If I Dont Agree With My Fico Score What Should I Do

Your FICO® Score is provided to Wells Fargo by Experian® based on information within your credit report on the calculation date . If you feel this information is inaccurate, your next step should be to request a free credit report from annualcreditreport.com. If theres incorrect information within any of your credit reports, follow each bureaus instructions on how to dispute that information. If theres incorrect information about your Wells Fargo accounts, please call the Wells Fargo phone number in your credit report.

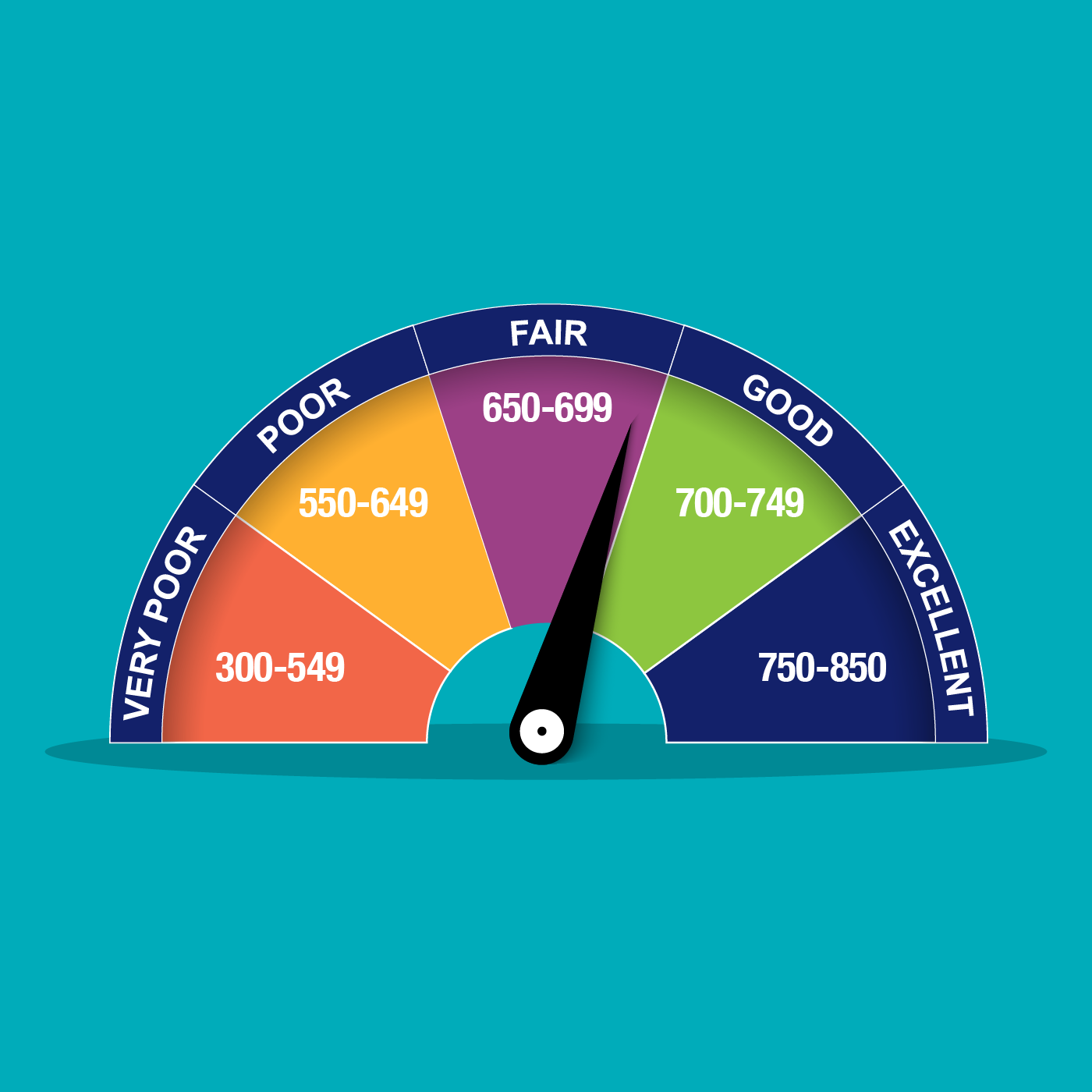

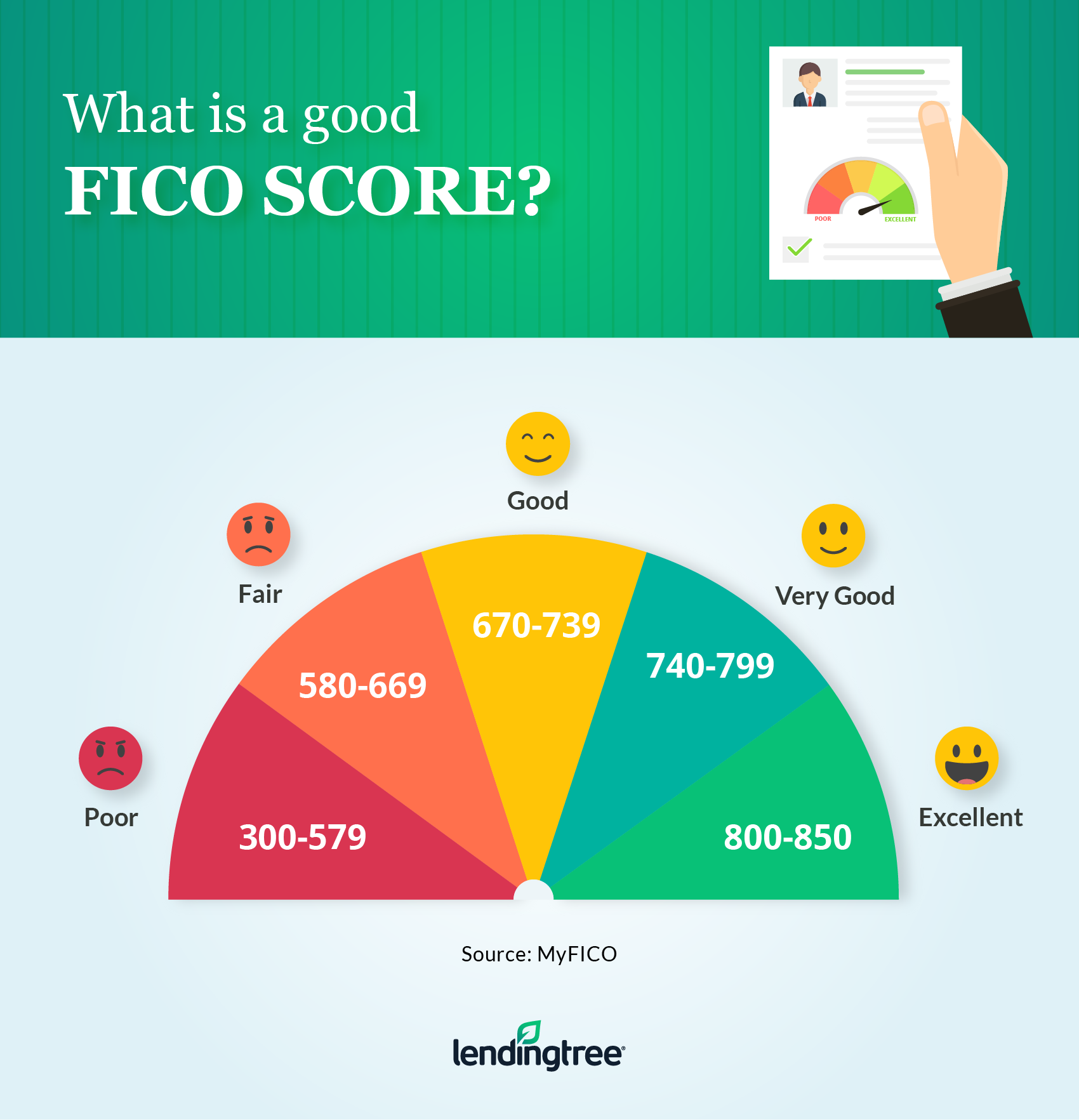

What Is A Good Score

Typically, the higher the score the better. Each lender decides which credit score range it considers a good or poor credit risk. The lender is your best source of information about how your credit score relates to their final credit decision. Your credit score is only one component of the information that lenders use to evaluate credit risks.

How Is My Credit Score Calculated

The score is a three-digit number that lenders use to help them make decisions. Lenders use scores to determine whether or not to grant credit, and if so, how much credit and at what rate. A higher score indicates that the individual is a lower credit risk.To calculate a score, numerical weights are placed on different aspects of your credit file and a mathematical formula is used to arrive at a final credit score. TransUnion calculates your credit score based on many factors in your credit history and payment behaviour, including but not limited to

What are the next steps? GET YOUR CREDIT REPORT & SCORE

- Your track record for repaying your loans and credit card balances

- How much money you currently owe on your credit accounts

- How long your accounts have been open

- The different types of credit you use or credit mix

- How much credit you use compared to the amount of credit you have available

- How often, and how recently you have applied for credit

When you apply for credit, like a mortgage, car loan, a new credit card, apply for a job or want to rent an apartment, companies need a way to gauge your credit worthiness. Your credit report includes a record of your financial reliability.

Read Also: Syncb/ppc Closed Account

Benefits Of Credit Scoring Models

Speed is the major benefit to consumers of having credit scoring models. Lenders can evaluate thousands of applications quickly and impartially. Decisions on mortgages, car loans or extended limits on credit cards can be handled in days or even minutes.

In fact, the consistency of data in scoring models allows for financial statements, credit ratings and credit account statuses to be evaluated quickly and accurately. It also reduces the possibility for human error. This helps customers and their orders get processed more quickly.

On the flip side, it reduces bad debt losses for companies. Otherwise, those companies could make bad decisions in whether to extend credit to a customer. Businesses can specify the factors they want considered in the credit decision process. They know almost immediately if they are dealing with a high-risk or low-risk customer.

That has allowed the businesses to operate more efficiently and reduce the cost of vital services like mortgages, car loans and credit cards.

Credit scores allow consumers access personal loans and help financial institutions control allocation of risk and costs with their customers. Businesses can better execute transactions with customers when they have access to objective information for evaluation of a customers creditworthiness.

Are Fico Scores Unfair To Minorities

No. FICO® Scores do not consider your gender, race, nationality or marital status. In fact, the Equal Credit Opportunity Act prohibits lenders from considering this type of information when issuing credit. Independent research has shown that FICO® Scores are not unfair to minorities or people with little credit history. FICO® Scores have proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given FICO® Score, non-minority and minority applicants are equally likely to pay as agreed.

You May Like: Carmax Minimum Credit Score

How To Find Your Credit Score

You can request a free copy of your credit report once a year.

Its important to have a general understanding of your credit score since it impacts all types of lending. If you plan on buying a car with an auto loan or taking out a mortgage to buy a home, having an idea of what your credit score is can help you determine what your loan may look like and how much you can afford to borrow.

You can request a free copy of your credit report once a year from each of the major credit bureaus. If you check your report and see any incorrect information, you can contact the credit bureau directly to have it removed.

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

You May Like: Unlock Transunion Credit Lock

Where To Get Your Fico Credit Score

Because there is no shortage of companies, products, and websites offering access to free credit scores, it can be especially confusing to determine exactly where to find your FICO credit score.

Fortunately, you can actually get your FICO score free with credit card companies such as Discover, Citi, and Barclaycard. You can also get your FICO score from MyFICO.com.

But heres the kicker:

Whats A Good Credit Score To Buy A House

Generally speaking, youll need a credit score of at least 620 in order to secure a loan to buy a house. Thats the minimum credit score requirement most lenders have for a conventional loan. With that said, its still possible to get a loan with a lower credit score, including a score in the 500s. How?

Also Check: Syw Mc/cbna

How Many Credit Scores Are There

There are many. And knowing which credit score is the most accurate can make a big difference when you’re applying for credit. On its face, a credit score is merely a numerical representation of the data in your credit reports held by the three major credit bureaus, TransUnion, Experian, and Equifax. So, that’s at least three potential credit scores right there.

Plus, there are two main credit scoring models that those credit bureaus use FICO and VantageScore. Not to mention the credit scores that are available for educational purposes only.

Different creditors might report your activity to one or all three of these bureaus. This is another reason your credit score could vary among different providers.

Further, each company provides a credit score using its own formulas to calculate scores using the data in your credit reports.

It gets worse:

Each score can emphasize different aspects of your credit behavior.

For example:

One credit scoring company might give more weight to late payments, while another might focus more on your auto loan history or a mixture of credit.

Essentially, this means that your score can not only be confusing but also that there is no such thing as an “accurate” credit score.

Each formula uses factual information from your credit history. However, each weighs and calculates that information differently.

Now what?

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Read Also: Suncoast Credit Union Truecar

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

Recommended Reading: How To Get A Repo Removed From Your Credit

Fico Scores Are Evolving To Keep Up With Modern Behaviors And Needs

Think of how people use different versions of computer operating systems or have older or newer generations of smart phones. They all share the same base functionality, but the latest versions also have unique updated features to meet evolving user needs.

The same goes for FICO® Scores.

The various FICO® Score versions all have a similar underlying foundation, and all versions effectively identify higher risk people from lower risk people. Every time the FICO Score algorithm is updated it incorporates unique features, leverages new risk prediction technology, and reflects more recent consumer credit behaviors.

The end result is a more predictive score that helps lenders make more informed lending decisions, which ultimately makes the credit process easier, faster and fairer.

What Is A Credit Rating

A credit rating is a rating listed by some credit reporting agencies. It is an individual rating of each of your credit historys items detailing the type of credit being used and how quickly payments are made. The ratings for each item on your credit history are expressed on a scale of 1-9: 1 means you paid your bill within 30 days of its due date and 9 means you never paid your bill or that youve made a debt repayment proposal with the lender.

Along with the number, you will see a letter assigned to each credit rating. The letter stands for the type of credit being used. Theres I for instalment , O for Open and R for revolving .

Also Check: Aargon Agency Scam

Can I Expect The Fico Score Version I Receive From Wells Fargo To Change

FICO® periodically updates its scoring models and Wells Fargo may choose to upgrade to a more updated score version. If this happens, we’ll notify you when a change to the score version change occurs. You can locate the score version on your FICO® Score display. It is listed directly below the score and rating.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Recommended Reading: How Long Is A Repossession On Your Credit

Diversity Of Credit 10%

Diversity of credit shows lenders how many types of credit products you have in your credit history. The more diverse your credit history showing a variety of responsibly-used credit types like loans, credit cards and lines of credit the better. Credit diversity with payments made on time shows lenders youre responsible with all types of credit, which makes them more apt to lend to you.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Also Check: Does Wells Fargo Business Secured Credit Card Report To Bureaus

If Youve Applied For A Credit Card Auto Loan Mortgage Or Some Other Form Of Credit Odds Are Youve Heard The Phrase Fico Score

When you apply for credit, potential creditors may want to gauge how likely you are to pay your bills on time. Many creditors use FICO® credit scores to assess applicants, manage accounts, and determine rates and terms.

A FICO® score is a three-digit number ranging from 300 to 850 . These scores are largely based on your and can help creditors assess how likely you are to repay debt.

Fair Isaac Corporation, or FICO, introduced the first credit risk score in 1981. The organizations reputation as one of the primary credit-rating companies in the U.S. has grown since then, reaching different industries with scores geared toward different credit products.

Even though you may hear FICO score and think of it as a single credit score, you can actually have several of FICO scores, which can differ by industry. Read on to learn more.

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

Also Check: Does Apple Card Affect Credit Score

What If I Dont Want Wells Fargo To Display My Fico Score Anymore

You can opt out of the service at any time. On the FICO® Score screen, select the I no longer want Wells Fargo to display my FICO® Score link. If you decide to start the service again in the future, you can select View Your FICO® Credit Score on the Account Summary and follow the instructions to opt back in.

What Is The Credit Score Range Canada Uses

Canada operates with a credit score range between 300 and 900. The lower your score, the less likely you are to be approved for a credit card or loan. If you do manage to qualify for a credit card or loan despite a low score, the interest rate you receive will likely be high.

Conversely, the higher your credit score, the more likely you are to be approved for a credit card or loan, and the lower the interest rate will likely be. Good credit can also help you rent an apartment, get a better job, get approved for insurance coverage at a lower premium and get a better plan for your cable, phone or utilities.

*Please Note: credit score ranges are taken from the Equifax scoring model. Ranges are subjective and can vary by credit bureau and credit issuer.

Also Check: How To Remove A Repo Off Your Credit

What Is The Most Accurate Credit Score

Although there are many different scores and scoring models, there is a light at the end of this confusing tunnel.

Among all the credit score models, the FICO credit score is used by more than 90% of major U.S. lenders.

You might have a different score calculated by a different scoring model with a different provider.

However, it’s very likely that the lender or creditor will use the FICO score to determine if they’ll approve your application for a new line of credit.

Because of this, you might want to keep your eye on your FICO score, rather than many of the others that are available, simply because this is the number the lenders care about most. A FICO score ranges from 300 to 850 .