Identifying Credit Report Errors

Flubs occur because of human error or incomplete information being provided to a credit bureau. Errors can include:

- Reports of something you didn’t buy or a purchase you didnt authorize

- Reports of amounts differing from what you actually paid

- Inaccurate purchase dates

- Missing payments or credits to your account

- Accounts mistakenly attributed to you

- Reports of applications you didn’t fill out

The other credit report error is fraud, in which someone intentionally and illegally tries to mess with your financial statusfor example, by opening an account in your name.

In either situation, the best way to correct an issue is to find the source of the error. Of course, you wont know there is an error unless you check your report regularly. So, request a copy of your report and carefully review all the information it contains. Look for any entries that are mistakenly attributed to you because of confused names, addresses or Social Security information. Check for mixed account information that could be due to identity theft, incorrect payment status, an ex-spouses information mixed with yours, outdated information or remedied delinquencies not being reported.

Once you’ve discovered a possible problem, make sure to gather proof supporting your position that there is an error before you officially dispute it.

How To Build A Credit History

Sin writes histories. Goodness is silent. Unfortunately, these famous words from Johann Wolfgang von Goethe often ring true in the area of credit reporting. While it would seem that having no credit is a good thing because it can indicate that youve been financially solvent enough to pay cash for every purchase that youve ever made, lenders want proof that if they give you money, you wont take it and run.

If youve determined that you definitely dont have a credit history, or if the history you do have isnt sufficient to get you approved for a traditional credit card, then here are some of your options:

Is It Safe To Check My Credit Score For Free

Checking your free credit scores on Credit Karma wont affect your credit, and any attempts to monitor your credit with Credit Karma will not appear on your credit reports.

If you want to learn more about how Credit Karma collects and uses your data, take a look at our privacy policy.

You can also read Credit Karmas security practices to learn more about Credit Karmas commitment to securing your data and personal information as if it were our own.

Ready to help your credit go the distance? Log in or create an account to get started.

Dont Miss: When Does Open Sky Report To Credit Bureau

Read Also: Syncb/ppc Closed Account

What Does A Credit Score Mean

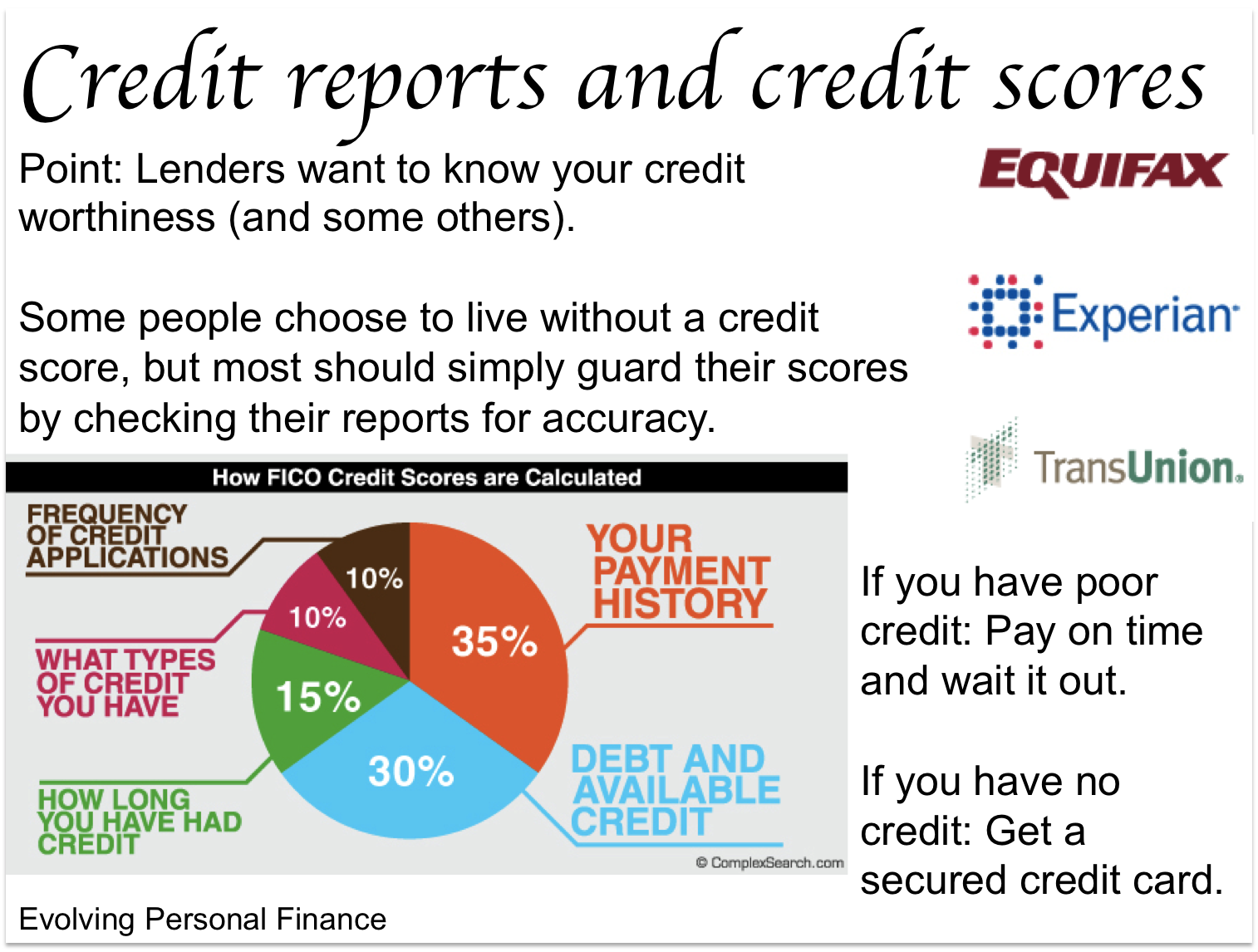

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

How Should I Report That Someone Has Died

When someone dies, a family member or an appropriate person such as an executor should send a notice letter to one of the three credit reporting companies and request that they update the credit record to indicate that the person is deceased. The credit reporting company will then share that information with the othertwo credit reporting companies so that they can update their records.

The letter should include the following information about the deceased:

- Legal Name

You May Like: Is 524 A Good Credit Score

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

You May Like: Affirm Approval Credit Score

Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

How To Safeguard Your Identity

If you find accounts listed on your credit reports that you did not open or if you are worried about identity theft, you might consider filing a free fraud alert on your credit file that remains active for one year through the Experian fraud center. The fraud alert notifies lenders pulling your credit report to take extra steps to verify your identity.

You can also freeze your credit reports, another free measure that prevents lenders from issuing new credit in your name altogether. Or try Experian CreditLock, a benefit of your Experian membership, which allows you to lock and unlock your report in real time, with no waiting period.

Read Also: Does Carmax Accept Bad Credit

How Do Errors Impact Your Credit Score

Your is calculated using different models such as VantageScore and FICO, the two most widely used credit-scoring models. Each model has its proprietary metrics and criteria. However, both use data from the major credit reporting agencies to generate your score.

Both scoring models also consider similar factors when calculating your score. These include your total credit usage and length of credit history, for example. But your payment history is the most important factor when determining your credit score.

Your payment history alone makes up around 35% of your FICO score and 42% of your VantageScore 4.0. Since payment history is so significant, a single inaccurate late payment could impact your score considerably. According to FICO, if your report has a 90-day missed payment, your score could drop by as much as 180 points.

How Do I Check My Credit Report

This is easy to do by phone:

- Answer questions from a recorded system. You have to give your address, Social Security number, and birth date.

- Choose to only show the last four numbers of your Social Security number. It is safer than showing your full Social Security number on your report.

- Choose which credit reporting company you want a report from.

That company mails your report to you. It should arrive 2-3 weeks after you call.

You May Like: Hard Inquiry Fall Off

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Also Check: Care Credit Score Needed 2021

How To Get A Copy Of Your Chexsystems Record

Because of the Fair Credit Reporting Act, federal law entitles consumers to a free ChexSystems report each year. Consumers are also entitled to a free report if they are denied an application for an account with a bank or credit union.

To receive a free copy of your ChexSystems reports, you can visit the ChexSystems website, call the ChexSystems consumer disclosure report number at 800-428-9623, or send in a request by fax or mail.

References:

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: 641 Credit Score Credit Card

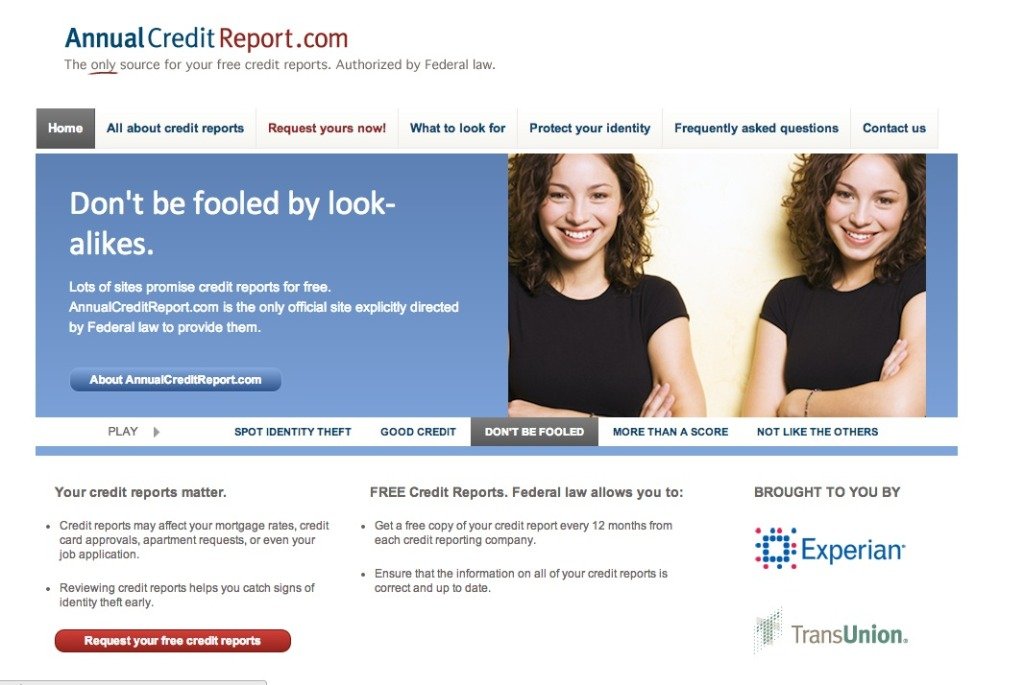

Check And Monitor Your Credit Reports And Credit Scores

Now that you know why your credit is so important, you can see why itâs a good idea to check and monitor your credit. But how do you do it?

How to Request Free Copies of Your Credit Reports

You can get a free copy of your credit report from each of the three major credit bureausâEquifax, Experian and TransUnionâby visiting AnnualCreditReport.com. Youâll need to provide your:

- Legal name.

- Social Security number.

- Current address.

If youâve moved in the past two years, you may need to include your previous address as well. There may be a limit on how often you can obtain your reportâcheck the site for details.

Once youâve provided the information above, youâll pick which credit reports you want before answering a few additional questions that help verify itâs really you. âThese questions are meant to be hard,â according to AnnualCreditReport.com. âYou may even need your records to answer them. They are used to ensure that nobody but you can get your credit information.â

How to Check Your Credit Scores for FreeâWithout Hurting Your Credit

Keep in mind that your credit scores donât actually appear on your credit reports. So what do you do if you want to check your scores?

Depending on your lender, you may be able to find your scores by checking your statement or by logging in to your account online. You can also get your scores directly from the credit bureaus and credit-scoring companiesâbut you might have to pay for them.

Related Content

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

You May Like: What Does Syncb Ppc Stand For

Finance A Store Purchase With An Interest

Especially around the holidays, stores often let you purchase items on credit with a same as cash offer that charges no interest for a set period of timeusually 90 days. Since this is a type of loan, it can help you establish good credit if you pay on time. To avoid paying interest or hidden fees, make sure to pay it off completely before the allotted period expires.

Offers like this can be found both in stores and online.

What If I Find A Problem Or Mistake On My Credit Report

If you have no plans to apply for new credit, it’s a good idea to review your credit report from each bureau on an annual basis. Check to ensure that your identifying information is correct, and that the credit accounts listed in your report are accurately represented.

If you do plan to apply for a new loan or credit card, it’s vital that you check your credit reports beforehand in case there is anything that needs to be cleared up. Negative information in your credit reports can lower your credit scores, and you want your credit scores to be the best they can be before applying for new credit.

Under the Federal Credit Reporting Act, both the credit reporting bureau and the information provider are responsible for correcting any inaccurate or incomplete information in your reports. To get information corrected, you must initiate a dispute with the credit reporting agency. This typically involves submitting your dispute in writing. The credit reporting agency must investigate your dispute within 30 days of your submission.

Experian makes it easy to initiate a dispute online through our Dispute Center. You can also initiate a dispute at Experian by phone or mail see “How to Dispute Credit Report Information” for more details.

Read Also: How Do Evictions Show Up On Credit Reports

Wallethub: Best For Credit Alerts

WalletHub provides you with credit reports from TransUnion and the TransUnion VantageScore. To register, you’ll need to provide your personal details and the last four digits of your Social Security number , and you’ll have to answer a few questions to verify your identity. The site also asks other questions, such as your annual income, monthly expenses, and credit card debt to complete the registration.

The dashboard shows all of your credit accounts and balances while the credit alert section gives you a report card-style letter grade on the factors that influence your score. For example, the site warns you if your debt load is too high relative to your income or if your is too high and hurting your score.

Drop-down menus provide additional details, such as your credit utilization ratio. An easy-to-read version of your credit report shows all of your current and closed accounts, and any negative items, like collection accounts.

A menu bar across the top of the page provides information about financial products and services, such as checking accounts and car loans. WalletHub earns money from some of these companies, which advertise and pay for premium placements on the site.

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently at the very least annually, if not more often to catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major once a year. However, because of the pandemic, all three bureaus are offering free weekly reports through the end of 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to check your reports from all three bureaus since each one can include different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service

P.O. Box 105281

Other ways to get your credit report

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance or employment in the past 60 days based on your credit

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- Youre a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

To request additional copies, contact the bureaus directly. Heres how to do it:

For a more detailed guide on how to request copies, make sure to read our article on how to check your credit report.

Recommended Reading: What Is Syncb Ppc

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you: