How Can I Get Things Removed From My Credit Report Fast

This is another common question consumers have.

Negative credit entries are often not discovered until you make an application for financing, employment, or even an apartment or utility service.

Since the application is already in process, there is hope and a need to get the negative item removed quickly.

How fast the process happens will depend on:

- the specific credit entry

- factors that caused it

- the degree of cooperation the creditor offers

Still another factor, and probably the most important of all, is any type of documentation you have that may prove that a negative item is an error.

But, even if you have such documentation, the time it will take depends on the creditor who made the entry. Some will move fairly quickly, which may be only a matter of a few days.

However, expect it to take 30 days or more to get most negative items removed from your credit report.

Make A Goodwill Request For Deletion

With pay for delete, you can use money as the bargaining chip for getting negative information removed from your credit report. If youve already paid the account, however, you dont have much-negotiating power. At this point, you can ask for mercy by requesting a goodwill deletion.

In a letter to the creditor, you might describe why you were late, state how youve since been a good paying customer, and ask that the accounts be reported more favorably. Again, creditors dont have to comply and some wont. On the other hand, some creditors will make these deletions if you talk to the right person.

Can I Erase Negative Items From My Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

The Fair Credit Reporting Act gives you the right to dispute inaccurate negative items on your credit report, but you don’t have a right to remove accurate items. Yet, there still may be some things you can do about negative items even when they are accurate. This article will discuss what you can do about negative items on your credit report and how to find and dispute inaccuracies on your credit reports. Weâll also touch on requests to remove items through pay-for-delete negotiations and goodwill letters.

Written byAttorney John Coble.

The Fair Credit Reporting Act gives you the right to dispute inaccurate negative items on your credit report. You have a right to good faith disputes. If you prevail in the dispute, the credit bureaus must remove the item from your credit reports. You don’t have a right to remove accurate items. Yet, there still may be some things you can do about negative items even when they are accurate.

Also Check: How To Unlock My Experian Credit Report

How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.

Get A Free Copy Of Your Credit Reports

Before you can take steps to get errors on your credit report fixed, its crucial to know and understand exactly what is wrong or incorrect. To find those details, youll need to get a copy of all three of your credit reports from Experian, Equifax, and TransUnion. Remember that each credit report may have different information reported to them, so checking just one of your reports isnt enough.

Fortunately, its not overly difficult to check your full credit reports online, and you can even do it for free. The website AnnualCreditReport.com lets you check each of your credit reports every 12 months without a fee, and you can do it all from the comfort of your home.

Once you have access to each of your credit reports, take the time to look them over to check for errors. According to the Consumer Financial Protection Bureau , the most common errors found on credit reports include:

- Errors regarding identity data, such as your name or address

- Accounts belonging to someone else with the same name as you

- Accounts opened fraudulently in your name Late or delinquent accounts that are actually in good standing

- Same debts listed more than once

- Accounts with incorrect balance or payment information listed

You May Like: Bp Syncb Pay Bill

How To Dispute Your Credit Reports In 5 Steps

If you find a mistake on your credit report, you have the right to request the correction of an error from the reporting agency. The Fair Credit Reporting Act gives you the right to dispute the information on your credit report if you can provide evidence that shows youre right . There is no cost or fee for making a request and the reporting agency must forward your dispute to the originator of the information that is in dispute. The whole dispute process can take from one to two months.

Review the Credit Report Closely.

Because accurate information is so important, you should also know how to read and understand your credit report. You can get a free copy of your credit report every year from each of the three credit bureaus . You can order this report online or by phone or through the mail. You can identify incorrect, outdated, or incomplete information by carefully reviewing the information.

Be sure to check the following on your credit report:

- Personal information (name, address, social security number, etc.

- Identifying information

- Your credit history

- Inquiries

What Can I Dispute On My Credit Report

Consumer credit reports can vary in the way they look and the order information is listed depending on which of the three major national credit-reporting bureaus provided the report. Consumers can obtain their free credit reports once every 12 months at www.annualcreditreport.com. If you believe that there is inaccurate information on your credit report, its important to know what you can dispute and the steps to take.

Review Your Credit Reports:

Start by getting a highlighter and a pen out and go through your credit report item by item, page by page highlight the items that are reporting incorrectly and make a note next to the item to help you in the dispute process following these guidelines:

Dispute Inaccuracies:

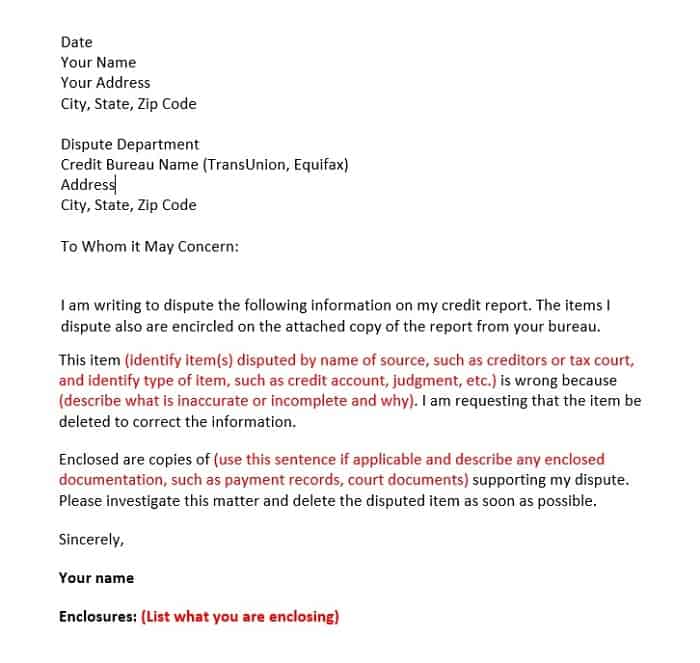

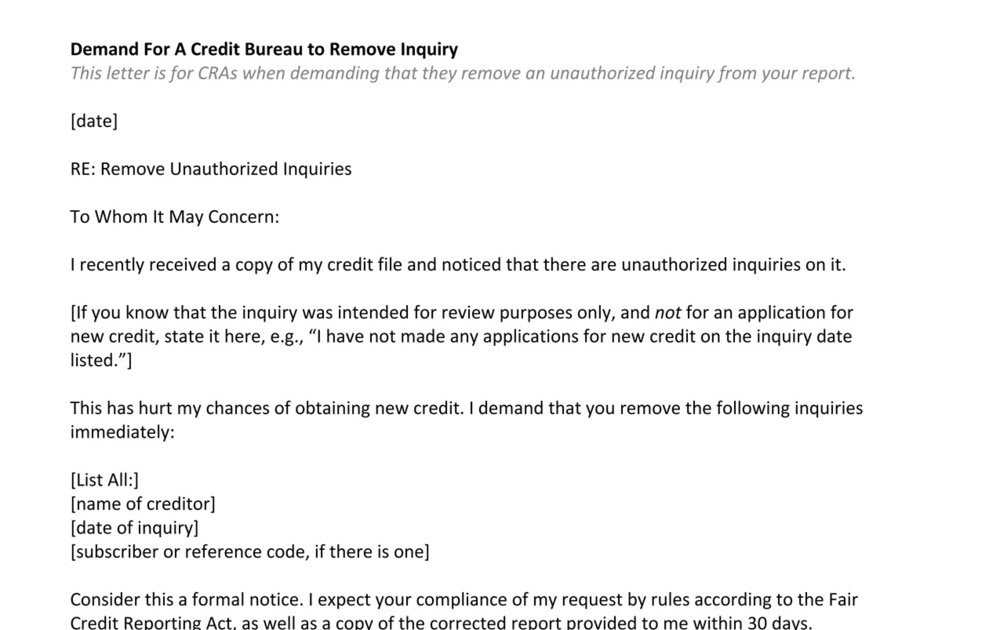

You may write to the credit reporting agencies with the information you have highlighted with a request for correction/deletion depending on your specific dispute. Mailing your letters certified or return receipt is recommended. Sample disputes letters can be found on page 113 of credit.orgs ebook, Consumer Guide to Good Credit, available for in English and Spanish. You may also dispute some items online at www.annualcreditreport.com.

Statute of Limitations for Reporting:

Negative entries on your credit report have different reporting limits. Typical retention periods are stated below, and may vary by state:

If you have questions, you can talk to a certified for free. Call us today or get started online.

Most Recent

Don’t Miss: Itin Number Credit Score

How Credit Absolute Disputes Your Negative Items

Derick Vogel, from Credit Absolute, discusses how is able to dispute and, ultimately, get negative items removed from your credit report, thus increasing your credit score.

He explains how, thanks to the Fair Credit Reporting Act, we can dispute inaccurate information in your credit report. The Fair Credit Reporting Act requires that all information on your credit report is accurate but the credit bureaus wont actually verify it until we dispute it. You could have paid off a debt years ago but it could still be showing up on your credit report, hurting your score, and they may never update it until its been disputed.

Derick goes on to explain that you can only remove inaccurate items. If there are valid debts or all information is accurate, you wouldnt be able to remove the item. That being said, as Derick explains in the video, most credit reports have numerous inaccuracies and its very likely that many of the negative items on your credit report can be disputed and removed.

What If My Credit Dispute Letter Is Rejected

Was your letter intended for repairing your credit rejected by the credit bureau? You do have some options available that might help you repair your credit. One of the more common next steps is to file an appeal with the Consumer Financial Protection Bureau .

If you decide to file an appeal with the CFPB, you should include all the supporting evidence that you sent to the bureau originally. In addition, include the bureaus response.

You should also include a detailed account of why you disagree with the bureaus findings, as well as any additional evidence that might be helpful beyond what you included with the original submission.

If the bureau took too long to process their response, you should be sure to let the CFPB know, and include any supporting evidence. Again, this is why its so important to use certified mail and retain all records and receipts.

Finally, its worth your time to write a statement summarizing your dispute. Explain exactly what happened and why you believe the item to be erroneous. The statement would be included with your credit report, and while it wont help your poor credit score, it may provide just enough insight and clarity about the flagged item to help sway a would-be lender to make a favorable decision.

About Rick Miller

Rick is a former US Army Aviator, West Point graduate, and Darden MBA. He owns and operates a successful Real Estate Investment firm, and he enjoys spending time with his wife and three children in Hartford, CT.

Also Check: How To Get Credit Report Without Social Security Number

Dispute The Information With The Credit Reporting Company

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

What Should I Do Before Sending A Credit Dispute Letter

The first thing you should do is make sure you have all your facts straight, along with any documented evidence such as court documents or payment records, to support those facts. There is always a possibility of not having enough documentation to support your claim, but its never a bad thing to have too much evidence.

If your dispute involves a mistake made by a specific creditor, you should They are the ones who provided the negative information, so it only makes sense to take up the issue with them first.

The creditor might acknowledge and fix the mistake right away, which could save you a lot of time and energy. They might agree to look into the claim and get back to you on it, in which case you should remind them that they have 30 days to give you an answer and let them know you will be following up with them often during that window of time.

If they dig in and stand by their reporting, you should demand that they send any evidence of verification as soon as possible. That information may help you determine what additional evidence you might need to include with the credit dispute letter that you are preparing to send to the credit bureau.

Don’t Miss: Does Fingerhut Report To The Credit Bureau

Determine If You Should Contact The Furnisher As Well

The CFPB also recommends that you contact the company that provided the information to the credit bureau. Companies that provide information to credit bureaus are also known as furnishers. Examples of furnishers include banks and credit card issuers. If the furnishers address is listed on your credit report, send your dispute to that address or contact the company for the correct address.

You can try going directly to the furnisher and asking them to correct their reporting mistake before contacting the credit bureau, says Kevin Haney, a credit bureau expert at Growing Family Benefits. That might save a step, since all the bureau can do in its investigation is communicate to the company that the consumer says its wrong, he says.

But if the error is an identity-related mistake made by a credit bureau, go to the bureau first.

Those are the most likely to get corrected, because the bureau owns the problem so it doesnt have to reach out to anyone, Haney says.

In this case, you should also check with the other major credit bureaus to make sure the identity-related error isnt on their reports as well.

Check For Updates To Your Credit Report

Updates to your affected credit reports may take some time to appear. It can depend on the specific credit bureaus update cycle and when the furnisher sends the new information to the credit bureau.

If the update doesnt appear on your credit reports within several months, contact the credit bureaus and the furnisher to verify its reporting your account information to the bureaus.

You May Like: Is 779 A Good Credit Score

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

What Are Common Credit Report Errors

When reviewing your credit reports, its a good idea to request copies from both credit reporting agencies, as Equifax and TransUnion may have different information on file about you.

Information commonly disputed includes information related to items being paid, no knowledge of the debt and updating accounts to show they were part of a debt repayment program, such as bankruptcy, Blumberg says.

Heres a recap of common credit report errors to watch out for:

- Personal information mistakes, such as outdated mailing addresses or an incorrect date of birth.

- Incorrect payment information, such as on-time payments showing as late.

- Negative information that remains on your credit report beyond the maximum seven years .

- or for someone who has fraudulently used your identity.

Read Also: What Is Syncb/network On My Credit Report

Inform The Company Who Made The Error

Once youve completed the dispute process and the credit reporting company corrected any mistakes on your credit report, its time to inform the company who made the error.

First, confirm that the credit reporting company removed the negative item, meaning any late payments, collection accounts, public records, etc.

If the credit reporting company is unclear whether the creditor contacted has removed the negative item, you can contact that creditor directly. This is the only way to ensure its removed for sure.

After requesting that the creditor remove the negative item from your credit report, the creditor will attempt to remove it from their records by following the process below.

Note: Not all creditors have the ability to remove a late payment from your credit report. Creditors that subcontract their collection accounts to other companies, for example, have no control over what shows up on your report. In these cases, you need to complete Step 5 to ensure this negative item doesnt come back to haunt you.

To have the negative item removed from your credit report, the creditor needs to complete the following:

Send you a letter with an original document attesting that the item has been removed from your credit report.

Send this original document to make it easier for you to provide proof to the credit reporting company in Step 5.