Types Of Credit Scores: Fico Vs Vantagescore

There are two main credit scoring models: FICO and VantageScore. However, lenders have a clear preference for FICO its model is used in over 90% of U.S. lending decisions.

FICO and VantageScore credit scores have some similarities: In both, scores range from 300 to 850 and payment history is the most influential factor in determining your score. But they differ in exactly how they weight and rank several other factors.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Your Credit Card Provider

Many credit card providers also offer cardholders the ability to check their credit scores for free. Oftentimes, these tools include access to view your score history and see what led to recent changes. Some providers also let customers forecast how their scores would react to variables like on-time payments, credit limit increases and taking out a mortgage.

Keep in mind, however, that most providers require cardholders to opt in to this service, so make sure you sign up if you want to access your score.

Heres a look at popular credit card providers with credit score tools.

Also Check: What Credit Score Do You Need For Affirm

Does Credit Karma Offer Free Fico Credit Scores

The VantageScore and FICO modelsdiffer in several ways, but that doesnt mean one is better or more accurate than the other. Lenders may rely on different scoring models when evaluating an application, and other considerations can factor in, too.

We recommend looking at your credit scores as a guide to your credit health rather than as a definitive number that determines whether youll be approved or denied for credit.

How Does Creditcom Get My Credit Score

![How to Get an 850 Credit Score [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-get-an-850-credit-score-infographic-tradeline.jpeg)

Okay, weve established that Credit.com provides your credit score and credit report card completely free of charge. But how exactly do we get your credit score? It comes directly from Experian, one of the three major credit bureaus, and is updated every 14 days. Not only that, but youll get access to your credit report card. Itll dig into the five factors that affect your credit scorepayment history, credit utilization, credit age, new credit inquiries and account mixand give you a personalized action plan to help you reach your credit and financial goals.

Read Also: Does Klarna Affect Your Credit Score

How Can I Check Credit Scores

Reading time: 2 minutes

Highlights:

-

You may be able to get a credit score from your credit card company, financial institution or loan statement

-

You can also use a credit score service or free credit scoring site

Many people think if you check your credit reports from the three nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports from the three nationwide credit bureaus do not usually contain credit scores. Before we talk about where you can get credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated based on a method using the content of your credit reports.

Score providers, such as the three nationwide credit bureaus — Equifax, Experian and TransUnion — and companies like FICO use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the three nationwide credit bureaus will also vary because some lenders may report information to all three, two or one, or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you get credit scores? Here are a few ways:

What Are Inquiries And How Do They Impact Fico Scores

Inquiries may or may not affect FICO® Scores. Credit inquiries are classified as either hard inquiries or soft inquiriesonly hard inquiries have an effect on FICO® Scores.

Soft inquiries are all credit inquiries where your credit is NOT being reviewed by a prospective lender. FICO® Scores do not take into account any involuntary inquiries made by businesses with which you did not apply for credit, inquiries from employers, or your own requests to see your credit report. Soft inquiries also include inquiries from businesses checking your credit to offer you goods or services and credit checks from businesses with which you already have a credit account. If you are receiving FICO® Scores for free from a business with which you already have a credit account, there is no additional inquiry made on your credit report. FICO® Scores take into account only voluntary inquiries that result from your application for credit. Hard inquiries include credit checks when youve applied for an auto loan, mortgage, credit card or other types of loans. Each of these types of credit checks count as a single inquiry. Inquiries may have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk.

Recommended Reading: What Credit Report Does Comenity Bank Pull

What It The Highest Credit Score

Most credit scoring models follow a credit score range of 300 to 850 with that 850 being the highest score you can have. However, there can be other ranges for different models, some of which are customized for a particular industry . While the majority follow the 300 to 850 range, there are some scores that range from 250 to 900 and others that may use other score ranges. For more information on the different scoring models, view Understanding the difference between credit scores.

Shoot For A Credit Score Of 800 Not 900

A credit score of 900 is either not possible or not very relevant. The number you should really focus on is 800. On the standard 300-850 range used by FICO and VantageScore, a credit score of 800+ is considered perfect. Thats because higher scores wont really save you any money.

If youre not sure what you need to do to get an 800 credit score, just join WalletHub. Youll get a personalized credit analysis that tells you exactly how to improve your credit and how long it will take. Some easy things you can do to start bringing up your credit score include paying on time, having low credit utilization, and paying down your debts. For other tips, check out WalletHubs helpful guide.

Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Opinions expressed here are the authors alone and have not been approved or otherwise endorsed by any financial institution, including those that are WalletHub advertising partners. Our content is intended for informational purposes only, and we encourage everyone to respect our content guidelines. Please keep in mind that it is not a financial institutions responsibility to ensure all posts and questions are answered.

Also Check: Do Storage Units Report To Credit

View Anytime Anywhere For Free

A good credit score can help you reach your financial goals.

Monitor your credit score1 for free through the U.S. Bank Mobile App or online banking. Its easy to enroll, easy to use, and free for U.S. Bank customers.

The VantageScore is a general indication of your credit health. U.S. Bank does not use your VantageScore to make credit decisions.

Are Fico Scores Unfair To Minorities

No. FICO® Scores do not consider your gender, race, nationality or marital status. In fact, the Equal Credit Opportunity Act prohibits lenders from considering this type of information when issuing credit. Independent research has shown that FICO® Scores are not unfair to minorities or people with little credit history. FICO® Scores have proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given FICO® Score, non-minority and minority applicants are equally likely to pay as agreed.

Recommended Reading: What Company Is Syncb Ppc

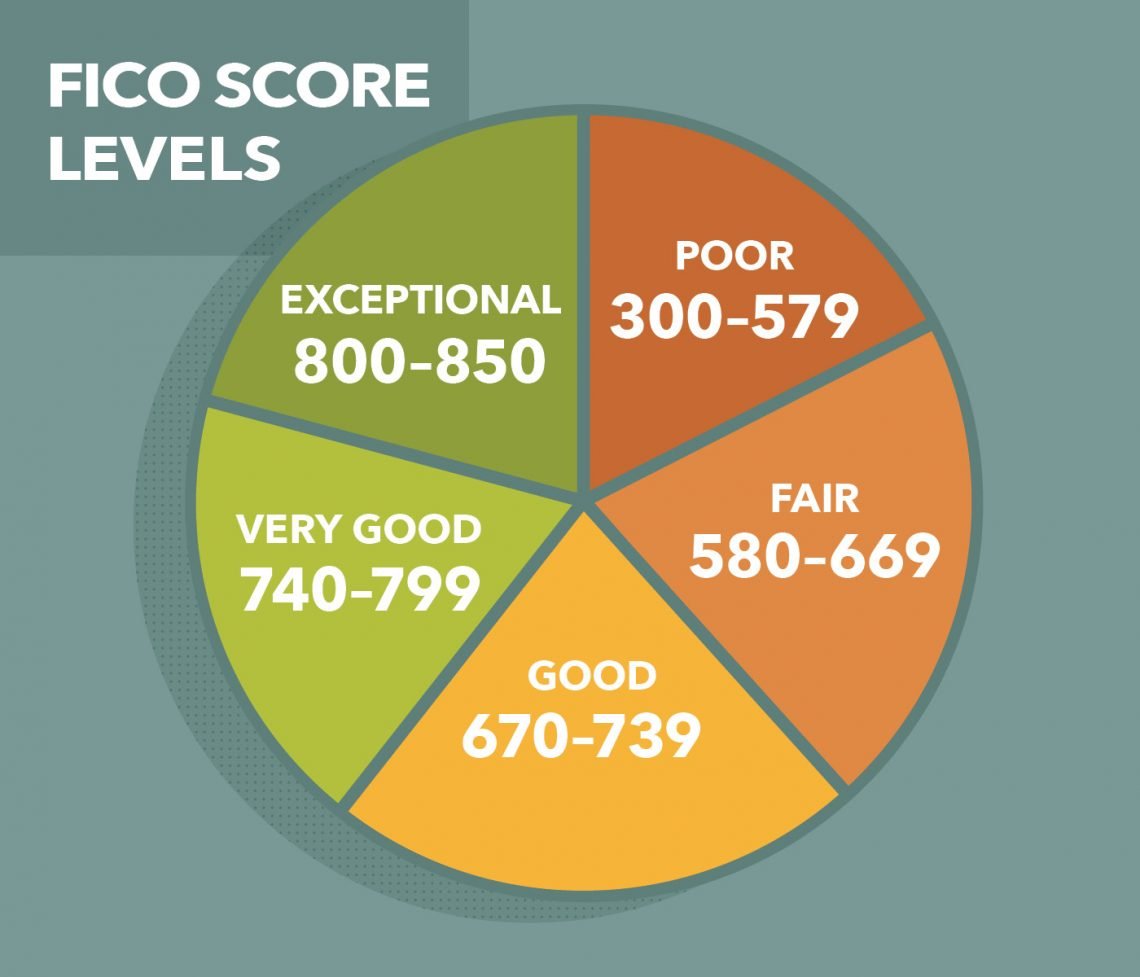

How To Interpret Your Credit Score

Checking your credit score is easy, but merely knowing the number isnt enough. To get the most out of your scoreand improve itits necessary to interpret your score and your credit report as a whole. This involves understanding the five credit score ranges and what each means to lenders. FICO scores fall into the following ranges:

Poor . A score between 300 and 579 is well below the national average FICO Score of 711. Because of this, lenders consider borrowers with a poor credit score to be risky and are less willing to extend credit to them. That said, some lenders offer bad credit personal loans tailored specifically to low-credit borrowers.

Fair . Still below the national average, fair credit scores between 580 and 669 typically qualify borrowers for loans. However, these loans or lines of credit are more likely to come with high interest rates, lower limits and shorter terms. Borrowers with fair credit may access better terms by choosing a secured loan that poses less risk to the lender.

Good . If your score is close to or above the national average, lenders consider it to be in the good range. This means youre less of a lending risk and more likely to qualify for favorable terms.

Very Good . An above-average credit score indicates to lenders that a borrower is reliable and more likely to make on-time payments. For this reason, borrowers with a very good credit score typically have access to more competitive credit cards and better loan terms.

How Do Public Records And Judgments Impact Fico Scores

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

Recommended Reading: Do Late Payments On Closed Accounts Affect Credit Score

Million Canadians Trust Borrowell

Courtney M.

Love this! I was a little skeptical at first but it tells you who you still owe and how much. Currently using this to view my credit and pay off what I owe.

Andrea B.

I have been using Borrowell for over a year now and I am a happy customer. I get the real deal on my credit and good advice also!

Ashvin G.

Excellent service. Recommend to understand your finance and banking accounts, debt control, loan utilization to build a good credit score for lending purpose.

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

Don’t Miss: Does Walmart Accept Affirm

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

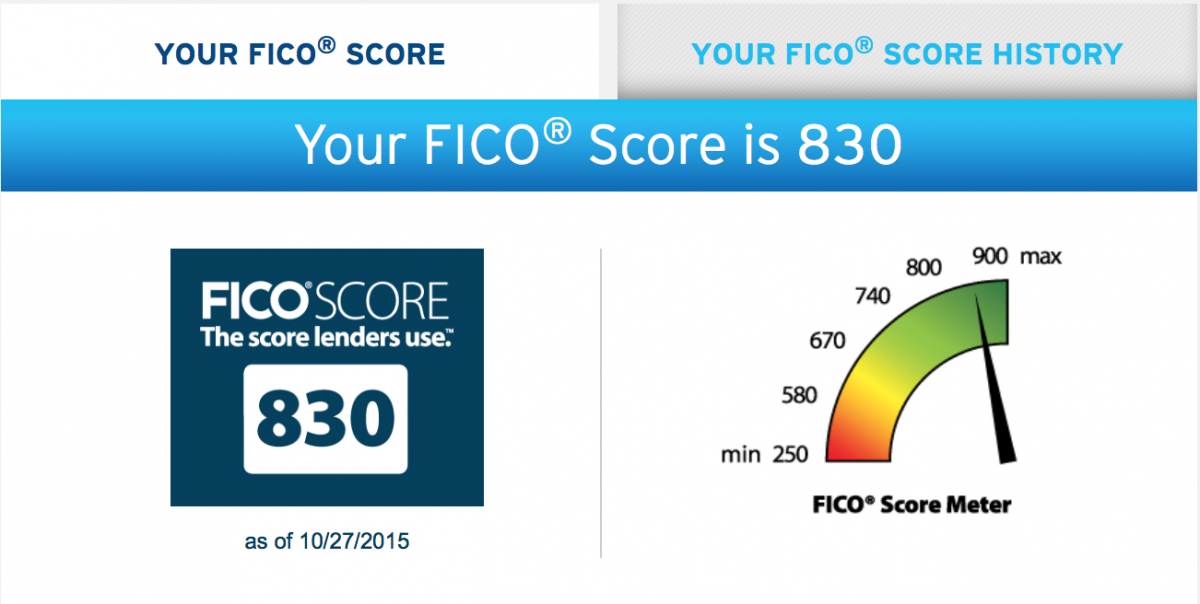

Why Is This Fico Score Different Than Other Scores Ive Seen

There are many different credit scores available to consumers and lenders. FICO® Scores are the most widely used credit scores and are the only credit scores used in over 90% of U.S. lending decisions. Its important to know that there are also several different versions of FICO® Scores. Different lenders may use different versions of FICO® Scores. In addition, your FICO® Score is based on credit report data from a particular credit bureau, so differences in your credit reports may create differences in your FICO® Scores. The FICO® Score Wells Fargo is providing you for free is for educational purposes. When reviewing any of your credit scores from any source, take note of the date, bureau credit report source, version, and range for that particular score. For more, see Understanding the difference between credit scores.

Don’t Miss: Itin Credit Check

Your Credit Score And Report

You can get your Equifax credit score and credit report for free with Borrowell! Check your credit score or download your credit report whenever you’d like. Receive weekly updates on how your score has changed, get personalized tips how to improve your score, and find the best financial products that match your profile. Checking your credit score with Borrowell doesn’t hurt it.

Can I Expect The Fico Score Version I Receive From Wells Fargo To Change

FICO® periodically updates its scoring models and Wells Fargo may choose to upgrade to a more updated score version. If this happens, we’ll notify you when a change to the score version change occurs. You can locate the score version on your FICO® Score display. It is listed directly below the score and rating.

Also Check: 888-826-0598

Does A Fico Score Alone Determine Whether I Get Credit

No. Most lenders use a number of factors to make credit decisions, including a FICO® Score. Lenders may look at information such as the amount of debt you are able to handle reasonably given your income, your employment history, and your credit history. Based on their review of this information, as well as their specific underwriting policies, lenders may extend credit to you even with a low FICO® Score, or decline your request for credit even with a high FICO® Score.

Indias Cut In Credit Rating

Indias credit rating has moved one step closer to junk after Moodys Investors Service had downgraded the country to a low investment grade level and had also surprised the economists.

Moodys had reduced the long-term foreign-currency credit rating to Baa3 from Baa2, and this implies that it can get cut further. This action brings it in par with the BBB- assessment from Fitch Ratings Ltd and S& P Global Ratings. The economy is now facing a huge contraction in over four decades.

4 June 2020

Read Also: How Long Repo Stay On Credit

What To Do If You Were Sent Too Much Money And Don’t Want To Owe The Irs Next Spring

If you’re eligible for the full amount of child tax credit money, you won’t have to pay it back. Child tax credit payments do not count as income. However, if you no longer qualify for the full amount but you receive the full amount anyway, you may need to pay back that extra money.

An overpayment from the IRS may occur if your income went up this year or if your child is aging out of a payment bracket this year . The age brackets for dependents apply to how old your child will be at the end of this calendar year.

The agency is using what it calls “repayment protection,” so if you do receive an overpayment but fall below a set income level, you don’t have to pay the money back. Above that income level, you will have to pay back some or all of the extra funds. Here’s more on taxes and how repayment protection works.

How To Get Your Equifax Credit Score For Free

Like Experian, Equifax offers a free 30-day trial of its full credit monitoring service. It costs £7.95 a month after the free trial.

Alternatively, you can get your Equifax report and score free through ClearScore.

The company makes it money from commission on products you take out via its website.

Recommended Reading: What Credit Report Does Comenity Bank Pull