Wait For The Mark To Fall Off Your Reports

Sometimes all you can do is wait. Fortunately, about two years after a derogatory mark appears on your reports, your credit should start rebounding if youre taking the right steps toward healthy credit. If youre working on building credit, you may consider getting a secured credit card, which is made specifically to help people with that process.

Derogatory Marks By Level Of Severity

Description: Payments that are 30 days past due. 12 months of on-time payments are more important than one missed payment.

Approximate on Credit Report: 7 years after the date the delinquency was first reported.

Description: A late payment that has been sent to collections if there hasnt been a payment in 180 days.

Approximate on Credit Report: 7 years after the date the delinquency was first reported.

Type: Repossession

Description: When your car or other assets are repossessed from the party that has claims on them.

Approximate on Credit Report: 7 years after the date the delinquency was first reported.

Type: Foreclosure

Description: Unpaid mortgage payments that result in the bank or other lenders taking possession of your home.

Approximate on Credit Report: Usually, 7 years after the date of the foreclosure is filed.

Description: You are delinquent after 90 days if you dont make a payment, but are considered in default after 270 days. Wages, social security, and tax refunds can be garnished.

Approximate on Credit Report: Student loan delinquencies stay on your report for 7 years.

Type: Bankruptcy

Description: A legal process where your debts are settled in court. Youll either pay off some or none of your debt.

Approximate on Credit Report: 7-10 years after the filing date, depending on the type of bankruptcy.

Description: A process where you renegotiate your debts to a lower value in order to avoid bankruptcy. Your credit score is damaged similarly.

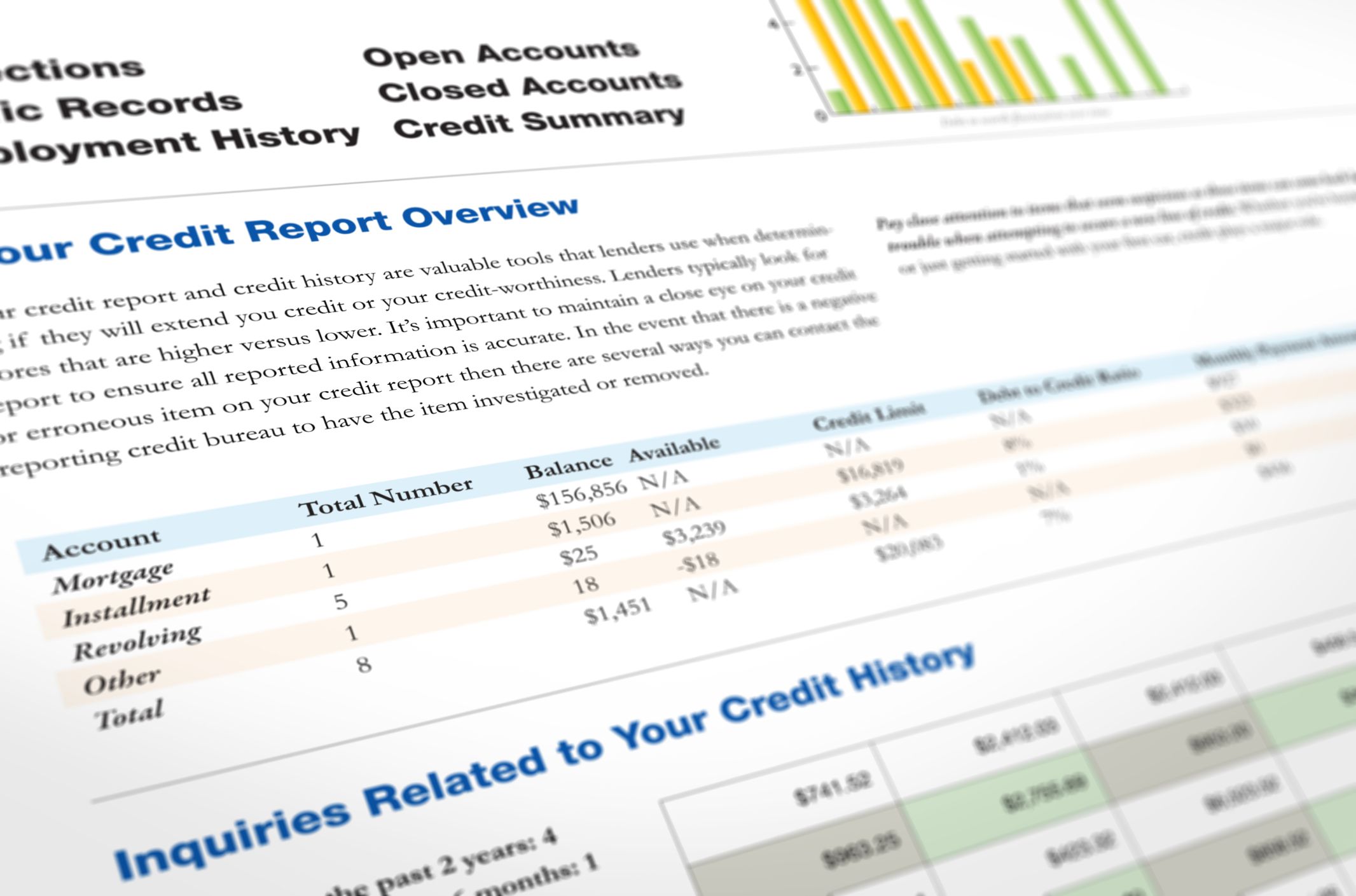

How Lenders Use Credit Reports

Be aware that different lenders look for different things when reviewing your credit report and deciding whether to lend to you. They can also take other factors into account.

For example, you might have been furloughed and taken a payment holiday during the coronavirus pandemic. While this won’t directly affect your credit score, it may affect your ability to borrow in the future.

Also Check: Does Paypal Credit Report To Credit Bureaus

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

How Long Does Derogatory Information Stay On Your Credit Report

Most derogatory information stays on your credit report for seven years. This includes late payments, unpaid debts, foreclosures, defaulted student loans, and judgments against you.

Chapter 7 bankruptcies can stay on your credit report for 10 years. Chapter 13 bankruptcies are deleted after seven years since it required at least a partial repayment of the debts.

An inquiry stays on your report for two years. Too many inquiries can be seen as a negative.

Unpaid tax liens can remain on your credit report indefinitely, although they are typically removed after 15 years. Once it is paid, it must be removed seven years from the date it was filed.

Recommended Reading: How To Remove Repossession From Credit Report

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

How Long Does Negative Information Remain On My Credit Reports

Content Marketer and Personal Finance Expert

by John Ulzheimer, Credit Expert for

Last month I wrote about the Fair Credit Reporting Improvement Act of 2014 and how it could possibly alter how long negative information remains on consumer credit reports. The article prompted several of you to reach out and ask me to clarify just how long negative information is allowed to remain on credit reports under the current iteration of the Fair Credit Reporting Act. The answer, as usual, is going to vary based on the scenario but there are several groups that information can fall into vis-à-vis credit reporting.

No More Than Seven Years

The vast majority of derogatory information can remain on your credit files for as long as seven years. The list is going to include late payments, collections, judgments, settlements, foreclosures, repossessions, released tax liens and charged off accounts. Those items make up the bulk of derogatory information appearing on consumer credit reports.

The seven-year period begins from the date of default, or 180 days after the date of the first delinquency that preceded the default or collection activity. And despite widespread mis-blogging on this topic, there is absolutely nothing that can legally restart the seven-year clock of credit reporting once it has already begun including, but not limited to, making a payment, settling an account or disputing an account.

No More Than Ten Years

No Time Limit, Meaning Indefinite

Bet You Didn’t Know…

You May Like: Paypal Credit Report

How Long Do Collections Stay On Credit Report

How long does an unpaid collection remain on a credit report? In most cases, an unpaid bill can remain on your credit report for up to seven years. An unpaid bill, often referred to as derogatory or negative information, can be reported by your original creditor and collection agency if the bill is associated with it.

How Do You Know If You Need To Dispute Incorrect Information On Your Credit Reports

To find out if there are errors on your , you need to get copies of your own reports.

Typically, you can do this for free once every 12 months with each of the three . However, due to the COVID-19 pandemic, the CRAs have made it easier to check your credit more often by making it free to check your credit reports every week until April 20, 2022.

To order your free credit reports, go to annualcreditreport.com, which is the only website that is federally authorized to provide your free credit reports, and request them there.

You May Like: What Card Is Syncb/ppc

Paying Off Derogatory Credit Items

It can be beneficial to pay off derogatory credit items that remain on your credit report. Your credit score may not go up right away after paying off a negative item however, most lenders wont approve a mortgage application if you have unpaid derogatory items on your credit report. Make sure the accounts are valid before sending payment, especially with debt collection accounts.

Start Healing Your Credit

Even if the derogatory mark is legitimate, you can start improving your credit. Make payments on any accounts that are past-due, and then consistently make the minimum payment on time. Keep your account balances low and only apply for new credit that you need.

And think twice before you ignore the problem. In some cases, such as with tax liens, ignoring the debt can lead to more problems, like wage garnishment so its important to address your debt.

You May Like: Does Balance Transfer Affect Credit Score

How Will Accepted Disputes Affect Your Fico Score

Often your score will improve when errors on your credit report are corrected. In some situations, however, your score may not improve when credit information is corrected or updated. For example:

- It is often thought that closing credit card accounts will improve your score. This is not true. Closing an account will neither remove it from your credit report, nor will it prevent the payment history from continuing to be displayed and considered in the calculation of your FICO Score.

- Removing negative information from your credit report may not have the impact on your FICO Score that you expect. There could be additional negative information remaining that will prevent an immediate increase in your FICO Score.

- FICO Scores only consider credit-related information on your credit report. If you change personal information , the credit information on your report will not be impacted and your FICO Score will probably not change. The FICO Score only considers credit account, collection, and public record information.

It typically takes the credit bureau 30-45 days to respond to your dispute.

Fixing A Derogatory Credit On Your Report

A derogatory credit item is a result of having negative information on your credit report. Negative items like previous delinquency, high balances, or other items show youre a potential risk if you borrow more money. This negative information is added to your credit report by the creditors you have accounts with or through public records you have on file with the local or state court.

Because your credit score is calculated based on the information in your credit report, derogatory credit items can hurt your credit score. Many credit score providers, like myFICO and , will give you personalized information about the items that are affecting your credit score.

Learn about derogatory credit and how to turn it around.

Read Also: Opensky Credit Card Delivery

The Bad News: You Do Not Have The Right To Have Accurate Negative Information Removed From Your Credit Reports

According to the FCRA, accurate and verifiable negative information can remain on your credit reports for up to seven years.

Unfortunately, that means if the derogatory information on your credit reports is accurate and verifiable, then the CRAs are under no obligation to remove it before the 7-year clock runs out.

Derogatory information that is accurate and verifiable can stay on your credit report for up to seven years.

How Long Can A Derogatory Mark Impact My Credit Scores

Derogatory marks can remain on your credit for up to seven to 10 years or more, depending on what type it is. However, your scores can start improving before that if you take steps to make your credit healthy over time. That can include making at least the minimum payment on time and keeping your balances low.

You May Like: How To Report Death To Credit Bureaus

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

Follow Up After The Investigation

Heres what to expect when the investigation is complete:

- The results of the investigation, in writing, from the credit reporting bureau.

- A free copy of your credit report, if the report has changed.

What about parties who have seen your incorrect information? You can ask the credit bureaus to notify them of the corrections, the FTC says. This includes:

- Notifying anyone who received your report in the past six months.

- Sending a corrected copy of your report to anyone who received it in the past two years.

But what if the investigation doesnt resolve your dispute? If the furnisher continues to report the error, you can ask the credit bureaus to include a statement in your credit file that describes your side of the dispute and it will be included in future credit reports. For a fee, you can usually ask the credit bureau to send a copy of the statement to anyone who has recently received a copy of your report.

Also, if you believe you were treated unfairly or a valid error remains on your credit report, you can file a complaint with the Consumer Financial Protection Bureau. The CFPB is required to forward the complaint to the company with which you have an issue. The CFPB usually will provide you with a response within 15 days.

How long can it take for an error to be corrected on your credit report after the dispute is resolved? Credit bureaus have five business days after finishing their investigation to notify you of the results.

Don’t Miss: How To Get A Repo Removed From Your Credit

What Types Of Derogatory Marks Are There

When youre checking your credit report for negative information, it helps to know what to look for.

Here are some types of derogatory marks that can end up on your credit report, in order from the least to most severe:

- Late payments: A late payment can be reported when its overdue by more than 30 days, and it will experience an uptick in severity every 30 days.

- Loan and credit defaults: For installment loans such as mortgages, auto loans or student debt, your loan might be listed as in default. When your loan defaults depends on your account agreement, but its typically after 120 to 180 days of nonpayment.

- Debts sent to collections: Once an account is overdue by a certain number of days, it might be sold to a collection agency, which can put a new derogatory mark on your credit.

- Foreclosures or repossessions: If a mortgage lender foreclosed on a home you owned or you had a vehicle repossessed, those situations usually are listed as derogatory marks.

- Bankruptcies: If you in the past seven to 10 years, this event will be listed on your credit reports.

How Long Does It Take To Get A Charge Off Off A Credit Card

Acceptable rates. The credit card company usually starts a countdown when you miss your first payment and waits four to six months to try to collect the debt before reporting the bill as an expense. The exit charge will remain on your credit report for seven years plus a payment period of four to six months.

Debt settlementWhat are the pros and cons of a debt settlement? The pros and cons of debt settlement and consolidation differ, including how long it will take and how it will affect your credit. They are both meant to make your debt more manageable.Is debt settlement necessarily a bad thing?Paying off debt can negatively impact your credit score, but not in all cases. In some situations, there are ways to negotiate a seven-year penalty,

Read Also: What Is Cbcinnovis On My Credit Report

How Do I Know If I Have Derogatory Credit

When you enter delinquency, have a loan sent to collections, or have a car repossessed, the mark doesnât go quietly. Youâll receive a barrage of phone calls and letters in the mail notifying you.

Nevertheless, if youâve somehow managed to avoid all communications from your debt collectors, you may not even know about derogatory credit marks on your account. Thatâs why itâs crucial to regularly check your credit report and ensure that you pay any debts on time.

To check if you have derogatory credit, youâll need to get a copy of your credit reports. Luckily, the Federal Trade Commission enacted theFair Credit Reporting Act. This act allows everyone access to a free credit report annually.

Due to the COVID-19 pandemic, the 3 credit reporting agencies â TransUnion, Equifax, and Experian â are offering free weekly credit reports until .

To get copies of your credit report, go to AnnualCreditReport.com.

To keep an eye on your credit, I recommend that you regularly:

- Review your credit report for any negative information.

- Look for any late payments in your payment history and ensure youâve addressed them.

- Examine the public records section for any outstanding judgments or liens.

- Go through the consumer credit section for any collection accounts.

Lawsuit Or Judgment: Seven Years

Both paid and unpaid civil judgments used to remain on your credit report for seven years from the filing date in most cases. By April 2018, however, all three major credit agencies, Equifax, Experian, and TransUnion, had removed all civil judgments from credit reports.

Limit the damage: Check your credit report to make sure the public records section does not contain information about civil judgments, and if it does appear, ask to have it removed. Also, be sure to protect your assets.

You May Like: Affirm Virtual Card Walmart

How Long Does Positive Information Remain On Your Credit Reports

The Fair Credit Reporting Act is the federal statute that defines consumer rights as they pertain to credit reports. Among other consumer protections, the FCRA defines how long certain information may legally remain on your credit reports.

There is no requirement in the FCRA for credit reporting agencies to remove positive information such as on-time credit paymentsthey can remain on your credit reports indefinitely. Even after a positive account has been closed or paid off, it will still remain on your credit reports for as long as 10 years.

The credit bureaus keep a record of your accounts in good standing even after they’ve been closed because it’s important for credit scoring systems to see their proper management. As such, credit scoring systems such as FICO and VantageScore® still consider closed accounts that appear on your credit report when calculating your scores.