How Long Does A Derogatory Account Stay On Your Creditreport

Derogatory accounts will generally stay on your creditreport for seven years but can show for as long as 10 years for some accountsand in some states. This will usually depend on the laws in your state and thetype of debt.

Bankruptcies, the granddaddy of debts, will stay on yourcredit report for up to 10 years in most states while foreclosures and studentloans will drop off after seven years. Tax liens and simple late payments willgenerally drop off after seven years.

Its important to understand when the clock starts tickingon different types of derogatory accounts and how that affects when they dropoff your credit report. This is usually the date the late payment or other badmark was added to your credit but can also be the date of your last payment orwhen the collection agency took over. If you make a payment plan with thecollection agency or they file a change to the debt, that might start the clockover and it could be another seven years before it drops from your report.

Check your credit report and score with TransUnion credit monitoring. Get a 30-day free trial here.

Strategies To Remove Negative Credit Report Entries

Negative details on your are unfortunate glaring reminders of your past financial mistakes. Or, in some cases, the mistake isn’t yours, but a business or credit bureau is to blame for credit report errors. Either way, its up to you to work to have unfavorable credit report entries removed from your credit report.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for. To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Negotiate For Early Removal

You can negotiate with a creditor or collection agency to try to get a delinquent account off your credit reports early. Credit reporting is voluntary. A company can ask a credit bureau to add an account to your credit report. It can ask a bureau to remove an item from your report as well.

Of course, getting a creditor or collection agency to make this request isnt easy. Youll usually need to offer to pay or settle the delinquent account in full. Even then its a long shot. If a company agrees to a deletion in exchange for payment, be sure to get the offer in writing before you pay a dime.

Also Check: How To Rebuild Your Credit Rating

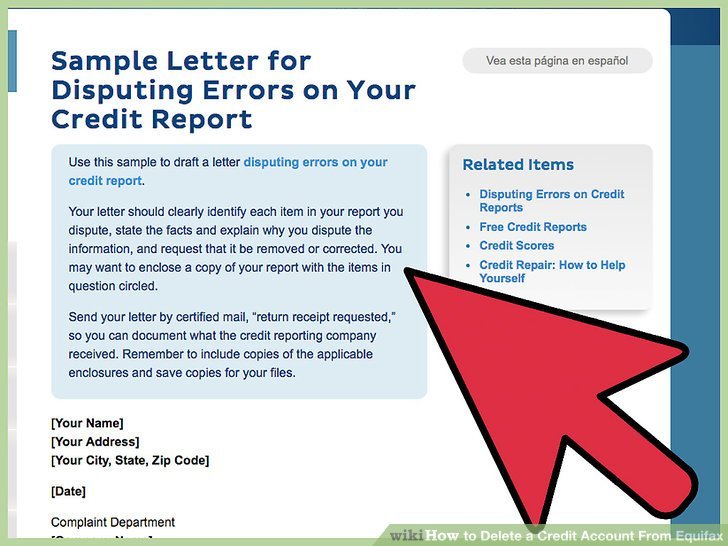

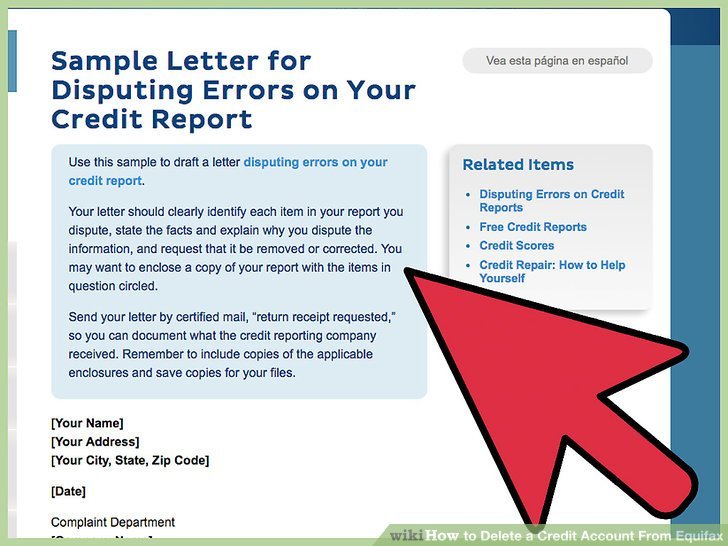

Disputing Errors And Expired Debt

If you identify expired debt that is still being reported, you will need to dispute the debt with the reporting agency. These agencies are only allowed by law to report the debt for 7 years. When disputing this or any error on your credit report, you should do so by writing a dispute letter. The letter should be sent via certified mail so that you can request delivery verification. The agency then legally has 30 days to respond or it violates the Fair Credit Reporting Act.

Ways To Remove Old Debt From Your Credit Report

According to the Federal Reserve Bank of New York, 2.5 percent of outstanding debt is in some degree of delinquency as of September 2021. However, having an accurate and up-to-date credit history without old collections or delinquent accounts is important when youre applying for loans or other new credit.

If youve noticed old debts on your credit report, its best to act as soon as possible to remove these items. Here are a few steps you should take.

Also Check: Does Bluebird Report To Credit Bureaus

How Many Points Can My Credit Score Increase If I Settle My Debt

When collection accounts are removed, credit scores may increase. Collection accounts hurt when they stay on your credit report.

The effect of removing a collection account depends on a number of different factors. Late payments and collection accounts makeup roughly a third of your FICO score and removing a collection account often makes a difference.

If you cant remove an account, its not the end of the world. As collection accounts age, they have less of an effect on your credit score.

The Account Was Closed Years Ago

If the account that disappeared from your credit report was closed , the most likely explanation is that it simply reached its credit-reporting age limit.

How long do closed accounts stay on credit reports?

The time it takes for a closed account to be removed from your credit report depends on whether the account was in good standing when it was closed .

As shown in the table below, accounts that are closed in good standing remain on your credit for 10 years, whereas delinquent accounts are removed after 7 years . 1234

When Are Closed Accounts Removed from Your Credit Report?

| Type of Account |

|---|

| The Fair Credit Reporting Act |

Recommended Reading: How Long Does Info Stay On Credit Report

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Keep Old Accounts Open And Deal With Delinquencies

The age-of-credit portion of your credit score looks at how long youve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts that youre not using, dont close them. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. That wont erase the late payments but can raise your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsand bankruptcies for 10 years.

Also Check: Which Credit Score Is Used

When To Write A Goodwill Letter Instead

A goodwill letter is a request that asks a lender or creditor to remove derogatory information from your credit report. Unlike a dispute, the creditor has no obligation to take any action in response to a goodwill letter or assist your credit repair efforts.

Goodwill letters are most effective when consumers had some temporary difficulty that resulted in failing to make timely payments. For example, your goodwill letter may explain that you suffered a severe injury or illness that prevented you from working and created struggles with paying bills.

The effectiveness of a goodwill letter that cites extenuating circumstances is further increased when the account has since been back into good standing. Accounts that have been forwarded to a collection agency and left unpaid are less likely to be successful using a goodwill letter.

Keep in mind that some goodwill letters involving unpaid accounts may be open to a compromise. The creditor might respond to the goodwill letter stating they will consider removing the negative credit entry if the debt is paid however, these arrangements should always be first put in writing.

The pay-for-delete option has risks because the organization is not legally obligated to remove the entry from your credit report regardless of whether the debt is paid. Also, if the debt was sold to a third-party collector the original creditors negative entry may remain and affect your credit score.

Will Making Payments Change The Timeline Or Keep A Collection From Falling Off Your Credit Reports

In general, making payments on a debt in collection should not affect the time it stays on your credit reports.

As the Consumer Financial Protection Bureau notes, however, in some states a partial payment can restart the time period for how long the negative information appears on your credit reports.

A partial payment can also restart the statute of limitations, or period of legal liability, for the debt. If the debt is still within the statute of limitations, a debt collection agency may choose to sue you for your unpaid debt. Each state has its own statute of limitations that determines how much time a debt collection agency has to take legal action, but for many states it ranges from three to six years.

If you do pay off an account in collections, the collection agency may be able to contact the credit bureaus and remove the collection account from your credit reports before the seven-year mark.

You may have to do some extra pushing to make this happen.

Before paying off an account in collection, get on the phone with an agent from the debt collection agency and confirm that the agency will update your credit reports. If the agent cant or wont agree to remove the paid account from your credit reports, ask if the account can be updated as paid as agreed upon once your payment/s are received.

Read Also: Does Cancelling Finance Affect Credit Rating

If A Collection Is On Your Report In Error Dispute It

You may have a collections account on your credit report that shouldnt be there. Maybe its too old to still be reported, or the collection itself is incorrect.

Too old to be reported: Delinquent accounts should fall off your credit report seven years after the date they first became and remained delinquent. But that doesnt always happen. For debts that linger longer than they should, file a dispute with any credit bureau that still lists the debt.

If a credit bureau has made a mistake on your report if you dont recognize the account or a paid account shows as unpaid, for example gather documentation supporting your case. Then, file a dispute by using the credit bureau’s online process, by phone or by mail. The bureau has 30 days to respond.

Collection is incorrect: If you think the error is on the part of the debt collector, not the credit bureau, ask the collector to validate the debt to make sure its yours. Note that you have 30 days from the date the collector first contacted you to dispute the validity of the debt. If the collector cant validate, the collection should come off your reports. Follow up to make sure.

Dispute Any Inaccurate Information

If you find any inaccuracies in your credit report, dispute them as soon as possible. Send a letter to the credit bureau that has inaccurate information . In the letter, let them know what the correct information is and ask them to change it.

Donât assume that your credit report is always right â take the time to review it annually. Remember, no one is going to correct a mistake unless you do.

Read Also: What Is The Best Credit Report Website

Ways To Scrub A Collections Stain Off A Credit Report

Your credit scores take a hit if you fall behind on payments to a creditor, and again if an account is sent to the creditors collection department or sold to a third-party collector. You may be able to repair some damage to your scores by resolving a collections account on your credit reports.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent. You may want them off sooner than that unpaid collections always hurt your scores. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

There are a few ways to get a collections account off your credit report, depending on your relationship with the creditor and the account status.

First, do your homework

Get information on the debt from two places: your credit reports and your own records.

You can get a free credit report every 12 months from each of the three major credit reporting bureaus by using AnnualCreditReport.com. Some personal finance websites offer free credit report and score information.

Gather your own records for details on the account, including its age and your payment history.

Between the two, verify these details:

- Account number

- Account status

- The date the debt went delinquent and was never again brought up to date

Once you have the details straight, you can decide which approach works for you.

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

Read Also: What Does A Credit Report Freeze Do

How To Remove Collections From A Credit Report Canada

Note that the tips included here assume that a collections account assigned to you is accurate. If you find a collection account on your Canadian credit report that isnt yours or that has incorrect information, youll want to dispute it with the credit bureau thats reporting the information before doing anything else.

If you want to remove accurate collections from your credit report in Canada, follow these steps:

- Ask for debt validation. Once you are contacted by a debt collector, send them a letter requesting that they validate the debt. Ask them to verify the name of the original creditor, the amount owed and whether the debt is still within the statute of limitations for your province. Debts that are outside the statute of limitations are no longer considered collectable.

- Request pay for delete. Pay for delete is essentially an agreement in which you ask the debt collector to remove a collection account from your credit report in exchange for payment. Whether they agree to this usually depends on how old the debt is, how much is owed and your past account history. Keep in mind that if youre asking for pay for delete, its with the expectation that youll pay the full amount owed, including the original balance as well as interest and any fees charged by the collection agency.

Donât Miss: How Does Leasing A Car Affect Credit Score

Summary Of Moneys Guide For Getting Negative Items Removed From Your Credit Report

- Order a copy of your credit report through AnnualCreditReport.com and search for inaccurate information, like missed payments or accounts that don’t belong to you.

- If you find any, file a dispute online or through the mail with the credit bureaus Equifax, Experian and TransUnion.

- You should also notify your bank or credit card issuer. They can help you verify that the information in your report is, in fact, erroneous and notify the bureau.

- Be on the lookout for a response from the bureau. It should arrive in around a month or less. If they accept your dispute, request your credit report again to make sure the negative information was removed.

- If your report is riddled with errors or you’re finding the dispute process difficult, consider hiring a .

- Categories

Don’t Miss: When Is Your Credit Score Updated

What Is A Derogatory Account

A derogatory account is just another way to say a bad mark on your . It notes a loan or line of credit that has one or more late payments, unpaid debts or other charge-offs.

Some accounts reported on your credit might even result inmultiple derogatory marks. If you fail to pay on a loan an its sent to a collectionagency, the original lender might have a derogatory account on your creditreport as well as the collection agency if they are unable to collect.

Civil judgements against you also go on your credit report and are counted as derogatory marks when applying for a new loan.

Why Should You Use Donotpay To Dispute Delinquent Accounts

DoNotPay has a history of being fast, easy and successful. We know your time is valuable, so we make sure you don’t have to waste it by filling out online forms, making numerous phone calls, or trying to write effective negotiation letters. You only have to give us the important information, and we handle everything by making the best case to help repair your credit.

Also Check: When Does A Bankruptcy Leave Credit Report