The Minimum Required To Calculate A Credit Score

For a credit score to be calculated, your credit report must contain enough informationand enough recent informationon which to base a credit score.Generally, that means you must have at least one account that has been open for six months or longer, and at least one account that has been reported to the credit bureau within the last six months. What are the minimum requirements to have a FICO Score?

Want To Improve Your Credit Score

If your credit score is a little lagging or damaged by past mistakes, donât be disheartened. Your credit score can change for the better over time by making positive steps like these:

- Pay off credit debt – Lenders like to see you using credit – but not all of it. Sticking to less than 30% of your overall limit can make you seem responsible, so if you can reduce your debt to this figure, your credit score could rise.

- Join the Electoral Roll – To help lenders identify you, . This only takes minutes and itâs a really simple way to boost your credit score.

- Always pay on time, every time – If you have existing credit agreements, set up alerts and pay with Direct Debit to make sure you never miss a payment. Even if youâve made mistakes in the past, keeping up with current debts will help you improve your credit score.

- Keep applications low – Applying for credit means lenders need to check your credit report, which will leave a search on your history. Too many searches can make it seem like youâre desperate to get your hands on money, which could be off-putting to some lenders.

Tip: try checking if youâre eligible before you apply to help keep applications low.

Disclaimer: All information and links are correct at the time of publishing.

Become a money maestro!

Sign up for tips on how to improve your credit score, offers and deals to help you save money, exclusive competitions and exciting products!

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

You May Like: Does Speedy Cash Report To Credit Bureaus

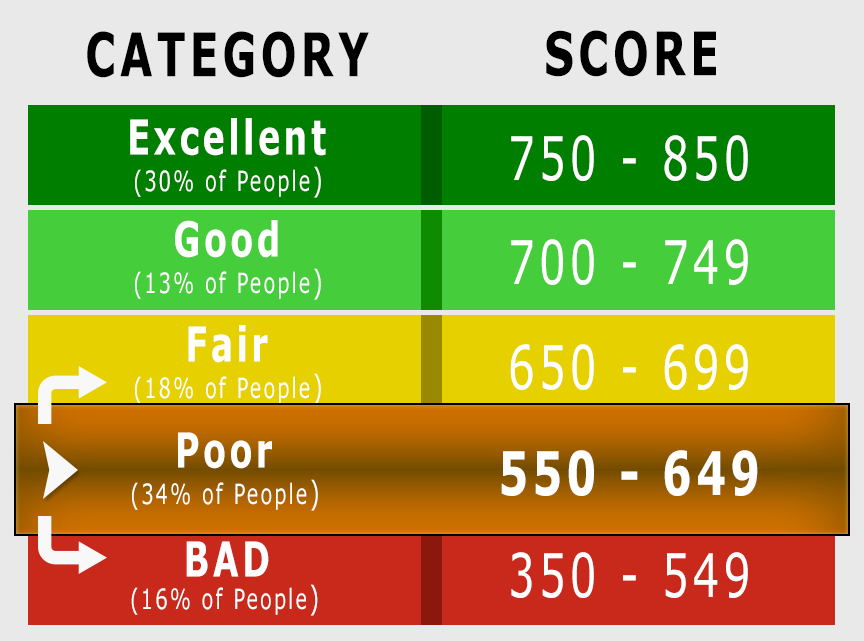

Getting Mortgages With A 631 Credit

Just like with personal loans, a credit score between 550 and 649 will provide you with sub-par rates and terms. In fact, with a 631 credit score, you may not even qualify for mortgages with many lenders. If you will you should anticipate interest rates ranging from five to six percent.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 631 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

What makes an impact on your credit?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

The third factor in play is your length of credit history, which assesses the average age of your accounts and how long its been since those accounts were actually used. The last two, smallest factors are how often you apply for new accounts and how diverse your credit portfolio is. In other words, opening multiple accounts at a time hurts your score, while having different types of accounts improves it.

Tips To Get A Personal Loan With 631 Credit Score

As mentioned, it can be harder to get approved for a personal loan when your credit score is around 631. On the bright side, there are some ways to increase your chances of being approved for a loan quicker without having to apply for dozens of loans through the process:

Personal Loan Requirements

Apart from ones credit score, there are several requirements that determine if one is eligible for a personal loan, such as the following :

- Age: 21 to 60 must show proof of birthday.

- Employment: Must show proof of employment must be with current employer for at least one year or have been self-employed for at least two years.

- Proof of Income: Provided by W-2 forms, tax returns, bank statements, or pay stubs.

- Identification: Proof can be provided by a drivers license or state ID, Social Security, and/or a passport.

- Verification of home address: Can be provided by utility bills or copy of lease.

Depending on the lender, there may be additional requirements or specific details asked apart from the above, such as certain information about your employer, your contact details, your previous address, your college/university name and major, and the like.

Alternative Option to a Personal Loan: A Credit Card

Improving Your Credit May Save You Money

Also Check: What Is Syncb Ntwk On Credit Report

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

Fha Loan With 631 Credit Score

FHA loans only require that you have a 580 credit score, so with a 631 FICO, you can definitely meet the credit score requirements. With a 631 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

Also Check: Speedy Cash Collections

Applying For A Loan With A 631 Credit Score

Say you have a credit of 631: Youre smack dab in the center between bad and fair credit. To lenders, this means your financial responsibility isnt the best, but it also isnt the worse. Due to this, lenders may be more likely to approve you for a secured loan that has a collateral than an unsecured loan without a collateral.

However, it isnt the end of the world. Even with 631 credit score, you can receive even an unsecured personal loan. The situation is much more complex than just having poor credit theres other things that go along with it.

There are some companies out there who will only lend to individuals with good or excellent credit. However, there are still plenty of lenders who will lend to borrowers with 631 credit score.

Below, you will discover a list of some of your most desirable options for receiving a personal loan with a 631 credit score.

Different Scores At Each Credit Bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

Read Also: How To Remove Repossession From Credit Report

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Inaccurate Credit Histories Are Common

Many people in this situation discover they have a few negative entries on their credit reports that are not accurate.

When you discover inaccurate credit information on your credit report, youll want to get that negative entry removed as soon as possible so your credit score can be all that it can be.

Unfortunately, when you apply for credit, credit card issuers and other lenders wont care whether your credit score doesnt really reflect your actual credit risk. No matter how well you explain things, the lender will rely on what myfico says.

The terms of your new car loan or personal loan will reflect this reported credit risk. In other words, youll pay higher interest rates because of your inaccurately low score.

When you have worked hard to establish a long history of on-time payments and responsible credit utilization, these kinds of lending decisions are beyond frustrating!

So removing inaccurate credit information from your credit history is a must. Doing this should restore your credit history within a couple months.

There are a couple ways to go about it:

- Do It Yourself Credit Repair: You can call the lender who reported incorrect credit information and ask that they correct the inaccurate data. I always recommend handling this in writing.

- Professional Credit Repair: If youre the type of person who would rather pay a professional handle it and just be done with the whole thing, I suggest you check out Lexington Law.

Recommended Reading: Is 626 A Good Credit Score

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

You Need A Mortgage Loan

You definitely dont need a mortgage loan to have good credit. However, if you want to max out your credit score, having a mortgage loan with good payment history is a must.

Since a mortgage loan is usually a relatively large loan and more difficult to get than other installment loans such as an auto loan, a mortgage shows creditors you have been responsible enough with your credit to get the mortgage in the first place.

Fair Isaac Corporation, which provides the FICO score, recommends you have a mix of different types of credit accounts. So along with credit cards and installment loans, a mortgage loan is the last piece of the pie to round off your credit mix.

I also want to note I didnt start seeing my credit score go up because of the mortgage loan until about a year later, so it definitely takes some time.

You obviously shouldnt take out a mortgage loan just to get a perfect credit score. But a mortgage loan is normally considered to be good debt, in that interest rates are relatively low and youre financing something that usually appreciates in value.

If you dont already have a mortgage, be sure to fix up your credit report before applying for a mortgage assuming youre ready for homeownership.

You May Like: Credit Report Itin Number

Request A Credit Report And Dispute Any Credit Report Errors

It’s smart to look over your credit reports from each of the three major : Experian, Equifax and TransUnion. You can proactively monitor your credit and receive three free credit reports annually at annualcreditreport.com.

Be sure to check for errors on your credit reports that could be hurting your score. While it may seem unlikely that your reports would be flawed, 26% of participants in a study by the Federal Trade Commission found at least one error on their reports that could make them appear riskier to lenders.

Common mistakes, according to My FICO, occur when a person applies for credit cards under different names, if a clerical error is made when information is typed from a hand-written application or if an ex-spouse’s information remains on a person’s report. If you spot an error, you should then gather any supporting evidence and dispute the mistake either online or by phone with the respective bureau who issued the incorrect report.

Can You Get A Credit Card With A 631 Credit Score

Credit card applicants with a credit score in this range may be required to put down a security deposit. Applying for a secured credit card is probably your best option. However, they often require deposits of $500 $1,000. You may also be able to get a starter credit card from a credit union that comes with a low credit limit and high interest rate.

If you are able to get approved for a credit card, it is vital that you make your payments on time and keep your balance below 30% of your credit limit.

See also:7 Best Secured Credit Cards

Recommended Reading: What Credit Score Does Carmax Use

Usda Loan With A 631 Credit Score

USDA loans are for people who plan to purchase a home in a rural area with little to no down payment. The property will need to be located in an eligible area. You can search for property eligibility using the USDA eligibility tool.

You should be able to get a USDA loan with a 631 credit score because the USDA guidelines do not have a minimum credit score requirement.

What lenders will look for is a history of paying bills on time. So, you can have a lower credit score but the lenders underwriter will make a judgement call based upon what they see on your credit report.

Requirements for a USDA loan:

- Employed for the past two years

- Positive credit payment history

- You must be a US Citizen

- Home must be your primary residence and cannot be a working farm

- No recent bankruptcies or foreclosures.

We can help you to qualify for a USDA loan with a 631 credit score. Just contact us to get the conversation started or read more about USDA loans here.

How To Improve A 631 Credit Score

The best approach to improving a 631 credit score is to check the of your free WalletHub account. This will tell you what problem areas to focus on and how to correct them. If your grades are similar to those earned by the average person with a 600 credit score, improving your credit utilization and paying your bills by the due date every month should be among the first orders of business.

There are four ways to improve your credit utilization, which refers to how the balances listed on your credit card statements each month compare to the credit limits for those accounts. You can spend less, make bigger payments or pay your bill multiple times per month to bring down your statement balances. You can also request higher credit limits, but thats harder for you to control.

On-time payments are important because your payment history accounts for a lot of your credit score, and success in this area is directly within your control. The best approach is to set up automatic monthly payments from a bank account. This will at least save your score from taking a hit just because you lose track of time.

Below, you can get a feel for how your credit analysis might look as well as what your other top credit-improvement priorities might be.

631 Credit Score Sample Scorecard:

Was this article helpful?

Related Scores

Recommended Reading: Speedy Cash Repayment Plan