How To Get A Good Or Excellent Credit Score

If you havent already, access some credit. After you have an open account for six months and its been reported to credit bureaus youll have enough data to get a credit score with both FICO and VantageScore. Perhaps surprisingly, it is possible for an individual with only six months of positive reported credit history to have a score in the 700s, despite having a short credit history. But payment history and credit utilization would need to be very strong. I would consider this to be a fragile score. Since it is based on very little data, any negative entries would have a large effect.

See related: Best cards for young adults

Pay your bills on time, every single time. Payment history is the No. 1 factor in the FICO model, making up a whopping 35% of your score. Paying your bills on time and in full also impacts your , or how much of your available credit you have used at any given time. This is also very important as it counts for 30% of your FICO score. Know what your credit limit is and try to stay under 30% of that limit. The closer you can get to single digits in this category, the better it will be for your score.

See Related: Best credit cards for good credit

How To Stay On Top Of Your Credit Score

First, keep track of your credit regularly for unexpected changes. As mentioned above, you may be able to do so through your banks or credit card provider, and federal law requires each of the three nationwide credit bureaus to provide one free credit report per year.

Second, set up automatic payments, through online bill pay, to help ensure all your bills are paid on time. Every missed or late payment can have an impact on your credit. Setting up automatic payments helps eliminate human error from the bill payment process while saving time and avoiding late fees.

Finally, use credit smartly. Dont max out your credit cards, and dont apply for credit you dont need. Manage how much of your credit line you use and, if possible, make additional payments to reduce how much of your credit line youve used.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Itin Number Credit Report

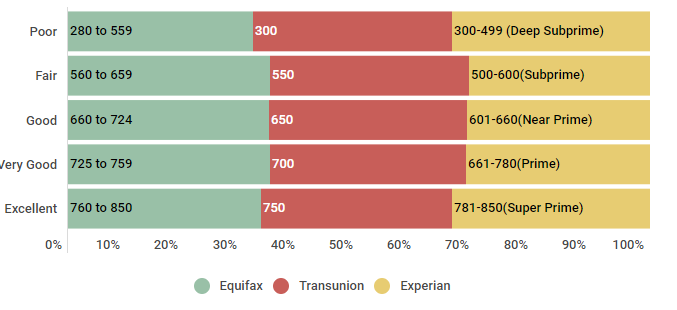

What Is A Credit Bureau

A credit bureau, also known as a consumer reporting agency, collects and stores individual credit information and provides it to creditors so they can make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit card issuers. The three largest credit bureaus in the U.S. are Equifax®, Experian®, and TransUnion®.

Start Creating A Good Credit History

Itâs hard to get credit if you donât have a credit history. But you canât have a credit history if youâve never had credit. Itâs a bit of a chicken and egg situation.

So what can you do instead? Here are some ideas:

Consider asking your bank for a small overdraft facility

An overdraft allows you to borrow money from your bank account. Since itâs a form of credit, it shows up on your credit report.

Some current accounts feature a small automatic overdraft facility, so itâs worth checking if yours has one. If it doesnât, try explaining your situation to your bank and ask them what your chances of being approved would be if you were to apply.

You donât have to use your overdraft. In fact, itâs usually better not to, as overdrafts tend to be expensive due to the interest you pay. The point is to build your credit history by adding more information to your credit report.

Put your utilities, broadband and other household bills in your name

More and more, companies such as utilities and broadband providers are sharing data with credit reference agencies. If you donât have a credit history, putting these bills in your name is your opportunity to start building your score.

For best results, check that your name is spelled correctly and always write your address in the same format. Even something as simple as a misspelled street name could lead to inaccuracies in your report.

Pay by direct debit whenever possible

You May Like: Which Banks Report Authorized Users To Credit Bureaus

Howis Your Starting Credit Score Calculated

Credit scores are calculated using information from your credit reports. This information is summarized into a three-digit score that lenders can use to determine your financial trustworthiness. When talking about credit scores and credit utilization, youll be referring specifically to your FICO score the vast majority of the time.

FICO scores are compiled from five main data points:

- Another10% of your credit score is calculated based on your credit mix. Thisincorporates the different types of credit accounts you have in your records,such as credit cards, mortgages, student loans, installment loans and more. Typically,this isnt a key part of determining your credit score but is used as a way topaint a picture of your overall credit history.

- Length of History 15%: A largerchunk of your credit score is calculated based on the length of your credithistory. This looks at the age of all your credit accounts and how long theyvebeen active. In general, people with a longer credit history will have a higherscore.

How Do Public Records And Judgments Impact Fico Scores

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

Recommended Reading: Does Balance Transfer Affect My Credit Score

What Is Your Starting Credit Score

We all start out with no credit score which makes sense, given that our credit scores are based on the information contained in our credit reports, and these reports arent even generated until we have had credit in our names for 6 months or longer. Without an established history, your credit report and credit score dont magically appear when you turn 18, despite many common misconceptions.

Once you have established credit, your first credit score could range anywhere from lower than 500 to well in the 700s, depending on your initial financial performance. The only connection between your first credit score and the scoring metrics would be the age of your credit profile. And given that this factor is only worth about 15% of the points in your total credit score, even by essentially failing this category and doing well in the others, you would still have a credit score well above 640.

Wondering what the credit scores of US consumers look like? Lets take a closer look.

U.S. Population Categorized by the Five FICO Ranges for Credit Scores

| Age | |

|---|---|

| 17% | 32% |

It comes as no surprise that older consumers with a more established credit history, have better credit scores with approximately one-third of Baby Boomers having excellent credit. Younger generations that are just starting out in building their credit are still working on improving their scores, with the bulk of Gen Zers and Millennials having poor or fair credit.

Open A Secured Credit Card

If your score isnt good enough to get a decent credit card and start building your score, try opening a secured credit card instead. Companies are happy to hand them out because they carry such little risk.

These cards require you to put down a deposit upfront usually one or two times your desired credit limit. If you default on your debts, youll forfeit your deposit.

As long as you use your card regularly and pay off your balance in full and on time, your payment history will improve.

After a few months you can ask your issuer for a higher credit limit, which will help to bring down your utilization ratio. You might also get the option to upgrade to a non-secured card.

Read Also: Does Speedy Cash Report To Credit

How To Maintain Your Good Credit Score

Once you build or improve your credit score, the next step is to maintain it. Keeping your credit score above 670 will make your life easier in many ways. To ensure it stays in the good or excellent range with minimal surprises, you’ll want to start developing these simple habits:

- Tip 1: Pay bills on time and in full

- Tip 2: Maintain a low credit utilization rate

- Tip 3: Limit new credit applications

What Are The Fico Credit Score Ranges

In addition to understanding how a FICO credit score is calculated, its a good idea to know the FICO credit score ranges. FICO scores range from 300 to 850, and are divided into the following categories:

- Exceptional: 800-850

- Fair: 580-669

- Very Poor: 300-579

Your goal should be to get your FICO score above 670 as quickly as possible. Once you have good credit, youll be able to apply for some of todays best credit cardsplus, itll be easier to take out a mortgage, rent an apartment, buy a car, sign up for a new smartphone plan and more.

Don’t Miss: Syncb/ppc Account

Whats Considered A Good Credit Score

Most major credit score models range from 300 to 850, with the highest number representing the strongest score. However, credit companies such as FICO or VantageScore dont officially decide what constitutes a good or bad score. This is all up to lenders. Theyll use your credit score to determine a variety of things, including:

- The interest rate theyll charge for a loan

- The discount they may offer on an insurance policy

- Whether to approve credit and how much to approve

- Whether to increase or decrease credit limit

- Whether to close a risky account

So what do lenders consider a good or bad credit score? Every credit score model uses a slightly different scoring system. For this example, well use the FICO score system of 300850, as its very commonly used.

- 300599: bad credit

- 700749: good credit

- 750850: excellent credit

Remember that the system is relative. What one lender may consider an unacceptable score, another may accept. For example, most mortgages require a minimum credit score of 620 or even as low as 500 for an FHA or bad credit loan. But if youre applying for a low-interest credit card, lenders may not accept anything below a 700.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Recommended Reading: How To Remove Hard Inquiries Off Credit Report

How Do I Monitor My Score

SFIO CRACHO / Shutterstock

With so many factors affecting your score from month to month, it can be hard to tell how much of an impact your efforts are making. Thankfully, a number of free online services allow you to monitor your progress.

One popular option in Canada is Mogo , which provides access to your Equifax credit score for free, as well as a suite of services to improve your financial health .

This article was created by Wise Publishing, Inc., which provides clear, trustworthy information people can use to take control of their finances. Millions of readers throughout North America have come to count on the Toronto-based company to help them save money, find the best bank accounts, get the best mortgage rates and navigate many other financial matters.

What Goes Into A Credit Score

While there are various credit scores, 90% of top lenders use FICO® Credit Scores, including Discover.* While the exact FICO® Score formula is proprietary, FICO breaks down the general categories and weight additionally. According to FICO, these percentages refer to the general population, but may vary from one person to anotherfor instance, the relative importance of the categories may be different for consumers who have not been using credit long.

Don’t Miss: Ccb/mprcc

Tip : Maintain A Low Credit Utilization Rate

“If your balances increase over time, your credit scores will suffer. Your is the second most important factor in scores, behind your payment history,” Griffin explains.

To calculate your utilization rate, add up the total balances on all your credit cards and divide by the total of your credit limit across all cards.

Let’s say you have two credit cards:

- Card A: $1,000 balance and $3,000 credit limit

- Card B: $3,000 balance and $5,000 credit limit

Your total balance would be $4,000 and total credit limit $8,000. That makes your utilization 50%, which is high. You should aim for a low utilization rate around 30% to improve your credit score.

If you find it hard to keep track of the percentage of credit you use, take advantage of various alerts card issuers set, such as when your balance exceeds a certain amount or when you’re approaching your credit limit. If you have no problem paying your balance in full each month, you can also call your card issuer and ask them to increase your credit limit.

Option : Get Credit For Paying Monthly Utility And Cell Phone Bills On Time

Having a credit card is not the only way to build credit. If you are already responsible about making your utility and cell phone payments on time, but you don’t have a credit card, then you should check out Experian Boost. It’s a free and easy way for consumers to improve their credit scores. Roughly two out of three people see instant increases to their credit scores, with an average increase of 10 points, and many people become scoreable for the first time as a result, according to Rod Griffin, senior director of consumer education and advocacy at Experian.

The way it works is simple: Connect your bank account to Experian Boost so it can identify your utility and cell phone payment history. Once you verify the data and confirm you want it added to your Experian credit file, you’ll get an updated FICO score delivered to you in real time. Visit Experian to read more and register. By signing up, you will receive a free credit report and FICO score instantly.

Don’t Miss: Credit Score For Prime Visa

Does The Fico Score Im Seeing Reflect My Most Recent Payments

Scores reflect data from your Experian® credit report at the time it was calculated and may be from a previous period. All lenders have their own reporting schedule, so you should allow 30-60 days from the time of any payments or other activity for that activity to be reported in your credit report and then reflected in your FICO® Score. If you believe your FICO® Score is incorrect or doesnt reflect your most current activity, the first thing you should do is check your credit report. You can check your credit report from each of the three consumer reporting bureaus once per year for free at annualcreditreport.com. If you see an error or a particular lender has not reported your latest activity to the credit bureau, follow each bureaus instructions on how to dispute the information or contact the lender directly. If you see an error associated with a Wells Fargo account, call us at 1-855-329-9605, Mon Fri, 7:00 a.m. 7:00 p.m. Central Time.

How To Get Your Credit Score To 800

A credit score in the 800s is a remarkable milestone. Although it will take time, its completely possible to achieve. Heres how to get started:

- Pay all of your bills on time.

- Never max out your credit cards.

- Dont apply for every credit card you see.

An 800 credit score is a great goal but itll likely take many years to reach this elite status as credit scores factor account ages into the score. As your average account age grows, so can your credit score.

Recommended Reading: Read Experian Credit Report

What Is A Credit Report

While a credit score is a simple shorthand for your creditworthiness, a credit report is a more complete overview of your financial history, and its one of the major tools a lender uses in determining whether or not to give you credit. Contained within your credit report is key identifying information like your address and social insurance number, your payment history with your creditors, a record of bankruptcies or any court judgments that would affect credit worthiness, a list of lenders or other parties that were authorized to look into your credit, and any banking or collections information.

Canadians are entitled to one free credit report per year from either Equifax or TransUnion. to apply for your free credit report from Equifax by mail, and to receive your free credit report from TransUnion either by mail or online. If you cant wait a year for your free report from the credit bureau, Borrowell, a Canadian financial technology company and credit monitoring service, can give you free access to your credit score any time. I reached out to Borrowells CEO, Andrew Graham, to get his thoughts on the value of this new offering.

Borrowell has recently launched free credit report monitoring. For the first time, Canadians are able to monitor important information in their Equifax credit report on a monthly basis for free online, said Graham.