Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

How To Get Car Financing With Your Current Score

Car financing is available, even to those with not-so-perfect credit. If you have doubts about your credit score and credit history, there are a few steps that can be taken to improve your chances of getting approved for a loan in San Diego, such as:

- Highlight the Positives: Even if an applicants , a lender might be lenient depending on the situation. If an applicant has an outstanding credit card balance but has always kept up with their car payments, they may gain some favor.

- Bring Proof of Employment & Address: If you can show proof of employment and proof of address, youll get some extra plus points, especially if youve held your job and lived at your address for at least six months.

- Have Collateral: Do you own a home or are you able to make a down payment of at least 25%? If so, theres a good chance youll qualify for auto financing, as well as a .

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

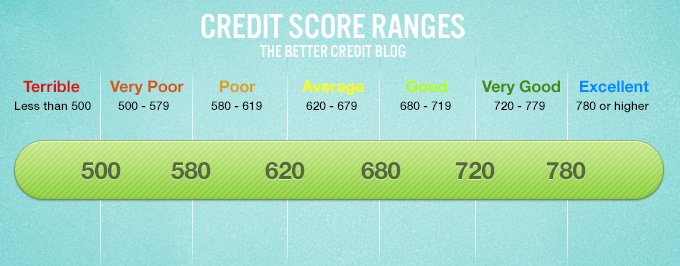

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Dealing With Negative Information Which Impacts Your 718 Credit Score

If your credit score is a negative in your life, then there are several things you can do if you want to improve it.

Firstly, you can enhance your 718 credit score by simply paying all your bills on time. Making late payments, partial payments or trying to negotiate with lenders all work to drive your score lower. To make sure you can pay your bills on time you should ensure that you have a monthly budget. Stick to it, pay your bills first and your credit score will improve over time.

In addition to paying your debts on time, taking on as little debt as possible in the first place will keep your credit score in good health. Lenders can only lend you so much. If you have a lot of debt your repayment capacity will decrease and your credit score will follow. Again, budget so you do not need to borrow.

If you do need to borrow then make sure you pay off the debt as quickly as possible. Dont just make the minimum repayment, this again will aid an increase in your credit score.

Another aspect of your 718 FICO score is one not many people know about. Every time you apply for credit that application is logged.

The more applications you make the more it looks like you cannot manage your finances and always need a constant stream of loans to meet your day to day obligations. So again, if you do need credit, only apply when your going to draw it down and make as few applications as possible.

What Is The Average Credit Score In Canada

While credit scores in Canada range from 300 – 900, the average is around 650, according to TransUnion, though it varies from province to province. Once you’ve reached a credit score of 650 or higher, you’ll be able to qualify for more financial products. A credit score below 650 is going to make it hard to qualify for new credit, and anything you are approved for will likely come with very high-interest rates.

Do you know your credit score? You can use Borrowell to get your credit score in Canada for free. With Borrowell, you’ll get weekly credit score updates, see exactly what’s impacting your credit score, and get personalized tips on how to improve your score. You can also find your free credit score here.

Check out this infographic that shows the average credit scores in Canada:

Also Check: What Day Does Opensky Report To Credit Bureaus

Learn About The Average Credit Score In The Us Including By Age And State

The average FICO® credit score in the U.S. was 710 in 2020. Thatâs according to data from an annual study by Experian®.

The Experian 2020 Consumer Credit Review uses FICO scores nationwide to determine averages by age, state and more. FICO is a credit-scoring company that provides some of the most commonly used scores in America. Read on for more of the studyâs findings and see what they mean for you.

Wait Wait Then Wait Some More

You simply have to be patient. Even when you make all the right decisions, itll take some time to see results.

Part of your score relates directly to the length of credit history. But even on more important credit reporting factors such as your payment history and credit utilization ratio, time is your friend.

This is especially true if your past credit behavior has been questionable. With each passing year, your past bad decisions have less of an impact on your current credit information.

So be patient and continue making good decisions to establish a positive credit history, even if you dont see immediate results.

Keep making your payments on time and make sure you dont get any negative entries like a collection account. And let your current credit accounts grow older. The older your accounts, the better your credit score can be.

For example, my oldest credit card is 15 years old, and my average credit card is 8 years old.

Learn More:

Recommended Reading: Does Paypal Credit Report To The Credit Bureaus 2019

A 718 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates and better terms. You might also be approved for credit cards with valuable sign-up bonuses and attractive rewards programs.

Why do these three-digit numbers matter so much to your financial well-being? Well, lenders use your as a gauge of how likely you are to pay back any money they lend to you. So, a good credit score can give a lender the confidence to lend you money at terms favorable to you. It might not be enough to unlock the absolute best financial products or terms, but its a milestone indicating youre on the cusp of excellence.

People often talk about their credit score as if they have only one, so you might be surprised to learn that there are many different credit scores out there. A credit score is based on a credit-scoring model, which differs depending on the company that created it, like VantageScore or FICO. To generate your credit scores, these models can use data from different sources: Equifax, Experian or TransUnion .

Each model has its own standard for what qualifies as good. And to make matters even more confusing, its often not clear which credit score, model or bureaus data a particular lender is using and what other factors the lender may look at beyond scores.

What’s So Good About A Good Credit Score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments appear in the credit reports of 29% of people with FICO® Scores of 718.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

Recommended Reading: How Accurate Is Creditwise Credit Score

What’s The Difference Between A Fico Score And A Vantagescore

FICO is a leading analytics company. VantageScore is a collaboration between the three CRAs to provide greater credit score consistency.

FICO scores consider five categories from your credit reports:

- 580 to 669: fair

- 579 and below: poor

Just remember that everyone’s financial situation is unique. There’s no magic number that will guarantee you better loan rates and terms.

How The Fico Score 9 Is Different

-

Medical debt. Health care-related debt has less of an impact on the score than other types of debt. About 43 million Americans around 1 in 5 who have credit reports have medical debt, according to the Consumer Financial Protection Bureau. FICO’s latest scoring model gives that debt less weight than, say, credit card debt.

-

Paid collections.Collections accounts that have been paid in full are disregarded in score calculations. The newest versions FICO 10 and FICO 10T also disregard paid collections).

-

Rent payments. If rent payments are reported, they are part of the score calculations. Before now, rent payments were added to credit reports but weren’t used to calculate a FICO credit score .

Also Check: Does Carmax Accept Bad Credit

Use Apps To Improve Your Score

There are reputable personal finance apps that promise to improve your credit score within six months for a low monthly fee. These apps and tools work by using deposited cash to issue you a small loan, and then they report monthly repayments on these loans to major credit bureaus. These regular, on-time payments will improve your credit score. There is usually a monthly fee for this service.

What Is A Good Credit Score And Tips To Maintain It

Get answers to commonly asked questions related to the credit score and credit reports

If you are wondering what exactly constitutes a good credit score and how it is calculated, we have all the details for you. Read on to find out everything about a good credit score and the various benefits it offers.

About Good Credit Score

Also Check: Does Paypal Credit Report To Credit Bureaus

Can You Get A Personal Loan With A Credit Score Of 718

Most lenders will approve you for a personal loan with a 718 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

Average Credit Score By Age

Millennials have an average credit score of 680, while baby boomers have an average credit score of 736.

The average FICO Score tends to improve with age.

The average credit scores coincide with the financial situations facing younger generations. Its usually around the millennial age range that major expenses and debt begin to rack up such as weddings and first mortgages, among others. Despite their ages, millennials hold an average of $4,322 in .

The other age group whose average credit score skews lower is Generation Z . A contributing factor to this is the limited access to credit this age group faces. Following the 2009 CARD Act, it became significantly harder for 18- to 21-year-olds to open new credit card accounts. As a result, many young adults dont begin building a credit file until later in life driving averages down.

Americans of all ages owe debt. In fact, U.S. household debt spiked to $14.35 trillion in the third quarter of 2020 the latest available data amid the coronavirus pandemic, according to the Federal Reserve Bank of New York. And that debt is growing while more people remain out of work. The federal unemployment rate was 3.5% in February 2020 before spiking to 14.8% in April 2020.

Also Check: Does Klarna Help Build Credit

How To Build Up Your Credit Score

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good or Exceptional credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Consider credit score monitoring. Continually tracking your FICO® Score can provide good reinforcement for your score-building efforts. Marking steady upward progress is good incentive to maintain healthy credit habits. And monitoring will also alert you to any sudden credit-score drops, which may be a sign of unauthorized activity on your credit accounts.

Avoid high credit utilization rates. High , or debt usage. The FICO® scoring system bases about 30% of your credit score on this measurementthe percentage of your available credit limit represented by your outstanding payment balances. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with good credit scores have an average of 4.5 credit card accounts.

Tips To Get A Perfect Credit Score

The first thing to keep in mind is that obtaining a perfect credit score takes time.

Its rather easy to remove negative items from your credit report and get a better score, but a perfect score is another story.

Now, assuming you dont have any negative items on your credit report like late payments or a collections account, lets get into the more advanced credit behavior youll need to learn and put into practice.

Keep in mind that all of the steps outlined below are based on my personal experience, not random advice Ive read on the internet.

You May Like: Aargon Debt Collector

How To Keep On Track With A Very Good Credit Score

To achieve a 798 credit score, you’re probably disciplined in your financial habits, with solid debt-management skills. You can still increase your score, however, and of course you’ll want to avoid losing ground. To those ends, it’s a good idea to keep an eye on your score, and avoid behaviors that can bring it down.

Factors that affect credit scores include:

. To determine your on a credit card, divide the outstanding balance by the card’s credit limit, and then multiply by 100 to get a percentage. Calculate the utilization for all your cards, and then figure out your total utilization rate by dividing the sum of all your balances by the sum of all your borrowing limits . You probably know credit scores will slip downward if you max out your credit limit on one or more cards by pushing utilization toward 100%. You may not know that most experts recommend keeping your utilization rate below 30% for each of your cards and for all your revolving accounts overall. Credit usage is responsible for about 30% of your FICO® Score.

Timely bill payments. This may seem obvious, but there’s no greater influence on your FICO® Score: Late and missed payments hurt your credit score, and on-time payments benefit your score. Payment history accounts for as much as 35% of your FICO® Score.

. The FICO® scoring system generally favors borrowers with a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

Improving Your 718 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ 885-2800, or chat with them, today â

You May Like: How To Report To A Credit Bureau Landlord

Use Your Credit Card But Never Max It Out

Im not the type of person who buys everything on my credit card. I do use one of my credit cards a lot, however.

Ive found I need to use the credit card a lot to get the highest FICO score possible. The caveat is that you should never max out the card. In fact, I recommend you pay it down every month and never get even close to the credit limit.

As a general rule, you should try to keep your . In other words, if you have a credit card with a total credit limit of $1,000, never rack up more than $250 worth of charges on the card.

This is why its also important to have a credit card with a high limit. For example, my main credit card has a credit limit of $30,000, and I never get even close to 25% utilization.

If you dont have a card with a high enough limit to keep you comfortably under 25% utilization, give the creditor a call and request that they up the credit limit.