian and TransUnion. The may not know which information is incorrect unless you flag it.

To check for incorrect hard inquiries on your credit reports, look for a section labeled something like

- Requests viewed by others

- Regular inquiries

There may also be a separate section for soft inquiries, which should be labeled something like requests viewed only by you. Unlike hard inquiries, soft inquiries wont affect your credit scores.

Not sure how to read the information your credit reports? Learn more about whats on your credit reports and how to read them.

Accessing And Preparing To Dispute Hard Inquiries

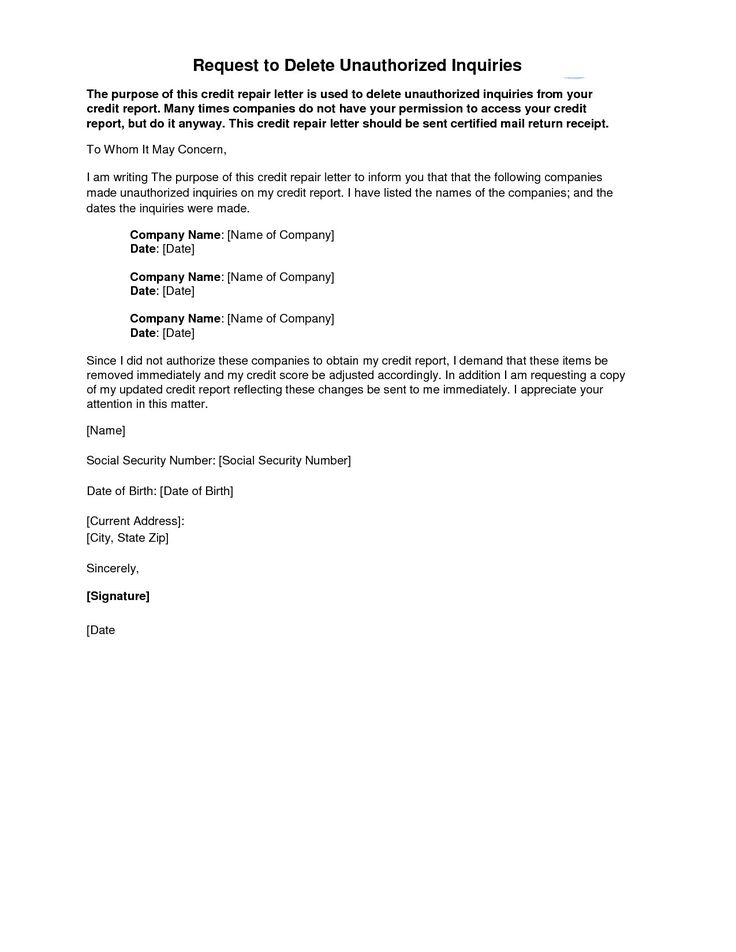

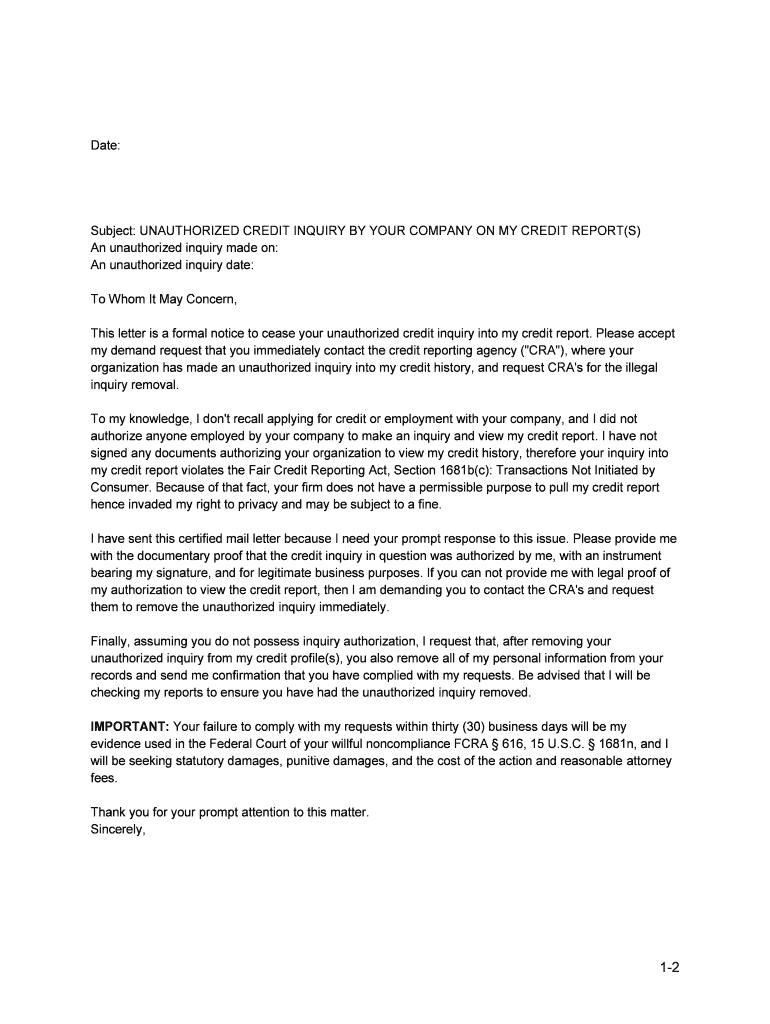

The first thing you need to do when you are attempting to remove hard inquiries from your file is to gain access or a copy of your credit report. These can be accessed through your bank or financial institution. When you start the process, you will want to have some items or documents ready in order to make the process as quick and efficient as possible. You will need government documents, such as your social security card, drivers license, or any form of government identification, a bill to confirm your information, as well as a dispute letter. This is all needed to make the dispute more effective, clearly stating your reasoning for the removal and increasing your chances of success. Depending on the credit bureau, the form requirements may vary.

Recommended Reading: Does Klarna Report To Credit

Add A Consumer Statement To Your Report

Sometimes when you dispute something on your credit report, such as a credit inquiry, the credit bureau may rule against you and keep the inquiry on your report.

If this happens, you arent completely out of luck. You have the opportunity to add a consumer statement to your credit report. Consumer statements are 100-word statements that cover individual pieces of information on your report or your credit report in general.

You can use a consumer statement to inform lenders that you disagree with the information contained in your credit report. You can also use consumer statements to provide an explanation for negatives like a late payment.

Adding a consumer statement to your credit report wont impact your credit score at all but lenders will see the statement when they request a copy of your credit report.

You can add and remove consumer statements at any time. If you do add a consumer statement to your report, make sure you remember to remove it after the item youre discussing falls off your credit report.

The last thing you want is a consumer statement justifying a missed payment when that missed payment no longer appears on your credit report. Instead of explaining a mistake that a lender already knows about it, it will inform potential lenders of negative information they wouldnt otherwise have learned about.