Fair Debt Collection Practices Act

The Fair Debt Collection Practice Act of 1977 protects consumers from being harassed by third-party debt collectors. This includes harassing, threatening or inappropriately contacting someone who owes money. Notably, this only applies to third-party debt collectors, who lenders often turn to after trying and failing to collect a debt on their own.

What Does My Credit Score Mean

Your credit score is a three-digit number that sums up all the information on your credit report into one tidy number. It follows you around for your entire life, its value moving up and down depending on whats happening in your financial life.

This three-digit score goes by two different names, FICO or VantageScore. The FICO score is named after the company who invented this three-digit scoring system in the mid-1980s, Fair Isaac, Inc. Many lenders use the FICO scoring system.

More recently, the three major credit reporting agencies created their own scoring system, called the VantageScore, designed to produce a more consistent score across all three credit reporting agencies.

So what does a score mean? Whats a good credit score? Or a bad one?

The Vantagescore Compared To The Fico Score

So what are the similarities and differences between the two scores? Because the VantageScore and FICO Score use different scoring systems, a VantageScore of say, 650 does not equal a FICO Score of 650 .

If you want to assess whether or not youd qualify for a loan before you actually apply for it, youll want to assess your credit by the same credit score your lender will use. Just ask your lender if it uses VantageScore or FICO.

Similarities

Both VantageScore and FICO appear to place high importance on:

- Payment history: whether or not bills are paid on time.

- New : how often you request new credit for, say, a credit card, a mortgage loan, or an auto loan.

Differences

Vantage Score appears to emphasize:

- how much of your available credit you use.

FICO appears to emphasize:

- Length of credit history: the number of years youve been using credit.

- Types of credit you use: credit card, mortgage loan, auto loan, for example.

Recommended Reading: 766 Credit Score Mortgage Rates

Calculating A Credit Score

Credit scores vary from a scoring model to another, but in general the FICO scoring system is the standard in U.S., Canada and other global areas. The factors are similar and may include:

Introduction Of The First Credit Bureau

Atlanta-based Retail Credit Company was the first credit bureau founded in 1899 and began collecting data on Americans. They not only collected credit information, but political and social preferences as well as rumors about peoples personal lives which caused criticism over the years. Because some of the facts were suspect, the government wouldnt allow them to automate this information.

Recommended Reading: What Company Is Syncb Ppc

No The Us Isn’t The Only Country That Uses Credit Scores

Money, Home and Living Reporter, HuffPost

Perhaps you saw a social media post from earlier this summer claiming that only exist in the United States. One such tweet garnered thousands and thousands of retweets, likes and replies from users lamenting the complexities of the U.S. credit system.

I knew this country was jokes when i found out we were the only ones with credit scores

Hippolytas Esthetician

Considering how confusing the financial systems in our country can be, its easy to believe the above statement. And its a misconception thats been over and over.

Welcome to the only country that feeds on debt and then saddles its citizens with something called a ‘credit score’ to help banks decide if you deserve things like shelter.

Public Citizen

But the truth is that credit scores are not a uniquely American headache. Several other countries have credit scoring systems in place, some of which closely mirror that of the U.S.

Read on for a closer look at how our credit scores compare to other countries.

Fico Gives Millions A Path Toward A Decent Credit Score

There is already evidence that a new credit-scoring approach by Fair Isaac Corp. will provide a pathway to decent FICO scores for some consumers who currently dont have traditional scores.

Fair Isaac, also known as FICO for its trademark credit scores, is expected to announce a new approach as soon as this week that uses alternative data, including payment history with cable bills, cellphone bills, utility payments and other factors Continue Reading

Read Also: Does Removing An Authorized User Hurt Their Credit Score

Fico’s Legacy: The Good The Bad And The Ugly

FICO’s dominance in the credit scoring industry isn’t without its critics. Its greatest competition comes from the credit bureaus themselves, which provide the much-needed credit histories to produce the FICO score. In 2006, the three credit bureaus banded together and created a new credit score called the VantageScore as an alternative to the FICO score.

FICO struck back in 2007 with a lawsuit claiming a long list of infractions against VantageScore Solutions LLC and the three credit reporting bureaus. In court papers, FICO said its share of the credit scoring market had fallen a whopping 4 percentage points to 74 percent since VantageScore entered the scene. FICO eventually dropped the suit in 2011 after courts ruled in favor of VantageScore.

“FICO and the bureaus, the simplest way to describe it is as a cooperative relationship and a competitive relationship,” says Watts, who noted that the credit bureaus sell the FICO scores to lenders, while FICO has no direct relationship with lenders. “We need the bureaus very much in partnership on the FICO score.”

Consumer advocates and some in the lending industry have also questioned the accuracy of FICO credit scores. Leyrer notes that the FICO credit score leaves no room for nuance. For example, a person with a bankruptcy could have a similar score as someone who has many late payments, but no collections.

“The system doesn’t do a good job distinguishing those folks from those who may have difficulty managing credit,” she says.

How To Improve Credit Score Where Better Credit Is Due

Having trouble paying your bills on time? Millions of Americans are woefully behind on credit card payments, utility or medical bills, even parking tickets and may not understand the devastating effect on late payments or not paying at all can have on their credit. A study released in late July by the Urban Institute found that 35% of Americans have debt that has gone into collection… Continue Reading

Also Check: Opensky Billing Cycle

How Do I Check My Credit Score

Everyone is entitled to receive a free copy of their credit reports from each of the three bureaus each year. You can order your free credit report online from annualcreditreport.com. It is the only authorized website that provides free credit reports. Your report will include your score. You can also keep an eye on Experian score free by accessing it and a free credit report card on .

This article was originally published July 27, 2016, and has been updated by another author.

Image: PeopleImages

The Merging Of Credit And Card

In the late 19th century and early 20th century, companies built on the idea of revolving credit to include a physical object that could be used to easily identify their customer accounts. Some were in the form of coins or medals that included the name and logo of the merchant, as well as the customer’s account number.

Just like many credit card transactions in the late 20th century, the merchant would make an imprint of the coin or medal on the customer’s sales slip. In the 1930s, these coins and medals evolved into rectangular metal cards called Charga-Plates that looked like something between a credit card and military dog tag.

Watch our Great Moments in Credit History video series on YouTube for more

Don’t Miss: When Does Usaa Report To Credit Bureaus

The Score That Changed It All

In the 1980s, FICO was creating custom scores for lenders based off credit bureau data. It also developed a score that helped prescreen potential borrowers from a consumer database at the credit bureaus for a lender’s marketing efforts.

“That worked pretty well,” says Craig Watts, public affairs director at FICO. “And then the light bulb went off: Can we take the credit report and from that, make a general credit risk score?”

FICO did that in 1989. The first general-purpose credit score based on Equifax credit reports debuted. Two years later, TransUnion signed up, and by 1991, the FICO credit score was available at all three credit reporting agencies.

“It was the first score that had transcended the three national credit bureaus,” says Watts.

“It’s critical in this industry,” says John Stearns, a mortgage banker with American Fidelity Mortgage in Wisconsin. “For the most part, the scores are accurate, a good reflection of what has been going in a consumer’s credit history.”

What Is A Credit Score

A credit score is what banks and other businesses use to determine how creditworthy a person is and how likely they are to pay off their debts.

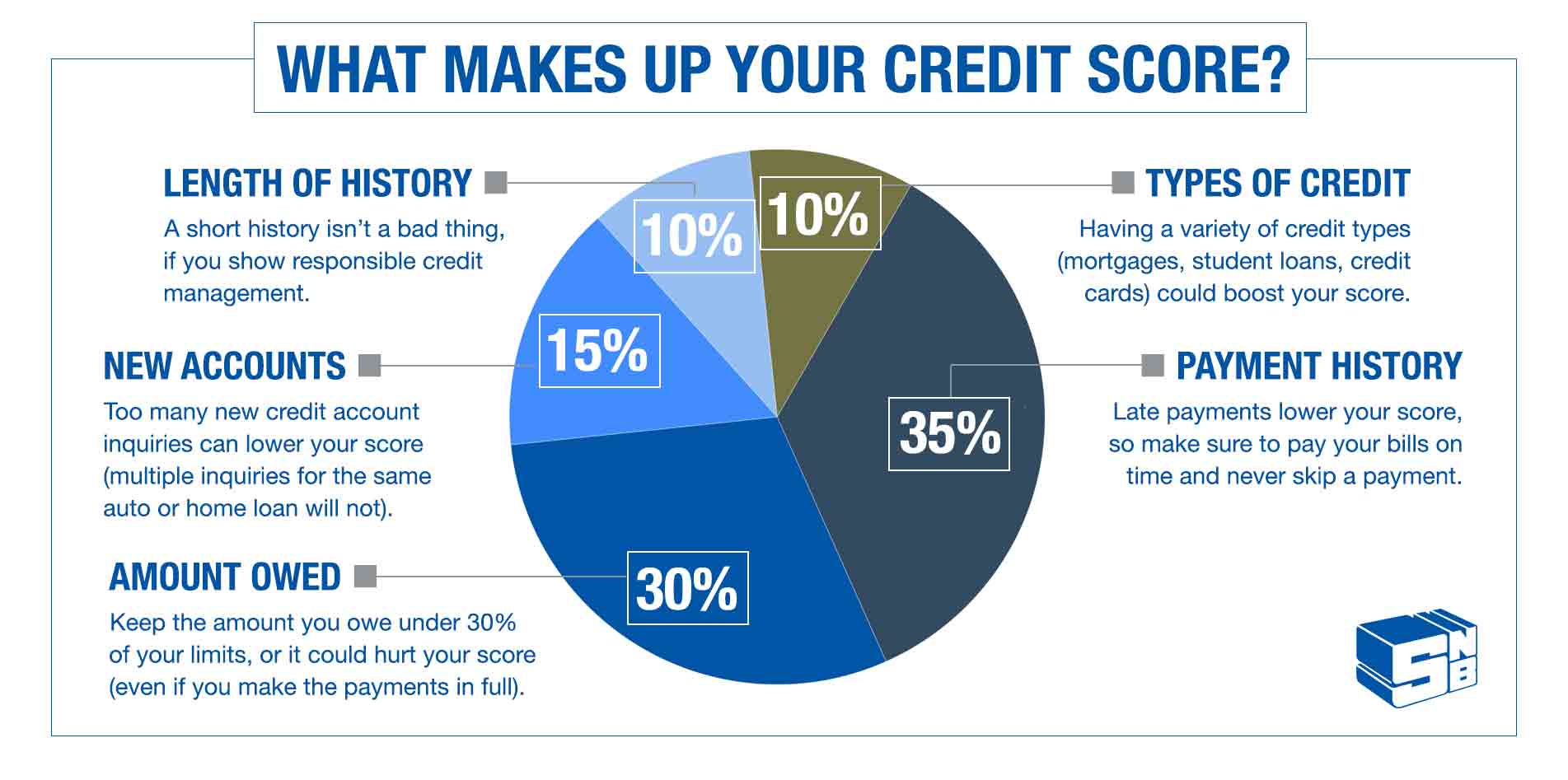

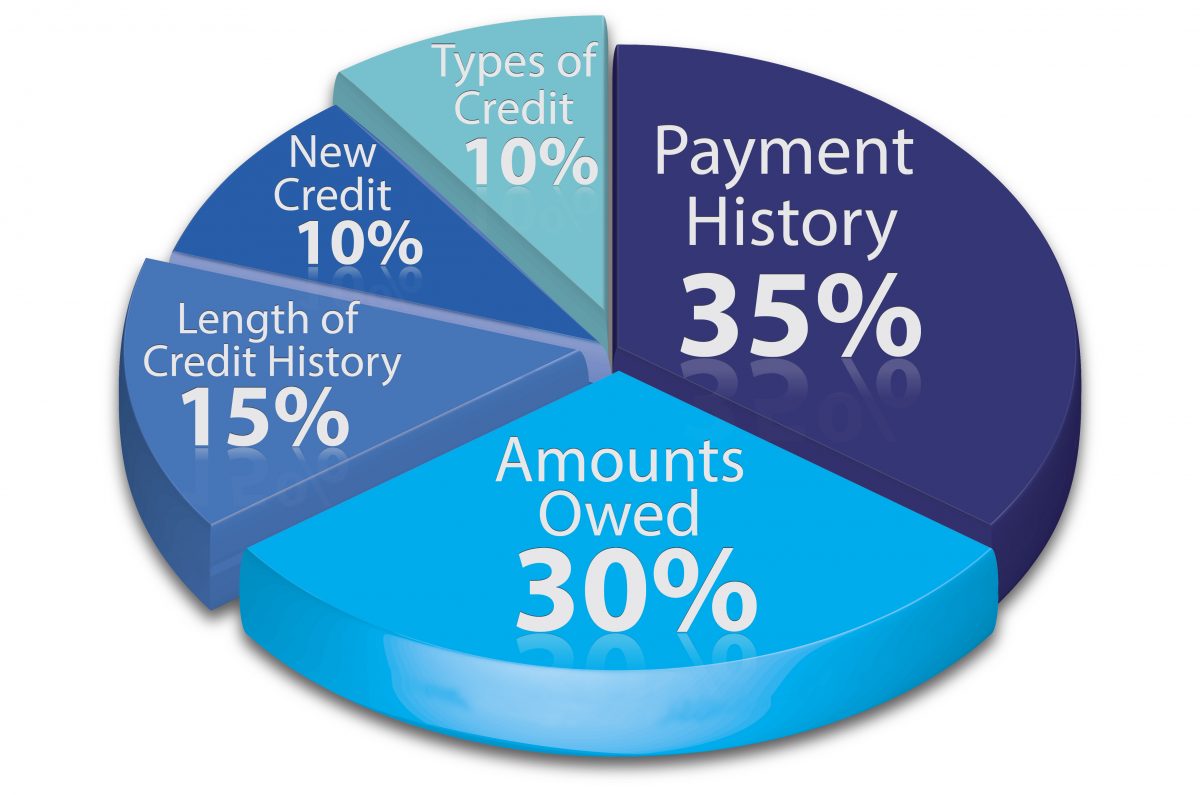

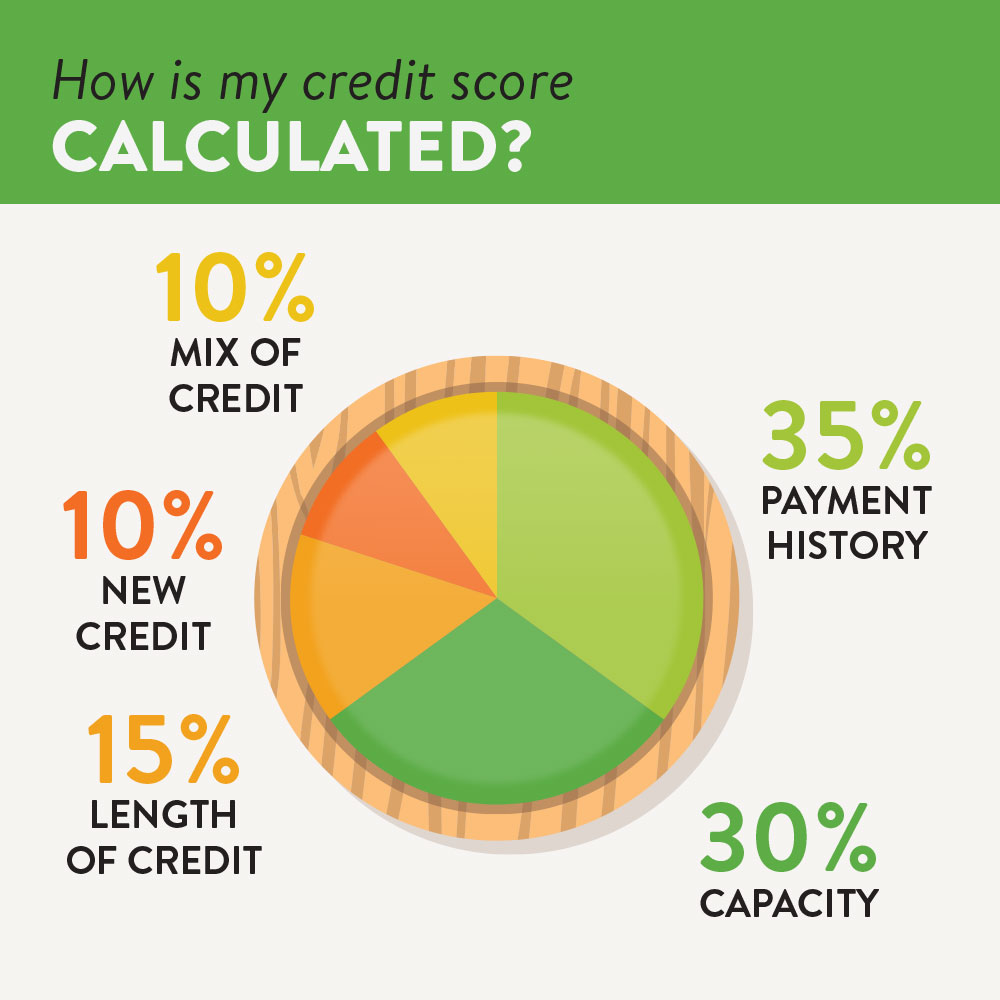

Factors like the amount of overall debt, payment history, length of credit history, types of credit used, and the number of credit inquires are considered when determining a persons creditworthiness.

Consumers receive a rating number between 300 and 850 on the level of their creditworthiness.

Lenders use these scores to assess risk in lending money to a borrower. For example, a borrower with a credit score of 750 is more likely to be approved for a home loan than someone with a credit score of 500.

Interest rates are also subject to a borrowers credit score. Those with higher scores are charged lower interest rates than those borrowers who have low credit scores.

In 1970, the Fair Credit Reporting Act was adopted to regulate what information is collected, how long it was kept, and how consumers could obtain credit reports

Read Also: What Credit Report Does Target Pull

How Does Fico Calculate Your Score

Information from your credit bureau report goes into FICOs algorithm and then produces a number that ranks you in comparison to other scored consumers. The algorithm weights certain factors more heavily than others. Below youll see that your payment history has a greater impact on your score than the length of your credit history, but that both matter.

When Were Credit Scores Invented

Disclosure regarding our editorial content standards.

A persons credit history can be long and complicated, so weaving all of that information into a simple three-digit score made life easier for lenders. But the journey to create spans back at least a hundred yearsand you could even argue that credit scores wouldnt be around today if it werent for ancient civilizations that used credit thousands of years ago.

Read on to learn about the origins of credit, how credit reporting began and where credit scores came from.

You May Like: What Is Syncb Ntwk

How Systems In Other Countries Compare

Canada’s credit scoring system is fairly similar to the United States. Credit scores in Canada range from 300 to 900 and are calculated by the country’s two major credit reporting companies, Equifax and TransUnion. These companies track only a person’s financial history in Canada, according to a .

- Payment history

- Number of delinquencies, bankruptcies and debt collections

- Number of recent credit applications

- Length of credit history

- Mix of credit types

- Number of credit accounts

Germany’s major credit bureau, SCHUFA, tracks borrowing activity, defaults and information about financial history to generate a score, which can be used by lenders to determine eligibility for loans, apartment leases, phone contracts and more, according to the company’s website. Lower scores typically mean less desirable interest rates on loans and more trouble obtaining credit, according to the Open Knowledge Foundation of Germany.

France does not have a major credit reporting company, according to a 2018 Business Insider article, instead requiring documented proof of income, three months of bank records and a contract of sale for mortgage loans.

In other countries, like Spain and The Netherlands, credit bureaus track negative marks, like unpaid debts, that can land people on a “black list” for bad credit, which can last for several years or until the debts in question are paid, Business Insider reported.

Fact check:An Obama law school essay makes only brief reference to Trump

What Other Services Do Credit Bureaus Offer

Consumers can also pay for services to help with their credit. This includes:

- if someone suspects theyre a victim of identity fraud

Because credit bureaus collect so much data, they naturally have a lot of information that can be useful to businesses. As a result, many credit bureaus now offer marketing, data analytics and research services based on decades of consumer data.

You May Like: Does Speedy Cash Check Credit

Civil And Political Risk Index

In addition to the overall ranking, the report provides insight into specific human rights violations, highlighting which cities are most at risk.

Perhaps unsurprisingly, Pyongyang, North Korea places first on the list when it comes to civil and political rights violations. Under the current North Korean regime, some significant civil rights violations include arbitrary arrests and detentions, the holding of political prisoners and detainees, and a lack of judicial independence.

In addition to North Korea, Syria places high on the civil rights risk index as well, with three of the top five cities located in the war-torn country.

What Are The Fico Score Ranges

Heres the breakdown of FICO score ranges:

- Excellent: 800850

- Fair: 580669

- Poor: 300579

FICO scores range from being called excellent to the very bottom of the barrel of poor. The higher the credit score, the less the credit risk for lenders . They assume that if youve taken out enough debt to get a high credit score, then surely youre less likely to default on them.

Also Check: How Long For Things To Fall Off Credit Report

Avoid Loan Application Rejections

With the loan marketing increasing and becoming more accessible, there are more options when you want credit. There are more and more new financial institutions that are offering loans. But that does not mean you should take loans every time an emergency arises, in an impromptu manner. When applying for a loan, make sure you are applying for one that is most eligible for you. Doing so will maximize your chance for approval , as loan rejections can lower your credit score.

The Future Of Credit Cards

Like any technology-based industry, advancements in credit cards continue to shape the future of both how theyre used by consumers and what issuers can offer. One of the latest innovations in the payment industry combines blockchain technology with credit cards in several ways.

Some cards offer cryptocurrency as a rewards option instead of cash back or points. In some cases, a credit card can be used to purchase select shares of cryptocurrency. And from the business side, the indelibility of using blockchain technology as a recording ledger may very likely replace the way issuers currently record transactions.

Contactless payment technology, which saw a surge in use due to Covid, will likely continue to grow in popularity with users shifting away from traditional credit cards towards mobile wallets and wearable devices.

Artificial intelligence will continue to evolve and play a greater role in how issuers determine risk when assessing a credit card application, likely continuing to shift away from the limited data points provided by credit reports and incorporating more holistic information about an applicant.

Recommended Reading: Does Klarna Financing Report To Credit Bureaus

The History Of Credit

4-minute readJune 04, 2021

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

Believe it or not, Americas love-hate relationship with credit began before the 1900s. The earliest and most common form of credit were loans from local shopkeepers. Thats right, hardworking Americans ran tabs to buy groceries, furniture, farm equipment and the like when times were tight. Its also a common myth that borrowing was unheard of during those days. While its true that many disliked like the idea of debt, it became a way of life as people found it necessary to purchase necessities. Unlike today, it was thought to be shameful to borrow money for pleasure. Below is timeline of the history of credit in America.

Acquiring And Understanding Credit Reports And Scores

Consumers can typically check their credit history by requesting credit reports from credit agencies and demanding correction of information if necessary.

In the United States, the Fair Credit Reporting Act governs businesses that compile credit reports. These businesses range from the big three credit reporting agencies, Experian, Equifax, TransUnion, to specialty credit reporting agencies that cater to specific clients including payday lenders, utility companies, casinos, landlords, medical service providers, and employers. One Fair Credit Reporting Act requirement is that the consumer credit reporting agencies it governs provide a free copy of the credit reports for any consumer who requests it, once per year.

The government of Canada offers a free publication called Understanding Your Credit Report and Credit Score. This publication provides sample credit report and credit score documents with explanations of the notations and codes that are used. It also contains general information on how to build or improve credit history, and how to check for signs that identity theft has occurred. The publication is available online through , the site of the Financial Consumer Agency of Canada. Paper copies can also be ordered at no charge for residents of Canada.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus