How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

What Your Credit Score Means Depends On The Model

As you can see, different credit-scoring models may have different ranges and scoring criteria. That means the same credit score could represent something different depending on which credit model a lender uses.

A VantageScore 3.0 score of 661 could put you in the good range for example, while a 661 FICO score may be considered fair.

And lenders create or use their own standards when making credit-based decisions. In other words, what one lender might consider very good another could consider good.

Even with all thevariability, knowing where you generally fall on the credit score range canstill be important. Your range could help you determine which financialproducts youre eligible for and the terms a lender might offer you.

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

Don’t Miss: Coaf On Credit Report

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Whats Impacting Your Score

Below are the aspects of your credit profile and history that are important to your Equifax credit score. They are listed in order of impact to your scorethe first has the largest impact, and the last has the least.

- Ratio of satisfactory trades to total trades in last 24 months.

- Number of personal finance trades with high utilization in the last 3 months.

- Worst rating for installment trades in the last 12 months.

Don’t Miss: Can A Repo Be Removed From Credit Report

Only Use The Credit You Really Need

Just because you have three credit cards, that doesnt mean its wise for you to max them out every month, even if youre making the monthly payments on time. The credit bureaus frown on individuals using too much of their available credit although they do like to see a diversity of credit accountsmortgages, auto loans, credit cards, installment accountsmanaged responsibly. Solution: Go easy on the credit. Make a determined effort to not use more than 10% of your total available credit. Your credit score will thank you.

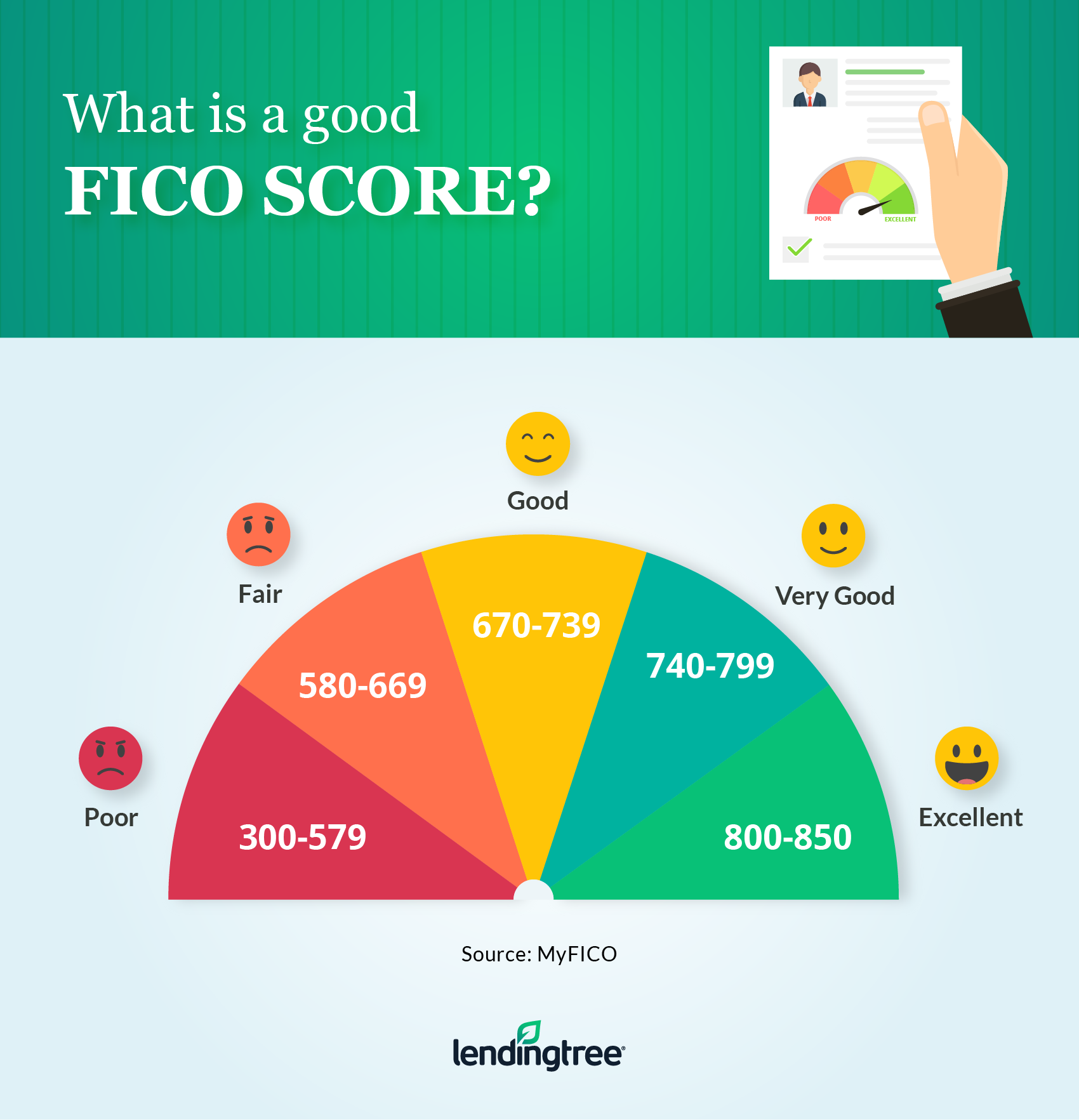

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

Don’t Miss: How Do I Report A Tenant To The Credit Bureau

Other Credit Scoring Models

Outside of the conventional and well-known outlets, there are several other credit scoring models.

TransRisk Its based on data from TransUnion and determines an individuals risk on new accounts, instead of existing accounts. Because of that specialized nature, theres not much information available about the TransRisk score. Accordingly, it isnt utilized by many lenders. It has been reported that an individuals TransRisk score has generally been drastically lower than their FICO score.

Experians National Equivalency Score It assigns users a score of 0-1,000 with the typical criteria of payment history, credit length, credit mix, credit utilization, total balances and the number of inquiries but Experian has never publicized the scores criteria or weight. The scoring seems counterintuitive for consumers accustomed to the FICO system. In Experians system a score of 100 means a 10% chance that at least one account will become delinquent in the next 24 months, while a score of 900 means a 90% chance of that. There is an alternative scoring method of 360 to 840 (840 is good, 360 is bad, making it more compatible with the FICO model.

It was developed to help businesses approve new account candidates. It inspects credit reports for ways to raise its score quickly or detect false information. By improving those scores, that should lead to more loan approval for customers.

Why Is A Good Credit Score Valuable

Now you know a little about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit card or loan applications, but their influence goes beyond that.

Good scores can affect interest rates, credit limits, housing applications and even job prospects. And they can offer more options, more bargaining power and more financial flexibility.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit card offers if you have a good score. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how credit inquiries can affect your credit.

Interest Rates and Credit Limits

If youâre approved for a loan or a credit card, a good credit score could mean higher credit limits, lower interest rates or both. And when youâre paying less in interest, you may have smaller payments and be able to pay off your debt faster. In general, that means that higher credit scores could decrease the cost of borrowing money.

Beyond Credit Cards and Loans

Finally, good credit scores could affect other parts of your life, too:

Don’t Miss: How Can I Check My Credit Score With Itin

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

How Can I Check And Monitor My Credit

You can check your own credit it doesn’t hurt your score and know what the lender is likely to see.

You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0.

It’s important to use the same score every time you check. Doing otherwise is like trying to monitor your weight on different scales or possibly switching between pounds and kilograms. So, pick a score and get a game plan to monitor your credit. Changes measured by one score will likely be reflected in the others.

Remember that, like weight, scores fluctuate. As long as you keep it in a healthy range, those variations wont have an impact on your financial well-being.

Don’t Miss: Sync Ppc Credit Card

What Is A Credit Scoring Model

Scoring calculations are based on payment record, frequency of payments, amount of debts, credit charge-offs and number of credit cards held. A weight is assigned to each factor considered in the models formula, and a credit score is assigned based on the evaluation.

Scores generally range from 300 to 850 .

Lenders use credit scores to help determine the risk involved in making a loan, the terms of the loan and the interest rate. The higher your score, the better the terms of a loan will be for you. There are different credit score models, which emphasize varying factors.

Length Of Credit History

If you have had credit available to you for a long time, your credit report should provide an accurate picture of how you use credit and if you had one, how you got through a difficult time. For someone who has not used credit for very long time, it is difficult to tell if they really know how to use credit responsibly.

Good or bad, most information will be automatically removed from someones credit report after 6 7 years, so the only way to keep a credit report active, is to use credit, at least very minimally, on an ongoing basis.

Time is needed to get a true picture of how responsible someone is with credit. This is why the length of your credit history is the third most important factor in your credit score calculation.

Your score will reflect how long it has been since you first obtained credit, how long each item on your credit report has been reporting and whether or not you are actively using credit right now.

If you have recently obtained credit for the first time, your credit score will not be very strong. However, if you have been using credit responsibly for many years, this factor can work in your favour.

If you have been involved in a bankruptcy, consumer proposal, orderly payment of debt or debt management program, your credit history will essentially restart whenever you complete your program.

You May Like: 623 Credit Score Credit Card

Fico Score Vs Vantage Score

The three major credit bureaus created the Vantage Score back in 2006 to compete with Fair Isaac Corporations FICO credit score model. Since then Vantage Score has released several new credit score models, including Vantagescore 3.0 and 4.0.

While the Vantage Score has grown more popular and is easier to check, thanks to free credit monitoring services like Credit Sesame, both your FICO score and your Vantage Score work to reveal your credit behavior.

The credit score ranges are very similar, although Vantage Score does have a category for perfect credit .

If you earn an improvement within one of these credit score models, you will almost always see the same result with the other model, too especially if you have a shaky credit history and have a couple years of work to achieve a good credit score.

How Are Credit Scores Calculated

Your FICO scores incorporate all your positive and negative borrowing/lending activity, and breaks it down according to a few factors:

- Payment history: 35%

- Length of credit history: 15%

- New credit: 10%

All of this activity is reported to the three credit bureaus — Experian, TransUnion and Equifax — which is then listed on your and, in turn, comprises the bulk of your credit score.

Don’t Miss: Leasingdesk Hard Inquiry

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

The Number Of People In Each Credit Score Range

When it comes to credit scores, it can be interesting to see how you measure up to the rest of the population. Knowing how your credit score compares to others may leave you feeling pretty confident, or it might reveal that you have some catching up to do.

Below is a look at the percentage of people in each of the five credit score ranges. There is a separate chart for FICO Scores and VantageScore credit scores.

Read Also: Syncb Ntwk Card

Learn About Credit Score Ranges From Fico And Vantagescore And How They Classify Excellent Good Or Poor Credit Scores

By Allan Halcrow | American Express Freelance Contributor

7 Min Read | January 31, 2020 in

Figuring out what a credit score of 640 means isnt really as tough as cracking the Da Vinci Code. But by the time youve considered the various credit score scales , it can certainly feel that way.

Fortunately, you dont need to be the hero of the Da Vinci Code to make sense of your . Thats because the different scales are more similar than different, and the scales are divided into credit score ranges whose names are simple and easy to remember .

Although cracking the credit code wont help you save the world, knowing the credit score range where your score lands can help you understand how lenders may view you in terms of credit risk. That could help you plan various aspects of your life, including the likely success of credit card, loan and rental applications, and whether you can expect to be offered favorable interest rates. And if you dont like the implications of your credit score range, you can take actions that could change it.

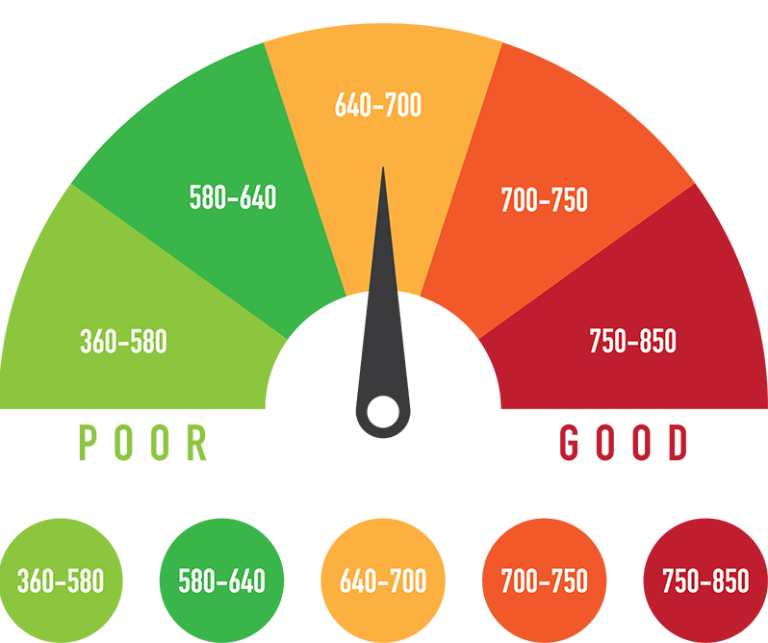

The two most commonly used credit scoring models, FICO and VantageScore, both rank credit scores on a scale from 300 to 850 and divide the scale into five credit score ranges. The ranges differ somewhat between the two models, and also have different names. If youve heard of higher scores, its either based on old information or industry-specific scoring models.

- Superprime

- Subprime

Equifax Credit Score Rangesand Others

How To Get Your Credit Score

You can find your credit scorewhich is based on information from your credit reportfrom a variety of sources. First, you can check your score for free through services like . Some banks, credit unions, and credit card issuers make your credit score available either on your billing statement or online, as well.

Finally, you can access your credit score from any of the major credit bureaus: Equifax, Experian, and TransUnion.

To help you understand your score, many of the companies that provide your credit score also will include a gauge that helps you figure out whether you have good or bad credit and the factors that influence your credit score.

Your credit report contains the information used to calculate your credit score. As a result of the financial hardship caused by the global pandemic, you can now access your credit report for free each week through AnnualCreditReport.com, through April 20, 2022.

Read Also: Does A Closed Account Affect Credit

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?