Strategies That Will Get You A Better Credit Score

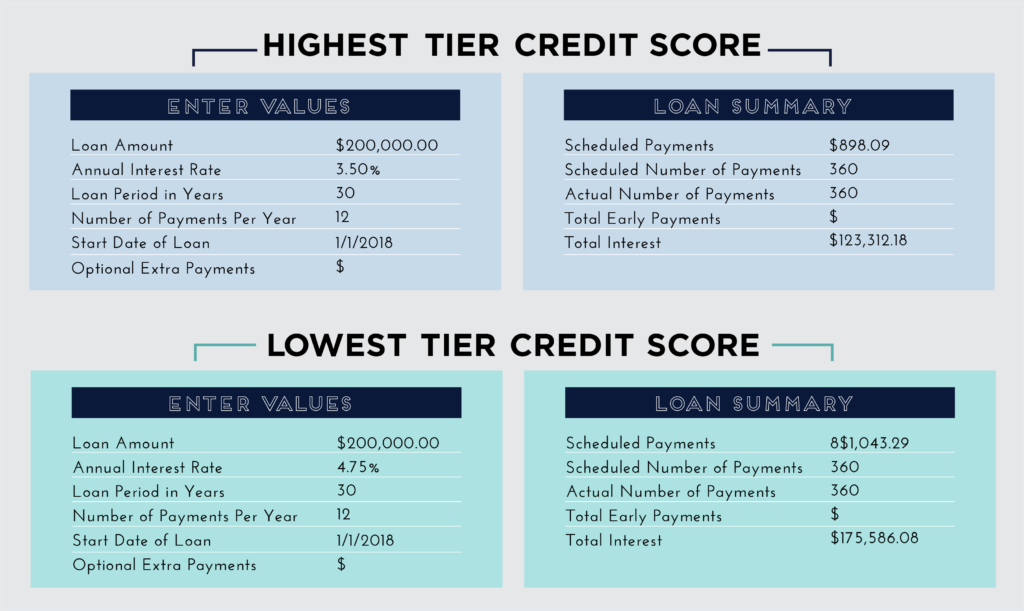

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow. If you’d like to improve your credit score, there are a number of simple things you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

Become A Credit Card Authorized User

If you’re looking to quickly establish your credit history — and, thus, your credit score — being a could help. In some cases, becoming an authorized user on an older account can also help improve your credit even if you already have a credit history. Not everyone looking at how to build credit fast already has a credit history.

Basically, authorized users are people who are added to someone else’s credit card account. The authorized user gets a card in their name and can make purchases with the account. Unlike the primary cardholder, authorized users are not legally obligated to make payments on the account.

Many credit card issuers will report the credit card account activity to the credit bureaus for both the primary account holder and the authorized user. As the authorized user, your credit score may benefit from both the credit history of the account and the credit limit.

If you’re starting from nothing, this is a great option for how to build credit fast. The important thing to note is that this only works if the credit card account is in good shape. Late payments or high balances can hurt both the primary cardholder and any authorized users.

Avoid Taking On Too Much Debt At One Time

The number of loans you take in a fixed period of time should be minimal. Repay one loan and then take another to keep your credit score from crashing. If you take multiple loans at once, it will show that you are in an unforgiving cycle where you have insufficient funds. As a result, your credit score will fall further. On the other hand, if you take a loan and repay it successfully, it will boost your credit score.

Additional Read:4 top factors that led to the growth of NBFCS in India

Recommended Reading: How To Get Credit Report With Itin Number

Why Do I Need To Build My Credit Score

A good can help increase your chances of successfully applying for a mortgage or loan. Itcan also improve your likelihood of being offered lower interest rates for repayments, or a higherspending limit on credit cards.

A low score may negatively impact your chances of being offered credit, as well as affecting the ratesand terms of the loan – which can be a financial obstacle for the future.

Learn more about what factorscan positively and negatively affect your , or you can access your Equifax Credit Report & Score to review your and get an indication of you creditworthiness free for 30days and £7.95 per month afterwards.

Related Articles

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

Also Check: What Is Syncb Ntwk On Credit Report

Be Wary Of New Credit

Opening several credit accounts in a short period of time can cause you to appear risky to lenders and, in turn, negatively impact your credit scores. Before you take out a loan or open a new credit card account, consider the effects it could have on your credit.

Note, however, that when you’re buying a car or looking around for the best mortgage rates, your inquiries may be grouped together and counted as only one inquiry for the purpose of credit scoring. In many commonly used scoring models, recent inquiries have a greater effect than older inquiries, and they only appear on your credit report for 24 months.

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

Also Check: How Accurate Is Creditwise Credit Score

Who Has Access To Your Credit Reports

Although not many people can access your credit report, a few individuals and institutions who legitimately requires it may have access to it. If a company has a genuine business requirement with you, it is safe to assume that they have access to your credit report and score. Hereâs a list of some of the institutions and individuals that have access to your credit report.

Banks â Quite naturally, banks can gain access to your to gauge your credit worthiness. You donât necessarily have to have a credit card for banks to have access to it. Your credit worthiness may be examined if youâre applying for a loan or even opting for an overdraft facility as this is considered to be a line of credit as well.

Anyone willing to loan you money will have to determine your credit worthiness before they put their faith in you. Credit card issuers and mortgage lenders are amongst a few that fall in this category. Determining your credit worthiness helps the creditor gauge if youâre capable of repaying the loan and helps the creditor determine the terms and conditions of the same. Generally, the better your credit score, the more likely you are to get a loan approved and attain favourable terms when it comes to repayment and interest rates.

Insurance Companies â Statistically, it shows that individuals with poor are more likely to file a claim. Insurance companies often measure your credit worthiness to determine how much they need to charge you for a new policy.

Limit Loan Applications To A Short Time Period

Lots of hard inquiries in a short time could be an indication to lenders that you’re searching for lines of credit you won’t be able to pay. Smart borrowers, though, will apply for a few loans of the same type to compare rates. For that reason, credit scorers tend to treat multiple hard inquiries of the same loan type made around the same time as one, so submit applications within a short time frame. That will prevent your credit score from suffering.

Also Check: 1?800?859?6412

Estimating Credit Score Changes

While youre waiting for your credit report and score to update, you can use a credit score simulator to estimate how your credit score might change. Credit Karma and myFICO both offer credit score simulators that can show how your credit score might change if the information on your credit report changes, like if you pay off an account or open a new loan, for example.

Set Up Automatic Bill Payments

The most important factor in your credit score is payment history. Help protect your score from the adverse effects of a missed payment by putting your bills on autopay. Make sure you have enough money in your checking account to cover each bill every month to avoid an overdraft. When you know you won’t have to deal with a sudden score dip after a forgotten bill, you can focus on other ways to improve credit.

Don’t Miss: Is Chase Credit Journey Accurate

How To Manage A Credit

Pick the right type of credit-builder loan. Look for one with a payment you can comfortably afford. Stretching your budget will only raise your risk of missing a payment and damaging your score. NerdWallet recommends choosing a manageable loan amount and a term no longer than 24 months. Choose a loan that reports payments to all three major credit bureaus.

Make payments on time. If you pay the loan as agreed, you build up good data on your credit reports. But a payment more than 30 days late will also go on your reports and can seriously hurt your score.

Monitor your credit score. Use a personal finance website such as NerdWallet to get a free credit score. NerdWallet updates your score weekly watch the overall trend of your score, but dont obsess over tiny movements.

Pay Down Your Revolving Credit Balances

If you have the funds to pay more than your minimum payment each month, you should do so. Chipping away at your revolving debt can have a major impact on your credit score because it helps to keep your credit utilization rate low.

“How quickly depends on how quickly the individual creditors report the paid balance on the consumer’s credit report.” Triggs says. “Some creditors report within days of the payment, some report at a specific time each month.” Credit card companies typically report your statement balance to the monthly, but this could vary depending on your issuer. You can call or chat online with your card issuer to find out when they report balances to the bureaus.

The sooner you can pay off your balance each month the better. You can also make multiple payments toward your balance throughout the month so it is easier to track your spending, and it keeps your balance low. And although it helps to even pay off a portion of your debt, paying off the entire balance will have the biggest and fastest impact on your credit score.

Also Check: How To Get Credit Report Without Social Security Number

The Better Story How To Increase Credit Score Fast

Fast forward to this year

I got a credit card

Started rebuilding my credit

Both of us landed new remote jobs

And I came up with a financial plan for our family.

I wont go into the whole financial plan in this post, but one of the goals was to help hubby increase his credit score.

So How did we do it?

I added him as an authorized user to one of my credit cards. We checked his credit score 1 week later, and it was 150 points higher on Transunion. 50 Points higher on Equifax. Woot!

Surprisingly, it was that simple.

DISCLAIMER This strategy isnt for everyone

Honestly outside of my parents and my husband, there isnt anyone else Id really consider using this strategy with. You may not have either of those as an option right now. If not, no worries. This strategy may not be the best option for you, but there are plenty of other ways to increase your credit score fast. Im researching and experimenting with different methods and Ill be sharing my wins and losses right here, weekly. So subscribe for updates.

Why this strategy worked to increase his credit score fast

Your available credit / credit utilization, makes up about 30% of your credit score.

Simply put, the more credit you have available to use, the better. So having a credit card with a low balance or no balance is great for your credit.

That process was slow and steady and it required patience. Once Id put in the groundwork though, it made it easy for us to see a huge increase in hubbys credit score

How Can I Raise Credit Score 20 Points Quickly

In order to achieve this small spike quickly, you want to choose a tactic that wont raise your credit score at all, like to apply for another credit card.

The hard inquiry alone can drop score temporarily, which defeats your purpose. Same as getting a non-revolving credit line, like a mortgage loan.

As you can see above, those hard inquiries can drop your score by 10 points.

Still, you want to attack one of the rules that affects your credit the most:

- Payment History

You May Like: Does Klarna Report To Credit

Making Full Repayments On Time

When you take out credit, missed payments are recorded on your . This may show lenders thatyoure financially stretched, or that youre having difficulty managing debt, which maynegatively affect your chances of applying for credit in the future.

Making your repayments in full and on time can help prove to lenders that you are sensible with yourmoney and can pay back what you borrow. If lenders see evidence that you have previously managed yourcredit accounts well, this may also help improve your .

Can I Raise My Credit Score By 100 Points

The best way to increase your credit score is to pay your cards on time, in full, every month. You can easily increase your credit score 100 points over six to 12 months this way.

That said, if you’re someone who’s searching the internet for “How to raise credit score 100 points?” you likely want to know how to build credit fast. In this case, the results will depend on how your credit looks when you start.

If your score was low due to errors, disputes could increase your score up to 100 points. If you have high utilization , then huge debt payments could see a 100-point improvement. How much your score actually increases will depend on your overall credit profile.

For those without credit, becoming an authorized user on a card with a long, positive credit history is the only fast way to build credit. Otherwise, it takes six months to even get a credit score.

Don’t Miss: Credit Check Without Ssn

How Long Does It Take To Rebuild Credit

It’s hard to say with certainty how long it takes to rebuild credit because each person’s credit history is different. If you’ve had credit difficulties in the past, how long it will take to rebound depends in part on the severity of the negative information in your credit report and how long ago it occurred. While some actions can have an almost immediate effectsuch as paying down credit card balancesothers may take months to make a significant positive impact.

If you’re disputing information in your credit report you believe is fraudulent or inaccurate, the investigation can take up to 30 days. If the credit reporting agency finds your dispute valid, the information will be removed from your credit report, and your score will reflect that change as soon as it’s calculated again.

If you’re making payments or reducing your credit card balances, don’t worry if your credit report isn’t updated right away. Creditors only report to Experian and other credit reporting agencies on a periodic basis, usually monthly. It can take up to 30 days or more for your account statuses to be updated, depending on when in the month your creditor or lender reports their updates.

Responsibly Add To Your Credit Mix

Lenders look for a mix of accounts in your credit file to show that you can manage multiple types of credit. These include installment loans, for which you pay a fixed amount per month, and revolving credit, which comes with a limit you can choose to charge up to . If you only have one type of credit in your file, adding something different could improve your credit mix. Credit mix accounts for just 10% of your FICO® Score, however, so don’t apply for credit simply to improve your score. That could put you at risk of taking on debt you can’t repay.

Don’t Miss: How Accurate Is Creditwise Credit Score

Don’t Close Your Cards

Once you’ve paid off a card, it can be really satisfying to cut it up! But don’t close your account. Keeping your credit card account open but unused helps give you a long, established credit history, and can improve your overall credit utilization ratio. . Although sticking the credit card in a drawer has it benefits you may also be able to request a credit card freeze. You may be familiar with a credit card freeze since it used whenever you report your credit card lost or stolen. In this case, you may use a credit card freeze if you want the card open in your name but don’t want or need to use the credit card for purchases.

Get Higher Credit Limits

You can also ask your creditors for higher credit limits. When the number is higher but your balance doesnt go up, it lowers the total amount of credit that you use.

This factor can also improve your credit.

This option is good if you earn more money now than when you first opened the account. However, youll want to make sure that you dont start maxing out your credit after you get the limit raised.

If you arent sure how credit works, I recommend reading The School of Credit: Learn & Master the 12 Levels of the American Credit System found on Amazon.com.

This book, written by author Flame Newton, covers all of the essentials youll want to know about credit. The text contains information you could only find in special seminars dedicated to credit scores, making it well worth the read.

Don’t Miss: Does Paypal Report To Credit Bureaus