High Credit Utilization Ratio

Keeping an eye on your credit utilization ratio is one of the golden principles you should follow. It’s the amount of credit you’ve utilized concerning the credit limit you have available. Experts recommend that you use no more than 30% of your credit limit at any given time. If your credit card limit is Rs.1 lakh, for example, you should spend about Rs.30,000. Your credit score may suffer if you have utilized more than 50% of your credit limit. Lenders will be wary of you if you have a lot of credit exposure because it means you’re more likely to default.

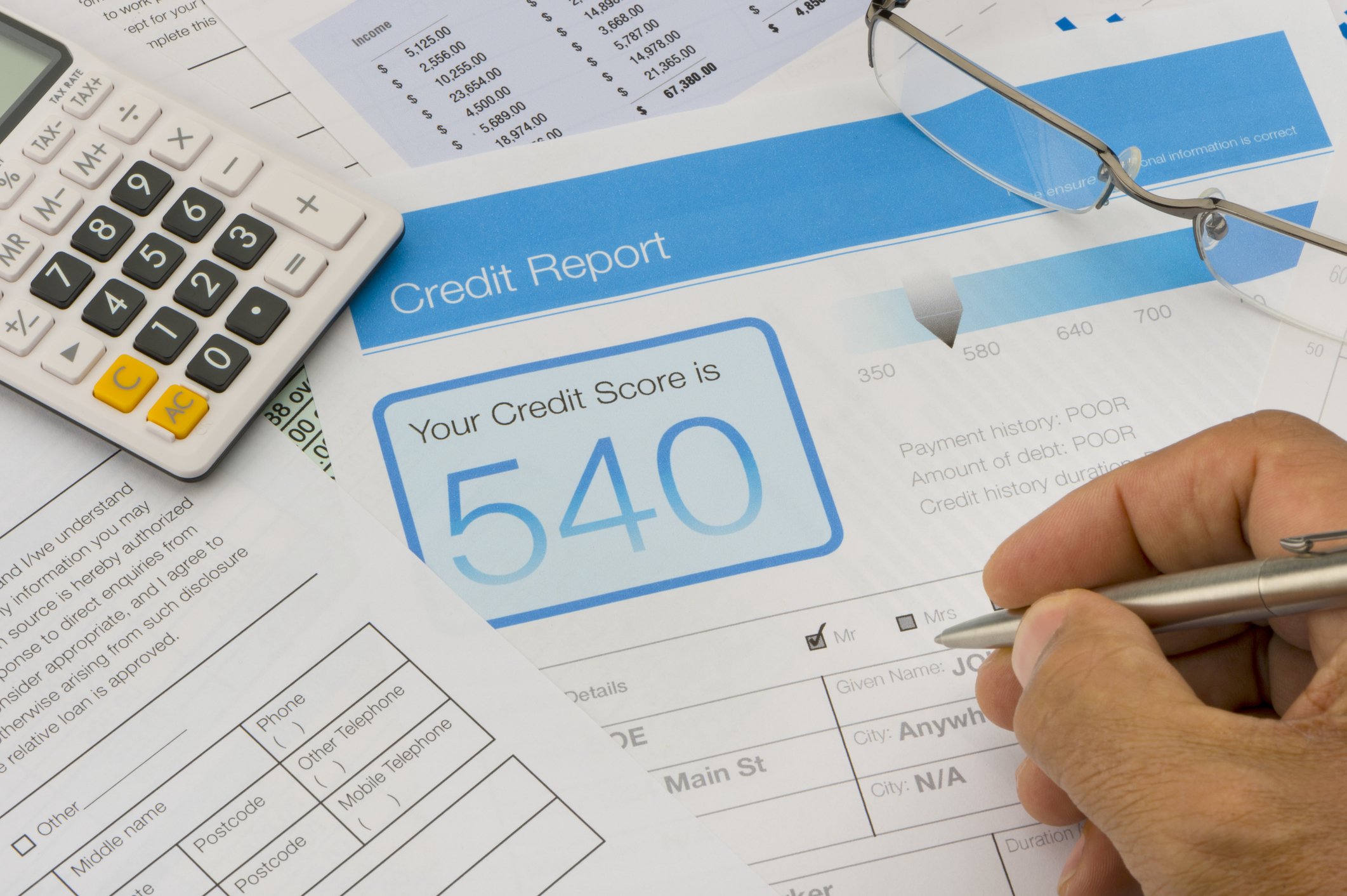

Constant credit score check online will help you know about your scores and will help you make better decisions ahead.

Ask For Higher Credit Limits

When your credit limit goes up and your balance stays the same, it instantly lowers your overall credit utilization, which can improve your credit. Call your card issuer and ask if you can get a higher limit without a hard credit inquiry, which can temporarily drop your score a few points. If your income has gone up or you’ve added more years of positive credit experience, you have a decent shot at getting a higher limit. Some issuers may also be willing to work with you during the COVID-19 crisis.

Use Multiple Types Of Credit

Using your credit card and paying it off every month is an excellent way to help boost your score. However, creditors want to see that you have experience managing multiple types of credit.

A credit card is considered a revolving type of credit. Revolving credit refills after you pay it down and allows you to use it again and again. As for non-revolving credit lines, you can only use those once. As soon as you pay off a non-revolving account, your lender closes your account. Personal loans, mortgage loans, and student loans are all examples of non-revolving credit types.

Don’t Miss: 611 Credit Score

Factors That Influence Your Credit Score

To better understand how your credit score can change after paying off debt, you should know the elements that make up your credit score.

There are two primary credit-scoring sources: FICO and VantageScore. Each has a different model and lenders have their own algorithms, too.

Several factors impact a FICO Score:

- Payment history: 35%

- Length of credit history: Less influential

- New credit: Less influential

Lets take a look at a few ways these factors can affect your credit score.

Your credit utilization or amounts owed will see a positive bump as you pay off debts. Generally, it is a good idea to keep your credit utilization ratio below 30%. Paying off a credit card or line of credit can significantly improve your credit utilization and, in turn, significantly raise your credit score.

On the other side, the length of your credit history decreases if you pay off an account and close it. This could hurt your score if it drops your average lower.

How Soon Will Your Credit Score Improve

Unfortunately, theres no way to predict how soon your will go up or by how much. We do know that it will take at least the amount of time it takes the business to update your credit report. Some businesses send credit report updates daily, others monthly. It can take up to several weeks for a change to appear on your credit report.

Once your credit report is updated with positive information, theres no guarantee your credit score will go up right away or that it will increase enough to make a difference with an application. Your credit score could remain the sameor you could even see your depending on the significance of the change and the other information on your credit report.

The only thing you can do is watch your credit score to see how it changes and continue making the right credit moves. If you’re concerned about inaccurate reporting on your credit score or simply want to keep a closer eye on it you could use a .

Also Check: Carmax For Bad Credit

Get A Secured Credit Card

If your credit score is poor or you do not have a credit history at all , it may be difficult to qualify for a regular credit card.

A secured credit card requires you to put down a deposit with the bank that secures the amount of credit they are extending to you. For example, if your credit card has a limit of $2,000, you will be required to deposit $2,000 in a designated account.

A secured credit card helps you to build your credit score when there are limited options. You will still need to pay your balance on time and this is a good way to learn about how to use credit responsibly.

You can compare the other secured credit cards in Canada.

You can also raise your score by becoming an authorized user on someone elses credit account. For example, if you know someone with an excellent credit history, they could add you to their own credit card as an authorized user. They do not have to give you a credit card to use, however, their high credit score will impact your positively.

Lower Your Credit Utilization Rate

The fastest way to get a credit score boost is to lower the amount of revolving debt youre carrying.

The typical guidance from personal finance experts is to use no more than 30% of your credit limit, which applies both to individual cards and across all cards. For example:

- On a card with a $500 credit limit, spend no more than $150.

- On a card with a $700 credit limit, spend no more than $210.

- On both cards , spend no more than $360.

How much will this action impact your credit score?

Reducing your balances is the single most effective way to boost your credit score. Provided you have no derogatory marks on your credit reports, such as late payments or delinquencies, you are guaranteed to see a big jump in your scores quickly if you knock down your balances to $0 or close to zero.

Still, if your utilization is currently over 30%, and simply paying the debt off immediately isnt a viable option, there are a few other ways to lower your credit utilization rate.

Also Check: Does Barclaycard Report To Credit Bureaus

How Can I Raise My Credit Score 10 Points Fast

Getting a 10 point boost on your credit report is a cinch.

Unlike a 200 point increase, 10 points can be achieved by choose to act on one of the tactics below.

Thats not the same for a higher increase, which would require both of these tactics and more to see a significant rise.

What matters most is that you know the basic rules of :

Once you understand those rules you can actually pick and choose which factor would help you to raise your score the quickest.

How Long Does It Take

Recovering your credit score depends on the situation. For example, if you are late on a single payment your credit score can rebound within one or two months. Sometimes it can take up to 6 months for your credit score to be improved or for newly opened or paid off accounts to have an affect on your credit score.Credit Bureaus do this to ensure you don’t pay off one account and then immediately open up a new account.

If an individual has entered into the filing of bankruptcy their credit score might take 5 years to 10 years to rebound back to where they were.

- Bankruptcy: 6+ years.

- Maxed out credit card: 3 months

- Closing an account: 3 to 6 months

- Applying for credit: 3 to 6 months

Your focus should not lie just with short term credit score improvement but with obtaining and maintaining a high credit score and paying your accounts on time over the long term.

No matter where your score starts, if its below optimal, there are simple things you can do that will have an immediate effect on your credit health.

Recommended Reading: What Credit Report Does Paypal Pull

The Road To A Healthier Credit Score

Maybe credit problems from your past haunt your current score. Thats ok, because you always have the power to change your credit habitsit. Here are some good credit practices that usually wont harm your credit standing and may actually help it:

- Pay bills on time. Even if you cannot pay in full, be sure to make the minimum payment.

- Watch your credit card balances. Make sure youre not using too much of your available credit.

- Dont mindlessly open new credit card accounts. If you apply for new cards, make sure you dont do so too frequently. This behavior may look irresponsible to creditors.

- Alert banks and card companies when you move. You dont want to see your bills have gone unpaid because the mail didnt go to the correct address.

- Check your accounts online. Theres no reason to wait for the bills to come in the mail. You should make sure payments are clearing and cards are being kept current.

- Pay off delinquent bills. Paying down delinquent accounts wont remove missed payments from your report. But it can make you look better to creditors.

- Look for inaccuracies. Sometimes information reported to the credit reporting agencies isnt quite right or is incomplete. The credit reporting agencies make it easy for you to dispute these inaccuracies. And remember, credit bureaus are just the messengersits up to you to let them know one of your creditors reported inaccurate information.

And remember, pay your bills.

Use A Credit Build Card To Build A History & Restore Past Issues

You need to build a decent recent history to show that you can be responsible with credit and use it well. The catch-22 is that as you have a poor credit history, getting credit is difficult.

The solution is to grab a credit rebuild card. See the full guide for full help, how to protect yourself, and top picks.

This is a card with a hideous rate, say 35% APR, which accepts people with a poor credit history. Yet provided you repay the card IN FULL each month, preferably by direct debit, and never withdraw cash, you won’t be charged interest, so it’s no problem.

Then just spend say, £50 a month on the card, and provided you have no other issues after six months or so, things should start to improve. After a year, it should make quite a difference.

Obviously, if you already have a credit card you aren’t using, then you can do the same on that without the need to apply for a new one.

You May Like: Itin Number Credit Report

Not Eligible To Vote In The Uk Add Proof Of Residency

If you aren’t eligible to vote in the UK so can’t be on the electoral roll , send all three credit reference agencies proof of residency and ask them to add a note to verify this. This should help you get credit.

Some foreign nationals are allowed to vote in local elections, and therefore can be registered on the electoral roll in the normal way.

Update: Despite the UK having left the EU, and the so-called transition period having ended, the rules described above about EU citizens and their right to vote in UK local elections remain the same.

Raising Your Score Depends On Your Starting Point

Your credit score isnt just a judgment call its determined through a formula considering five different factors. Listed in order of importance, each of the following factors can raise or lower your :

- Payment history

- New credit

With a history of consistent payments being the most influential factor, a great opportunity is offered to those new to credit cards. Every month you pay your cards bill on time will bump your credit score up, so set a routine and you can grow your creditworthiness quickly as long as you can avoid missing a credit card payment.

Your credit utilization ratio is how much of your total credit limit you use. Typically, you want to keep this figure between 10 and 30 percent to stay in good standing. Opening up new card accounts or getting a credit limit increase can help build credit by decreasing this ratio, but that isnt all it takes. By making the effort to pay off your outstanding balances youll help your credit utilization, thus improving your credit score.

The length of credit history is fancy-talk for the average age of your credit accounts. The longer the account has been open, the better, so you may want to avoid closing an old account to keep yourself out of poor credit. There are cases where canceling a credit card account is the right move, but as a general rule youll benefit from keeping old ones open.

Learn more:How to check your credit score

Recommended Reading: Credit Report With Itin Number

Can You Raise Your Credit Score By 200 Points

If you monitor your credit scores, you may have noticed that they fluctuate on a regular basis. It’s normal to see your credit scores rise or drop by a few points from one month to the next, but making a huge improvement in your scores won’t happen overnight.

If you’re looking to raise your score by a large number, know that your unique credit history makes it impossible to guarantee a certain increase over a set time period. Any promises to increase your score by a specific number should be viewed with caution.

However, you can take steps to improve your credit score by learning about the issues that are bringing it down and adopting new habits that can put you on a path to a higher score.

Keep Credit Cards Open

If you’re racing to improve your credit profile, be aware that closing credit cards can make the job harder. Closing a credit card means you lose that cards credit limit when your overall credit utilization is calculated, which can lead to a lower score. Keep the card open and use it occasionally so the issuer wont close it.

You May Like: What Is Cbcinnovis On My Credit Report

Estimating Credit Score Changes

While youre waiting for your credit report and score to update, you can use a credit score simulator to estimate how your credit score might change. Credit Karma and myFICO both offer credit score simulators that can show how your credit score might change if the information on your credit report changes, like if you pay off an account or open a new loan, for example.

Some Defaults Or Missed Payments & Declined Applications

Defaults or missed payments will usually stay on your report for six years. If you close an account, the missed payments could stay on the account for six years after the closure, so keep that in mind. Bankruptcy is wiped six years from the date you’re declared bankrupt, provided it’s been discharged.

And when it comes to declined applications, lenders can only see whether you’ve applied for credit elsewhere, not whether you’ve been accepted or declined. However, they may be able to guess by examining the credit accounts you have open and when they were opened.

If you’ve attempted to, or have successfully reclaimed PPI or bank charges, it won’t appear on your credit files. If you’ve had bank charges, the penalties will show on your records.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Pay Down Debt Strategically

OK, lets build on what you just learned about utilization ratios.

In the above example, you have balances on more than one card. Note that Card A has a 42% ratio, which is high, and Card B has a wonderfully low 10% ratio.

Since the FICO score also looks at each cards ratio, you can bump up your score by paying down the card with the higher balance. In the example above, pay down the balance on Card A to about $1,500 and your new ratio for Card A is 25% . Much better!

How Can A Credit Repair Company Help

A credit repair company can help you remove negative items from your credit report, advise you on the best course of action, monitor your reports, and write those dispute letters on your behalf.

Here are 3 companies we recommend that provide a free consultation. We suggest you call all three to see what they can offer you and compare fees.

Read Also: Does Klarna Report To Credit

Your Credit Report Dictates The Product And Rate You’ll Get

In the past 10 years the credit landscape has almost completely shifted towards ‘rate for risk’. This means almost every credit provider on the market uses your credit file to not only dictate whether they’ll provide you with credit, but also what interest rate you’ll get.

The most obvious way this manifests itself is in representative rates on loans.

Here, only a minimum of 51% of accepted customers must get the rate advertised. They might be advertising a 6% rate . But you could be accepted and offered a 40% interest rate instead, because of a poor credit score.

It applies to other products too. Some 0% credit cards give you a shorter 0% period if you’ve got a poor credit history , others will simply offer you a different product to the one you’ve applied for. This is why it’s so important to manage your creditworthiness.

How To Get A Credit Score Of 700 Or 800

5-minute readJune 07, 2021

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

A credit score is a three-digit number that can have a big impact on your life. While a good credit score can open many doors, a bad credit score could leave you in a lurch.

Luckily, credit scores arent static numbers, and if you can figure out how to get a credit score of 700 or 800, you can enjoy some of the best rates and terms on financial products like mortgages, car loans, credit cards and personal loans.

If you dont know where to start, were here to help. Read on to learn more about the benefits of knowing how to increase your credit score and the best tips for doing so.

You May Like: Does Paypal Credit Report To Credit Bureaus