Checking And Understanding Your Credit Score Just Got Easier

There are no limits to how often you can check your credit score. The CreditView Dashboard gives you the power to:

View your score anytime.

Your score1 is updated once per month upon log in and checking it will not affect the score.

Use the Score Simulator.

This tool estimates what your score could be if you make certain changes.

Review your progress.

Use the Score Trends Graph to view up to 12 months of your credit score history.

Access credit education.

Learn credit basics, how to raise your score and more.

Use Different Types Of Credit

Your score may be lower if you only have one type of credit product, such as a credit card.

Its better to have a mix of different types of credit, such as:

- a credit card

- a car loan

- a line of credit

A mix of credit products may improve your credit score. Make sure you can pay back any money you borrow. Otherwise, you could end up hurting your score by taking on too much debt.

Why Should I Check My Credit Report Regularly

Your because many companies use it to predict future financial behaviors. So the better your credit, the better your chances of qualifying for things like credit cards, loans, mortgages and other credit products. And the better your rates and terms might be.

By monitoring your credit, you may be better prepared as you apply for loans. And it can give you an idea of areas where you can work to improve your credit.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

Capital One does not provide, endorse or guarantee any third-party product, service, information, or recommendation listed above. The third parties listed are solely responsible for their products and services, and all trademarks listed are the property of their respective owners.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

Related Content

Read Also: Is 804 A Good Credit Score

Dont Miss Or Make Late Repayments

Missed and late payments can stay on your credit file for up to six years. If youve made a late payment due to circumstances beyond your control , so long as you made the payment promptly when you noticed, talk to your credit provider and see if you can get this black mark removed. This also applies to late payments for utility bills like gas or electricity.

How Often Should You Check Your Credit Scores

The CFPB recommends checking your credit reports at least once a year as well as if youre

- Applying for a loan. Whether you want to buy a house, apply for a car loan or open a new credit card, its a good idea to check your credit scores before you submit your application. Your scores are one of the factors lenders consider when deciding whether to approve you for a loan and what interest rate youll be offered.

- A victim of identity theft. If your identitys been stolen or youre a victim of fraud, it makes sense to check your credit scores regularly until the issue has been resolved. You may also want to consider freezing your credit, which can make it tougher for fraudsters to open new accounts in your name. A credit-monitoring service may also be able to help you keep an eye on your credit reports and notify you about any changes to your accounts.

- Applying for a job. Depending on where you live, employers and landlords may be able to look at your credit history as part of the application process. If you plan to apply for a new job, make sure your credit scores are accurate.

- Building credit. If youre just starting out or rebuilding credit after a rough financial patch, checking your scores more often can help you track your progress.

You May Like: Can Checking Your Credit Score Lower It

How Your Credit Score Is Calculated

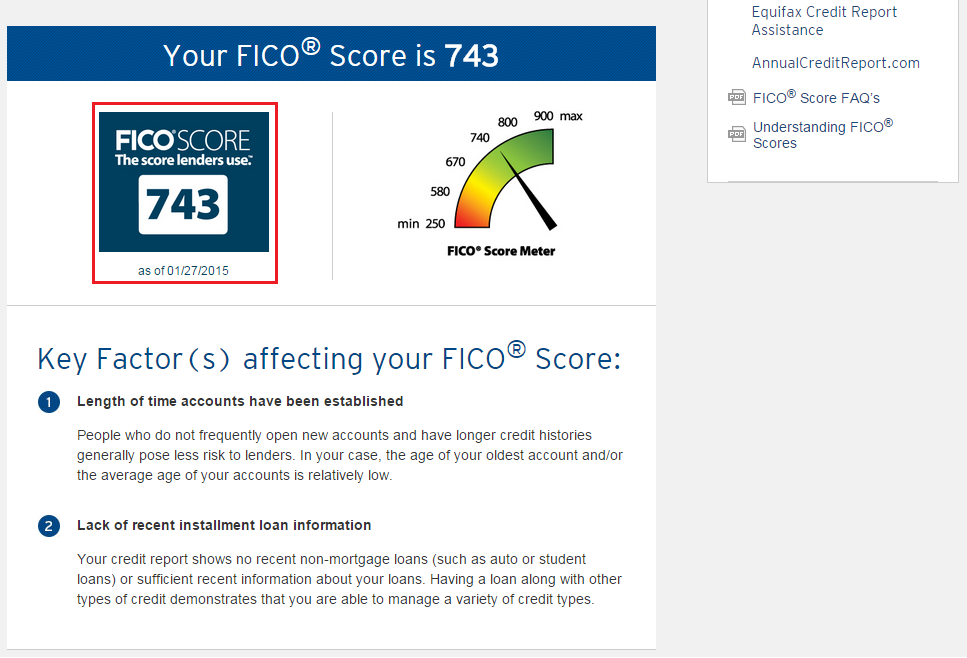

Your FICO score is calculated based upon the following 5 main elements in your credit report:

- payment history

- amount of debt and credit utilization

- length of credit history

- new credit

Other scores take into consideration different elements.

If youre trying to build credit, its important to understand how these factors work together. One of the most influential of these categories for your FICO score is the payment history. Having late payments, liens, charge-offs, and bankruptcies on your credit report can drastically harm your FICO score. Another influential category is the amount of debt you have and your credit utilization rate. If you already carry a lot of debt in the form of a mortgage, car loan, student loans, and/or maxed-out credit cards, then potential lenders may be concerned that youre carrying more debt than you can handle.

The length of your credit history moderately influences your FICO score. This shows potential lenders how you handle credit over time. The type of credit and new credit inquires play a smaller role in calculating your FICO score. If youre applying for a mortgage or preparing to finance a car, you might consider not applying for other types of credit.

1 Kritt, Erica, Buying a home? The first step is to check your credit, Consumer Financial Protection Bureau, January 9, 2017.

FICO is a registered trademark of Fair Isaac Corporation.

VantageScore is a registered trademark of VantageScore Solutions, LLC.

Think Before Applying For New Credit

Making an application for credit will leave a footprint on your credit file, which will be visible to other lenders.

If youve recently been turned down for credit, its unwise to apply for another credit card or loan immediately, as multiple applications over a short period of time may suggest to lenders that you are in financial difficulty.

This could ultimately make them reluctant to let you borrow.

Its worth asking lenders to perform a quotation search rather than a credit search when you are looking to get new credit.

This should give you an idea of whether your application would be accepted, as well as what interest rate youd be charged, but wont be visible to other lenders on your credit report.

Quotation searches are most frequently used for mortgage applications, particularly if youre shopping around for the best deal.

Applying for credit immediately after moving house or changing your job might affect your success rate.

Lenders like to see evidence of stability, so not having been in the same job or at the same address for long could count against you.

Also Check: Can You Get Charge Offs Removed From Credit Report

Best For Credit Monitoring: Credit Karma

If you’re interested in viewing your credit performance over time, CreditKarma may fit the bill. It lets you access your Equifax and TransUnion reports quickly and easily.

-

Only offers reports from two credit bureaus

-

Account required

While you will have to create an account to use Credit Karma, you dont have to enter your credit card information or remember to cancel any free trial subscription. You can access your credit reports at any time by logging into your account either directly through your web browser or through their mobile app. Your credit report information is updated to reflect changes in your credit history and activity, giving you continued access to changes in your credit information. Although, changes my require some days to be reflected in what is shown by Credit Karma.

Youll have access to your credit report information along with an explanation of the factors that are currently contributing to your credit score. Credit Karma also uses your free credit report information to show credit card and loan offers that you may qualify for based on your credit standing. You dont have to take advantage of these offers if youre not on the market for a new credit card or loan product.

Understanding Your Credit Score

Determining your score is more complicated than just weighing the different aspects of your credit history. The credit scoring process involves comparing your information to other borrowers that are similar to you. This process considers a tremendous amount of information, and the result is your three-digit credit score number.

Remember, no one has just one credit score, because financial institutions use several scoring methods. For some credit scores, the amount you owe might have a larger impact on your score than payment history.

View all of your credit reports annually to help ensure the information is accurate. You may also want to use a credit monitoring service year-round. TransUnion offers some of the latest and most innovative credit monitoring services, to help you spot inaccuracies, potential fraud and other blemishes that could lead to higher interest rates.

Also Check: How To Read Equifax Credit Report

How Often Should You Check Your Free Credit Scores

Checking your free credit scores on Credit Karma isnt a one-time set-it-and-forget-it task. Your scores may be updated frequently as your changes, so checking them regularly can help you keep track of important changes in your credit profile.

Since you can check your free credit scores without hurting your credit, feel free to check as often as you like. If you see your credit scores steadily growing, it can help motivate you on your credit-building journey. And when youre ready to submit a credit application, getting a better idea of your overall credit health beforehand can give you a better sense of where you stand.

Types Of Credit Scores: Fico Vs Vantagescore

There are two main credit scoring models: FICO and VantageScore. However, lenders have a clear preference for FICO its model is used in over 90% of U.S. lending decisions.

FICO and VantageScore credit scores have some similarities: In both, scores range from 300 to 850 and payment history is the most influential factor in determining your score. But they differ in exactly how they weight and rank several other factors.

Also Check: What Does Closed Derogatory Mean On Credit Report

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

How Do I Check My Credit Score

CIBC clients can check their credit score using the CIBC Free Credit Score Service in the CIBC Mobile Banking® App.

You can also contact one of Canada’s credit bureaus to receive a copy of your credit report by mail, free of charge. For a fee, you can view your credit report online.

For more information, contact one of the credit bureaus directly at:

- Equifax Canada: www.equifax.ca

Recommended Reading: How To Get A Good Credit Score At 18

Why You Should Check Your Credit Scores

Companies use your credit scores to make a number of decisions, including whether to approve you for loan applications, insurance premiums , rental requests and, in some states, even employment applications. How high or low your scores are can influence everything from how much interest youll pay on your next loan to whether you get your dream job or apartment. Thats why its important to know how your scores stack up. And dont worry checking your scores is considered a soft credit inquiry, so your credit wont be affected.

How To View Your Credit Report For Free

Chris Hoffman

Chris Hoffman is Editor-in-Chief of How-To Geek. He’s written about technology for over a decade and was a PCWorld columnist for two years. Chris has written for The New York Times and Reader’s Digest, been interviewed as a technology expert on TV stations like Miami’s NBC 6, and had his work covered by news outlets like the BBC. Since 2011, Chris has written over 2,000 articles that have been read nearly one billion times—and that’s just here at How-To Geek. Read more…

If you keep a regular eye on your credit report, youll notice when identity thieves open accounts in your name and when errors are listed that might cause you problems in the future. Heres how to do it for free.

US law entitles you to a free yearly credit report directly from each agency, but youll have to go elsewhere if you want to get your credit report more frequently. Dont worryits still free.

Recommended Reading: What Credit Score Do You Start With

How To Check Your Credit Score

17 min read

Your credit score is a very important number to know and understand. The terms on just about every credit card, personal loan or mortgage you apply for are influenced by those three little digits. Lenders look at your credit score as shorthand to determine how risky or reliable you are as a borrower, so you should get into the habit of checking it often.

In this guide, well walk you through the different ways you can check your credit score whether youre an individual or a business.

Best For Improving Credit: Creditwise

-

Timely notifications about credit report changes

-

Only offers TransUnion report access

-

Sign-up required

You can check your TransUnion credit report and credit score through CreditWise, a credit report and credit score tool from Capital One. Credit Wise is available for free, even for those who arent Capital One customers. Signing up is simple and easy. You wont have to enter any credit card information, theres no trial subscription to cancel, and your credit information is updated weekly. You can access Credit Wise online or use the mobile app to keep up with your credit score.

Also Check: Does A Judgement Show Up On Your Credit Report

What Do I Do With My Credit Report

Read it carefully. Make sure the information is correct:

- Personal information are the name and address correct?

- Accounts do you recognize them?

- Is the information correct?

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

How Credit Score Is Calculated

If you want to improve your credit score, its important to understand how it is calculated. Five categories of data are used for the calculation. The breakdown is as follows:

35% = Payment History. Lenders want to know whether you have paid your bills on time. Having late payments or collections on overdue bills will negatively impact payment history.

30% = Debt Level. The amount of debt you have compared to your credit limit is referred to credit utilization. If you are currently using a lot of your available credit, a lender may interpret that as a higher risk of default. So a higher credit utilization will hurt your credit score.

15% = Length of Credit History. Having a longer credit history will improve your credit score because it gives more information about your spending habits.

10% = Inquiries. Opening several credit accounts in a short period of time will hurt your credit score since an inquiry is made each time you apply for credit.

10% = Credit Mix. Your ability to manage different types of credit will be viewed favorably by lenders.

Also Check: How To Correct Credit Report Transunion

Never Ever Make A Late Credit Or Loan Payment

The most important factor in your credit score is your payment history, so this deserves the most focus. Further, a late payment stays on your credit report for seven years, so it takes a long time to fix a mistake in this area.

Contrary to a popular myth, you dont need to carry a balance to build an on-time-payment history. If you dont have to make a payment, its considered similar to an on-time payment. Just make sure you use your cards at least every once in a while to avoid having them closed for inactivity.

The easiest way to avoid late payments is to set up automatic payments. I have a few old credit cards that get a small charge every month one gets Netflix, one gets Spotify, and one gets Hulu. I generally dont use those cards for anything else, so I have autopay set up, and I never have to worry about paying late or overdrafting.

I generally pay off my more active accounts in full a few times a month. This helps me avoid having to make one big payment at the end of the month. There is no penalty for making extra payments, only for missing a payment.

If there is any one thing you should do for your credit, it is always pay on time. No exceptions.