How Can You Boost Your Credit Score

There are one-off actions that can improve your credit score, such as registering yourself on the electoral roll and clearing errors on your credit report. However, careful, long-term credit use is the most effective way to improve your credit score.

Its easy to think that never taking out a credit card would show youre good with money, but it can actually lower your credit score. Thats because lenders dont know how reliable youre going to be with repayments, as theres no record of you ever borrowing. If youre looking to improve your credit score, try:

- Spending and paying off a small amount each month on a credit card to show lenders you can responsibly manage your credit.

- Prioritising paying off debt to improve your debt/income balance.

- Making sure you know when payments are coming out and always having enough money in your account to cover them.

- Closing any old credit card accounts youre no longer using having too many open will make it look like youre relying on credit too much.

- Encouraging your partner or spouse to work on their credit score too, particularly if theyre an associated financial partner .

Optimizing Credit In The Futureand Now

Getting a mortgage is a positive opportunity to build your credit, accumulate wealth and live in your own home. Checking your credit score before you begin the application process can help you determine whether it might be a good idea to take time to improve your credit score before submitting your applications.

If your score isn’t where you want it to be, check out Experian Boost. This free service lets you add on-time utility, phone and streaming service payments to your credit score calculation, which may help offset a minor dip in your credit score while you’re waiting for the positive effects of paying your new mortgage to kick in.

How To Improve Your Credit Score To Get A Better Interest Rate

If youre concerned about how your credit score will affect your mortgage approval, you can take steps to improve your credit score now. Your score wont go up overnight, but slow and steady improvements can make a big difference in the interest rate youre offered once youre ready to apply for a home loan.

Several factors affect your credit score, including your amount of debt, payment history, and the length of your credit history. You can take actions to improve several of these factors.

Recommended Reading: What Credit Score Do You Need To Rent An Apartment

Why Do Lenders Care About Credit Scores

From the lender’s point of view, a credit score is a mathematical construct that demonstrates a borrower’s creditworthiness and the likelihood they will meet future financial obligations. The minimum score needed for FHA loan or a conventional loan typically varies because FHA loans offer financing options with less restrictive credit guidelines than conventional loans. Several scoring algorithms generate consumer credit scores, with the FICO Score the most widely known tool.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Which Credit Score For Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

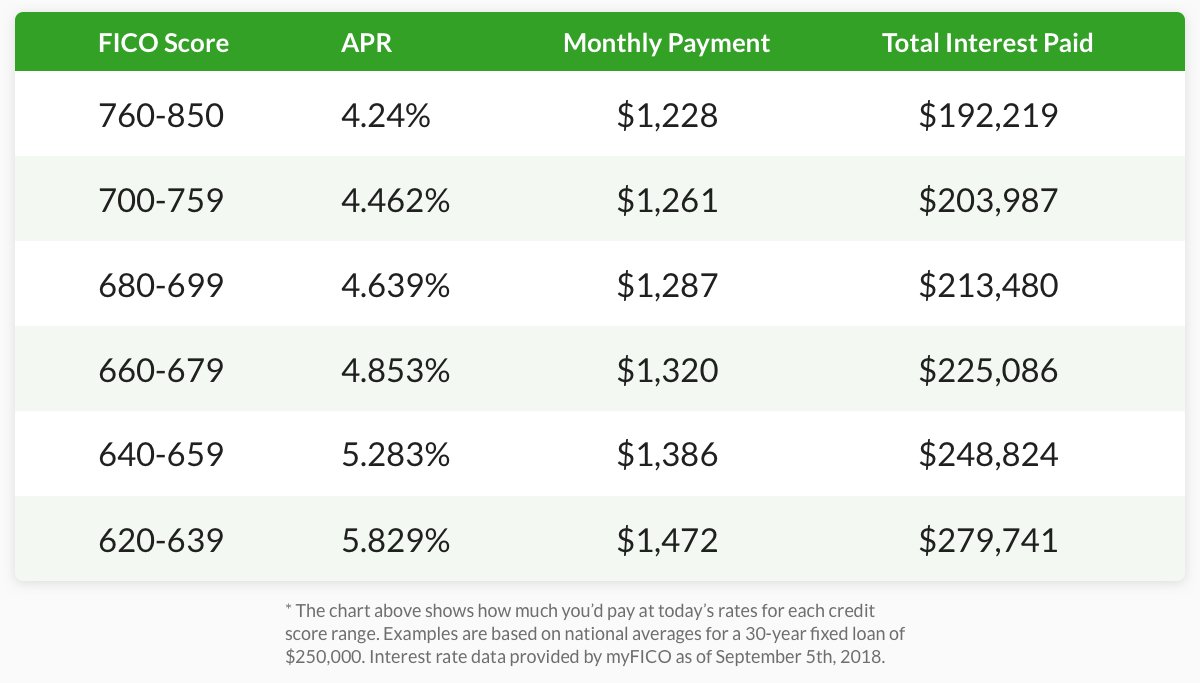

How Much Can A Good Credit Score Save You

When comparing the difference in mortgage rates, the impact can look small. Without context, the difference between 4.55% and 4.76% seems negligible. But over 30 years, that little difference can add up.

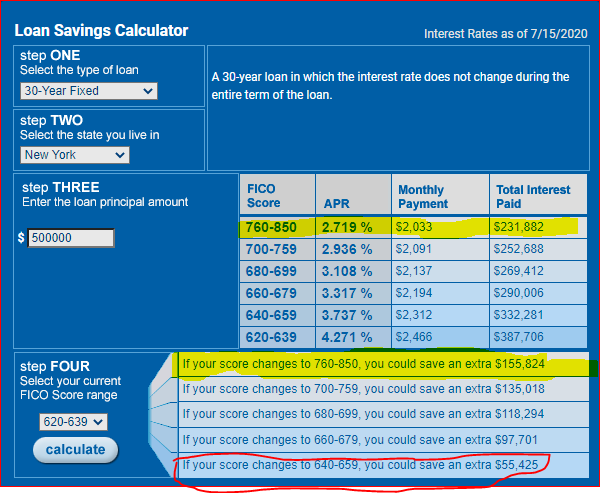

Using the Loan Savings Calculator from myFICO, you can compare the interest rates, monthly payment, and total interest cost of a mortgage based on your state and mortgage size.

We used this tool to estimate the national average interest rate and total cost of a $244,000 mortgage â a $305,000 single-family home with 20% down. This is equal to the current average new mortgage balance in the U.S.

The difference between good and excellent is significant. A person with a 760-850 FICO score could secure a 30-year fixed mortgage with a 4.147% interest rate. This rate is more than 0.6 percentage points lower than the 4.76% interest rate for a person with a 660-679 score.

This results in a monthly mortgage payment that is $88 a month higher at $1,274 and a total interest cost over the life of the loan of $214,745. Thatâs $31,905 more in interest cost than the person with an excellent score for the exact same house.

But interest cost isnât the only factor. A higher interest rate not only results in a higher monthly payment, but it also reduces the amount of principal you pay off early in the loan. The average American homebuyer wonât stay in their home until the mortgage is paid off, on average selling their home after about ten years.

Don’t Miss: What Are Inquiries On Your Credit Report

How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

How Credit Card Debt Can Hurt A Mortgage Application

If you have a relatively small credit card balance and diligently make your minimum payments on time, that debt is unlikely to have any effect at all on your mortgage application. But a history of overdue payments or a large credit card balanceespecially when combined with other forms of debtoften reduces the amount you can borrow for a home purchase, and it might even disqualify you for a mortgage altogether.

To understand how credit card debt plays into a mortgage assessment, you need to look at two different factors: credit score and debt-to-income ratio.

Recommended Reading: How To Get Credit Score Report

When You Apply For A Mortgage

When you want to buy a house, the first step is to get prequalified for a mortgage. Its a helpful step for everyone because it ensures youre shopping within your budget. During this process, lenders will typically check your credit using a soft inquiry, which doesnt hurt your credit score. However, some may process a hard inquiry.

Once youve found a house and need to finalize the mortgage, your lender will need to process a hard inquiry on your credit report, which will affect your credit score. How many points does a mortgage inquiry affect ? Its usually five or less.

If youre going to shop around for the best mortgage rate, which is a good idea, try to lump your applications together within a small window of time. When you do so, all the inquiries count as one, minimizing the negative impact on your credit score. The credit scoring bureaus can vary in their allowable time frame, but typically, its 14-45 days.

When You Pay Off Your Mortgage

When you make your final mortgage payment and own your home free and clear, what will happen to your credit? The loan will be marked closed in good standing on your credit report for 10 years. As for your credit score, dont expect any dramatic change.

Closing a mortgage has very little impact on your credit score, unlike closing a revolving credit card, which can hurt your score by reducing your available credit. However, you may see a drop if the mortgage was your only installment loan, as it will impact your credit mix.

Recommended Reading: How Long Does High Balance Stay On Credit Report

How Your Credit Scores Affect Mortgage Rates

Modified date: Jun. 2, 2022

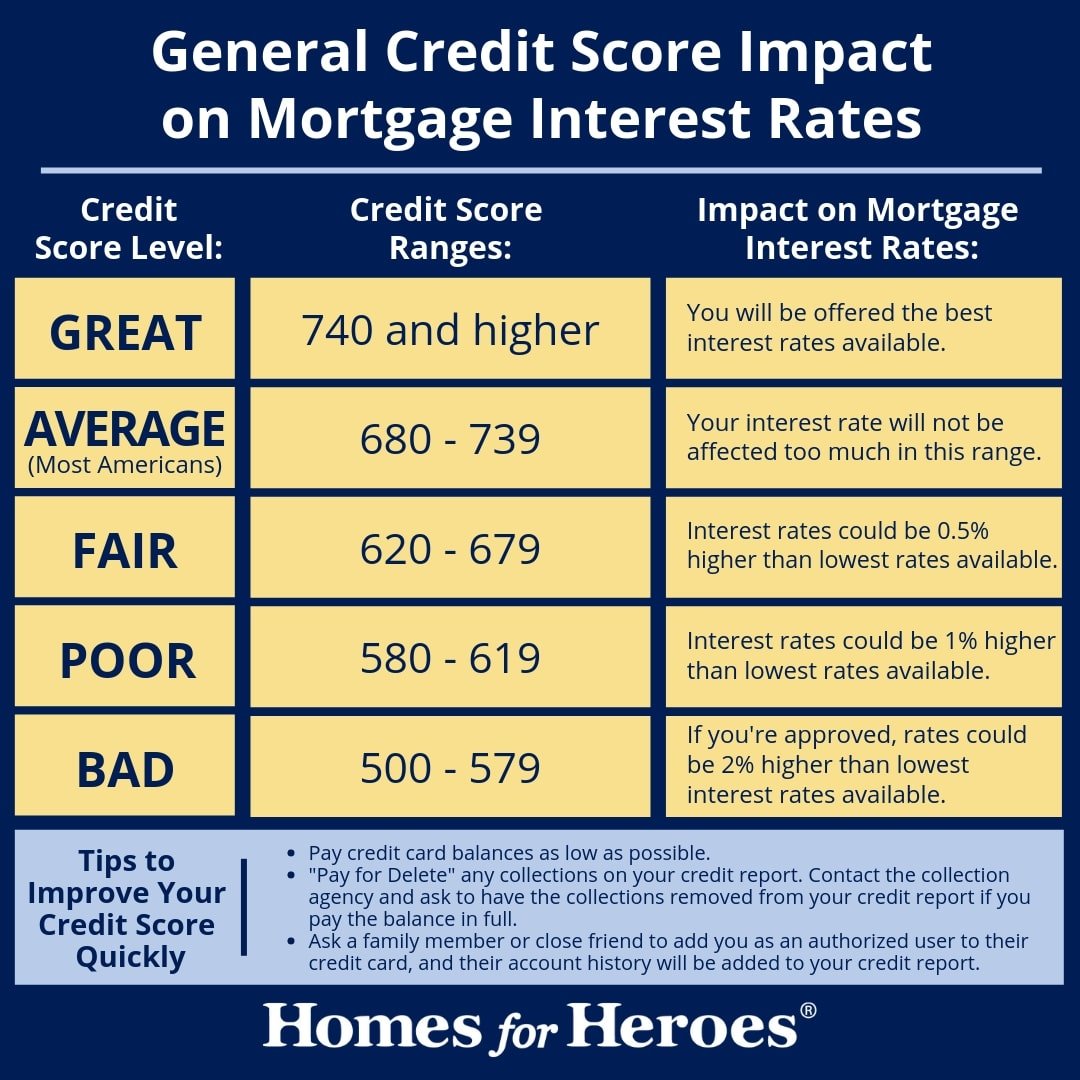

Its no surprise that your credit scores are instrumental in getting approved for a mortgage. Even so, you may not realize just how many ways your credit scores affect mortgage rates and all aspects of the mortgage application process.

Your credit scores affect the kinds of mortgages you can be approved for, how much you can borrow, the mortgage rates youll pay and even how much youll pay for private mortgage insurance.

When it comes to conventional financing at least, you will be required to have a credit score of at least 620 in order to be eligible for a loan. The higher your credit score is beyond that, the better the terms will be.

This is why its so important to understand your credit score in the months before you apply for a mortgage. If you do have impaired credit history, youll want to work to improve your credit scores before you even apply. And if you already have good credit, youll want to keep it as high as possible by avoiding taking on other new debt.

Lets take a look at some of the ways your credit scores affect mortgage rates

Whats Ahead:

Is It Important To Compare Mortgage Rates

Comparing mortgage rates is one way to save money on your home loan. If you accept the first offer you see, you may regret it later. With so much competition in the lending industry today, you can usually find a lower rate if you do a little price comparison.

The easiest way to find low rates is to shop around. This is really easy in todays internet-driven world. There are loan calculators, comparison tools, lender portals, and more all designed to help you line up offers to see which is giving you the right deal.

You May Like: How To Report To A Credit Bureau Landlord

Applying For A Mortgage

What this means is that regardless of your income, if you dont have good credit you will be a bigger risk and banks will want a better return to offset that risk.

Generally, banks offer different products with different interest rates and you should expect the products with the best interest rates to have stricter credit scoring criteria. Of course some banks are more risk averse than others, so be realistic about which products you apply for and do your research to give yourself the best chance of getting the best deal.

How Long Will It Take To Improve My Credit Score

Its tricky to say how long it will take for you to see improvements in your credit score. If youve picked up a negative mark, such as a missed payment or a time when you went over your credit limit, it will stay on your report for six years.

Even if youre taking all the right steps to improve your credit score, delays in reporting from lenders can mean it takes a good few months to see your score move in the right direction. For example, it could take weeks for a positive action like registering on the electoral roll to show up on your credit report.

You May Like: How To Find Out If A Mortgage Is In Default

Also Check: Can You Self Report To Credit Bureaus

Why Is My Mortgage Credit Score So Much Lower

There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using.

Typically banks, credit card companies, and other financial providers will show you a free credit score when you use their services. Also, credit monitoring apps can show free credit scores 24/7.

But the scores you receive from those third-party providers are meant to be educational. Theyll give you a broad understanding of how good your credit is and can help you track overall trends in your creditworthiness. But they arent always totally accurate.

Thats partly because free sites and your credit card companies offer a generic credit score covering a range of credit products.

Difference Between Best Credit Poor Credit

All told, you’re looking at a difference of about 1.6 percent between the top of the credit range and the 620 range on a 30-year fixed-rate mortgage. That works out to a difference of about $100 per month per $100,000 of mortgage amount between the best credit and worst , according to Fair Isaac. For example, a borrower with a $300,000 mortgage would pay about $1,400 a month at 4 percent interest, versus $1,700 at 5.6 percent.

It should be stressed that there are a variety of factors that affect your interest rate besides your credit score. Among these are the size of your down payment, the type of loan you’re getting, where you live, any discount points paid, etc. Rates also will vary from lender to lender for the same customer, so it pays to shop around – and compare all costs of the mortgage, and not just interest rates.

Recommended Reading: How To Pull My Credit Report

Improve Your Credit Scores Before Opening New Credit Accounts

Remember: The better your credit scores, the better your interest rates might be. That means improving your scores might help you qualify for better rates.

Here are some ways you can improve your credit scores:

Speaking of applying for credit: Want a better idea of whether you might be approved? Pre-approval or pre-qualification can help you find out whether you might be eligible for a credit card or loan before you even apply.

With Capital Oneâs pre-approval tool, for example, you can find out whether youâre pre-approved for some of Capital Oneâs credit cards before you submit an application. Itâs quick and only requires some basic info. And since it only requires a soft inquiry, checking to see whether youâre pre-approved wonât hurt your credit scores.

How To Get Your Credit Score Ready For A Mortgage

No matter what type of mortgage you seek, its always advantageous to apply with the highest credit score you can manage. Meeting the minimum score requirement for a loan is just the start. Lenders also use your credit score to help set interest rates and fees on the loan, and generally speaking, the higher your credit score, the better your borrowing terms will be and the less youll pay in interest and fees over the life of the loan.

If youre planning to apply for a mortgage in the next 12 months, you may be able to take steps starting today to spruce up your credit score so your loan application reflects the best credit score you can get.

Any credit score that helps you qualify for a mortgage you can afford can be considered a good score. Even so, most of us have room to improve our scoresand reap potential savings over the lifetime of a mortgage loan.

You May Like: How To Dispute Negative Items On Your Credit Report

What Are Today’s Mortgage Rates

Although mortgage rates fluctuate daily, 2020 and 2021 were years of record lows for mortgage and refinance rates across the US.

While low average mortgage and refinance rates are a promising sign for a more affordable loan, remember that they’re never a guarantee of the rate a lender will offer you. Mortgage rates vary by borrower, based on factors like your credit, loan type, and down payment. To get the best rate for you, you’ll want to gather rates from multiple lenders.

| Mortgage type |

How Much Does A Credit Pull Really Hurt

When youre in the market for a mortgage, its best to shop around to find the best rates or get better lender fees. But because this process typically involves multiple lenders checking your credit score, many buyers are concerned these credit inquiries or often referred to as credit pulls will hurt their score, leaving them less inclined to shop around. But the good news is as long as you follow a few guidelines, you can shop around for mortgages without doing too much damage to your credit.

Read Also: How Many Years Until Bankruptcy Comes Off Credit Report