Why Does This Matter To Consumers

If it were up to a credit card applicant to decide, they obviously would want a card issuer to pull a report that contains the most favorable information most notably their credit score.

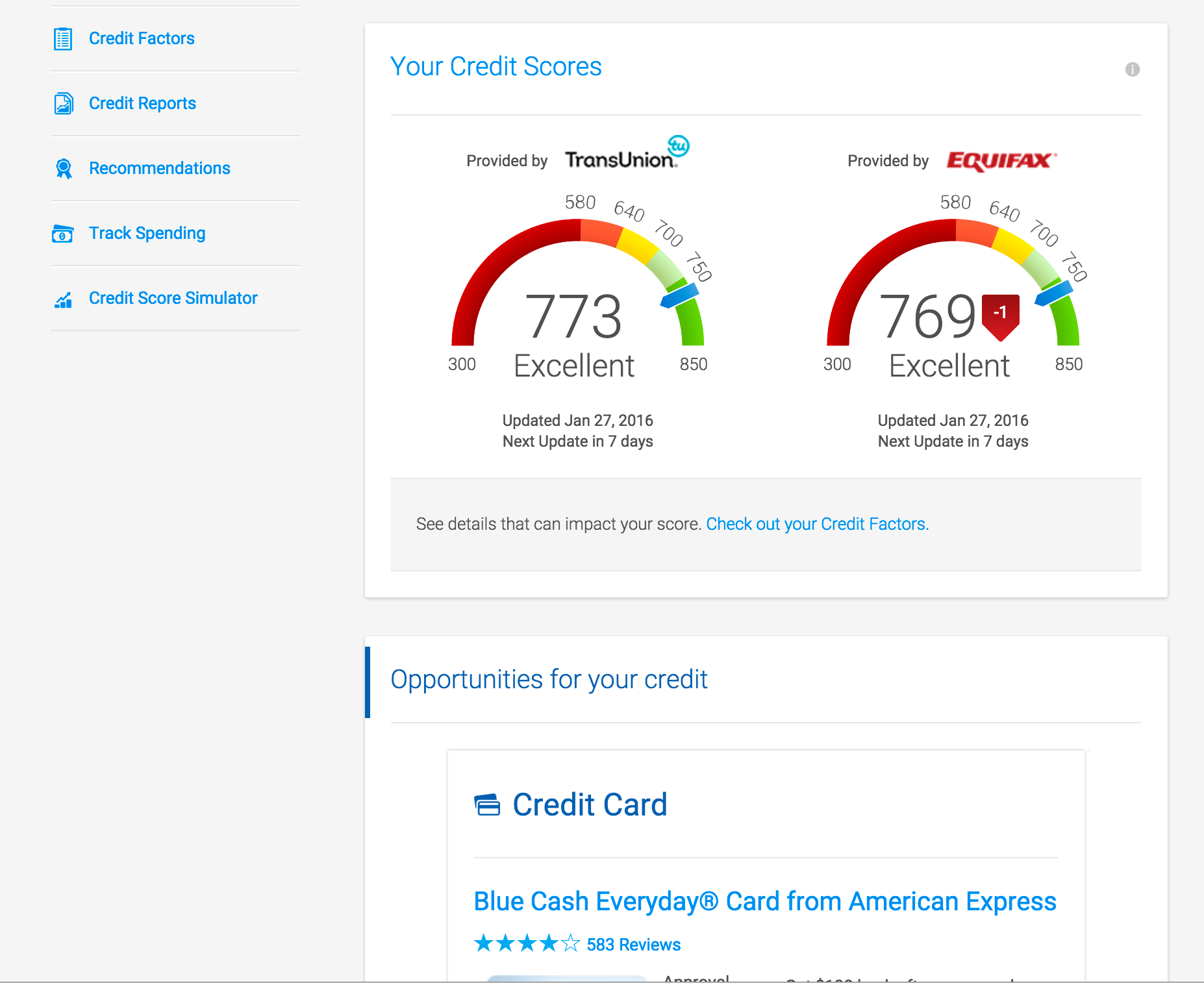

However, an applicant has no say in the matter. Therefore, a card issuer could pull your report from Experian, for example, and it shows a credit score of 680, while your Equifax report puts your score at 700 and your TransUnion report puts it at 710.

As such, the Experian report indicating a credit score of 680 might lead to less desirable terms, such as a higher APR for a credit card.

Ted Rossman, industry analyst for CreditCards.com, says which credit bureau is used also might come into play if youve set up a credit freeze with one bureau but not the two others.

Furthermore, he says, one or more credit bureaus might supply inaccurate information such as a late payment on a credit card account when you actually had no late payments that could hinder your ability to get credit.

See related: How to dispute an error in your Experian credit report

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Remove American Web Loan From Your Credit Report Today

Lexington Law specializes in disputing American Web Loan collections. They have over 18 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

If youre looking for a reputable company to help you with collection accounts and repair your credit, we highly recommend Lexington Law.

Call them at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

- Top Trending Debt Collection Agencies

-

Heres a list of some of the nations most popular debt collectors that cause damage to your credit.

Recommended Reading: How To Raise Credit Score With Credit Card

Applying For A New Card: Which Credit Bureau Gets Used

Good credit is one of the better things to have around. If you dont already know your credit score, there are many free options available. Each time you apply for a new credit product, a lender will check your credit history from a credit bureau with a history of your financial information. There are two credit bureaus in Canada, Equifax and TransUnion. A creditor will usually pull one report during your credit check, which varies depending based on the bank or financial institution.

Each credit inquiry decreases your score by several points, so you should want to know which inquiries are with TransUnion and Equifax. That lets you avoid having all credit pulls with one bureau. As well, you want to have few credit inquiries on your report when applying for a large secured loan like a mortgage, so knowing the credit inquiries on your account are important.

Can American Web Loan Sue Me Or Garnish My Wages

Remember that it is illegal for American Web Loan to make empty threats to sue you or garnish your wages. A collections company will likely choose not to sue if they cannot verify your debt or you may not owe said debt. However, these companies can still summon debtors to court and garnish wages after a default judgement. If you find that American Web Loan may have violated the FDCPA, the wisest course of action would be to hire legal aid. Contact an attorney preemptively to ensure the safety of your assets and rights. Lemberg Law has helped thousands of consumers fight back against these cases of fraudulent collection practices. Call us today to find out how we can help you resolve this issue.

Get Free BBB A+ Attorney. Call NOW

Unlawful Debt Harassment? Learn the Law & Sue the Collector.

You May Like: What Credit Score Is Needed To Get A Credit Card

Banks Arent Obligated To Report

Were constantly hearing about the dangers of paying late on our bills or getting into too much debt. After all, banks are reporting our every move to the credit bureaus, right?

Not necessarily. In fact, no lender has to report your account information to Equifax, Experian or TransUnion doing so is totally voluntary. Laws related to credit reporting give us rights to our credit information if its reported. But theres no legislation requiring lenders to take the step of reporting in the first place.

The primary reason some banks choose not to report customers account activity to the credit bureaus is that doing so is costly and complicated. Reporting borrowers information requires the lender to go through the complex steps of setting up an account with each credit bureau. In addition, fees are associated with creating and maintaining these accounts.

This is why its more common for small banks and credit unions to opt out of reporting to the credit bureaus many dont have the resources to devote to the process.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Read Also: Is 583 A Good Credit Score

A Closer Look At An Awl Personal Loan

Here are some more details to consider before deciding if an AWL loan is an option for you.

- Live chat Theres a live chat feature on AWLs site if you prefer that type of communication to email or phone calls.

- Mobile app If youre a returning customer, you can use the AWL app to apply for a loan, update your personal info, schedule extra payments and make your final payment.

- Not available in all states AWL loans arent available in Arkansas, Connecticut, Georgia, New York or Vermont.

- Past impersonators AWL says there have been reports of scams where companies have posed as AWL to try to get the financial information of its borrowers. If you apply for an AWL loan, make sure to verify its through the official site.

Can I Stop American Web Loan From Calling Me

You can get American Web Loan to stop calling youat least temporarilyby sending them something called a debt verification letter, which is a formal request that obligates a debt collector to provide further evidence of a debt. You must send it within 30 days of them first contacting you.

If your debt is very old, there might also be a more permanent solution to get American Web Loan to leave you alone. If your debt has passed its statute of limitations and become time-barred debt, meaning you cant be sued over it, you can simply write a letter telling American Web Loan to never contact you again. Legally, theyll have to abide by your request.

However, if your debt is more recent, this isnt a good idea, as it could cause American Web Loan to resort to a lawsuit that they otherwise wouldnt have filed, and if they win, they might earn the right to garnish your wages.

Whatever you do, fight the temptation to simply ignore debt collectors like American Web Loan. If they dont hear from you at all, theyre more likely to escalate things. Its smarter to engage with them tactically to ensure you dont have to pay, or that you get the best deal you can.

Recommended Reading: How To Remove Multiple Late Payments From Credit Report

Not Sure If Awl Is Right For You Consider These Alternatives

- Rocket Loans: With Rocket Loans, you can apply for prequalification for a personal loan before going through the full application process.

- NetCredit loan: If your credit isnt great but you need a larger emergency loan and think you can pay it back pretty quickly, a NetCredit loan may be an option. NetCredit offers loans of up to $10,000. But with interest rates potentially in the triple digits, youll need to pay it off fast to avoid sky-high costs.

About the author:

Read More

Freecreditreportcom: An Alternative Owned By Experian

Screenshot freecreditreport.com, August 2019.

FreeCreditReport.com shows up as a separate site from Experian when searching for credit reporting services, but theyre actually owned by the major credit bureau.

Their sign up process does have a difference. While Experian asks for only the last four digits of your social security number, FreeCreditReport.com asks for your full number. If youre someone whos skeptical about giving out their social security number, youre better off simply creating your account with Experian.

We also noticed that if youve already created an account through Experian, you wont be able to create one FreeCreditReport.com using the same login information. If you try, theyll say your email address is already in use. Oddly, even though they say youre already registered, they still wont let you access your credit information because through Experian you only provide the last four digits of your social security number and they continue to ask for your full number.

Recommended Reading: Does Requesting A Credit Limit Increase Hurt Score

What Do Credit Card Users Say

Melinda Opperman, president and chief relationship officer at Credit.org, a nonprofit agency that provides credit counseling and related services, says her organizations review of online forums and discussion boards indicates American Express, Discover and U.S. Bank rely mostly or solely on Experian, whereas Barclays and Goldman Sachs depend primarily or only on TransUnion.

Heres how the credit-reporting landscape looks for other card issuers, according to Credit.org:

- Bank of America: Experian or TransUnion

- Capital One: Equifax, Experian and TransUnion

- Chase: Equifax, Experian and TransUnion

- Citi: Equifax and Experian

- Wells Fargo: Equifax, Experian and TransUnion

Opperman warned that this information only represents a quick survey of what users report. So it could differ from what you experience when applying for one of our best credit cards.

Nonetheless, visiting online credit card forums and discussion boards can give you a sense of which credit bureau will help decide the fate of your application.

When Can I Pull A Credit Report On An Existing Loan Customer

Q When is it permissible, under the Fair Credit Reporting Act, to pull a credit report on an existing loan customer when there is no new application?

A A bank may obtain a credit report on an existing customer to review an account to determine whether the customer continues to meet the terms of the account of FCRA). However, this applies only for purposes of reviewing an account to determine whether the consumer continues to meet the terms of the account.

As a practical matter, this means a review that may cause the bank to change the terms of the account, such as lowering or raising the credit limit or closing the account. Thus, banks generally may obtain credit reports for existing lines of credit because lenders can typically modify terms of such loans, although there may be legal restrictions on the types of changes permitted. However, because terms are usually not changeable for closed-end loans , there is typically no review permissible purpose for those loans.

You can learn more in an FAQ on permissible purpose addendum in an ABA members-only staff analysis.

Q The appraisal rules thresholds for determining whether a bank is required to obtain an appraisal versus an evaluation vary depending on whether the loan is for residential real estate or for commercial real estate .

Don’t Miss: What Is A Middle Credit Score

There Is No Date Closed

Loans have a finite life cycle. Credit cards do not. Credit cards can remain open indefinitely, while loans cannot.

Accordingly, credit cards have a field that would include the date you or your credit card issuer closed the account. That would indicate the card is no longer available for further purchases.

Loans, on the other hand, are temporary by design. For example, if you have a 48-month auto loan, then your account is active for only 48 months.

Once the loan has been paid in full, which may or may not take the full 48 months, your account is no longer active and your scheduled monthly payment amount is now zero. You dont have access to the loans funds again just because you paid the loan off as you would if you had just paid off a credit card or a line of credit.

There is no formal process that designates the account as closed. When it has reached a finalized status, it is reported to the credit bureaus as such, and any competent person/lender that reviews your credit reports afterward understands what that means.

Opploans Personal Loans: 2022 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You May Like: Does Credit Limit Increase Affect Credit Score

Report Details & Frequency

Free credit services are never as detailed as the report you get directly from the credit bureaus. Since we favored free memberships, we compared the reports they offered and selected the ones that provided the most comprehensive information.

We preferred free memberships that included personal information, open and closed accounts, account numbers, balances and status of accounts, payments, credit age and usage, derogatory items , public records, and inquiries.

Your credit report is constantly changing as creditors send new information about your credit accounts and payments to the major credit bureaus. However, not all creditors send information to the bureaus with the same frequency and credit bureaus dont update your credit report with the same frequency either.

We preferred credit reporting services that updated your information weekly over those that did so on a monthly basis. This should show you a more accurate view of your credit data, and how it can fluctuate over time.

About American Web Loan

American Web Loan is an online personal loan lender that has been around since 2010. The company is a tribal lending entity owned and operated by the Otoe-Missouria Tribe of Indians. American Web Loan was created as a part of the Tribeâs economic development program.

American Web Loan is a part of the Online Lenderâs Alliance, which is an organization that represents companies offering online loans. The company is also a part of the Native American Financial Services Association.

âIn this loan review youâll learn:

- The types of loans offered by American Web Loan

- How much you can borrow through the lender

- What rates and terms are offered by American Web Loan

- What requirements you need to get a loan

- Information about American Web Loanâs customer service

Don’t Miss: Why Does Your Credit Score Go Down

Full Review Of Opploans

OppLoans are short-term installment loans offered by the lender Opportunity Financial, or OppFi. OppLoans borrowers dont undergo a credit check, and while the company markets OppLoans as fast, affordable alternatives to payday loans, rates can still reach 160%.

NerdWallet doesn’t recommend loans with annual percentage rates above 36% unless youve exhausted all other borrowing options. OppFi also encourages borrowers to seek cheaper loans if they qualify.

The lender offers loans directly in some states and services loans funded by FinWise, First Electronic and Capital Community banks in many other states.

When Does Bank Of America Report To Credit Bureaus

Bank of America appears to report to all three major credit bureaus approximately once per month. Reporting usually occurs around or just after the same time a cardmembers monthly billing statement is issued. Changes to your credit report may appear immediately buyt can take more than a month to appear on a report.

Recommended Reading: How To Improve Mortgage Credit Score

Your Options Will Vary Depending On What You Want To Report

There are a number of services available that allow you to proactively add information to your reports or self-report your data to a lender.

They all work slightly differently and use different information to bulk up your financial profile. Experian Boost, for example, zeroes in on your cable, phone and utility payments. UltraFICO pulls an even wider variety of information from your account, including your cash flow, spending habits and account history.

Meanwhile, rent reporting services, such as Rent Reporters and Rental Kharma, will relay your on-time rent payments on your behalf.

Alternatively, you can work directly with a lender that uses alternative data and link your bank accounts so they can assess your transaction history. Or, you can use a nontraditional score service, such as PRBC, and ask a lender to consider it.

Depending on your goals and financial history, you could even use multiple alternative data reporting services to showcase your financial history.

If youre confident that giving lenders a more comprehensive view of your financial situation will help give you an edge, rounding out your financial profile with alternative data could be really useful especially if your credit history is thin or nonexistent.

Tip: In general, you cant remove accurate negative items from your credit report. And theyll stay there for up to seven years. But in some cases, black marks such as missed payments can be removed by contacting your creditors.