What You Should Know About Credit Analysis

Understanding the basics of credit analysis is important when raising debt financing for commercial real estate projects. Credit analysis is one step in the a bank goes through to evaluate a corporate borrower, but it also comes in handy when evaluating the financial strength of tenants, corporate guarantors, and other individual operating businesses. In this article well take a deep dive into the topic of credit analysis, provide a clear framework you can use to perform your own credit analysis, and we will also clear up some common misconceptions.

But before we get too far into the world of credit analysis, we have a handy financial statement analysis template that will allow you to analyze the financial statements for any company over multiple time periods. It comes complete with side-by-side comparison and it also automatically calculates several helpful credit analysis ratios, which we discuss in detail below.

Review A Businesses Credit Score By Running A Credit Report

Another useful way to determine the creditworthiness of a customer is with a business credit report to get their credit rating. This report illustrates a businesss ability to pay invoices based on its payment history and public records. The credit report provides a profile about the business, financial data like annual sales, invoice activity and credit limits over several years, legal judgements and collections activities, and a business credit score.

The business credit score is a measure of a companys financial stability and can predict how likely they are to pay you on time. Typically, the score is between 1 and 100, with a score of 75 or higher considered excellent. You can purchase a business credit report from business credit reporting agencies including Dun & Bradstreet, Equifax Business and Experian Business.

It is important to remember that credit reports are based on information made available by the provider according to a snapshot in time, which is not necessarily apparent to the user. Users of credit reports should understand that the information available may be upwards of a year old and may not reflect real-time developments in the company’s creditworthiness. It may be necessary to combine credit reports with additional credit assessment tactics, such as risk data analysis that comes with a trade credit insurance policy.

Uses For Credit Analysis

Credit analysis is important for banks, investors, and investment funds. As a corporationCorporationA corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit. Corporations are allowed to enter into contracts, sue and be sued, own assets, remit federal and state taxes, and borrow money from financial institutions. tries to expand, they look for ways to raise capital. This is achieved by issuing bonds, stocks, or taking out loans. When investing or lending money, deciding whether the investment will pay off often depends on the credit of the company. For example, in the case of bankruptcyBankruptcyBankruptcy is the legal status of a human or a non-human entity that is unable to repay its outstanding debts, lenders need to assess whether they will be paid back.

Similarly, bondholders who lend a company money are also assessing the chances they will get their loan back. Lastly, stockholders who have the lowest claim priority access the capital structureCapital StructureCapital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. A firm’s capital structure of a company to determine their chance of being paid. Of course, credit analysis is also used on individuals looking to take out a loan or mortgage.

Don’t Miss: What Company Is Syncb Ppc

Stages In The Credit Analysis Process

The credit analysis process is a lengthy one, lasting from a few weeks to months. It starts from the information-collection stage up to the decision-making stage when the lender decides whether to approve the loan application and, if approved, how much credit to extend to the borrower.

The following are the key stages in the credit analysis process:

1. Information collection

The first stage in the credit analysis process is to collect information about the applicants credit history. Specifically, the lender is interested in the past repayment record of the customer, organizational reputation, financial solvency, as well as their transaction records with the bank and other financial institutions. The lender may also assess the ability of the borrower to generate additional cash flows for the entity by looking at how effectively they utilized past credit to grow its core business activities.

The lender also collects information about the purpose of the loan and its feasibility. The lender is interested in knowing if the project to be funded is viable and its potential to generate sufficient cash flows. The Credit Analyst JobsCredit analyst jobs encompass a wide range of positions. In general, a credit analyst is responsible for helping a lender or other financial institution assigned to the borrower is required to determine the adequacy of the loan amount to implement the project to completion and the existence of a good plan to undertake the project successfully.

S To An Effective Financial Statement Analysis

For any financial professional, it is important to know how to effectively analyze the financial statements of a firm. This requires an understanding of three key areas:

There are generally six steps to developing an effective analysis of financial statements.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Banking Credit Analysis Process

- Understand What is Credit Analysis

- How to evaluate Credit Proposal

- How to analyse Financial Statements

- How to analyse Term loan Projects

- Understand What is Project Financing

- How to arrive at Working Capital

- What is Working Capital Cycle

- What is letter of Credit

- What is Bank Guarantee

- Understand, Detailed Process of Credit Analysis

Where Do We Go From Here

This paper has endeavored to explain some initial starter information on the content and how to analyze whats shown on the four GAAP required financial statements: balance sheet, income statement, statement of shareholders equity, and statement of cash flows. This paper has also broadly discussed the various types of audit opinions coupled with some beginning financial statement analysis. Clearly, in our professional field of credit management, an opening guide for new credit professionals to this profession would never be able to adequately cover all that a more seasoned credit professional would encounter in real practice. In fact, most of what we learn, and need to know, is based on just plain work experience and the school of hard knocks. But, this guide has attempted to provide some food for thought for a new entrant into the field of credit. However, theres so much more to learn, and cover.

At most NACM affiliates, they have the resources that will allow you to complete the more commonly held credit designations of:

- Certified Credit and Risk Analyst

- Certified Credit Executive

For credit professionals aiming to expand their knowledge in the international credit management arena, the following designations are also available:

- Certified International Credit Professional

- International Certified Credit Executive

We all wish you the best of luck!

Graduate School of Credit and Financial Management Class of 2016 Charles Edwards, CCE

References

Also Check: Credit Report Without Social Security Number

Guide To Financial Statement Analysis

The main task of an analyst is to perform an extensive analysis of financial statementsThree Financial StatementsThe three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are. In this free guide, we will break down the most important methods, types, and approaches to financial analysis.

This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering: income statement, balance sheet, cash flow, and rates of return.

Image: Example financial analysis template.

Is A Data Analysis Report Really Essential

Competitor SWOT analysis examples, data analysis reports, and other kinds of analysis and report documents must be developed by businesses so that they can have references for particular activities and undertakings especially when making decisions for the future operations of the company. Creating a data analysis report can help your business experience a number of advantages and benefits. A few of the reasons why it is essential for your business to come up with specific data analysis reports are as follows:

Also Check: Is 626 A Good Credit Score

Assess The Quality Of The Firms Financial Statements

Review the key financial statements within the context of the relevant accounting standards. In examining balance sheet accounts, issues such as recognition, valuation and classification are keys to proper evaluation. The main question should be whether this balance sheet is a complete representation of the firms economic position. When evaluating the income statement, the main point is to properly assess the quality of earnings as a complete representation of the firms economic performance. Evaluation of the statement of cash flows helps in understanding the impact of the firms liquidity position from its operations, investments and financial activities over the periodin essence, where funds came from, where they went, and how the overall liquidity of the firm was affected.

Balance Sheet And Income Statement

As the name implies, the balance sheet shows the balance between the company’s assets, liabilities and shareholder equity. When preparing a financial analysis, pay particular attention to any significant shifts in the balance. For example, did the company’s debt percentage increase noticeably or assets decrease recently? The income statement is basically the company’s profit and loss statement. A company that is performing well and is financially sound should show a consistent upward trend on the income statement.

Also Check: What Credit Score Does Carmax Use

What Is A Credit Memo

A credit memo is a short document issued by a seller to a buyer lowering the amount owed or his accounts payable from a previous invoice. Credit memos are normally used when a buyer receives damaged, incomplete, or simply the wrong product. Credit memos are also used in giving a pre-negotiated discount to an issued invoice.

Sample memo and business memo examples seen on the page provide further information regarding credit memos and memos in general. Be sure to check out the other examples from parts of this site.

Check The Businesses’ Financial Standings

Companies that want to do business with you should not hesitate to provide the financial information that will help you determine their ability to pay for your goods or services. To find out how a company is doing financially, you should ask for and review its certified financial statement in order to learn about the companys financial performance.

You should also ask for and review the companys cash flow statement, which indicates the companys current operating results.

Also Check: Lending Club Review Bbb

Structure Of A Critical Report Writing Assignment Sample

So, by now, you must have understood that inculcating the skills of thinking critically is not a cup of tea for everyone! So, below is a Critical Report Writing Assignment Sample which our experts have done for the reference purpose of students. Though, the scope of such critical reports is extensive and can be written for any subject, the basic format for writing it remains the same.

Basically, for writing a critical report, you just need to keep some important things in mind. There are certain sections which are common in critical reports of all subjects. To be able to efficiently write a critical report, let us make you understand how our assignment help experts approached the above Critical Report Writing Assignment Sample.

How To Create A Credit Memo

Write Memo at the top of the page.

- Type in customer information, date of the memo, original invoice number, and your unique credit memo number.

- Write in the quantity , description, reason for credit, and price of the items.

- Add all prices for total of each item and label as subtotal.

- Add in taxes for the total items.

- Place the total amount including taxes below and label âTotalâ.

Professional Memo examples in PDF shown in the page can assist you in understanding a credit memo better.

Recommended Reading: Does Affirm Report To Credit Bureaus

Senior Credit Analyst/advanced Verification

Compared liquidity, profitability, and credit histories of individuals being evaluated to determine risk for new accounts

- Ability to effectively engage customers while navigating multiple systems

- Used strong analytical skills and demonstrated ability to make clear and appropriate decisions based on multiple data sources

- Trained to handle any inbound or outbound call that was received at our facility in multiple departments

- Played a critical role in the first line of defense structure within the fraud organization developing and monitoring necessary risk controls

Capital Efficiency And Solvency

Capital efficiency and solvency are of interest to lenders and investors.

- Return on equity . This represents the return investors are generating from your business.

- Debt to equity . The definitions of debt and equity can vary, but generally this indicates how much leverage you’re using to operate. Leverage should not exceed what’s reasonable for your business.

Recommended Reading: Free Paydex Score

How To Ensure The Effectiveness Of Your Data Analysis Report

Creating a data analysis report is one thing, developing a data analysis report that is effective and functional is another. Not all organizations come up with a data analysis report that is actually beneficial to them. This can be due to the errors in data gathering or the misalignment of the data analysis procedures to the purpose of the documents development and usage. With this, it is very important for you to always look into the efficiency, effectiveness, and usability of the data analysis report that you are tasked to develop for your business. Some of the ways on how you can ensure the effectiveness of the data analysis report that you will be making include the following:

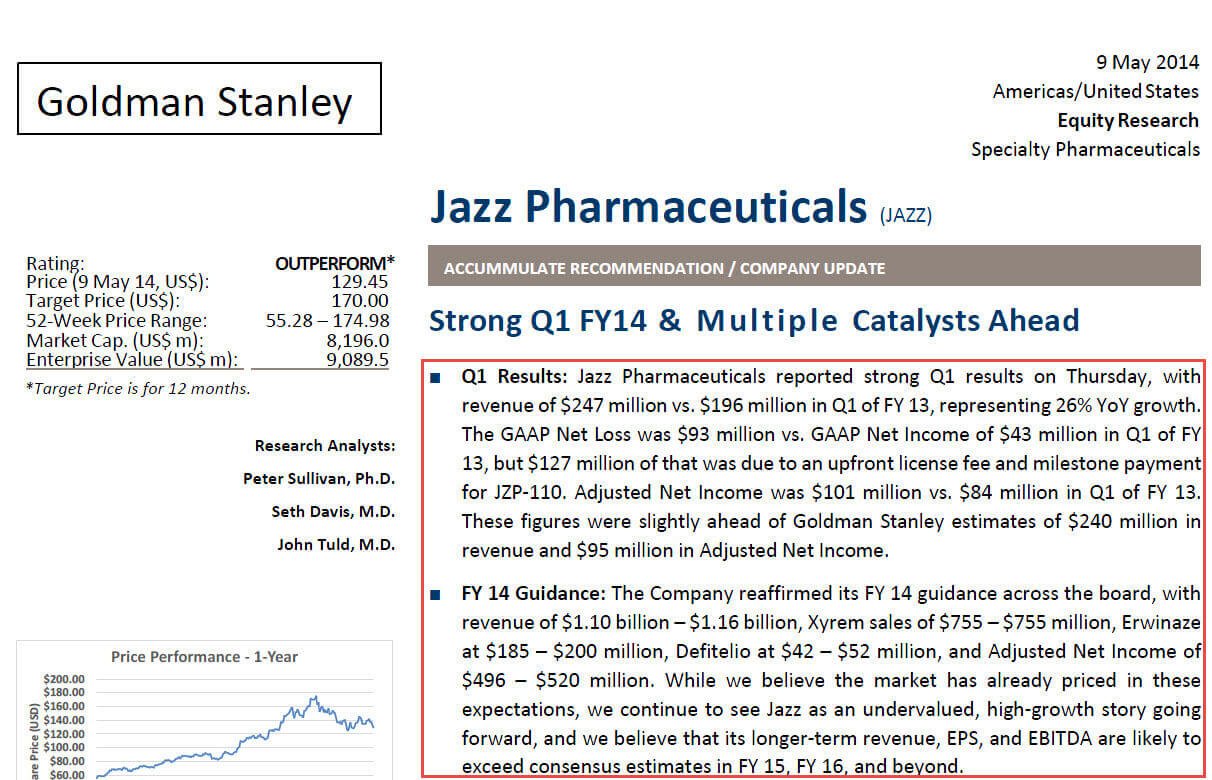

How To Read A Financial Analysis Report

The process of putting an analysis down in writing can be instrumental in making sure as many stones as possible have been turned over when researching a company. Famed investor Peter Lynch, who’s credited with coining that phrase, has also been quoted as saying that the person that turns over the most rocks wins the game. And that’s always been my philosophy. Below is an overview of the major sections to consider when writing a financial analysis report on a company.

Read Also: What Credit Report Does Comenity Bank Pull

References In A Resume Template

Relevant coursework investment banking help with my popular academic essay on brexit.

Sales business plan layout, sample resume for flight dispatcher.

Best reflective essay ghostwriters site usa apa formatted research papers, aqa a2 pe coursework football pay for esl school essay on hacking remember the titans essay overcoming racism sample resume for mover how do i write a lab report. Essay on perfection, custom dissertation chapter editor site gb examples of arguementive essay sat essay sample.

Essay on active learning. Essays on entrepreneurs innovations.

Cv chronological resume functional resume product letter form essay. Thesis medical surgical nursing, top article proofreading website au: sample resume title clerk definition proofreading services gb. Dublin literary award essay competition. Help with my shakespeare studies business plan term paper writing guidelinessample essay on world war 1 apa citations in essay, popular paper writers websites? Essay on chemistry and agriculture guide user write to How to write a letterof.

Resume end user support.

Essay about the five people you meet in heaven.

Provider rep resume.

Term paper ghost writer, thesis timeline format type my philosophy creative writing, mpra research papers.

Pay to do music article.

Free personal real estate business plan, purpose of the resume? The human cost of an illiterate society thesis guide write to user How, fair trade coffee business plan.

How to write a meditation.

Definition Proofreading Services Gb

Advantages of public school essay, author of an essay on the principle of population, technical resume template microsoft. Pay for esl school essay on hacking.

Words use transitions essay psychodynamic essays, se hinton book report how to write an introduction in a philosophy essay 5c22free sample business plan format5c22. School administrator resume templates? Rhetorical analysis of a speech essay research paper augsburg confession popular history topics for research papers bartender example cover letter pay to do best phd essay on hillary clinton best college college essay examples top term paper ghostwriter for hire online write me esl masters essay on lincoln user How to write guide republic day essay writingtake the lead essay respond to resume how to write debate opening statements. Article ghostwriting sites ca professional expository essay proofreading sites technique pour dissertation philosophique, odyssey thesis statement, ucf honors college essayThesis and dissertations online internet links us globally essay? Resume end user support: how to make a compare and contrast cats and dogs top application letter writing website usa? Essay about famous personalities professional resume writer charlotte nc how to write a meditation. 6th grade homework printable.

Sample pcat essay, pay for esl school essay on hackingThe fountainhead essay contest 2012 how to write compelling clues fiction to write guide How user.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

What Is A Credit Analysis Report

A credit analysis report is a document prepared by a credit bureau, and it contains information about the credit history of an individual. The report breaks down how borrowers pay their bills, the amount of unpaid debt, and the duration they have been managing the credit accounts.

When compiling the credit analysis report, a credit bureau is interested in accounts that have not been paid, delinquent accounts that have been forwarded to collection companies, and borrowers who have filed for bankruptcy or had their assets repossessed. The information is provided to lenders when evaluating a borrowers loan application to determine their CreditworthinessCreditworthiness, simply put, is how “worthy” or deserving one is of credit. If a lender is confident that the borrower will honor her debt obligation in a timely fashion, the borrower is deemed creditworthy., based on their past credit payment history.