There Are Ways To Improve It

An excellent credit score is like the top math score on the SAT. With both, 800 is exceptional.

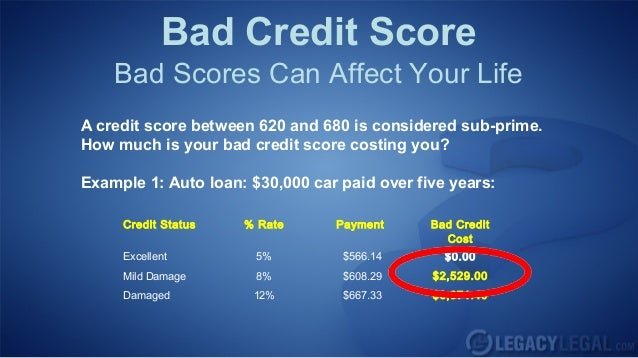

But if your credit score isn’t near that number, you should know what constitutes a good credit score that will let you qualify for a loan at a decent interest rate.

The answer: It should be at least in the mid to high 600s.

If your score isn’t that high yet, you’ll need to exercise good borrowing behavior, take some strategic steps, and have patience. You may also want to take advantage of two new programs offered by credit industry companies that are designed to improve those numbers .

The FICO score is the brand of credit score used by most consumer lenders, so it’s the one to pay the most attention to. FICO credit scores typically range from a low of 300 to a high of 850. When you get a credit score report from your lender, your number is often depicted on a continuum like a spectrum or rainbow, with bright green denoting the 800 range and red representingwell, you know.

FICO says there’s no “cutoff” where, say, a good credit score becomes a very good credit score, or a very good credit score becomes exceptional. But Experian, one of three major credit bureaus that supply data used in the FICO score, lays out the boundaries this way:

How To Get Your Credit Report In Canada

A credit report is a record of a borrowers credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

Read How to Check Your Credit Score 101 for detailed information on how to get your free credit report.

Is 711 A Good Credit Score

A 711 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Recommended Reading: Bby Cbna Credit Card

What Credit Score Is Needed To Buy A House

Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest

A good credit score falls between 690 and 719 on the 300-850 scale commonly used by the main scoring companies, FICO and VantageScore.

A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use

What Does A 750 Credit Score Mean For Your Wallet

A 767 credit score is well above the national average of 679, according to the latest data from TransUnion. As a result, such a score generally gives you access to some of the best loans and lines of credit. The very best rates, rewards and fees may still be out of reach, though, as youll see in the table below.

Recommended Reading: Does Affirm Approve Bad Credit

Percent Of Americans Who Have A Credit Score Of 800 Or Higher

Another report from The Ascent reveals that only 22 percent of Americans have a credit score of 800 or greater7.

Those who have a credit score of 800 to 850 are considered to have exceptional credit, and it appears that older individuals as well as those with incomes ranging from $101,000 to $150,000 have much higher credit scores within the perfect range.

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have several different types of credit accounts that include a mix of installment and revolving credit.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

Also Check: Does Eviction Go On Credit Report

How To Request A Report

There are three major credit-reporting agencies: Equifax, TransUnion, and Experian. You can receive a free copy of your credit report once a year from AnnualCreditReport.com, which gets the reports from each of the three companies.

It is a good idea to get a copy annually so that you can check it for errors. Errors range anywhere from name misspellings and incorrect Social Security numbers to accounts being listed as still open when in fact they have been closed an error that can hurt you when you need to get a mortgage.

Your credit report also will show whether you have been the victim of identity theft. If your personal information, such as your Social Security number, has been changed, the report will reveal it.

Mortgage Rates For Excellent Credit

Having excellent credit is one of the first steps to getting a great mortgage rate. But there are other factors at play here too, like the total cost of your home and your debt-to-income ratio.

Once youve got a sense of how much house you can afford and the type of mortgage you want, its time to shop around to understand the rates that might be available to you. Getting a mortgage preapproval can help you understand how much you can borrow and make your offer more competitive.

Compare current mortgage rates on Credit Karma to explore your options.

Read Also: How To Remove A Repossession From Your Credit

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

Explanation Of Credit Score Ranges

When it comes to purchasing something that requires borrowing money, your credit score is the three-digit number that tells lenders if you’re a worthy investment or not. Whether you are applying for a mortgage, home loan, car loan or boat loan, lenders will make a decision after looking at your credit score and other information. The higher your credit score is, the more chances you have at obtaining any loan you want at affordable interest rates .

Recommended Reading: How Long Does Car Repo Stay On Credit

What Is A Credit Score

A credit score is expressed in the form of a three-digit number that ranges between 300 to 900. It is a representation of an individuals creditworthiness. Lenders refer to your credit score before approving your credit application. A good credit score is certainly a winner in every loan or credit application. A credit score of 750 and above is considered a good credit score.

In India, credit scores are generated by credit bureaus like Equifax, CIBIL, Experian, CRIF High Mark, etc. Credit scores from each credit bureau may vary slightly since they have a different algorithm for calculating credit scores.

How To Get A 760 Credit Score

Theres no secret for getting a 760 credit score. Rather, it simply requires consistency and commitment. You need to pay your bills on time, use only a portion of the credit made available to you, and generally work to make any mistakes youve made look like freak occurrences rather than standard practice. You also need to know exactly where youre starting from and then actually track your progress over time to hold yourself accountable. So make sure to regularly check your latest credit score for free on WalletHub as you work your way to a 760 credit score.

You can find specific recommendations for what we recommend doing in your situation on your personalized credit analysis page. And below, you can check out some of the most common steps people need to take to get a credit score of 760.

You May Like: Credit Score For Affirm Approval

What Is A Good Fico Score

A good FICO score lies between 670 and 739, according to the company’s website. FICO says scores between 580 and 669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores typically express a consumer’s creditworthiness as a number between 300 and 850.

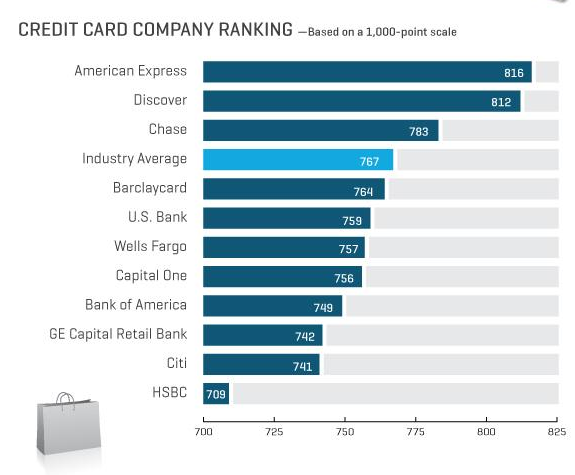

Shopping For Credit Cards With A 767 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

Also Check: How Do I Unlock My Transunion Credit Report

Is 767 A Good Credit Score Research Maniacs

In other words, is a persons creditworthiness good if his or her credit score is 767? First, to put the 767 credit score in perspective, credit scores

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 767 FICO® Score is above the average credit score. Consumers in

How To Read Your Cibil Report Or Credit Report

The credit report is a detailed document that highlights your entire credit history and record. It includes your personal information, contact information, employment history, credit limit on various credit cards, credit balances, and dates on which you opened various accounts. This credit report is viewed by various parties or organisations.

Some common parties who may view your credit report are as follows:

- Lenders like banks and non-banking financial companies

- Landlords

Given that it is a comprehensive document with multiple sections, it is important for you to know how to read your credit report. This will help you understand your report better, and even check to see if it does justice to your credit history.

Don’t Miss: How To Print Your Credit Report From Credit Karma

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

How Long Does It Take To Get A 767 Credit Score

It depends where you started out.

If you had good credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Recommended Reading: What Credit Card Can I Get With A Score Of 570

Why Do Lenders Check Your Cibil Score Before Approving Your Loan

Since CIBIL score measures your overall creditworthiness, a lender is certain to check your score when reviewing your loan application for a variety of reasons. They are:

- To check your credit history and past record

- To see whether you are capable of repaying debts

- To review your credit balance and understand the risk level of your profile

- To judge whether you qualify for the loan

- To decide on the loan amount to offer you and interest rate applicable

Improving Your 767 Credit Score

A FICO® Score of 767 is well above the average credit score of 704, but there’s still some room for improvement.

Among consumers with FICO® credit scores of 767, the average utilization rate is 23.7%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll also find some good general score-improvement tips here.

Don’t Miss: What Credit Bureau Does Paypal Credit Use

Are You Going To Get Good Financing Terms

There are plenty of lenders that specialize in providing people with excellent credit very affordable interest rates and highly flexible repayment terms. Even though someone with a credit score of 767 still has a slight chance of defaulting on a loan in the future, lenders don’t see them as a risky borrower compared to people with credit scores of 600, 450 and 300. After all, 767 is far from 300, and lenders will be happy to get your business.

Is 767 A Good Credit Score

Asked by: Salma Jacobi

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 767 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. 25% of all consumers have FICO® Scores in the Very Good range.

Also Check: When Does Open Sky Report To Credit Bureau

A 767 Credit Score Is Often Considered Very Good Or Even Excellent

A very good or excellent credit score can mean youre more likely to be approved for good offers and rates when it comes to mortgages, auto loans and credit cards with rewards and other perks. This is because a high may indicate that youre less risky to lend to.

Lenders use this three-digit indicator, which is calculated from all the information collected in your credit reports, to gauge how likely they think you may be to default on your loans and the higher the score, the better you look to a lender.

But even having an excellent credit score doesnt mean youre a shoo-in there are still no guarantees when it comes to credit approval.

A credit score can be an important factor when you apply for credit, yes. But you actually have multiple credit scores from different sources, each one drawing on data from your various credit reports with the major consumer credit bureaus . A credit score may be considered excellent according to one scoring model but could be calculated differently using another model that weighs certain factors differently, resulting in a different score altogether.

Also, scoring models and lenders can have different interpretations of what qualifies as excellent. And when its time to make a decision about whether to extend credit to you, lenders typically consider other factors not reflected in your scores, such as your income or employment status.

Learn more about keeping up and making the most of an excellent credit score.