Preventing Unauthorized Hard Inquiries

To prevent future unauthorized hard inquiries, consider placing a freeze on your credit report. This option prevents any lenders or creditors from accessing your credit information.

Its great for preventing identity theft because no one can open a new credit account using your financial information since they wont get approved without a credit check. However, it also helps prevent unwanted inquiries if you find this to be an ongoing headache.

Placing a freeze on your credit report and having it removed both incur separate fees in most states, so dont do this if youre planning on applying for a new credit card or loan in the near future. But if you anticipate your financials to remain the same for the time being, this can be a convenient option to keep your credit nice and clean.

Dont Worry About The Rest

Legitimate hard inquiries can ding your credit score, but not by much and not for long. Hard inquiries ⦠represent potential new debt that doesnt yet appear in the credit report as an account, says Rod Griffin, Experians director of public education.

Typically, any impact drops off dramatically after a month or two, Griffin says, either because you did not add the debt, so theres no risk, or you did open an account and its now wrapped into other credit factors.

Some companies say they can;remove even legitimate inquiries from your report for a fee but NerdWallet advises against using them. As long as youre not continuing to pile up applications, time will repair any damage to your credit.

Griffin advises keeping perspective because other things influence your credit score more .

Hard inquiries alone will never be the reason a person is declined for credit, he;says. Inquiries may be the proverbial straw that broke the camels back, but they will not be the entire bale of hay.

About the author:Bev OâShea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Read Also: Aargon Agency Inc Phone Number

How To Find And Evaluate Inquiries

You’re entitled to free;credit reports direct from the three major credit bureaus at least once every 12 months. Request them by using AnnualCreditReport.com.

Look over the section labeled inquiries.;Youre concerned with hard inquiries, the kind that happen when you apply for credit. Those can cause a small, temporary drop in your score. Soft inquiries, such as when you check your own credit or a marketer screens you for a pre-approved offer, dont affect your score.

Each credit bureau or website presents information in its own way, but all will label any inquiries that might affect your score. If you dont recognize something, its worth investigating. Reasons you might not recognize the entry range from benign to worrisome:

-

A store credit card you applied for may be issued through a financial institution with a different name.

-

Your car loan application may have gone to multiple lenders .

-

Debt collectors are allowed to check credit under the Fair Credit Reporting Act, although most often these are soft inquiries.

-

You may have fallen victim to identity theft and someone is opening fraudulent accounts in your name.

Read Also: Does Barclaycard Report To Credit Bureaus

What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one;credit reporting agency;;it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

Therefore If You Suffer From Bad Credit And A Lot Of Hard Credit Inquiries Life May Get Tough

Various financial institutions, real estate agencies, and even potential employers use your credit score to make a final decision. So, what can someone;do to help eliminate bad credit? Well, this is where hiring a credit repair firm like may come in handy, where professionals work with you to help to:

- save you money

- lower interest rates on loans

- and gain better financial position in the future.

Recommended Reading: What Is Cbcinnovis On My Credit Report

How To Contact The Credit Bureaus To Remove Inquiries

The easiest way to remove questionable inquiries is by contacting the credit bureaus. You can contact any, or all the three bureaus, to remove the inquiries from your credit report.

Removing Inquiries on Experian:

- Experian does not allow for inquiries to be disputed online through their dispute center. The other ways to contact Experian to dispute inquiries are as follows:

- 1-714-830-7000 then press 1, 8 am 10 pm CST weekdays, 10 am-7 pm CST weekends,;

- Experian, P.O. Box 4500, Allen TX 75013

- ;1-972-390-4925

Removing inquiries on Equifax:

- Equifax is the only bureau that allows you to dispute inquiries online, by mail, and by fax. Their phone, mail, and fax details are also given below.

- Online:;Equifax Online Dispute Portal

- ;1-800-846-5279, goes to live agent

- Equifax, P.O. Box 740256, Atlanta, GA 30374-0256

- ;1-888-826-0598

Removing inquiries from Transunion:

- Although Transunion does not allow inquiries to be disputed online, you can reach them via call, mail, or fax.

- 1-800-916-8800: then press;0,;8 am-11 pm EST, Monday through Friday

- Transunion, P.O. Box 2000, Chester PA 19016

- 1-610-546-4657

Read Also: Does Klarna Build Credit

Hard Inquiry Removal Letter: What Is It

Most consumers understand that every time they apply for credit, an inquiry is generated by the lender, and that goes directly on a credit report. Although these usually dont have much of an impact on your credit score, too many of them can generate points being taken off and it can lead to questions as to why you are so diligently seeking credit. However, inquiries are not as cut and dry as all that and some hardly affect your credit score at all. Do you know the difference between a hard and soft inquiry and what to do if you find any unauthorized inquiries on your credit report? These are the ones to worry about and if you spot them, you should take action to get them removed as quickly as possible.

Recommended Reading: Does Cashnetusa Report To Credit Bureaus

How To Monitor Your Business Credit And Personal Credit

Its wise to claim your free credit reports once every 12 months from the consumer credit bureaus. But an annual credit check may not be enough to alert you if a problem arises . Instead, youll be better off checking your credit more frequently perhaps on a quarterly or even monthly basis.;

Theres also no law that currently gives you free access to your business credit reports. You can, however, keep a closer eye on your credit historybusiness and/or personalif you sign up for a credit monitoring service.;

Some credit monitoring services give you access to one or more of your personal credit reports. Others may allow you to access one or more of your business reports. With Nav, you can review business and personal credit information in one location.;

Navs Final Word: Removing Inquiries from Your Report

The best way to prevent inquiries from hurting your credit scores is to apply very carefully, and only for loans or credit cards you think you are likely to get. If you are shopping for a vehicle, for example, get preapproved for a car loan ahead of time from a reputable lender. Dont let the dealership shop your credit application to dozens of lenders unless you want the risk of multiple inquiries on your credit reports. ;

On the other hand, unauthorized inquiries can be a sign of a serious problem. If you suspect that someone has been applying for new credit in your name or your companys name without your permission, its critical to take action right away.

Hard Vs Soft Credit Inquiries

Hard inquiries are the only type of credit pull that can affect your credit score, and theyâre the only ones that businesses will see on your credit report. Credit inquiries that donât affect your score and donât appear on your report are called soft pulls. Examples of soft inquiries include you checking your own report and a potential employer accessing it during a background check. And credit card issuers may do soft inquiries when they are preparing promotional card offers.

Credit inquiries carried out by insurance companies when youâre seeking quotes for various kinds of policies are considered soft inquiries and do not show up on your credit report.

Also Check: Does Paypal Credit Report To The Credit Bureau

Accessing And Preparing To Dispute Hard Inquiries

The first thing you need to do when you are attempting to remove hard inquiries from your file is to gain access or a copy of your credit report. These can be accessed through your bank or financial institution. When you start the process, you will want to have some items or documents ready in order to make the process as quick and efficient as possible. You will need government documents, such as your social security card, drivers license, or any form of government identification, a bill to confirm your information, as well as a dispute letter. This is all needed to make the dispute more effective, clearly stating your reasoning for the removal and increasing your chances of success. Depending on the credit bureau, the form requirements may vary.

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

How To Remove Hard Credit Inquiries

When they make a hard inquiry it will show on the consumers credit report. If this is done without the consumers knowledge or permission, it may result in too many inquiries that will lower the consumers credit score.

The consumer should view their credit report at least once or twice a year to see if there are any irregularities. If they are applying for credit and constantly getting turned down, it may be because their credit score is unfairly low.

Who Is Actually Able To See Soft Inquiries On Your Credit Reports

Soft inquiries will only show up when you personally check your own credit reports . The credit reporting agencies do not disclose information regarding soft inquiries on reports sold to third parties. If a lender, insurance provider, or employer checks your credit report, your soft inquiries will not be displayed.

You May Like: How To Get Credit Report Without Social Security Number

What About Inquiries From Fraud

Once youve submitted a request to dispute the fraudulent inquiry with the correct credit reporting agency, your next step to protect your identity could be either putting a security freeze on your account or placing a fraud alert, which lasts 90 days, with all three major credit bureaus. A security freeze will put a stop on any new accounts from opening and prevent inquiries without your permission.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Don’t Miss: How To Remove Hard Inquiries Off Credit Report

How Do Credit Inquiries Impact My Credit Score

They all check your credit, and by signing the application, you authorize them to do so. Credit scorers understand this is simply a consumer out shopping for the best rate they can get.

They allow for this activity and dont deduct points for each individual hard inquiry when this occurs. Instead, as long as the credit inquiries are all made within a 45-day window, they group them together and count them as one inquiry.

But if you take too long and shop around, the resulting credit inquiries can affect your score negatively.

How To Remove Inquiries From Your Credit Report

Because inquiries on your credit report can cause your credit score to drop a bit, you might be inclined to remove them. However, hard inquiriesthose that are made because you applied for more creditcan not be removed unless they are inaccurate or fraudulent.

Since hard inquiries have only a small effect on your credit score and they go away after two years, you shouldn’t waste your time trying to get them taken off your report. The wiser action is to limit the number of credit applications you make over a short period of time.

Read Also: What Credit Bureau Does Paypal Credit Use

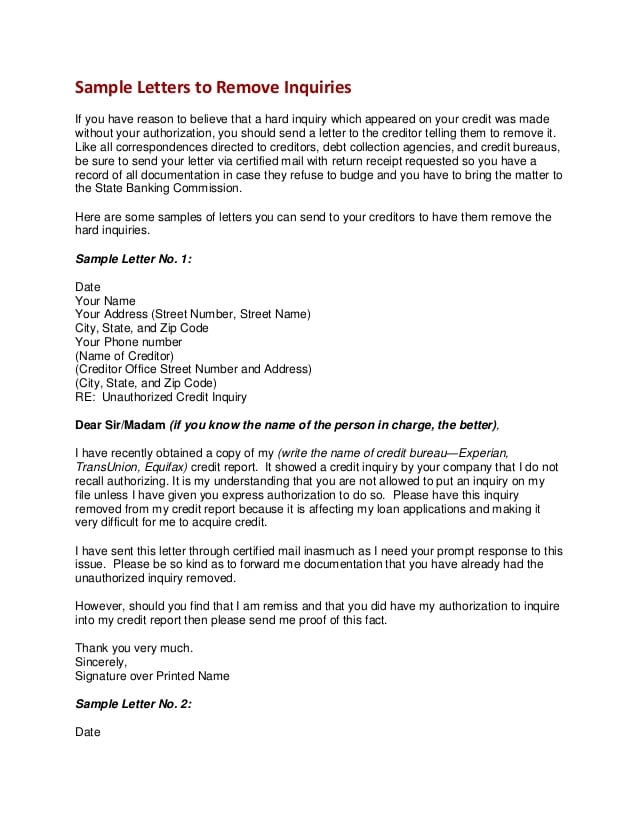

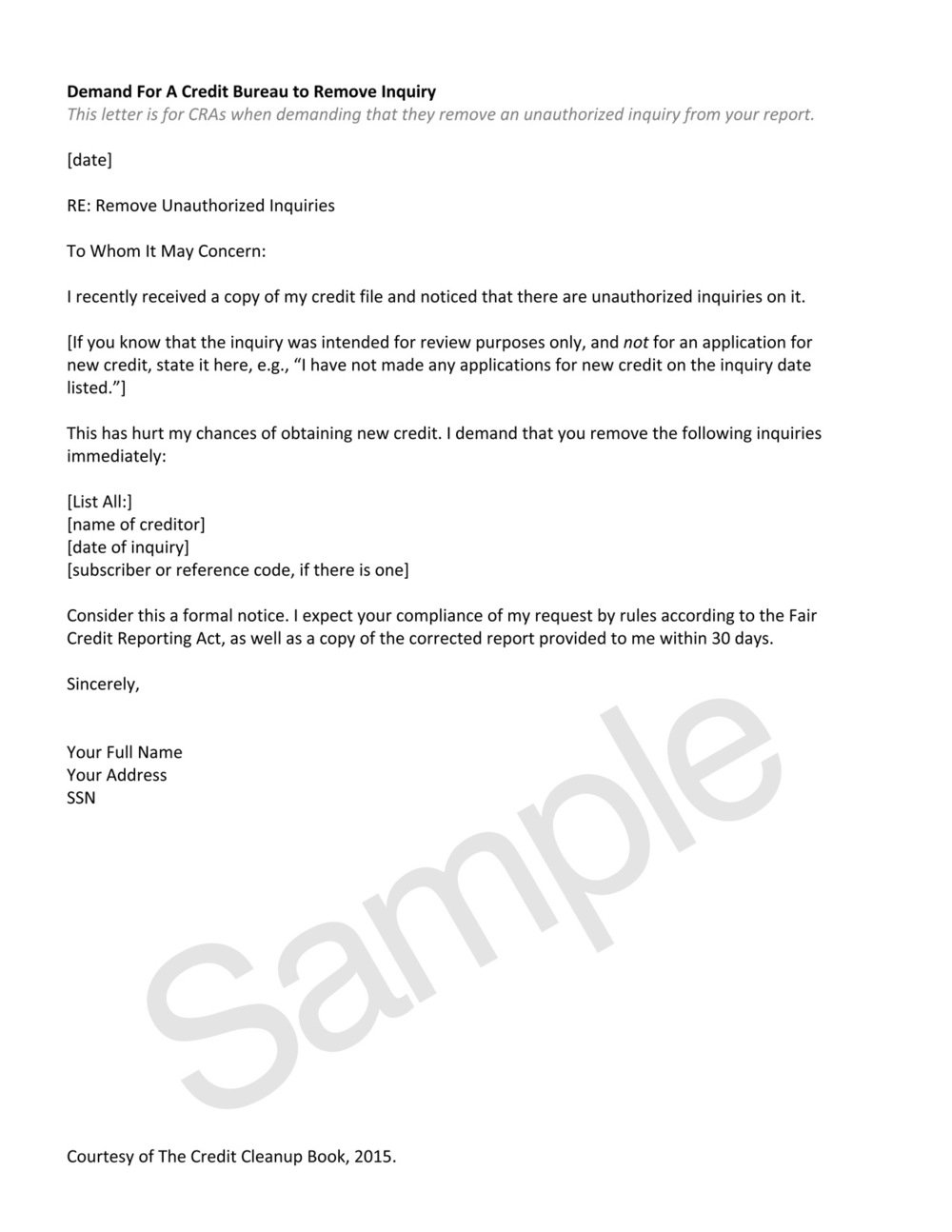

Write A Letter To The Creditors

Armed with the addresses of each creditor, write a letter notifying them of the disputed inquiries. ;The letter should include any documentation that supports your claims. These can be payment records that contradict the items in dispute. Request them to contact the reporting bureau that they gave the information to and have them remove the items from your records.

What Are Hard Inquiries And Soft Inquiries

Hard inquiries show up on your credit report. Soft inquiries do not. Applications usually count as hard inquiries. Offers usually count as soft inquiries.

A hard inquiry is often the result of an application for credit, like a home mortgage or an auto loan. Youve probably applied for either of those at some point in your life.

You can probably recall the volume of paperwork as something resembling a college textbook. When filling out these applications, the lender is required to provide you with a disclaimer. They are going to run a check on your credit and that it may appear on your credit report.

Its important to note that not EVERY hard inquiry will appear on your credit report. For instance, if you are shopping around for auto loans, the credit bureaus will typically be able to deduce that you are in the market for a loan.

They will know you are searching for approvals and/or comparing rates. According to TransUnion, if you have multiple inquires in a span of around 45 days, they will only count them as one hard inquiry.

Soft inquiries are the reason you may be getting a lot of unsolicited credit card offers in the mail. Lenders will scour millions of credit reports in order to determine who to send offers to. That kind of activity wont appear on your credit report, since you had nothing to do with it.

Recommended Reading: Credit Report Without Social Security Number

How To Spot An Unauthorized Hard Inquiry

First of all, hard inquiries are typically authorized by you when applying for credit. A soft inquiry doesnt cost you points and most lenders send them through by the tens of thousands in the pre-authorization process. Creditors know this and although they are listed as inquiries on that section at the bottom of your credit report, they have little to no bearing on your creditworthiness.

Its the hard inquiries you need to be concerned with, so it is suggested that you get a copy of your credit report from the three reporting agencies which you can get for free at least once a year. If you notice that there are hard inquiries which are negatively affecting your score and that you havent authorized them, its time to write what is referred to as a Hard Inquiry Removal letter to be submitted to each of the above-mentioned reporting agencies.

If Warranted File A Dispute With The Corresponding Credit Bureau

If you dispute errors in your credit reports, including unauthorized hard inquiries, the credit bureaus are required to investigate. Theyre also required to correct information thats found to be inaccurate.

You can file a dispute with any of the three major consumer credit bureaus Equifax, Experian and TransUnion that has an inaccurate hard inquiry recorded for you on its corresponding credit report. Credit Karma members can dispute errors on their TransUnion® report through the tool.

You may be able to dispute inquiries online, but consider mailing your dispute. Look for sample credit dispute letters online, like the one available from the Federal Trade Commission, to help you draft your dispute letter.

If the credit bureau in question investigates and finds that the inquiry wasnt authorized, it should remove the inquiry from your corresponding credit report.

Also Check: Which Business Credit Cards Do Not Report Personal Credit

How To Write And Send A Hard Inquiry Removal Letter

Remember, you will probably only be penalized five points for each of these inquiries but what happens if you have found more than a few that you didnt authorize? Even one can have a negative impact on your credit report if a future lender wonders why you didnt pursue that loan or werent granted a loan. This is being highlighted for you so that you understand why its important to write that letter, including the fact that this was an unauthorized hit.

Obviously, you would include your name and address and any contact information you choose to divulge, including email and phone numbers. Each of the reporting agencies should get their own copy, which you should send certified, return receipt requested to ensure the letter reached its destination. Detail any pertinent information as to the date and organization that made the inquiry. In other words, you are disputing the hard hit your credit report took and are asking it to be removed so that it cannot be seen in the future.

If you arent sure how to write the letter or what to include, you can research forms online or contact a reputable credit repair service. One unauthorized hard inquiry may not cost you much as far as points go but its the principle of the thing, which may cost you in the end when it comes to future authorized inquiries. Write that letter today!

Other Credit Repair Articles