Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay them all off. Then you’ll just have one payment to deal with and, if you’re able to get a lower interest rate on the loan, you’ll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period during which they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 35% of the amount of your transfer.

What Affects Credit Score Update Timing

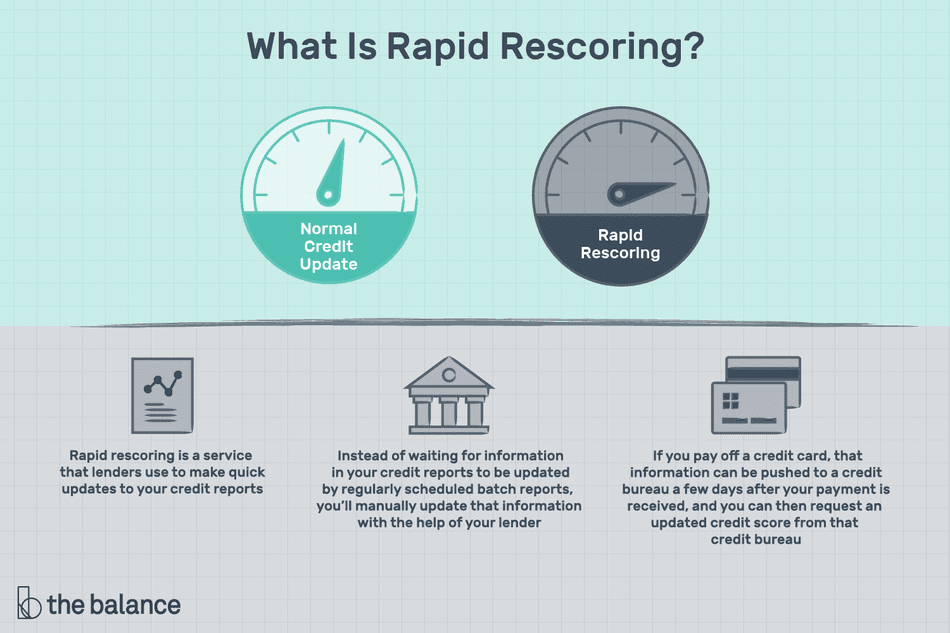

The timing of credit score updates is based on the timing of changes to your credit report. Since your credit score is calculated instantly using the information on your credit report at a given point in time, all it takes to raise your credit score is a positive change to your credit report information.

At the same time, having negative information added to your credit report can offset positive changes you might have seen to your credit score. For example, if you receive a credit limit increase but a late payment is also added to your credit report, you may not see your credit score improve. In fact, your credit score could fall.

Seriously negative information can weigh your credit score down, making it take longer to improve your credit score. For example, it can take longer to improve your credit score if you have a bankruptcy, debt collections, repossession, or foreclosure on your credit report.

The more recent negative information is, the more it will impact your credit score.

Sign Up For Free Credit Monitoring

Whether its with Credit Karma or someone else, keeping a close eye on your credit is essential. Signing up for credit monitoring can help alert you to important changes in your credit, so that you can check for suspicious activity. Fraudulent activity can weigh down what could be an otherwise good credit score, so its important to dispute any details you identify as inaccurate. If the credit bureau rules in your favor, the fraudulent activity will be removed from your credit report, which can help raise your credit scores.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.

Recommended Reading: How Accurate Is Creditwise Credit Score

Pay Down Revolving Account Balances

Even if you’re not behind on your bills, having a high balance on revolving credit accounts can lead to a high and hurt your scores. Revolving accounts include credit cards and lines of credit, and maintaining a low balance on them relative to their credit limits can help you improve your scores. Those with the highest credit scores tend to keep their credit utilization ratio in the low single digits.

Sign Up For Experian Boost

If your low score is primarily the result of being new to the credit-seeking game and you are timely with your payments for utilities and your cell phone, ask the lender to pull a report from Experian, using its Experian Boost plan. This hybrid model draws on what the industry calls alternative credit data non-traditional payments that provide lenders useful insight into an applicants creditworthiness.

The way forward gets a little steeper from here, so its a good idea to know what youre up against.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

How Fast The Credit Score Goes Up After Paying Debt

If the account youre paying off is a past-due collection account, you cannot see an immediate credit score increase once it is paid off. Whether you see an increase in credit scores depends on the scoring model being used as well as on the rest of your credit history. Most credit scoring models exclude collection accounts once theyre paid in full, so you can experience a credit score increase as soon as the collection is reported as paid.

Some lenders view a collection account that is paid in full as further favorable than an unpaid collection account. Additionally, when it comes to applying for credit, employment and even renting an apartment, youll probably have a simple time qualifying if any collection accounts that look on your credit history are paid in full. It shows though you had financial difficulties in your past, you have taken care of any of your debts owed. For example, some mortgage lenders will not approve you for a home loan unless any past-due accounts are paid off, no matter how small the dollar amount.

Recommended Reading: How Long Does Foreclosure Stay On Credit Report

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts, such as your old student loans, remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Also Check: Unlock Experian Account

Clean Up Your Credit Report

Before you do anything else, go to AnnualCreditReport.com and request a credit report from each of the three big nationwide credit reporting companies:

- Equifax

- Experian

- TransUnion

By law, youre entitled to one free report every 12 months. And through April 2022 you can get a free report weekly.

When you request your report, be ready to print it or save it to your computer.

Once you have the report, examine everything. In particular, look for any accounts that show late payments or unpaid bills. If that information is inaccurate, the report should tell you where to send a dispute.

Keeping a clean credit report isnt only important for your credit score. It can also affect your job prospects. Some employers pull credit reports before making hiring decisions.

You may also want to sign up for a free account with , which will give you an idea of how your reports are shaping your credit scores. Youll also get to see your VantageScore from TransUnion, one of the three big credit-reporting agencies.

Pay Down Credit Card Debt

After your payment history, your amounts owed are the most important part of your credit score calculation. But this doesn’t just mean how much debt you have overall. Creditors also want to know how much of your available credit you’re using . This is called your .

Your utilization is determined by dividing your credit card debt by your credit card limits. For example, let’s say you have a credit card with a $1,000 balance and a $5,000 limit. The utilization rate for this card would be: $1,000 ÷ $5,000 = 0.2 = 20%.

Credit score calculations look at both your overall utilization ratio and your ratio for individual cards. A lower utilization rate is better. In fact, an ideal credit utilization is below 10%.

When you pay down your credit card debt your utilization rate decreases.

For most people, the number one way to improve credit score fast is to pay down credit card balances. Once your lower balance is reported to the credit bureau, your credit score should improve. This is how to build credit fast if you have high utilization. However, this can help build credit even with moderate utilization.

If you’re unsure how to get started, check out our guide to paying off debt.

Also Check: Aargon Agency Hawaii

What’s The Fastest Way To Boost My Credit Score

Generally, the best answer for how to build credit fast is to improve your utilization ratio. You can do this by paying down credit card debt. You can also decrease your utilization rate by asking your credit card issuer for higher credit card limits.

If you’re building credit for the first time, being an authorized user is usually the fastest way to boost your credit score. Old accounts with positive payment histories are best for building credit as an authorized user.

Get A Copy Of Your Credit Report And Remove Errors

Studies by the Federal Trade Commission have found that 5 percent of consumers have errors on one of their three major credit reports. That’s why it pays to get a copy of your credit report and dispute any errors. Federal law allows you to get a free copy of your credit report every 12 months from each credit reporting company.

Also Check: Does Removing An Authorized User Hurt Their Credit Score

Avoid New Credit Card Purchases

New purchases will raise your a ratio of your credit card balances to their respective credit limits that makes up 30% of your credit score. You can calculate it by dividing what you owe by your credit limit. The higher your balances are, the higher your is, and the more your credit score may be negatively affected.

Under the FICO score model, it’s best to keep your credit utilization rate below 30%. That is, you should maintain a balance of no more than $3,000 on a credit card with a limit of $10,000. To meet that 30% target, pay cash for purchases instead of putting them on your credit card to minimize the impact on your credit utilization rate. Even better, avoid the purchase completely.

How Paying Off A Car Loan Could Affect Your Credit Score

With the categories of FICO information in mind, there are a few reasons why paying off yourcar loan could adversely affect your score.

The “amounts you owe” category is the biggest one that is affected. Specifically, your loans never have as much positive impact on this part of your credit score than when theyre almost paid off. In other words, if you only owe 1% or 2% of your original balance, its a major positive factor . After you pay the loan off, you lose this positive factor — the status changes to “paid loan” on your credit report.

Your length of credit history category could also possibly suffer, especially if your car loan was originated more than a couple of years ago. After all, paying off your loan can eliminate an established account from the calculation. Among other things, this portion of your score considers the average age of all of your reporting credit accounts, so if a paid-off loan causes your average to decrease, it could certainly be a negative factor.

Also Check: Does Paypal Credit Report To The Credit Bureaus

What I Learned From Being Denied For Credit Cards

When I was finally prepared to get a credit card on my own, none of the banks I applied to would give me a chance.

It went like this: I am unemployed, have no credit history, and have a couple of thousand dollars in college debt that I will have to start paying on in the next year or two.

Not exactly a winning pitch to convince someone to give you a line of credit! Two banks denied me, but one banker was kind and shared some info that has helped me raise my credit score over 100 points in the past five months.

First, I should stop trying to apply for credit cards that would get denied. His reasoning was simple: when you apply, they do a hard credit check which, in turn, can lower your credit score even more.

His second piece of advice was to get a secured credit card.

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

Read Also: Report Death To Credit Bureau

How Your Credit Score Is Calculated

There are multiple scoring models, and they all use data from your to determine your score. The data is broken down into five categories. For FICO scores the most commonly used scoring model some categories have a bigger impact on your than others:

- Payment history: Your payment history is the most influential factor and affects 35% of your score. It shows creditors whether youve paid past credit accounts on time or have a history of late or missed payments.

- makes up 30% of your score. It reflects the amount of available credit you use, and is calculated by dividing your total debts by your total available credit.

- Length of credit history: Lenders want to see that you have successfully handled credit for several years, so the length of your credit history determines 15% of your score.

- Your credit mix or the assortment of credit available to you affects 10% of your score. Lenders like to see that applicants can handle multiple types of credit, such as credit cards, mortgage loans, and personal loans.

- New credit: When you apply for several new credit accounts within a short time, lenders worry youll be overextended. Your new credit impacts 10% of your score.

Who It Can Help

If you are just shy of a credit score that would give you what you want getting a credit card or loan, say, or the best terms on a mortgage consider paying early or extra to get balances as low as you can. Its also worth doing if you just made the cut, because credit scores fluctuate. A margin of safety is a good idea.

Reducing credit utilization is a great way to see your score go up, says Jeff Richardson, a spokesman for scoring company VantageScore.

Rood notes that this strategy works best if high credit utilization is the only blemish on an otherwise good credit report.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus