How Long Medical Collections Stay On Your Credit Report

Left unchallenged, medical debt will remain on your credit history for seven years just like any other kind of debt.

You can shorten this time frame by taking steps to remove medical collections from your credit report.

Credit scoring models emphasize new debt over older accounts, so as your medical accounts age their impact on your credit score will have less weight. But any debt reported by a collections agency can harm your score.

Lenders may deny your applications for borrowing based on negative items that appear on your credit report. Removing negative items can help restore your credit.

Keep An Eye On Your Credit

If youâre still not able to pay your medical bill, you may want to search for additional resources to help you manage itâand hopefully avoid hurting your credit.

Either way, itâs always a good idea to monitor your credit. lets you access your free TransUnion® credit report and weekly VantageScore® 3.0 credit score anytime, without negatively impacting your score. CreditWise is free and available to everyoneânot just Capital One customers.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

How To Remove Medical Collections From Your Credit Report

This blog has partnered with CardRatings for our coverage of credit card products. This site and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

As an Amazon Associate, I earn from qualifying purchases. More information

If you have medical bills you cant pay they will likely end up on your credit report. This will negatively impact your credit score so its good to get it taken care of as quickly as possible.

First, make sure the bill is legit and has been through the proper processes before being reported on your credit. Ask for a copy of the bill and talk to your insurance company about why they didnt pay. If the bill is correct and insurance cant help then try to work out a payment plan with the collection agency.

If you have a bill you cant pay but it hasnt gone to collections yet, see if the hospital can work out a payment plan or if they have a debt forgiveness program. That can prevent it from ever going to collections in the first place.

Don’t Miss: Usaa Credit Check

A Call From A Debt Collection Agency Is A Call Nobody Wants To Receive But If You Become Significantly Delinquent On A Debt You May Need To Deal With A Debt Collection Agency In Order To Pay Back The Money You Owe

Before we go any further, lets agree on one thing: Unpaid debts can be stressful and confusing. You may not even be sure how your debt ended up with a debt collection agency in the first place. But its important to look beyond the potentially intimidating letters and phone calls to understand whats really happening and come up with a solution that works for you.

In this article, well go over how to make a payment to a debt collection agency. Heres a basic outline of the steps, in case youd like to jump ahead.

How To File A Complaint Against Cmre Financial Services

If CMRE Financial Services has violated your rights under the FDCPA or done something illegal, then you can report them to the Federal Trade Commission, the Consumer Financial Protection Bureau, or your state attorney general. From there, youll be able to find out whether you can also sue CMRE Financial Services.

Another option is filing a complaint on the Better Business Bureau website, but this might not have the outcome youre hoping for. Bear in mind that the BBB is actually a private organization that has no affiliation with the U.S. government, so your complaints will only go so far.

The BBB will forward your complaint to CMRE Financial Services, but they arent obligated to do anything except respond. Whats more, if the dispute is sent to an arbitrator, then you may give up your right to take CMRE Financial Services to court.

Read Also: How To Unlock Experian Credit Report

Does The Open Date Of A Collection Account Determine When It’s Removed

It sometimes takes a year or more between an account’s charge-off and its sale to a collection agency, and collection agencies that fail to collect their debts sometimes resell them to still other agencies. That means multiple collection account entriesall related to the same unpaid debtmay appear on your credit reports.

While that’s not great news, you need not worry that each new entry has its own seven-year countdown to expiration. Any collection entries related to the same original debt will disappear from your credit report seven years from the date of the first missed payment that led up to the charge-off.

Will Paying Off A Collection Improve Your Credit Score

Actually, this is a common misconception. The fact is, paying off a collection account will not improve your FICO score. Collection agencies and debt settlement companies will tell you the opposite because they want your money. When you pay off a derogatory account, the balance will be reported as paid, but your credit score will not increase.

The number of collection accounts you have, regardless of the amount owed, counts against your credit rating the same. The older these accounts get, the less impact they will have on your score, but paid or unpaid, it doesnt matter.

The only way you can increase your credit score is by having the collection completely removed from your credit report.

You May Like: Paypal Credit Minimum Score

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

How To Remove Medical Collections Violating Hippa From Your Credit Report

Find out how to remove medical collections that violate HIPPA from your credit report. Also, discover how much easier the dispute process is w/Credit Glory today!

You remove medical collections that violate HIPPA the same way you remove inaccurate items â with a dispute. You can dispute the record on your own, but there’s an easier way. When you partner with an expert you simplify the dispute process.

Also Check: How To Remove Repossession From Credit Report

Legislators Seek To Remove Paid Medical Debt From Credit Scores

Regardless of the reason why medical debt is present in ones credit history, many people think it is unfair to include paid collection actions when calculating ones credit score. A group of federal legislators is currently seeking to address the problem of medical debt through the proposed Medical Debt Responsibility Act of 2013 and related legislation. The New York Times reports that the Act would require credit reporting agencies to remove fully paid or settled medical debt information from a consumers credit report within 45 days of the debt being paid or settled.

These changes may help people with paid medical debt, but there are still many Americans who are unable to pay off their medical bills. When facing insurmountable medical debt and other bills, filing for bankruptcy may help. Through bankruptcy, you may be able to discharge your debt or develop a plan to repay the debt at a reduced rate over three to five years. If you have overwhelming medical debt, contact a knowledgeable bankruptcy attorney to learn more about your debt-relief options.

Is Cmre Financial Services A Scam

No, CMRE Financial Services isnt a scam. Although they have had a string of recent lawsuits brought against them, CMRE Financial Services is a legitimate company.

CMRE Financial Services parent company within Meduit, Receivables Management Partners, was accredited by the Better Business Bureau in 1992.

However, scammers may claim to be collectors from CMRE Financial Services. If you want to check what debts you owe to CMRE Financial Services, visit cmre.virtualcollector.net.

How to tell if a debt collection from CMRE Financial Services is a scam

If a debt collection agent calls you, you should receive written confirmation immediately afterward. If you dont, it might be a scam. Be especially cautious of anyone asking you to pay a debt that you dont recognize , and be sure to ask questions during the call to verify their affiliation with CMRE Financial Services.

Don’t Miss: How To Remove Items From Credit Report After 7 Years

Stay On Top Of The Debt

You want to make sure you are staying on top of your insurance company about the debt. Continue to follow up with them to ensure they pay their part of the medical bills. Get an estimate of how much you will be on the hook for. Stay in communications with the hospital and surgeon about the medical bills. Let them know you intend to pay your bills, so they do not prematurity send you to a debt collection agency. Being in constant communications with the doctor and hospital make it much less likely they will send the debt to a collection agency.

Ignoring the debt is the worst thing you can do even though it can make you anxious, ignoring medical debt will only make it worse. Before you know it, the bills will be in collections, fees and interest may be added that substantially increase the amount you owe.

Why Is Cmre Financial Services Calling Me

CMRE Financial Services will call you if you have unsettled debt . When they call, you should ask them to send a written notice detailing the debt theyre collecting, known as a debt validation letter, if they havent already.

In accordance with the FDCPA, all debt collectors are required to send this letter within 5 days of first contacting you. 4It must contain the following information:

- The amount you owe

- Your name

- A statement informing you of your right to dispute the debt within 30 days of receiving their letter

- A statement informing you that if you dispute the debt in writing, they must mail you evidence of the debt within the 30 days

- A statement informing you that within 30 days after youve received the letter, you can send them a written request to provide the name and address of the original creditor

CMRE Financial Services representatives will keep trying to contact you unless you either pay the debt or reach an agreement with them .

However, there are restrictions on how they can go about contacting you.

You May Like: What Is Syncb Ntwk On Credit Report

What Happens When A Medical Bill Goes To Collections

If youve got medical bills you havent paid, hospitals, clinics, and doctors might have their billing departments work to get you to pay. But what if you cant or wont pay. Or the doctor or clinic cant reach you. Maybe they have incorrect contact information and letters and phone calls go unanswered. What happens at that point?

Hospitals, clinics, and doctors offices dont typically report directly to credit bureaus. But eventually, they will likely send unpaid medical bills to collection agencies. The collection agencies will then attempt to get you to pay the medical bill.

If you still do not pay the medical bill or the collections agent cant reach you, the collection agency will report the unpaid item to credit bureaus.

And medical collections, like other collection items, do affect your credit report negatively. They can affect your ability to get credit, and they can affect the interest rate you pay when you get credit. Heres how long negative information stays on your credit.

Wait A Few Months And Dispute The Account Again

If you failed to get the collection removed from your credit report by this step, dont lose hope. Let a couple of months pass by and try to dispute the account for another reason.You can dispute accounts for several diffident reasons, and the older the paid collection gets, the more likely the creditor will ignore the Credit Bureaus requests.

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

How To Get Medical Collections Debt Off Your Credit Report

Medical bills are something almost every American has had to deal with at some point in their life. According to data from the Consumer Financial Protection Bureau, roughly 43 million Americans have medical debt collections on their credit report. About one-third of them otherwise have flawless credit. A single medical collections account can drop your credit score by as much as 100 points.

Medical bills can be very frustrating to deal with. If you have insurance, sometimes you have to wait to see how much your insurance company will pay, so you know what you owe. Sometimes, this can take months, and the medical debt could already be in collects by that time. We will cover ways you should handle your medical debt to keep it off your credit report.

Using Credit Cards To Pay A Debt

Using a credit card for medical debt is the last resort of last resorts.

Only use credit cards to consolidate medical debt if you can pay the credit card bills promptly. If you cant, first discuss whether the medical provider might offer an interest-free payment plan, which would be more manageable than a credit card debt that accrues interest.

Some patients opt to use medical credit cards, which are like conventional cards but are designed exclusively for medical expenses. Application forms are sometimes available in doctors offices.

Before applying for a medical card, especially one that advertises no interest on balances, carefully review the terms. You probably will discover that the no-interest grace period ends in several months and the interest rate charged after that is quite high.

You May Like: Opensky Payment Due Date

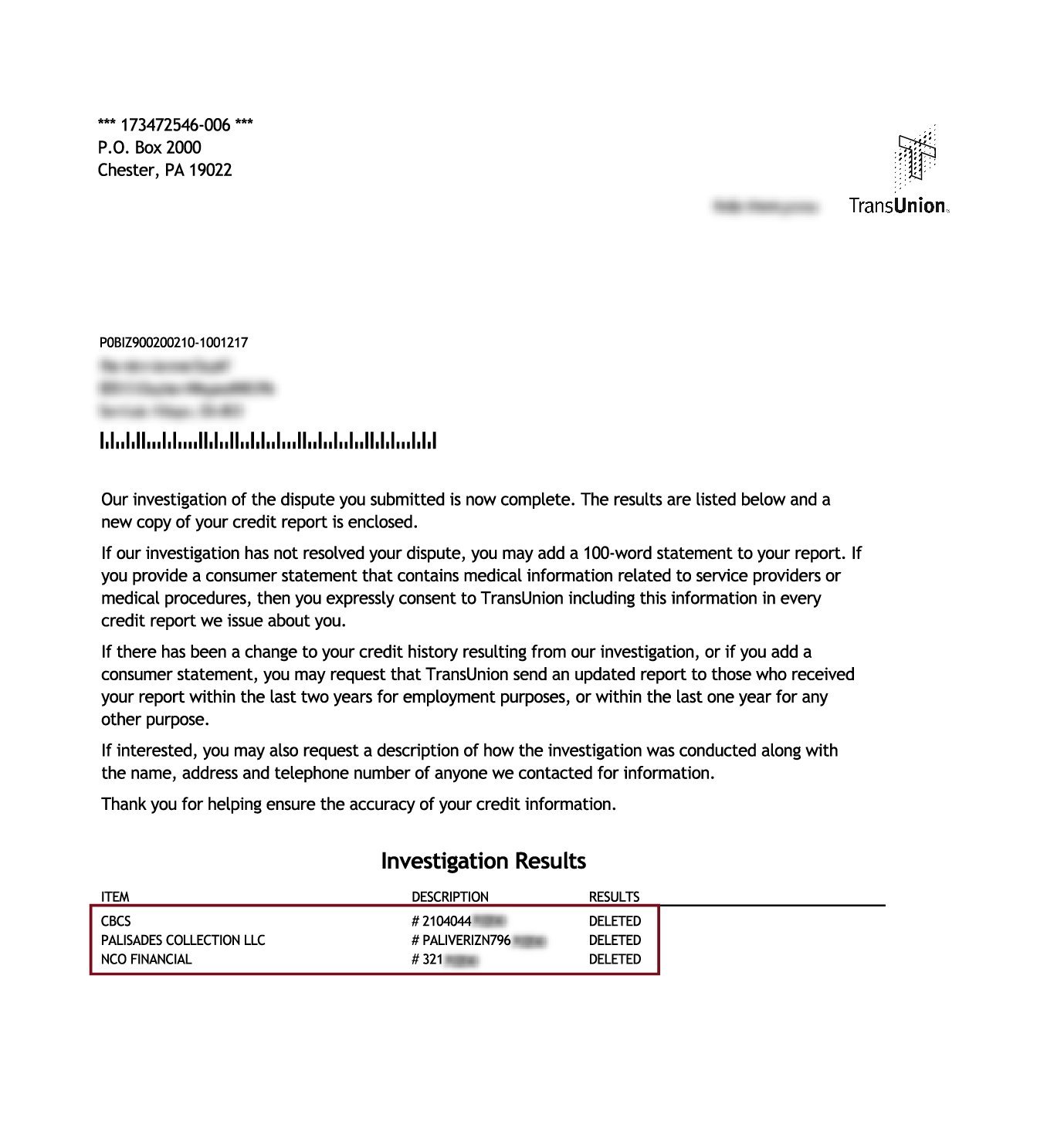

Can Collections Accounts Really Be Removed

Having previous experience with collections, I have used several ways to remove debt. My first was hiring a credit repair company. The items that they removed increased my credit score by over 70 points.

The disputed a charge from a previous landlord where I was the co-applicant. They also removed an old collection that lingered after the seven years.

With the help of the credit repair company, I was able to remove over seven derogatory items from my report. That gave me great hope for the future.

I was also successful with a couple of pay-for-deletions. Utilizing the pay-for-deletion strategy, I was able to remove a delinquent phone bill and an old cable bill.

My journey to good credit involved purchasing a new car and a house. So I incorporated other methods of dealing with collections.

If you have exhausted all previous methods to no avail, there is still hope of increasing your credit score. The method below should be the last Hail Mary, in terms of dealing with collections.

Some of my decisions were based on the newer FICO scoring models , where paid collections are better for your credit score than having an unpaid collection.

I was facing a medical bill over $4K, and did not want to set up a payment plan to reactivate the debt. Through some research, I learned of charity care, where the health care provider pays for your bills or old debt if you can prove you have or had a financial hardship at the time of service.

Filing A Hipaa Complaint

If you believe that your privacy pertaining to your medical history has been unlawfully accessed, you can file a HIPAA complaint. Click here to read all about filing a HIPAA complaint. HIPAA prohibits any retaliation against you. Under HIPAA, an entity cannot retaliate against you for filing a complaint.

Read Also: Usaa Credit Score

Look At Your Credit Report

Credit repair starts with regularly reviewing your credit report. Thanks to the Fair Credit Reporting Act the three major credit bureaus are required to provide free credit reporting on an annual basis. You can get a free copy of your credit report once a year if you request one. Equifax has started offering six copies per year starting in 2020 and running through 2026, but you must visit the Equifax website to get the additional copies.

You can request a free credit report from each of the national credit bureaus at annualcreditreport.com or you can call 1-877-322-8228 to get your free copy. The three major credit bureaus may report your credit information differently, so make sure to review each carefully for inconsistencies. Take a good look at your credit card accounts and medical collection accounts to compare the information noted on each report. If you find an account you donât recognize, you can dispute the account.

When Do Medical Collections Appear On A Credit Report

Not every medical collection will be included on your credit report. The three major credit bureaus wait 180 days before adding medical collections to your credit history. The purpose of this six-month grace period is to give you a sufficient amount of time to resolve any errors on your bill, pay your bill, design a payment plan or consult your insurance company so they can take care of it.

If you take action within the 180-day period, you can avoid medical bills from taking a toll on your credit scores. On the other hand, if your collection is 180 days old and unpaid, it may be added to your personal credit file and could stay on there for seven years.

Don’t Miss: Credit Score 672