Fraud Alert Frequently Asked Question

No. Federal law requires that the company that you contact to place your alert must tell the other two nationwide companies and, they, in turn, will place an alert on their versions of your report.

Innovis is not a nationwide credit reporting agency and must be notified separately.

How To Place A Fraud Alert On Your Credit Reports

Placing a fraud alert on your three credit reports is simple and free.

Fraud alerts are referred to as one-call alerts in the credit world. Even though the three major credit bureaus are entirely separate credit reporting companies, you only need to request a fraud alert from one of them to get the job done. Once you contact any one of the credit bureaus to request a fraud alert, its legally required to contact the other two on your behalf.

Initial alerts and active duty alerts can be placed easily online. But to place an extended fraud alert youll need to fill out a form, print it, and mail it to a credit bureau. Since each type of alert mentioned above lasts for a specified period of time, you should mark your calendar to remind you when the alert expires.

You can add a fraud alert to your three credit reports through any of the three methods below.

Read Also: Does Requesting A Credit Report Hurt Score

S To Take If Youve Lost Your Credit Card

If you lose your credit card, notify your bank immediately. Upon notification, the bank should cancel your lost credit card and reissue a new one.

Other things you can do:

- regularly monitor your credit card statements for any transactions that you didn’t make

- carry your cards in a safe place

- keep a list of your bank and credit card numbers in a safe place at home for reference purposes

You May Like: Does Paypal Credit Report To Credit Bureaus

What Is Identity Theft

Identity theft is when your personal informationanything from your name, your drivers license or Social Security Numberhas been hijacked by an imposter in order to commit fraud in your name. With that information, someone can easily open false lines of credit and rack up debt in your name, withdraw money from your accounts or get your tax refund, among other scams.

Identity theft can also happen to children, and it can go undetected for years. You can learn more here about how to spot child identity theft and how TransUnion can help.

As A Victim Of Fraud Or Identity Theft You Have The Right To:

- Request the credit reporting company to block information from your credit report that was the result of identity theft. You must provide an identity theft report from a law enforcement agency to request a block

- Dispute information you believe is incorrect

- Request a fraud alert be placed on your credit report

Also Check: Will Paypal Credit Report To Credit Bureaus

If Youve Been The Victim Of Identity Theft Or Fraud You Can Contact One Of The Three Major Credit Bureaus To Place A Fraud Alert On Your Credit Reports

A fraud alert is a statement in your that alerts anyone reviewing the reports that you may be a victim of fraud or identity theft. This alerts creditors and lenders that they should perform more-thorough vetting such as calling to check whether youre actually at a particular store trying to take out new credit when verifying your identity before extending credit in your name.

Heres what you should know about the different types of fraud alerts, how to place an alert on your credit reports, when you should place one, and if an alert can affect your credit scores.

What Is Fraud Alert

A fraud alert is used to inform creditors that you may be a victim of fraud. A fraud alert can make it harder for an identity thief to open accounts in your name. The fraud alert requires creditors to verify that you are the person adding new credit accounts or changing limits on existing credit accounts by contacting you at a phone number you have provided.

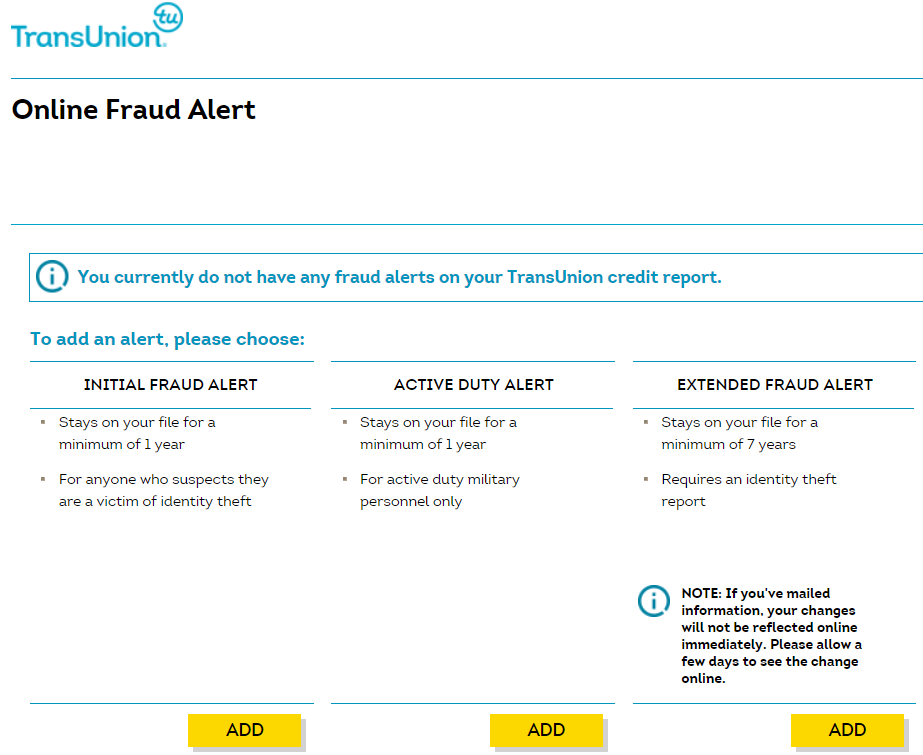

There are three types of alerts you can place on your file:

- Initial fraud alert – if you suspect that you have become or are about to become a victim of fraud or identity theft

- Extended fraud alert – if you are a victim of fraud or identity theft requires a copy of the identity theft report

- Active duty military alert – if you are in the military and want to minimize your risk of fraud or identity theft while you are deployed .

Contact any one of the credit reporting companies to place a fraud alert. They will share your request with the other credit reporting companies.

Read Also: Does Paypal Credit Report To Credit Bureaus

Is A Fraud Alert Right For You

Placing a fraud alert on your credit report is a smart move if you have any reason to think your information is at risk. It may require a small amount of extra effort if you want to apply for new credit, because youll have to verify your information with the lender but thats a small price to pay for peace of mind and additional security.

What Is A Credit Freeze

A credit freeze, sometimes called a security freeze, prevents lenders from accessing your credit report without authorization. Because credit card issuers and lenders usually want to see your credit history before approving a credit card or loan, they’re unlikely to issue new credit to you or someone pretending to be you if they can’t access your credit report. The freeze will stay in place until you lift or thaw it with a password-protected credit bureau account or a PIN.

To freeze your credit youll have to contact each credit bureau separately.

When you want to open a new account, you can unfreeze your credit and allow lenders to see your credit report. This step might also be necessary if youre renting an apartment or applying for insurance, both of which usually require a credit check. As long as you have your password or PIN, your credit report can be unfrozen in minutes.

Note: The credit bureaus also offer a similarly named product, sometimes for a fee. It may be simpler to unlock a credit lock than to lift a credit freeze, but the freeze may offer more legal protections.

Recommended Reading: Do Lending Club Loans Go On Your Credit Report

What Are Some Common Warning Signs Of Identity Theft Or Fraud

- Bills that do not arrive as expected

- Unexpected credit cards or account statements

- Denials of credit that you did not apply for

- Charges on your financial statements that you don’t recognize

- Incorrect information on your credit reports – accounts or addresses you don’t recognize or information that is inaccurate

The Federal Trade Commission’s website has additional information regarding the warning signs of identity theft, the Consumer Financial Protection Bureau’s website also provides information on common identity theft warning signs.

There Are Three Different Types Of Fraud Alerts

Anyone can place a one-year, temporary fraud alert on their credit without providing documentation such as a police report for identity theft. If you suspect someone that someone is fraudulently trying to access your credit but have no proof, a temporary fraud alert can help prevent future identity theft or credit fraud.

If youve already been the victim of identity theft, you may want to request an extended fraud alert, which stays on your credit report for seven years. However, unlike with a temporary fraud alert, you must submit a copy of a police report or other valid identity theft report when requesting an extended fraud alert.

A third type of fraud alert is an active-duty military fraud alert, a one-year fraud alert for service members deployed overseas. With an active-duty fraud alert, creditors arent required to contact you to verify your identity before approving credit but must verify your identity in some other way first. With this alert, however, you can choose to add a phone number where you can be reached to verify your identity.

Bartolomiej Pietrzyk / shutterstock.com

Recommended Reading: Credit Score With Itin Number

Why Check Your Credit Report

Your credit report is a record of how well you manage credit. Errors on your credit report can give lenders the wrong impression. If theres an error on your credit report, a lender may turn you down for credit cards or loans, or charge you a higher interest rate. You may also not be able to rent a house or apartment or get a job.

Errors can also be a sign that someone is trying to steal your identity. They may be trying to open credit cards, mortgages or other loans under your name.

Take a close look at your credit report at least once a year to see if there are any errors.

Fraud Alert Vs Credit Freeze Which Should I Choose

NerdWallet recommends a credit freeze for most consumers, because its the best protection available. Unlike a fraud alert, it wont expire, so you wont have to remember to extend it. But you will need to unfreeze your credit if you decide to apply for credit.

If you dont want to have to bother with freezing and unfreezing your credit every time you apply, then a fraud alert is a good choice.

You May Like: What Is Syncb Ntwk On Credit Report

Can A Ban Period Be Extended

If you’re still concerned about fraud towards the end of the ban period you can request the credit reporting body to extend it.

A credit reporting body must also extend the ban period if it believes that youve been or are likely to be the victim of fraud. If they decide to extend the ban period, they must let you know in writing and tell you the length of the extension.

There is no limit on the number of times that a ban period can be extended.

Remove The Fraud Alert From Your Credit Report

Once you place any of these three fraud alerts on your credit file, you can simply allow them to expire or remove them. If you choose to remove a fraud alert before its expiration, youll need to submit a request to the appropriate credit reporting agency.

The Experian letter referenced above can also be used to remove a fraud alert. You can remove a fraud alert with Equifaxs fraud center by written request with certain forms of documentation sent to the address in the table above. However, if youve activated the credit bureaus automatic fraud alert as part of an Equifax product subscription and wish to deactivate earlier, youll have to contact Equifax in writing.

For TransUnion, you can remove a fraud alert at any time online.

The real key when dealing with the exposure of your personal information or theft of your identity is to act quickly. If you can react before the identity thieves do, itll help you stay a step ahead of the bad guys.

Get LifeLock Identity Theft Protection 30 DAYS FREE*

Criminals can open new accounts, get payday loans, and even file tax returns in your name. There was a victim of identity theft every 3 seconds in 2019°, so dont wait to get identity theft protection.

Start your protection now. It only takes minutes to enroll.

Read Also: Does Having A Overdraft Affect Credit Rating

Read Also: What Is Syncb Ntwk On Credit Report

Active Military Fraud Alert

The active duty alert is designed for members of the military who have been stationed overseas for an extended period of time. Deployed service members are can place this type of credit alert on their credit to help reduce the risk of identity theft.

To get an active duty alert on your credit report, you will need to follow the same steps as with getting an initial or extended fraud alert but ask for the active duty alert instead.

Active military fraud alerts last for 1 year until re-instated. However, this fraud alert also removes your name from prescreened credit card marketing offers for 2 years.

Measures You Can Take To Prevent Fraud

- Do not routinely carry your Social Security card

- Never say your SSN aloud in public

- Beware of phishing scams to trick you into revealing personal information

- Create a account to help you keep track of your records and identify any suspicious activity

- Consider adding these blocks to your account with us:

- The eServices block It prevents anyone, including you, from seeing or changing your personal information on the internet. Once we add the block, you or your representative will need to visit your local field office to request removal of the block.

- The Direct Deposit Fraud Prevention block This prevents anyone, including you, from enrolling in direct deposit or changing your address or direct deposit information through or a financial institution . Once we add the block, you or your representative will need to visit your local field office to request removal of the block or make any future changes to direct deposit or contact information.

Read Also: Does Loan Me Report To Credit Bureaus

Additional Information Through Equifax

Equifax has a website, www.equifaxsecurity2017.com, which provides additional information and resources about the data breach. At this website, you may check if your personal information was exposed as part of the data breach. To do so, you must submit your last name and the last six digits of your Social Security number.

At this website, you may also enroll in Equifaxs free Lock & Alert product, which allows you to lock and unlock your Equifax credit file for free. You should be aware that a lock is similar to the credit freeze described above, but the lock does not contain all of the same protections as a credit freeze, which is governed by state law .Lock & Alert does not freeze or lock your Experian or TransUnion credit files.

Things To Know About Fraud Alerts

Reading time: 4 minutes

Highlights:

- A fraud alert encourages lenders and creditors to take extra steps to verify your identity before issuing credit

- You only need to contact one of the three nationwide credit bureaus to place a fraud alert – that bureau will transmit your request to the other two

- If you have a police report or a Federal Trade Commission Identity Theft Report, a 7-year extended fraud alert is available

When youve been a victim of identity theft, its tough to know what to do first. One of the phrases you may have heard when it comes to identity theft is a fraud alert. But do you know what fraud alerts do, what types are available or how fraud alerts work?

A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a victim of fraud, including identity theft. Think of it as a red flag to potential lenders and creditors.

Fraud alerts are free. To place a fraud alert on your Equifax credit report, you can create amyEquifaxTM account online call Equifax at 525-6285 or download this form to request a fraud alert by mail.

Here are seven things you might not know about fraud alerts.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Does Placing A Fraud Alert Hurt My Credit

Placing a fraud alert on your credit report has no effect whatsoever on your credit standing. The requirement that creditors verify your identity may limit your ability to get instant approval on in-store or online credit card applications, or financing at in-store kiosks . A credit alert may require you to take a few extra steps, such as talking with a service rep in the store or by phone, but by law a fraud alert cannot prevent you from being approved for a loan or credit if you qualify for it.

If you suspect your personal information has been compromised or that criminals have stolen your identity or are trying to do so, placing a fraud alert on your credit report is an easy form of protection you can initiate yourself quickly and easily, and remove whenever you like.

A Brief History Of Fraud Alerts And Credit Freezes

The Fair and Accurate Credit Transactions Act of 2003 otherwise known as FACTA is a federal law that, among other enactments, allows consumers to access their credit reports once every 12 months for free .

FACTA also requires the credit reporting agencies to place a fraud alert on the credit files of consumers who notify one of the agencies about potential or actual identity theft.

In 2002, California became the first state to pass a law giving consumers the authority to ask credit reporting bureaus to place a credit freeze, or a lockdown, on their personal financial data, meaning that it cannot be shared with potential lenders or creditors without the persons permission and verification of their identity.

Related reading: How to check your credit score for free

You May Like: Speedy Cash Extension

Escalate The Issue If Required

If you feel that a credit bureau has not treated you properly, you may file a complaint. This complaint can be made in writing to your provincial or territorial consumer affairs office. The federal government does not regulate credit bureaus.

In Quebec, these complaints must be directed to the Commission d’accès à l’information du Québec .

How To Replace And Remove Fraud Alerts

Adding and removing fraud alerts is very easy. All you have to do is contact one of the three major credit reporting agencies by mail, phone, or online and request one be added to your account. The credit bureau you contact must share the information with the other two they are required to do so by law .

Don’t Miss: Syncb/ppc Credit Card