How Long Does It Take For A Charge Off To Be Removed

The credit reporting agencies must remove the charge off from your credit report after seven years from the date. It might be possible, using one of the methods above, to remove the charge off early. But there are no guarantees when it comes to getting items removed from your credit file.

Trying to remove a charge off from your credit report can be a tedious process, especially if youre not familiar with the FCRA and other consumer protection laws. But you dont have to dispute charged off accounts alone. specializes in disputing errors that may be hurting your credit scores and showing you how to add positive information to your credit reports as well.

When Does The Reporting Clock Start

The credit reporting time period for debt collections starts from the date of the delinquency that caused the collection. With collections resulting from a charge-off, it starts the date the account was charged off . So, if you were first late in February 2013 and the account was charged off in July 2013, the account should fall off after July 2020. Some versions of your credit report may include phrasing that indicates when the collection will fall off your credit report, such as, “Scheduled to report until 06/2020.

The for debt collections is based on your delinquency with the original creditor, not when the debt collector started collecting on the debt.

How Does A Charge

Once the creditor writes off your account, it may report the account as charged off to the credit bureaus, which translates as a derogatory mark on your reports.

This derogatory mark can stay on your reports for up to a seven-year period from the date of the first payment you missed.

The creditor may have sold your account to a third-party collections agency if the debt was unsecured. In that case, the account could also appear as an account in collections on your reports.

If this happens, your may dip, and it may be more difficult to qualify for credit or get competitive interest rates.

Also Check: Credit Report With Itin Number

Can You Be Sued For Charged

The short answer is, yes, you can be sued for a charged-off account. But its important to keep in mind that how long a creditor has to sue you for bad debts can depend on state law.

Each state imposes a statute of limitations on debt. This gives creditors a certain amount of time to collect unpaid debts, typically beginning on the day after the first payment is missed. The statute of limitations can vary by state and by the type of debt. So, for example, if you become delinquent on a credit card, your creditor may have three years to collect. They may have four years or five years to collect on unpaid medical bills or a bad car loan.

One thing to note is that making a partial payment, or even agreeing to pay a bad debt, could restart the clock on collection efforts. Be careful when talking to debt collectors on the phone or corresponding with them by mail.

If youre sued for a bad debt associated with a charged-off account, its important to know your rights. First, your creditor has to serve you with proper notice of a debt collection lawsuit. Once youre served, there are several things you can do:

- Contact the creditor and agree to a repayment schedule to pay the debt in full

- Go to court and challenge the validity of the lawsuit

- Contact the creditor and attempt to negotiate a debt settlement

- Do nothing

Work With The Original Lender

If the debt hasnt been sold to a collections agency, you can work with the original lender to make payment arrangements. Once its paid off, the lender should change the status of the account to paid charge-off and update the balance to zero. Lenders usually see a paid charge-off as more favorable than unpaid debt.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

How To Remove Charge

When you fall behind on a bill, it usually isnt long before you start receiving calls and letters from your creditor. When you miss enough payments, the creditor may eventually give up on trying to collect the debt. At that point, the creditor often closes your account and marks it as a charge-off.

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

Also Check: 778 Fico Score

Removing Negative Items After Seven Years

Check your credit report to learn when negative items are scheduled to be deleted from your credit report. When the seven years is up, the credit bureaus should automatically delete outdated information without any action from you.

However, if there’s a negative entry on your credit report and it’s older than seven years, you can dispute the information with the credit bureau to have it deleted from your credit report.

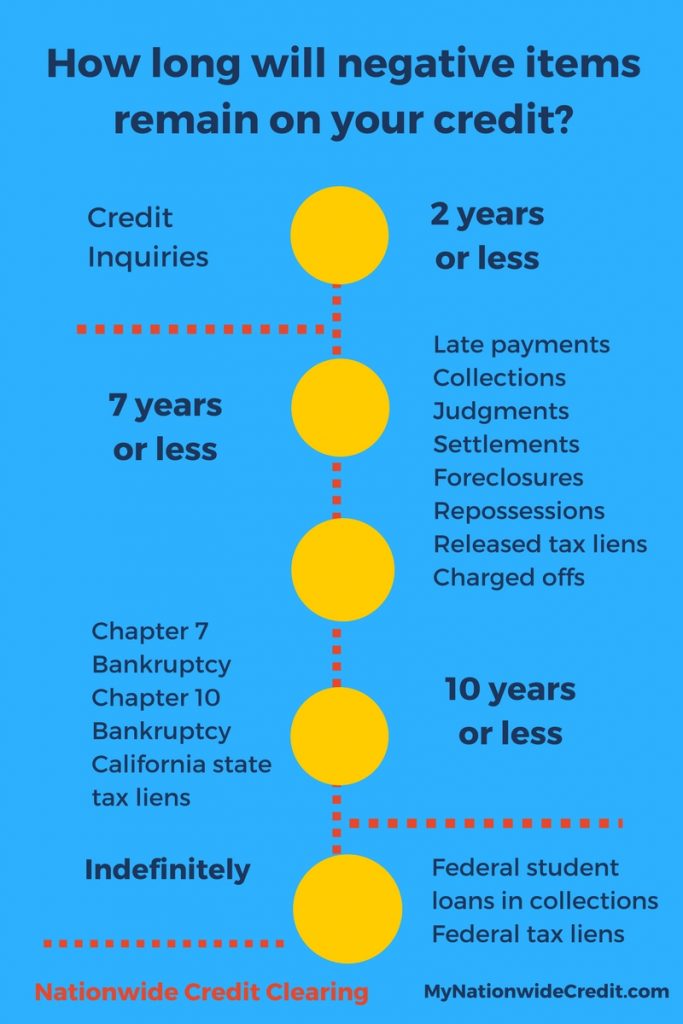

Hard Inquiry: Two Years

A hard inquiry, also known as a hard pull, is not necessarily negative information. However, a request that includes your full credit report does deduct a few points from your . Too many hard inquiries can add up. Fortunately, they only remain on your credit report for two years following the inquiry date.

Limit the damage: Bunch up hard inquiries, such as mortgage and car loan applications, in a two-week period so they count as one inquiry.

Also Check: What Is Syncb Ntwk On Credit Report

How Long Does Positive Information Remain On Your Credit Reports

The Fair Credit Reporting Act is the federal statute that defines consumer rights as they pertain to credit reports. Among other consumer protections, the FCRA defines how long certain information may legally remain on your credit reports.

There is no requirement in the FCRA for credit reporting agencies to remove positive information such as on-time credit paymentsthey can remain on your credit reports indefinitely. Even after a positive account has been closed or paid off, it will still remain on your credit reports for as long as 10 years.

The credit bureaus keep a record of your accounts in good standing even after they’ve been closed because it’s important for credit scoring systems to see their proper management. As such, credit scoring systems such as FICO and VantageScore® still consider closed accounts that appear on your credit report when calculating your scores.

What Does Payment After Charge Off/collection Mean

The statement, “payment after charge off/collection,” means that the account was either charged off as a loss by the company with whom you had credit, or that the account was sent to a collection agency for payment. After either one of these situations happened, the full amount owed was paid to the appropriate parties which brought the account to a zero balance.

Also Check: Paypal Working Capital Log In

Should You Pay Charged

The outstanding balance on a charge-off account is still your debt, and you are legally responsible to pay itto the original creditor or the agency that buys the debt. Furthermore, lenders who see unpaid charge-offs or collections may question your willingness and ability to repay future debts. Some will likely consider any charge-off grounds for declining a credit application, but some lenders will view paid charge-offs more favorably than unpaid accounts.

How Long Do Charge

A charge-off will remain on your credit report for seven years, and then its automatically deleted. For example, if you stopped making payments on one of your credit cards for six months, and it was marked as a charge-off on January 1, 2020, it would remain on your credit report until January 1, 2027.

Even if the statute of limitations on the debt expires after three or five years in your state, your credit report will still show the charge-off, and your credit score will suffer. Statutes of limitations protect you from legal action but not from bad credit or from phone calls from debt collectors.

Also Check: Credit Score 672

The Credit Repair Option

Another option is to work with a legitimate company to try to get charge-offs or other negative information removed from your credit file. While this can save you time, there’s typically a fee involved, and in most cases, the credit repair company can’t do anything for you that you couldn’t do by yourself.

Worse, some credit repair companies are just thinly disguised scams whose only goal is to defraud people who need credit help.

Will Paying A Charge

Paying will not increase your credit scores. If you are facing a debt collection lawsuit, paying a charge-off can avoid legal actions. But even with a zero balance, your credit reports still show a history of late payments and the fact the account was charged-off. A FICO Scores purpose is to help lenders predict the likelihood that youll fall 90 days or more behind on any credit obligation during the next 24 months.

Read Also: Will An Eviction Show Up On My Credit Report

Why Do You Store Social Security Numbers On Credit Reports

Your personal information, such as name, address, date of birth, and Social Security Number, is reported to TransUnion by your creditors. TransUnion maintains a separate credit file for each individual. Without your Social Security Number, the quality and accuracy of your credit history could be compromised. The federal Fair Credit Reporting Act permits TransUnion to maintain personal and credit information in our records.

Other Products & Services:

Chase, JPMorgan, JPMorgan Chase, the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary of JPMorgan Chase & Co.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC , a registered broker-dealer and investment advisor, member FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. , a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. . JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

“Chase Private Client” is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

Also Check: How To Get Navient Off Credit Report

Why Can’t You Delete My Credit File At Transunion

TransUnion is a credit reporting company that operates under the Fair Credit Reporting Act. Your credit file is maintained as allowed by federal and state laws. The Fair Credit Reporting Act does not require credit reporting companies to maintain a file on every person, or require credit reporting companies to delete files at a consumers request. The Act does require the companies to use reasonable procedures to assure accuracy. Creditors may access your credit report only if they have a permissible purpose under the Fair Credit Reporting Act.

Know Your Rights When Dealing With Collectors

One important thing to keep in mind before you start calling debt collectors, or before you answer their phone calls, know your rights as a consumer. The Fair Debt Collection Practices Act protects you from abusive debt collection practices. However that doesn’t mean that all collectors actually follow the rules.

With that in mind, here’s what debt collectors are not allowed to do:

- Talk about your debts to anyone except you or your attorney. They are, however, allowed to call friends or family members for the purposes of finding out how to get in touch with you.

- Harass you. They can’t keep making debt collection calls repeatedly and can’t use foul language when speaking with you.

- Keep calling if you request they stop. You can submit a request in writing to ask them to stop making collection calls. If you do that, they can only contact you to say that they’ll be stopping collection efforts or taking legal action against you. This is my preference, as it’s easier to deal with collectors in writing — plus having written records helps protect you.

- Make any claims that they can’t legally follow through on. They can’t threaten to have you arrested for not paying, or foreclose on your house.

- Lie about who they are or the purpose for their contact. Before the FDCPA, it was common practice for a collector to call pretending to be an old friend just to get you on the phone. A legitimate debt collector will not do this today.

Read Also: Does Zebit Report To Credit Bureaus

How Do You Remove A Charge

According to Freddie Huynh, vice president of data optimization at Freedom Debt Relief, if a charge-off listed on your credit reports is legitimate, there isnt a whole lot that a consumer can do to remove it.

One thing you can do is try to negotiate with the original lender. If the lender hasnt sold the account, you can offer to pay the debt in full in exchange for the charge-off note to be removed from your reports.

Some debt collectors may offer to remove the charge-off note from your credit reports this is sometimes known as a pay for delete offer. But keep in mind that lenders are required to report accurate and complete information, so any pay for delete service is unlikely to be successful.

Otherwise, you can just wait out the clock. A charge-off should automatically drop off your credit reports after seven years.

Positive And Negative Information On Your Credit Reports May Affect Your Credit Scores But There Are Time Limits To Keep In Mind

Ever heard the saying that knowledge is power? When it comes to your credit, that can absolutely be true. So letâs start by asking a few questions and gaining some knowledge. What exactly is a credit report? What kind of negative information can be on it? And how long does it stay?

Essentially, you can think of a as a statement thatâs filled with information on your credit activitiesâthings like your history of making on-time payments. Your reports can also contain negative information that could impact your credit scores. And some negative information could stay on your reports for up to 10 years. Read on to learn more.

Also Check: How To Report A Death To Credit Bureaus

How Long Does Negative Information Remain On Your Credit Reports

The length of time negative information is allowed to remain on your credit reports is largely defined by the FCRA. Unlike positive information, almost all negative information eventually must be removed from your credit reports. However, not all negative information has the same timeline for removal.

For example, late payments are allowed to remain on a credit report for as long as seven years from the date of their occurrence. This includes any notation that one or more of your accounts was 30, 60, 90, 120, 150 or 180-plus days past due. These are the only late payments that can appear on your credit reports.

Charge-offs, accounts in collections, repossessions, foreclosures and settlements all indicate that you’ve defaulted on an account. In every one of these scenarios, the credit reporting agencies are allowed to report them for no longer than seven years from the original delinquency date that led to their default.

Bankruptcies are another example of negative information that can appear on your credit reports. There are two main types of bankruptcies consumers can file: Chapter 7 and Chapter 13.

How To Know If Youve Received A Charge

Your lenders should notify you when they charge off your account.

When one of your accounts gets listed as a charge-off, youll generally receive communication via mail from the creditor, says Tayne. You can also see the charge-off on your credit report.

But charge-offs arent sudden, and should not come as a surprise. Having a credit card charge-off means that your lender has attempted to reach out and settle your debt for at least six months.

If you see a charge-off on your credit report, you should contact your lending company immediately. You may be able to negotiate with the lender to have the charge-off removed from your credit report, assuming you can repay the debt promptly.

You May Like: What Is Syncb Ntwk On Credit Report

What Is A Charge Off On A Credit Report

When an account displays a status of Charge off it means that the account is closed for future use. Although the debt is still owed by you.

The debt is still the consumers legal responsibility. Sometimes the creditor stops trying to collect it directly.

Even after writes off your account from your records, it shows as a derogatory mark on your reports.

For up to seven years This stays on your reports as a derogatory mark. This duration starts from the date of the first payment you missed.