Is The Credit Reference Agency To Blame If There Is An Error

The three credit reference agencies, Experian, Callcredit and Equifax provide lenders with your credit report if you apply for a product with them.

This gives them plenty of power of your ability to get a mobile phone contract, credit card, mortgage and much more.

As a result, having an error free credit report is absolutely important, as any mistakes could damage your credit score.

Why Donotpay Is The Best Way To Dispute Credit Report Mistakes And Win

Taking all those headache-inducing steps out of the credit report disputing process is just the beginning. DoNotPay is the best way to handle disputes because we make it :

Fast –You don’t have to spend hours researching credit reporting dispute forms, sending them, and following up for determinations.

Easy –You don’t have to struggle to fill out tedious forms yourself or keep track of which platform requires what as proof.

Successful –You can rest assured knowing we’ll make the best case for you!

Choosing To Challenge Online Or By Phone

Going through the credit bureaus online dispute system is convenient and fast. Credit bureaus may even encourage you to challenge credit errors online. However, its best to do everything on paper so that you have a written record.

Although you can attach evidence to your online dispute, your best bet is to have a paper trail. This means:

- Mailing a detailed letter via certified mail

- Attaching evidence proving the mistake

- Making copies for your records

Read Also: Usaa Credit Card Approval Score

Fixing Credit Report Errors

To ensure mistakes are corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau. Both these parties are responsible for correcting inaccurate or incomplete information in your report under the Fair Credit Reporting Act.

Keep in mind that all three of the credit bureaus now accept the filing of disputes online, with Experian now only accepting online submissions.

Find out how to initiate a dispute online.

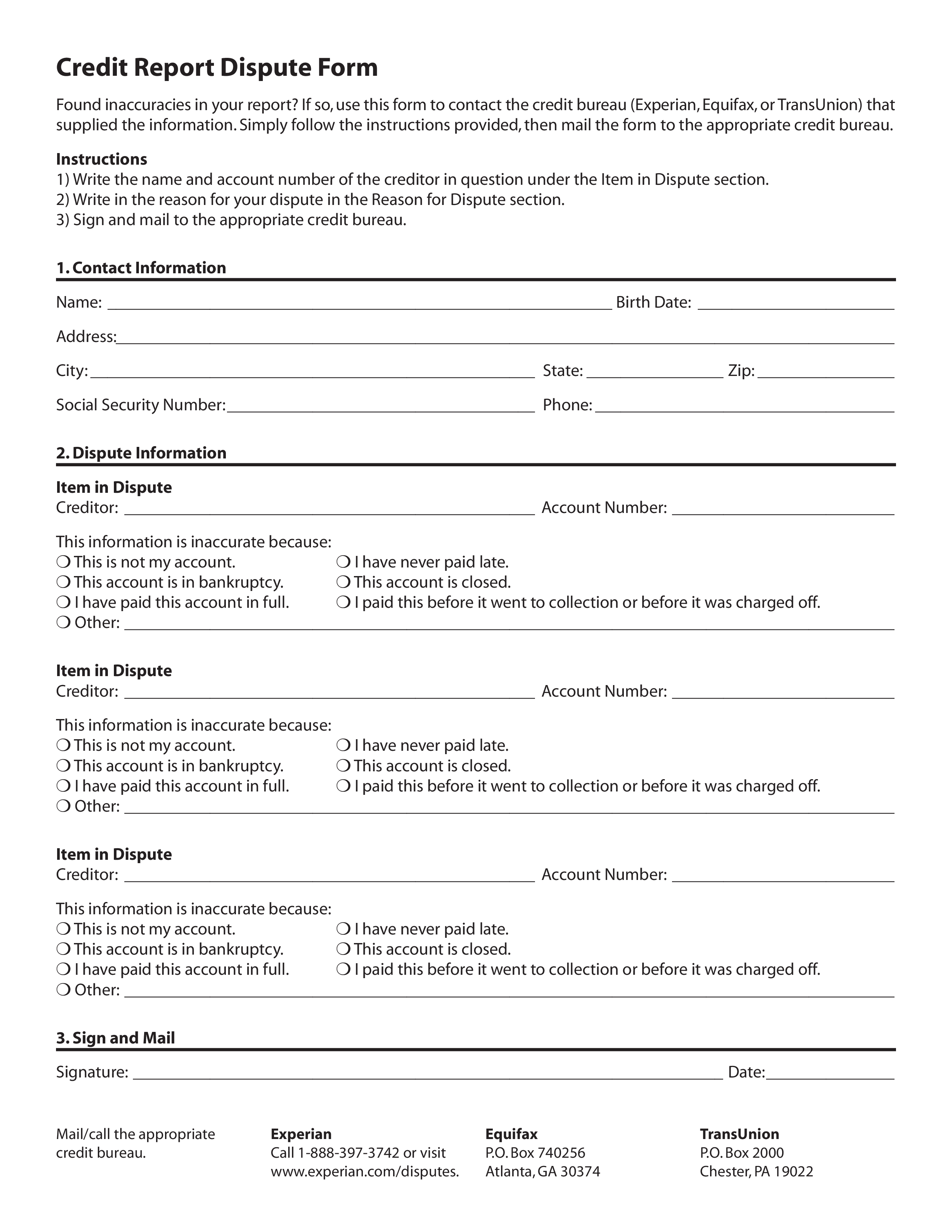

Begin by telling the credit bureau what information you believe is inaccurate. Credit bureaus must investigate the item in question-usually within 30 days-unless they consider your dispute frivolous. Include copies of documents that support your position. In addition to providing your complete name and address, your communication should:

- Clearly identify each disputed item in your report.

- State the facts and explain why you dispute the information.

- Request deletion or correction.

You may also want to enclose a copy of your report with the items in question circled. Your communication may look something like this sample.

If mailing a letter, send it by certified mail, return receipt requested, so you can document that the credit bureau did, in fact, receive your correspondence. Also, keep copies of your dispute letter and enclosures. If you want help disputing mistakes on your credit report, myFICO can help you write a free letter in minutes.

Ways To Dispute Information On Your Credit Report

![50 Best Credit Dispute Letters Templates [Free] á? TemplateLab](https://www.knowyourcreditscore.net/wp-content/uploads/50-best-credit-dispute-letters-templates-free-a-templatelab.jpeg)

TransUnion and Equifax have their own processes for disputing credit reports, but Experian provides three methods for submitting disputes:

- Online: Get access to your Experian credit report and initiate a dispute at the Experian Dispute Center . There is no cost to you for using this service.

- : To initiate a dispute by phone, you’ll call the number displayed on your Experian credit report. If you’d like to have a copy of your credit report delivered to you by mail, call 866-200-6020.

- : You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. .

You May Like: 824 Fico Score

How To Write A Credit Dispute Letter

Writing a credit report dispute letter can be stressful if you don’t know what you’re doing. Below, we’ve outlined the steps to take when writing a letter of dispute to a credit bureau, as well as some pointers to keep in mind when drafting your letter to make it as effective as possible.

Personal information: A dispute letter should begin with the senders information listed at the top:

- Senders name

- Senders date of birth

- Senders mailing address

The letter must also include the credit reporting agencys name and address. The three reporting agency addresses are listed below.

- TRANSUNION:P.O. Box 2000Chester, PA 19016-2000

- EQUIFAX:P.O. Box 740256Atlanta, GA 30374-0256

- EXPERIAN:P.O. Box 4500Allen, TX 75013

Account number: Each person has an account number with each individual credit bureau thats listed on the credit report. This account number should be included in the dispute letter.

Type of error being disputed: In the letter, note what type of mistake is being disputed. Errors can range from basic typos to duplicate or out-of-date information, or even potentially fraudulent credit inquiries.

Description of error being disputed: Explain exactly where the mistake was made. If you know where the inaccurate information came froma mistake made by your credit card company, loan issuer, etc.you should state that here as well.

Closing: Close the letter formally with your printed name and signature.

Wait Up To 45 Days For The Results

After you dispute credit reporting errors with a credit bureau, it typically has 30 days to investigate your claim. It must notify you of the results five days after completing the investigation. However, it can take up to 45 days under the following circumstances:

- Youve submitted a dispute after receiving a free credit report from AnnualCreditReport.com

- During the 30-day investigation window, you submit new materials and documents

You May Like: Does Paypal Report To Credit Bureaus

How To Dispute Collections From Your Credit Report

- If the negative item is nearing the time it will be removed you may choose to let the item drop of naturally. most negative information wont last longer than seven years from the date of the last activity. Chapter 7 Bankruptcy will show up for ten years.

- If you have accounts in collections, you can either pay them in full or offer a settlement. If you pay it off make sure you get it writing that the creditor will remove the item from your credit report. Settled accounts dont look as good on a report as those that are fully satisfied.

What To Do If You Disagree With The Outcome Of Your Dispute

If you don’t agree with the results of your dispute, here are some additional steps you can take:

- Contact the information source. Your best next step is to contact the entity that originally provided the disputed information to Experian and offer proof their information is incorrect. The source may be the lender or financial institution that issued you a loan or credit, but it could also be a collection agency or government office. Contact information for each source appears on your credit report, and you can use it to reach out to them.

- Add a statement of dispute to your credit report. A statement of dispute lets you explain why you believe the information in your credit report is incomplete or inaccurate. Your statement will appear on your Experian credit report whenever it’s accessed or requested by a potential lender or creditor, so they may ask you for more details or documentation as part of their review or application process. To add a statement of dispute, go to the Dispute Center, choose the item in dispute, and select Add a Statement from the menu of dispute reasons.

- Dispute again with relevant information. If you have additional relevant information to substantiate your claim, you can submit a new dispute. If you’re filing the dispute online, follow the steps listed above for using the Dispute Center, and use the upload link to provide your supporting documentation.

Also Check: Does Paypal Report To Credit Bureau

Error Detected Now What

Alas, your good word isnt good enough on its own. You will need the best available evidence. Been divorced five years, but your ex is still on your report? Present a copy of your divorce decree.

Payments made on time were recorded as late? Bank statements are your friend.

In short, you need documentation. Whatever is relevant applies: Loan documents, credit card statements, marriage licenses, divorce decrees, birth or death records, bank statements.

Investigators will be delighted to have help. Demonstrate that you are organized, reliable, and circumspect. Help them help you. Youve spotted an error, and you can back up your claim with the hard evidence of a paper trail .

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Recommended Reading: How Do I Unlock My Experian Credit Report

Start By Reviewing Your Credit Report

To get started, you’ll need to review your to catch any errors. There are three main credit bureaus, each with its own report: Experian, Equifax and Transunion. You’ll need to obtain a credit report from all three, since they all collect information in their own way.

Though the credit bureaus can charge you for a credit report, federal law allows you to obtain your credit reports for free once a year on annualcreditreport.com. Even better, temporary changes to the federal law allow you to obtain up to six free credit reports per year through 2026 by visiting the Equifax website. And all three credit bureaus continue to provide free weekly reports as the pandemic stretches on.

To access your reports, make sure you have your Social Security number ready and follow the steps described on the website. You’ll be able to view or download them directly from the site so you can read them over carefully for errors.

Do All Late Payments Appear On My Credit Report

![50 Best Credit Dispute Letters Templates [Free] á? TemplateLab](https://www.knowyourcreditscore.net/wp-content/uploads/50-best-credit-dispute-letters-templates-free-a-templatelab.jpeg)

Generally speaking, creditors must wait until a payment is at least 30 days past due before reporting it to the credit bureau. If you have a good relationship with your lender and a good payment standing, its possible your lender may even extend that time to cut you some slack but could still charge you a late fee. If your payment is 90 180 days late, your lender could also take it a step further and send a notice of late payment to the credit bureau which could result in them actually closing your account.

Don’t Miss: Does Acima Build Credit

Consider Contacting Your Lenders

If there is something specific to one of your accounts that you dont understand or looks wrong, it may be easier and faster to reach out to your lenders directly. You can find their contact information on your credit report. Lenders will have more details about the status of things like credit card balances and recent payments. They may be able to provide answers and resolve certain concerns quickly. If youre unsure if account information on your report is inaccurate or if an account balance just hasnt been updated yet, your lender may be able to help you. Any updates they make will be sent to us to add and/or change on your credit file.

What If The Information Is Rightbut Not Good

If theres information in your credit history thats correct, but negative for example, if youve made late payments the credit bureaus can put it in your credit report. But it doesnt stay there forever. As long as the information is correct, a credit bureau can report most negative information for seven years, and bankruptcy information for 10 years.

You May Like: Creditwise Simulator

Review Your Credit Reports For Errors

Your are based on information provided by companies to the three major credit bureausExperian, Equifax and Transunion. To identify which credit reports contain errors, you have to review each report separately. You can do this by visiting AnnualCreditReport.com. Due to Covid-19, you can view all three of your reports for free weekly through April 20, 2022.

How To File A Dispute Online

You can file disputes by phone or mail, but the fastest and most secure way to submit a dispute is online at the Experian Dispute Center.

To start, click “start a new dispute online.” After signing in or creating an account, you’ll be guided through your credit report section by section. Following the prompts, highlight the items you want to dispute and select your reasons for each dispute from the dropdown menu.

You can also upload supporting documents, review your dispute and submit it online. Once your dispute is finalized and submitted, the Dispute Center allows you to track its status until it’s resolved.

Read Also: Usaa Free Credit Score

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, you’ll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didn’t initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

How Often Do Errors Require Disputing Credit Reports

In a one-of-a-kind 2012 study, the Federal Trade Commission selected 1,001 Americans at random and asked them to review and dispute credit report information that they felt was wrong.

Heres what happened1:

- 26% of total participants identified one or more errors and disputed their credit reports

- 21% had changes to a credit report based on their dispute

- 13% saw their credit score change as a result

- 5% saw their credit score increase enough to improve their credit risk level by one tier

That last statistic is perhaps most important. As the FTC report notes, the credit report disputes by those 5% resulted in enough improvement to get them better loan terms should they seek one, including a lower interest rate.

Recommended Reading: Does Applying For Paypal Credit Affect Credit Score

What Information Do I Need To Provide When Submitting A Dispute

Types of information you should be prepared with:

- Your full name, including middle initial and suffix, such as Jr., Sr., II, III

- Social Security Number

- Current address

- All addresses where you have lived during the past two years

Depending on how you submit your dispute , you may also be asked to provide the following additional information:

- Email address

- A copy of a government issued identification card, such as a driver’s license or state ID card

- A copy of a utility bill, bank or insurance statement

You should list each item on your credit report that you believe is inaccurate, including the creditor name, the account number and the specific reason you feel the information is incorrect.

You may also submit documents to support your dispute. Depending on the type of information disputed, the following documents may be helpful in resolving your dispute:

- Police reports or an FTC Identity Theft Report, showing that an account was the result of identity theft

- Bankruptcy schedules showing that an account was included in or discharged in bankruptcy

- Letters from creditors showing how an account should be corrected

- Student loan disability letters showing that a student loan has been discharged due to disability

- Cancelled checks showing that a collection account has been paid

- Court documents regarding public records

A Slice Of Useful History: Youre Not In This Alone

Errors on credit reports are, unfortunately, nothing new. A 2012 Federal Trade Commission study unearthed an alarming number of material mistakes that is, an error with the potential to lower a credit score. More than a quarter of 1,001 people who reviewed their credit reports identified mistakes ranging from credit card accounts that werent theirs to a disputable late-payment charge.

OK, its one thing to claim an error. The proof in the pudding is whether they stick. So: Nearly 80 percent of those whose claimed errors were presented to the Big Three credit bureaus Experian, Equifax, or TransUnion saw at least one change in their credit reports.

What this means to you: Theres about a one-in-five chance your credit report is being weighed down by inaccurate data. Wait. This also means theres a four-in-five chance your report is error-free. Those are pretty good odds, right?

The question is: Are you willing to assume the risk to your credit health that ignoring your credit report implies?

Hint: Because your credit report can be instrumental in obtaining a credit card, increasing your debt limit, securing a loan with the best possible terms, or even getting a job, the correct answer is, Absolutely not!

As mentioned above, credit report errors often happen when Social Security numbers get transposed on an application, or someone with the same name in a similar ZIP code applies for credit.

7 Minute Read

You May Like: Sywmc Cbna On Credit Report