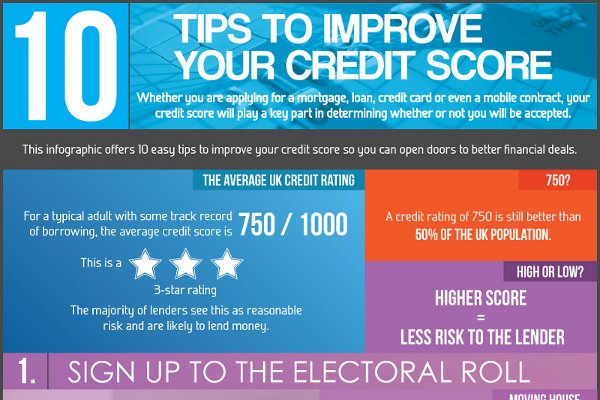

Improving Your Credit Score

Your credit score is important. The higher your credit rating, the better your chances of being accepted for credit at the best rates. It can influence your ability to get things like credit cards, loans, mortgages, mobile contracts and more.

Looking for tips on how to improve your credit score? Try following the steps below.

What Credit Scores Are Used For

Banks, building societies and credit card companies use credit scores to work out how risky it would be to lend money to you. They will analyse your score to decide if:

- you qualify for a product

- what interest rate you will pay

- what credit limit to offer

Your credit score will be checked if you are looking for a mortgage, personal loan, credit card or an overdraft on your current account even a student current account.

Get A Credit Card And Use It Wisely

Credit: Kaspars Grinvalds Shutterstock

As long as you don’t let things get out of hand, applying for a credit card and simply using it will help to boost your credit score.

It makes sense, really. Your credit rating is used by lenders to see how reliable you are at making repayments, and with a credit card, you’ll essentially be ‘given’ money to spend by the bank each month it’s then up to you to repay it on time.

We’d recommend only using it to spend as much money as you would if it were your own money , and always paying off your credit card in full each month . Late payments will damage your credit score, and unless you repay in full each month, you’ll have to pay interest too.

One technique for using a credit card responsibly is to assign a specific purpose to it, like paying for a holiday. If you only ever use it to pay for purchases related to your holiday, you should find it easier to keep track of how much you’ve spent on the credit card, and how much needs to be repaid.

If you’re not keen to go down the credit card route there are some prepaid credit cards that have features specifically designed to help build your credit score.

Recommended Reading: How To Get Credit Report Without Social Security Number

Not Being Approved For Contactless

My sister moved here a couple of years after I had been living here. She applies for a bank account and upon opening an account she was given a contactless card but I wasnt. I ask my bank to switch me to contactless and they just tell me Im not eligible for one with no explanation. As she didnt have any credit score yet again I am confused why I cant get contactless.

I ask a couple of times confused why I couldnt get one and still no answer. I forget the whole issue for while, after all, it stops quick spending.

Then not long ago I lose my wallet and ask for a replacement card. Open the mail a couple of days later and to my surprise, there was a contactless card. It seems that the birthday issue had been affecting my finances this whole time.

Do you have any tips building your credit score in the UK? Any disastrous stories that impacted your score? Let me know in the comments below.

Will My Credit Score Improve After Six Years

While its true that missed and late payments can stay on your credit file for up to six years, theres no guarantee that your score will improve after this time or, indeed, that it wont improve before then. Negative information typically matters less and less as time goes on, though bankruptcies can stay on your credit file for longer and will be far harder to recover from. Again, it all comes down to your own circumstances.

Read Also: Why Is There Aargon Agency On My Credit Report

Use Credit Ladder To Record Your Rent Payments

Since March 2016, it’s now possible to arrange for your rent payments to be shown in your credit report. Known as ‘The Rental Exchange’, this is a great option for anyone who is good at paying their landlord on time and who’s looking for ways to improve their credit score.

To get involved, you need to sign up to a third-party website called the . Credit Ladder then verify your rent payments when they go to your landlord or letting agent.

Every time a payment is made, they record how punctual you are with the payment and whether you paid the right amount, and they then store this data to be picked up in your credit report. Nice.

Things You Can Do Over Time To Raise Your Credit Rating

Five things you can do over time:

Improving your credit rating wont happen overnight, so be prepared to make longer-term changes to your finances.

First, do all you can to reduce your outstanding debt. This will signal to the credit rating agencies that youre tackling any issues and working to improve your credit worthiness.

If you can, stay in one address for a long period. This shows stability on your part, which is something that lenders like to see. The more stable your life appears on paper, the higher your credit rating is likely to be.

Its an obvious point, but it cant be overstated: keep on top of bills, payments and contracts. Jot down debit dates in your calendar to make sure theres enough money to pay the bills and you dont go overdrawn or default on your payment.

There are specific credit cards designed to help you improve your credit rating. Using one responsibly over a long period can boost your reputation with credit reference agencies.

The trick to using one successfully is staying within your credit limit and making at least the minimum payment each month. If you dont make at least the minimum repayments on time and stick to the limit all the time, it could in fact worsen your credit score the exact opposite of your goal. Read more about Barclaycards .

Also Check: Can I Get A Credit Report With An Itin Number

Close Any Unused Accounts

Closing any unused bank accounts can help improve your credit score. And if you have multiple credit cards, you should look at consolidating the debt into just one. Take a look at interest-free balance transfer credit cards, which allow you to move debt from cards that charge interest onto one that dont .

Don’t Panic If Your Credit Score Drops Slightly It’s Actually What’s On Your Credit Report That Matters

The idea that getting accepted for credit is all based on a simple score given to you by one of the credit reference agencies is false. At best, it’s a guide to roughly how good or bad a risk you are. As we say above, lenders will judge you on three main criteria when you apply for credit:

Yet the first two aren’t factored in to your credit score so it’s based on incomplete information. Plus, different lenders are looking for different things. When you apply, they assess you based on their own ‘ideal customer’ scorecard and each lender is different. Just because one lender rejects you doesn’t mean another will do the same. So bear in mind:

The impact of a slight credit score drop is near meaningless

It’s inevitable at some point that your credit score will drop. However, this shouldn’t be a cause for panic, especially if it’s only a slight dip. In general, the impact of your score going down a small amount is near meaningless. Have a watch of this video to see why:

You May Like: How Long Foreclosure On Credit Report

Think Carefully About When You Apply For Credit

Each credit application you file will be noted on your credit report, even if these applications are unsuccessful. Therefore, each time you are rejected for a loan, it could be damaging your credit history. Lenders will often be put off if a business intends to rely solely on financial credit. You will want to consider this before applying.

When Applying For Credit

Here are some things to be mindful of when applying for credit.

The application form fill in the form correctly with your key details, one slip such as entering your salary wrong can impact your application. Also, inconsistency can raise your fraud scoring like different job titles, the way you write your address, phone number, etc.

Previous dealings with the lender companies will assess your past data/dealings with them. For example, you may find your bank is more willing to lend you money than an alternative bank as you have a rapport with them. However, if youve had problems then they might make it harder to get accepted there as well.

Equifax, Experian, and TransUnion credit files Ive detailed at the start of this article what credit agencies will look for but in summary:

- Electoral roll information.

- Search, address and linked data.

- Utilities such as gas and electricity firms .

- Account data. Banks, building societies, credit cards etc.

Fraud data if you have committed fraud or someone has stolen your identity and committed the fraud then this will be held on file.

You May Like: How To Report A Death To Credit Bureaus

Close Accounts You No Longer Use

Keeping nice and tidy accounts shows to financial companies your suitability for credit and how much credit you already have available to you.

This is a balancing act as you dont want too many short relationships and it can be better to leave them inactive. It can give you a short-term boost closing them when you need it.

Pay Bills By Direct Debit

Missing a payment will leave a negative mark in your credit report, and it can push your credit score down. An easy way to avoid this is to make sure all your bills are paid by direct debit.

If you think you might not be able to make a payment, talk to your creditor before defaulting, as they may be able to arrange a repayment plan that helps you avoid a big black mark.

Recommended Reading: Can Lexington Law Remove Repossessions

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These services, many of which are free, monitor for changes in your credit report, such as a paid-off account or a new account that youve opened. They typically also give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Who Are The Credit Reference Agencies In The Uk

The UK has three Credit Reference Agencies that lenders generally use to verify you when you are applying for credit. Just to keep us on our toes the credit scores are not standardised so each one will score your credit differently.

Here is Experian, Equifax and TransUnion score breakdown from very poor to excellent:

| Agency |

You May Like: Does Zzounds Report To Credit Bureau

How Long Does It Take To Rebuild A Credit Score

There’s no set timeline for rebuilding your credit. How long it takes to increase your credit scores depends on what’s hurting your credit and the steps you’re taking to rebuild it.

For instance, if your score takes a hit after a single missed payment, it might not take too long to rebuild it by bringing your account current and continuing to make on-time payments. However, if you miss payments on multiple accounts and you fall over 90 days behind before catching up, it will likely take longer to recover. This effect can be even more exaggerated if your late payments result in repossession or foreclosure.

In either case, the impact of negative marks will diminish over time. Most negative marks will also fall off your credit reports after seven years and stop impacting your scores at that point if not sooner. Chapter 7 bankruptcies can stay for up to 10 years, however.

In addition to letting time help you rebuild your scores, you can follow the steps above to proactively add positive information to your credit reports.

How To Raise Your Credit Score By 100 Points In 45 Days

Insurance carriers use credit scores as part of their calculations to determine the level of risk you would pose to them as an insured. They have found a direct correlation between credit scores and claim activity. Knowing that, it’s important to keep your credit scores in good shape so that your insurance premiums stay in line.

Don’t Miss: Will Klarna Build Credit

End Financial Associations With Ex

Living with or being married to someone who has a bad credit rating won’t affect yours, but taking out a joint financial product with them will.

Opening a joint current account, for example, will create a ‘financial association’ between you and the other account holder.

Lenders may look at their credit report as well as yours when assessing your application, as their circumstances could affect your ability to make repayments.

If you have ever jointly held a financial product with someone you no longer have a relationship with, ask all three credit reference agencies to break this link so that your ex-partner’s financial situation doesn’t have an impact on any credit applications you may make in the future.

Breaking a financial link with an ex-partner or disassociating could boost your score within a month.

Council Tax Arrears & Parking Or Driving Fines

Councils don’t share data about your payments, whether good or bad. If you’re in arrears, it won’t affect your credit score. However, it’s always wise to prioritise your council tax payments as many councils are quick to prosecute. Council tax arrears are dealt with as a criminal matter, not a civil one, so you could end up with a criminal conviction.

Any fines you’ve incurred, for example, a parking or driving fine, won’t be listed. Even though they’re issued by the courts, they aren’t ‘credit’ issues, so they’re not listed.

Read Also: Does Affirm Report To Credit Bureaus

How To Get Your Fico Score For Free

Understand the reasons that help or hurt your FICO® Score, including your payment history, how much credit you are using, as well as other factors that influence your overall credit.

- Which Debts Should I Pay Off First to Improve My Credit?: Prioritizing certain bills can be important when you’re trying to increase your credit scores.

- : Learn the truth and don’t get caught off guard.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How To Unlock My Experian Credit Report

Pay Off Debts On Time

You can improve your credit score by paying off debts on time. This shows lenders that you are a reliable borrower and can manage your money.

Missing or late repayments are recorded in your credit report and can negatively impact your credit score.

If you apply for new credit, lenders may see the missed repayments and reject your credit application as there could be a higher risk of you not being able to pay them back.

If you miss several payments your lender may place your account into default, which can be more damaging to your credit score.

Missing and default payments stay on your credit report for six years, so it may take a while for your credit score to recover if you have any in your report.

»MORE: What happens if I can’t make my loan repayment?

Use A Credit Build Card To Build A History & Restore Past Issues

You need to build a decent recent history to show that you can be responsible with credit and use it well. The catch-22 is that as you have a poor credit history, getting credit is difficult.

The solution is to grab a credit rebuild card. See the full guide for full help, how to protect yourself, and top picks.

This is a card with a hideous rate, say 35% APR, which accepts people with a poor credit history. Yet provided you repay the card IN FULL each month, preferably by direct debit, and never withdraw cash, you won’t be charged interest, so it’s no problem.

Then just spend say, £50 a month on the card, and provided you have no other issues after six months or so, things should start to improve. After a year, it should make quite a difference.

Obviously, if you already have a credit card you aren’t using, then you can do the same on that without the need to apply for a new one.

You May Like: Is 626 A Good Credit Score