The Soft And Hard Pull

To process your request, the credit card issuer may access your credit report via a hard or soft pull depending on the credit card issuer. A soft pull or inquiry wont affect your these are the types of inquiries that appear only on your version of your credit report. However, a hard pull can affect your credit score depending on the other information contained in your credit report.

The hard inquiry will appear on all versions of your credit report for up to two years. If you’ve built up a lot of debt in other places you may wait to request a credit line increase until some debt is paid off.

If you’re concerned about adding inquiries to your credit report, ask your credit card issuer whether they’ll do a soft or hard credit check before proceeding.

How Does The Credit Utilization Percentage Impact My Credit Score

Advertiser Disclosure

Credit Card Insider is an independent, advertising supported website. Credit Card Insider receives compensation from some credit card issuers as advertisers. Advertiser relationships do not affect card ratings or our Editors Best Card Picks. Credit Card Insider has not reviewed all available credit card offers in the marketplace. Content is not provided or commissioned by any credit card issuers. Reasonable efforts are made to maintain accurate information, though all credit card information is presented without warranty. When you click on any Apply Now button, the most up-to-date terms and conditions, rates, and fee information will be presented by the issuer. Credit Card Insider has partnered with CardRatings for our coverage of credit card products. Credit Card Insider and CardRatings may receive a commission from card issuers. A list of these issuers can be found on our Editorial Guidelines.

The percentage of your credit limits you use has a big impact on credit scores. Thats why maxing out credit cards drops credit scores quickly. Even if you use credit cards heavily, you can take steps to reduce credit utilization and maximize scores.

Credit utilization is one of the most important factors in the calculation of . But many people dont understand what it actually means.

Does Getting Declined For A Credit Limit Increase Affect Your Credit

Getting declined for a credit limit increase might impact your credit scores. Whether it does depends on if the card issuer reviews your credit report with a hard or soft inquiry before making their decision. If it’s a soft inquiry, your credit scores won’t be affected at all. However, similar to when you apply for a new credit account, a hard inquiry might hurt your scores.

Don’t Miss: How To Remove Repossession From Credit Report

The Best Line Of Credit Scenario

If youre expecting a payment but needing to pay a bill, a line of credit would be a good option because the balance would be paid down. Use your line of credit only for purchases you can afford. Those whose income is commission-based, for example, may have a stable and significant annual income but that is variable month-to-month. Those individuals would benefit greatly from a line of credit.

What Cards Can I Get A Credit Line Increase For

You should not be limited with respect to the type of card you can get a credit line increase for. Heres some of the popular Discover cards that you might increase a credit line for:

- Discover it Secured

- Discover it Student Cash Back

- Discover it Student Gas & Restaurants

- Discover it Balance Transfer

- Discover it Chrome

Also Check: Does Paypal Report To Credit Bureaus

The Worst They Can Say Is No Shouldnt I Try

Oftentimes, a limit increase request will trigger a hard pull on your credit report. This can hurt your credit, especially if you have a short credit history. If you call your credit card issuer, you can ask whether a hard inquiry will be initiated. Sometimes you can take a smaller increase and forgo the pull.

Asking for an increase could affect your credit score.

If you decide its the right time to up your limit, either call customer service or request a credit limit increase online. Its a very simple procedure. Dont be discouraged if your request is denied. Your in the future when the timing is right.

Bottom line: Try to time your credit limit increase request so its more likely to get approved. And, of course, try to keep your spending low enough that you can pay your credit card in full each month.

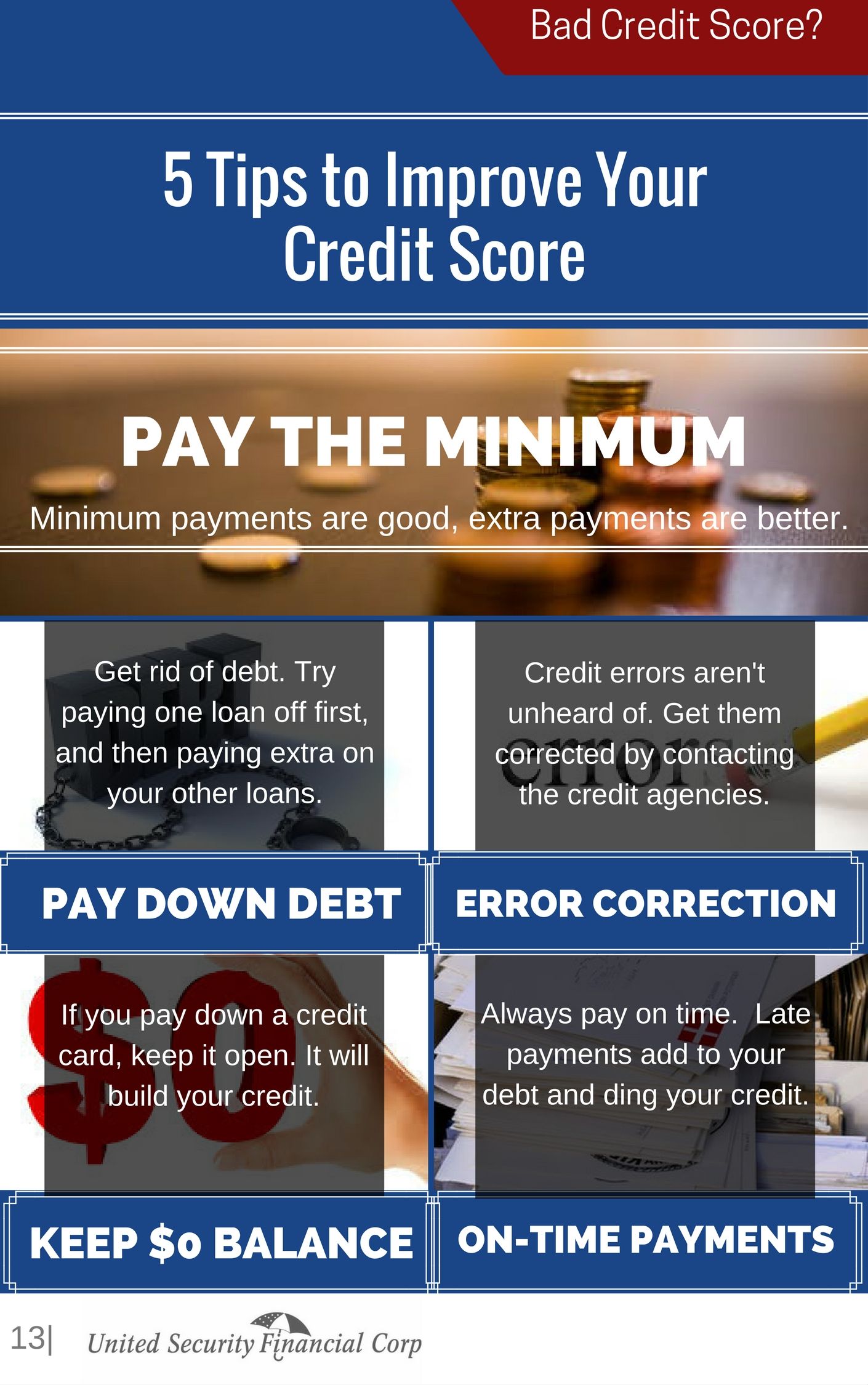

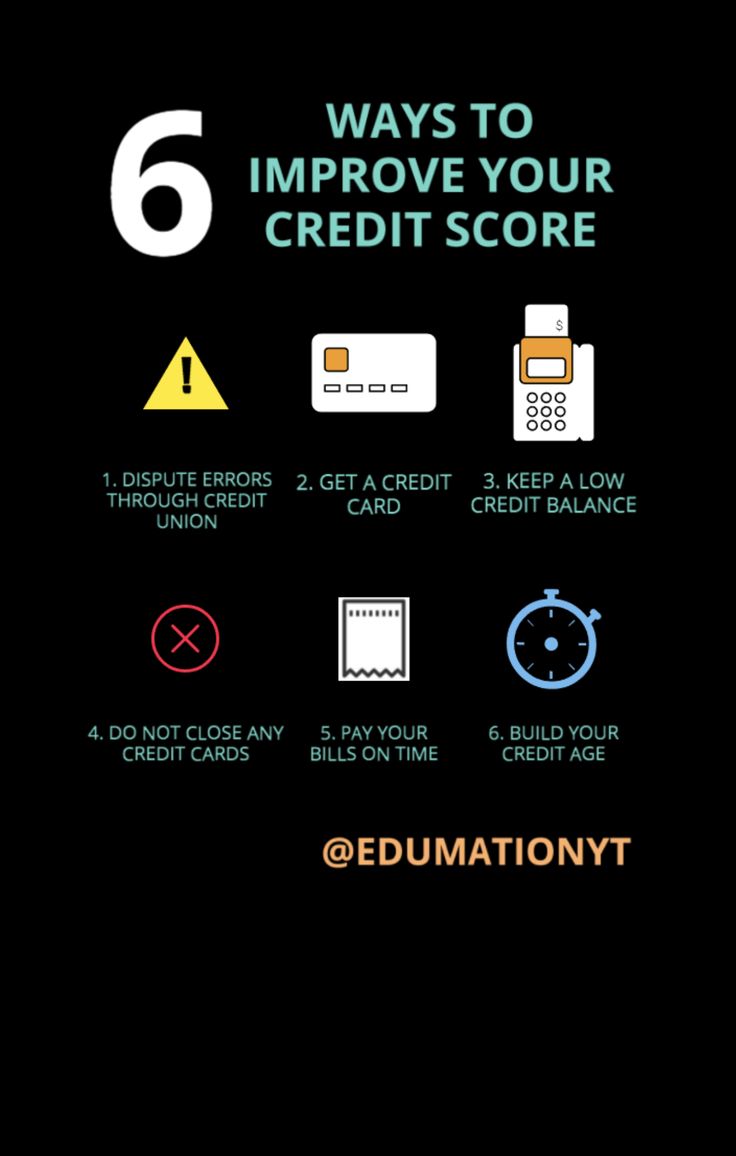

Your Credit Score Is Low

Your credit score says a lot about your financial habits, so you likely wont get approved for more credit if it isnt good. Lenders use your credit score as a decision-making tool to determine your risk as a borrower. So if your score is in bad shape, its best to improve it first, wait a few months, and then ask for a credit limit increase.

You May Like: What Is Syncb Ntwk On Credit Report

Increasing Your Credit Limit Has Upsides But Only If You Don’t Overspend

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Increasing your is merely an opportunity to spend beyond your means, right? Not necessarily. In fact, increasing your credit limit can have a number of upsides if you manage your credit wisely. For example, it can help you repair your credit, make large purchases efficiently, or use credit to handle a sudden emergency. A higher credit limit can even boost your .

There are at least six key benefits of increasing your credit limit.

Length Of Credit History

When you first open a new line of credit, it could lower the average age of accounts on your credit reports. Since scoring models consider your average age of credit, a new credit account might make your credit scores drop at least initially. As the line of credit grows older, however, it could help you here.

Keep in mind, length of credit history is only worth 15% of your FICO Score. So, while your average age of accounts matters, a line of credit might still help your scores overall if you pay on time or use it to lower your utilization ratio by paying off credit cards.

Also Check: Can I Get A Repossession Off My Credit

Should I Increase My Credit Limit If Offered

If it is offered, chances are your credit wasnt accessed in a way that will hurt you and an increase will help your utilization score. However, if you feel that an increase may be too tempting and be reflected in overspending you might want to think twice. This is a question only you can answer, but it is an important one. Most of you know, but for those who dont, more credit is not the same as more income. Its just another way to spend the money you already have budgeted.

Why Should You Increase Your Credit Limit

Recommended Reading: How To Report A Death To Credit Bureaus

What If Your Credit Limit Seems Low

A low credit limit is not the same as a low credit score. A lack of credit history can lead to a lower limit. This is because the credit card issuer doesnt have enough information to justify giving you access to a large amount of money via a high credit limit on a credit card.

Opening a credit card is like starting a new relationship: You have to build trust. Your initial credit limit reflects your issuer extending you a small amount of trust. If you establish a good credit history i.e., build trust they may be more comfortable increasing your credit limit in the future.

Take Out A Personal Loan

Because personal loans are installment rather than revolving accounts, they dont impact your revolving utilization. If you want to improve your credit utilization, you could pay off credit card debt with a personal loan.

Just be cautious with this route: You dont want to get a personal loan and then end up maxing out your credit card again. Balances on installment loans can also affect your credit scores, but not as much as on credit cards.

Read Also: What Credit Card Is Syncb Ppc

What Is A Line Of Credit

A line of credit is a type of revolving credit, not so different from a credit card. When youre approved for a line of credit, the bank or credit union assigns you a . You can borrow up to that amount and will only pay interest on the funds you access.

Like a , you are required to make at least a minimum payment each month. As you repay the money you borrow, your lender will let you access cash again, up to your limit. As long as the account is open and in good standing, you should be able to borrow and repay funds again and again.

With a line of credit, your account balance can fluctuate significantly, depending upon the amount you draw out of your account. Most lines of credit come with variable interest rates as well. Both of these factors can cause your payments to change from month to month.

Reasons Why Your Credit Limit Increase May Have Been Denied

When you request a credit limit increase, the card issuer may review your credit reports, credit scores, how you use credit cards, your history with the company, and the income information it has on file.

- The credit card account is only a few months old

- You requested and received a credit line increase in the past few months

- You have a low credit score

- Your income isn’t high enough

- You don’t use the card often

- You rarely pay more than your minimum monthly payment

- You’ve missed a payment or are currently past due on this or another credit account

When you’re denied a credit limit increase due, at least in part, to your credit information, you might be sent an adverse action letter. If the lender used your Experian credit report in their decision-making, receipt of an adverse action letter means you have the right to request a free copy of your report, which you can do on the Experian’s Report Access page. If a report from one of the other major consumer credit bureaus was used, you can request a copy of your report from those companies as well.

The letter will also explain why the card issuer denied your request. Addressing any issues included in that explanation may increase your chances of getting approved later, although it’s no guarantee.

Also Check: Credit Report Without Ssn Or Itin

When Is It Time To Ask For A Credit Limit Increase

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editors note: This is a recurring post, regularly updated with new information.

There are many reasons to ask for a credit limit increase. For example, perhaps you frequently spend up to your credit cards limit. Or, you may be looking to lower your to boost your credit score and get a new rewards credit card.

Regardless of why you want to increase your credit limit, you may be wondering when is the right time. Heres what you need to know.

Get the latest points, miles and travel news by signing up for TPGs free daily newsletter.

What To Do After Your Credit Limit Decreases

If you notice one of your limits drop, contact your creditor immediately for more information. This reduction could be a mistake, but if it’s not, you’ll want to know why your limit was reduced.

Ask the creditor whether it has a policy for reissuing previous credit limits. If you catch it in time, you may be able to get it back. If not, you’ll need to figure out why it was reduced and work toward remedying whatever caused it.

If you see your utilization ratio increase as a result of a credit limit reduction, focus on how you can bring it down before it impacts your scores too much. Here are a few things you can do to improve your utilization:

As you consider actions to take when a creditor decreases your credit limit, monitor your credit scores so you can see what your overall credit utilization is and how it’s impacting your scores. You can get free credit monitoring from Experian that can alert you to changes in your credit.

Don’t Miss: Is 672 A Good Credit Score

Gather The Documents Youll Need When You Ask For A Credit Limit Increase

Your card issuer may want to know your current annual income, employment status and how much you pay for housing each month. Have that information ready to go before you call.

Thats right, we said . You can sometimes ask for a credit limit increase by applying on your card issuers website, but youll have a better opportunity to ferret out information if you speak to a representative on the phone.

If you request an increase over the phone, youll be able to talk to the representative and ask questions or see if theres an amount of additional credit you could get without a hard inquiry, so that may be better in certain situations, says Ganotis.

Requesting An Increase From Your Card Issuer

While some credit card issuers automatically increase your credit limit, others will only raise your limit if you ask. To start the process, call the toll-free number and listen to the promptsthere may be a prompt for requesting a credit limit increase. If not, choose the option to speak to a customer service representative and ask for an increased credit limit.

Some credit card issuers let you request a credit limit increase from your online account. Log in and look for a menu option to request a credit limit increase.

The card issuer will likely ask for some additional information to process your request. For example, they may ask for your monthly income, the credit limit increase you’re requesting, and the reason for the increase.

Also Check: How To Get Credit Report Without Social Security Number

How Soon Is A Credit Limit Increase Decision Made

If your credit card account is in good standing and you can demonstrate that you have enough income to handle a higher credit limit, many times youll find out immediately if your request was approved. Sometimes, though, the process takes a bit longer and your credit card issuer will sometimes notify you a few days later via mail.

Can You Be Instantly Approved For A Credit Line Increase

Many people will be instantly approved for a credit line increase with Discover.

But on other occasions your request might go to a manual review process.

In that case, you might see a message like, Were reviewing your request and will let you know in 2 days. Its not clear what that means for your approval odds but many people have been approved for credit line increases after receiving the message.

Recommended Reading: Can Lexington Law Remove Repossessions

When Should I Ask For A Credit Limit Increase

In much of life timing is everything. In credit this is particularly true. If you want to time your request for maximum chance of success I suggest asking for an increase if something positive has happened since you got your card, like an increase in your household income, a decrease in your debt load or an increase in your credit score.

Conversely, I dont suggest you apply if any of the following has happened: youve lost your job or had an income cut your credit score has decreased youre at or near your credit limit you recently missed a payment or paid less than the minimum or youve recently added new credit.

In general, after six to 12 months of on-time payments, you may be eligible for an increase. You should make sure that those payments have been for more than the minimum required. Your current utilization on the account will also likely be taken into account in the decision, so try to keep your percentage at 30 percent or less to help increase your chances of being approved for an increase. These actions demonstrate a responsible use of the credit you already have.

Just like accessing new credit, you want to limit your requests in this area. Too many asks may signal that you are about to go on a spending binge. You might be turned down and if a hard inquiry was made, the hit you take from that might be felt more.

Does Asking For A Credit Limit Increase Hurt My Credit Score

Title says the bulk of it but below is some background for my situation.

I’m 25 yr old, gross income ~$72,000/yr, credit limit of $12,000. I’ve always paid off my credit in full and on time and over the last 2 years have usually had a monthly credit card statement in the $1800 – $2200 range. However over the last 4 months I’ve had several large expenses. I moved and got new furniture, had a 2 week vacation in November, did the gift giving thing in December, and paid outright for some dental work .

Because of these last 4 months my revolving utilization has been over double the usual average and my credit score has gone from its usual 790-800 range down to 720 and I’m afraid it will drop further.

I don’t foresee any more unusually expensive months for a while until next July when I’ll be paying to fly myself and my girlfriend to a wedding and have a 3 night hotel stay.

Will my credit score rebound if my revolving utilization returns to normal? Should I ask for an increase in credit limit to forcibly drop the % utilization or does asking for an increase drop my score further?

Thanks in advance for any insight you all can provide.

Don’t Miss: Can A Repo Be Removed From Credit Report