How To Improve Your Credit Score

4 minsJune 11, 2017

Given the rise in lifestyle expenses and peoples aspirations, using a credit card for shopping or availing a personal loan for travel is normal practice. Then as per ones life stage people also borrow home loans for an asset and car loans. In order to approve the loan and decide the amount banks check your credit scores and credit history, which are provided by credit bureaus.

That is, how likely are you to repay a loan. The more credit worthy you are , the easier your application process for a loan is likely to be.

Raising Your Score Depends On Your Starting Point

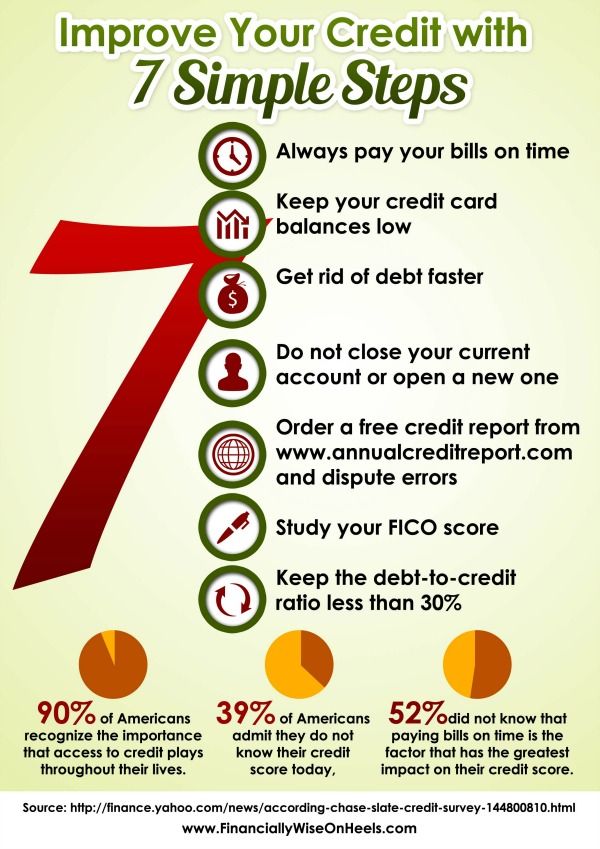

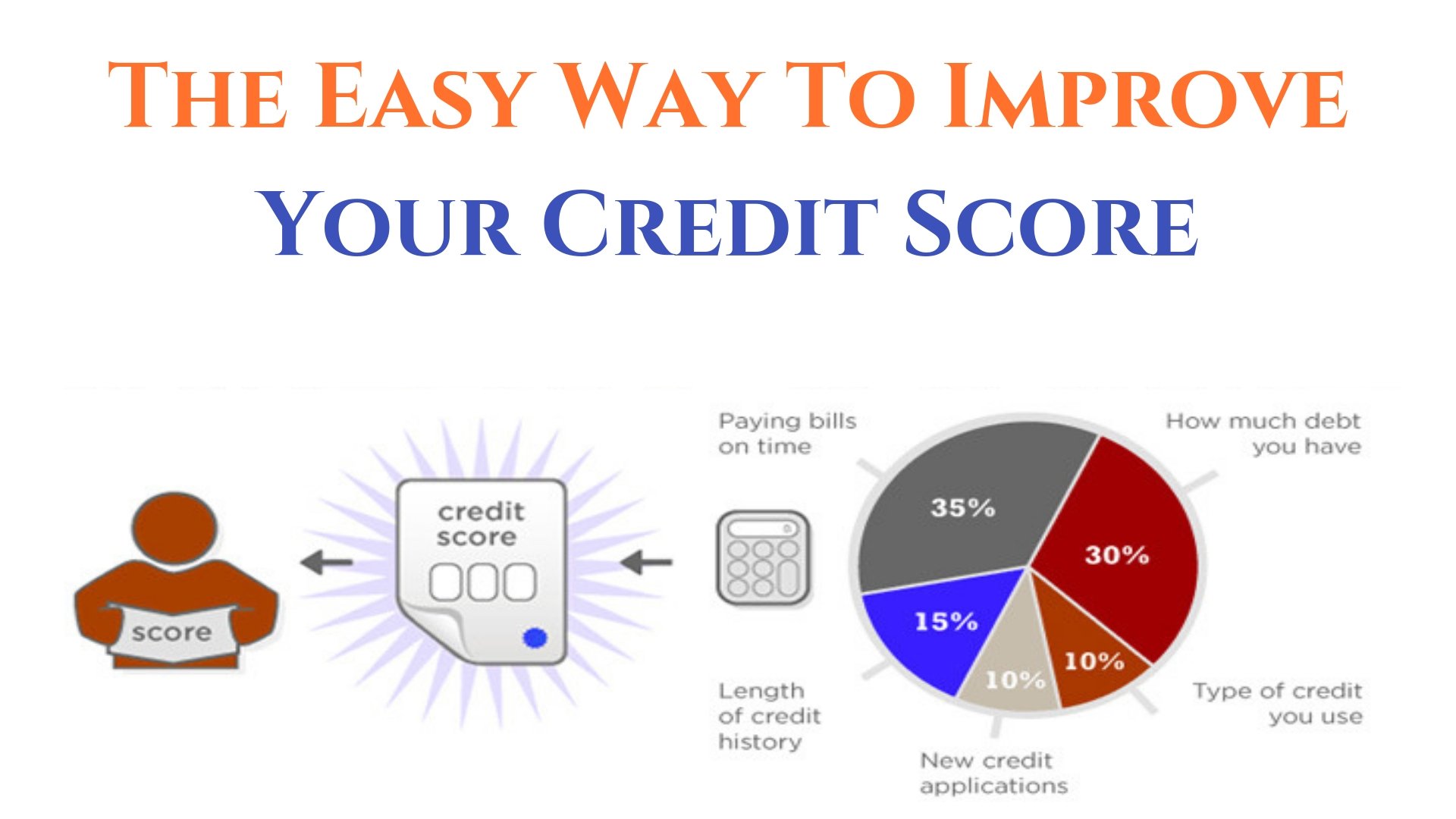

Your credit score isnt just a judgment call its determined through a formula considering five different factors. Listed in order of importance, each of the following factors can raise or lower your :

- Payment history

- New credit

With a history of consistent payments being the most influential factor, a great opportunity is offered to those new to credit cards. Every month you pay your cards bill on time will bump your credit score up, so set a routine and you can grow your creditworthiness quickly as long as you can avoid missing a credit card payment.

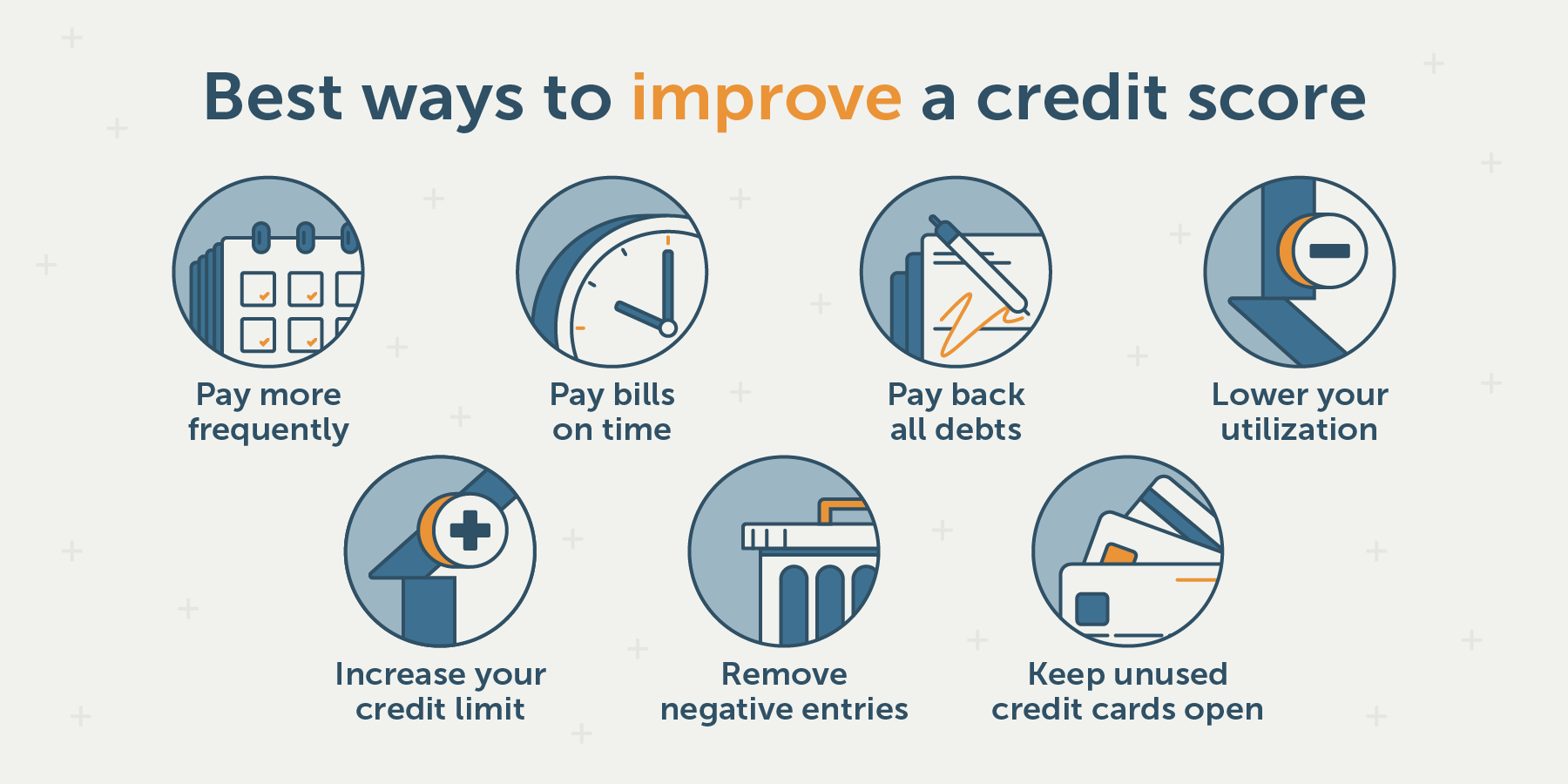

Your credit utilization ratio is how much of your total credit limit you use. Typically, you want to keep this figure between 10 and 30 percent to stay in good standing. Opening up new card accounts or getting a credit limit increase can help build credit by decreasing this ratio, but that isnt all it takes. By making the effort to pay off your outstanding balances youll help your credit utilization, thus improving your credit score.

The length of credit history is fancy-talk for the average age of your credit accounts. The longer the account has been open, the better, so you may want to avoid closing an old account to keep yourself out of poor credit. There are cases where canceling a credit card account is the right move, but as a general rule youll benefit from keeping old ones open.

Learn more:How to check your credit score

Council Tax Arrears & Parking Or Driving Fines

Councils don’t share data about your payments, whether good or bad. If you’re in arrears, it won’t affect your credit score. However, it’s always wise to prioritise your council tax payments as many councils are quick to prosecute. Council tax arrears are dealt with as a criminal matter, not a civil one, so you could end up with a criminal conviction.

Any fines you’ve incurred, for example, a parking or driving fine, won’t be listed. Even though they’re issued by the courts, they aren’t ‘credit’ issues, so they’re not listed.

You May Like: Does Removing An Authorized User Hurt Credit

How Long Does It Take To Rebuild A Credit Score

There’s no set timeline for rebuilding your credit. How long it takes to increase your credit scores depends on what’s hurting your credit and the steps you’re taking to rebuild it.

For instance, if your score takes a hit after a single missed payment, it might not take too long to rebuild it by bringing your account current and continuing to make on-time payments. However, if you miss payments on multiple accounts and you fall over 90 days behind before catching up, it will likely take longer to recover. This effect can be even more exaggerated if your late payments result in repossession or foreclosure.

In either case, the impact of negative marks will diminish over time. Most negative marks will also fall off your credit reports after seven years and stop impacting your scores at that point if not sooner. Chapter 7 bankruptcies can stay for up to 10 years, however.

In addition to letting time help you rebuild your scores, you can follow the steps above to proactively add positive information to your credit reports.

What Is The Credit Limit

With traditional credit cards, using a high percentage of your available credit limit could negatively impact your credit score. You dont have to worry about that with Credit Builder because Chime does not report credit utilization. Your credit score may go up or down depending on your payments. On-time payment history can have a positive impact on your score, while late payment may have a negative impact on your score.4

How much you can spend with Credit Builder is shown to you as Available to Spend in the Chime app.

You May Like: Credit Report With Itin

Ask For A Credit Limit Increase

A higher credit limit is another way to help reduce your credit utilization ratio, which can help raise your credit scores. Keep in mind though that some credit issuers do a hard credit check when you request a credit limit increase, and that can cause your credit to dip. Read up on how to ask for a credit limit increase.

What Happens If I Miss A Payment

If you miss a payment, well disable your Credit Builder card and ask you to pay your overdue balance. See How and when do I pay off the card? on how to make a payment.

If your balance due isnt paid in full after 30 days, we may report information about your account to the major credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected on your credit report.4

Don’t Miss: Zzounds Payment Plan Denied

Don’t ‘spend’ Your Applications Too Often

Every time you apply for a credit product , it adds a footprint to your file for a year.

Too many, especially in a short space of time, can trigger rejections as it makes it look like you’re desperate for credit. Therefore, space out applications if you can and don’t do them frivolously.

In fact it’s almost worth thinking about applications as ‘spending’. Is it really worth spending an application on what you’re doing, or could you save it for something else?

So if you fancy a cashback credit card and have no other credit you need to apply for in the next six months or so, great, spend your application. But if you’re just about to apply for a mortgage, wait until after you’ve done that. Prioritising is important.

For the same reason, if you apply for a cheap credit card and don’t get the credit limit you need, don’t automatically apply for another one. Read the Low Credit Limit guide for more information.

Ways To Improve Your Credit Score

So you want in on some of Canadas latest and greatest rewards credit cards, annual fee waivers and free flight offers. You have the income, but for some reason, your credit score just isnt up to snuff. Heres a few tips to improve your credit score and get it cracking the 700+ barrier.

In This Article:

You May Like: How To Remove Repossession From Credit Report

Use A Credit Build Card To Build A History & Restore Past Issues

You need to build a decent recent history to show that you can be responsible with credit and use it well. The catch-22 is that as you have a poor credit history, getting credit is difficult.

The solution is to grab a credit rebuild card. See the full guide for full help, how to protect yourself, and top picks.

This is a card with a hideous rate, say 35% APR, which accepts people with a poor credit history. Yet provided you repay the card IN FULL each month, preferably by direct debit, and never withdraw cash, you won’t be charged interest, so it’s no problem.

Then just spend say, £50 a month on the card, and provided you have no other issues after six months or so, things should start to improve. After a year, it should make quite a difference.

Obviously, if you already have a credit card you aren’t using, then you can do the same on that without the need to apply for a new one.

Avoid Pay For Delete And Late Payment Adjustments

There are some suggestions for how to improve your credit score in 30 days that, while they look interesting, are less than reputable.

Pay for delete and late payment adjustments are two credit cleanup methods where borrowers ask debt collectors to report information that may not be entirely true to the credit reporting bureaus.

Pay for delete is a process in which a borrower offers to pay the debt they owe only if the creditor will remove the negative account history from their credit report.

Late payment adjustments also known as goodwill letters are letters written by borrowers to lenders asking them not to report late payments.

Both these methods might be a violation of the Fair Credit Reporting Act , which requires fair and accurate credit reporting.

According to the FCRA unfair credit reporting methods undermine the public confidence, which is essential to the continued functioning of the banking system.

Accounts in collections and late payments stay on your credit report for seven years. If you pay off an account in collections, it should be reported as paid collection. If its not, ask your debt collectors to send a letter stating that the debt has been paid in full.

Even if your creditors follow through with pay for delete or late payment adjustments, theres no guarantee it will occur in 30 days.

Recommended Reading: Paypal Credit Report To Credit Bureau

Pitfalls To Avoid When Working On Your Credit Scores

When it comes to building credit, its easy to get overly focused on ways to raise your credit scores fast. The truth is that building credit takes time. So take a step back and make sure your strategy doesnt do more harm than good.

Here are a few donts to keep in mind.

- Dont apply for a bunch of new credit cards just because you want to increase your credit utilization. Even though this might help lower your credit utilization ratio, it could also make you look like a risky borrower thanks to the new hard inquiries on your reports.

- For the same reason, dont take out a loan just to improve your credit mix. Only apply for a new loan if you actually need it.

- Dont carry a balance on your credit card just so you can build credit. Carrying a balance can lead to unnecessary interest charges, and it might actually hold your scores down by increasing your credit utilization ratio.

- Dont cancel your credit card after you pay it off unless you have a good reason to do so. Closing your credit card will hurt your length of credit history, so its better to leave it open, even if youre not using it anymore. Of course, if having a card tempts you to spend more, or it comes with an expensive annual fee, you might want to rethink this conventional wisdom.

Open A Store Credit Account

Many stores offer credit accounts. Most are reported as revolving credit, the same as a credit card. Home Depot offers project loans. Many local home improvement stores also offer credit accounts, and some are available with the payment of a deposit in lieu of good credit. Staples office supply store has several credit products, including a personal credit account administered by Citibank. Before applying for store credit, be sure the vendor reports to the credit bureaus.

Also, keep in mind that some are better than others for people with poor credit scores, while others can help individuals recover from poor credit.

You May Like: What Is Syncb Ntwk On Credit Report

How To Rebuild Your Credit Score Fast

Rebuilding your credit score is a task that can take time. The credit bureaus receive information from many sources and some of them, like your utilities or credit card providers, bill monthly. That said, it can take up to 90 days for a new product to show up in your account. But what if you dont have time to wait? If youre looking into applying for a mortgage or getting a car loan you might not want to wait for the choice and better interest rates that come with a high credit score. If you have a pressing reason to get a better credit score, there are actions you can take.

Before anything else, you need to do the following:

Perhaps you have done all these things and your score is still lower than youd like. This is when you might seek assistance from a company like MyMarble.ca.

Increase Your Credit Lines

As we mentioned above, you really shouldnt have balances greater than 30% of your outstanding lines of credit. There are 3 ways to combat the problem. First, ask for a credit line increase. By spending the same, but having a higher credit line, youll be using up a lower percentage of your credit line. Second, apply for more credit cards. Having additional lines of credit, with the same amount of spend, will once again reduce your total balance to line ratio. Third, if you cant get a line increase or apply for new credit, pay your credit card balance down twice a month. Again, you wont be spending any more, but you will be reducing your balance more frequently.

You May Like: How To Raise Credit Score 100 Points

The Basics: How Credit Works

Your credit reports and score are a reflection of how you’ve managed debt in the past. Your credit reports contain information reported by your creditors that’s used to calculate your score. The three-digit scoreâwhich typically ranges from 300 to 850âevaluates the risk you pose as a borrower. Lower scores mean more risk, and vice versa.

Your credit becomes important when you ask a potential lender to extend you some type of credit. This can happen for small thingsâfor example, your credit reports may be checked if you finance a new cellphoneâand is also required for large purchases, such as taking out a mortgage for a home purchase.

Good credit is something you earn as you show you can manage your debt obligations well. And there are rewards for managing your debts responsibly. When you apply for additional credit with a good credit score, it’s more likely you’ll be approved and may get favorable terms from the lender.

Customise Your Credit Limit

Your credit utilisation ratio has a significant impact on your credit score. The more you are able to restrict your credit usage as per the allotted limit, the better it is for your credit score. Reaching the limit has the opposite effect as it lowers your credit score. One way of tackling this is to get in touch with your lender and customise your credit limit based on your expenses.

You May Like: What Is Syncb Ntwk On Credit Report

Check Your Credit Report For Errors And Remove Them

According to the Federal Trade Commission, one in five people had errors in at least one of their credit reports. This can be anything from reporting late payments that werent late to including fraudulent accounts in the report, which all can impact your credit score negatively.

Thats why its important to regularly check your credit reports. You can request one free report a year from each of the credit bureaus through annualcreditreport.com. Even more important, if you find anything that is inaccurate or fraudulent, dispute it immediately and have it removed.

What Is A Credit Report

A credit report is a detailed breakdown of an individual’s credit history prepared by a . Credit bureaus collect financial information about individuals and create credit reports based on that information, and lenders use the reports along with other details to determine loan applicants’ .

In the United States, there are three major credit reporting bureaus: Equifax, Experian, and TransUnion. Each of these reporting companies collects information about consumers’ personal financial details and their bill-paying habits to create a unique credit report although most of the information is similar, there are often small differences between the three reports.

Don’t Miss: Syncb Ppc Closed

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Pay Off Cards With The Highest Balances First

In addition to limiting your future spending, work on paying off your credit cards. If you have several cards with a balance, focus on the highest card balance to reduce your credit utilization ratio.

Paying down your outstanding debt can also improve your debt-to-income ratio, which is not a factor in your credits core but is used by many lenders.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Factors That Affect Your Credit Scores

As we mentioned above, there are several factors that go into determining your credit scores.