Hard Inquiries Vs Soft Inquiries

The essential difference between a hard inquiry and a soft inquiry is whether or not you gave the lender permission to check your credit report.

Generally speaking, if you let a lender scrutinize your credit report, its a hard inquiry. If a lender or bank peers into your credit report without your knowledge or permission, its a soft inquiry.

As far as your credit score is concerned, soft inquiries are harmless and will mostly go unnoticed. Hard inquiries, however, can leave a mark on your credit report, especially for anyone rapidly applying for credit in a short time span.

Check Your Credit Reports For Free

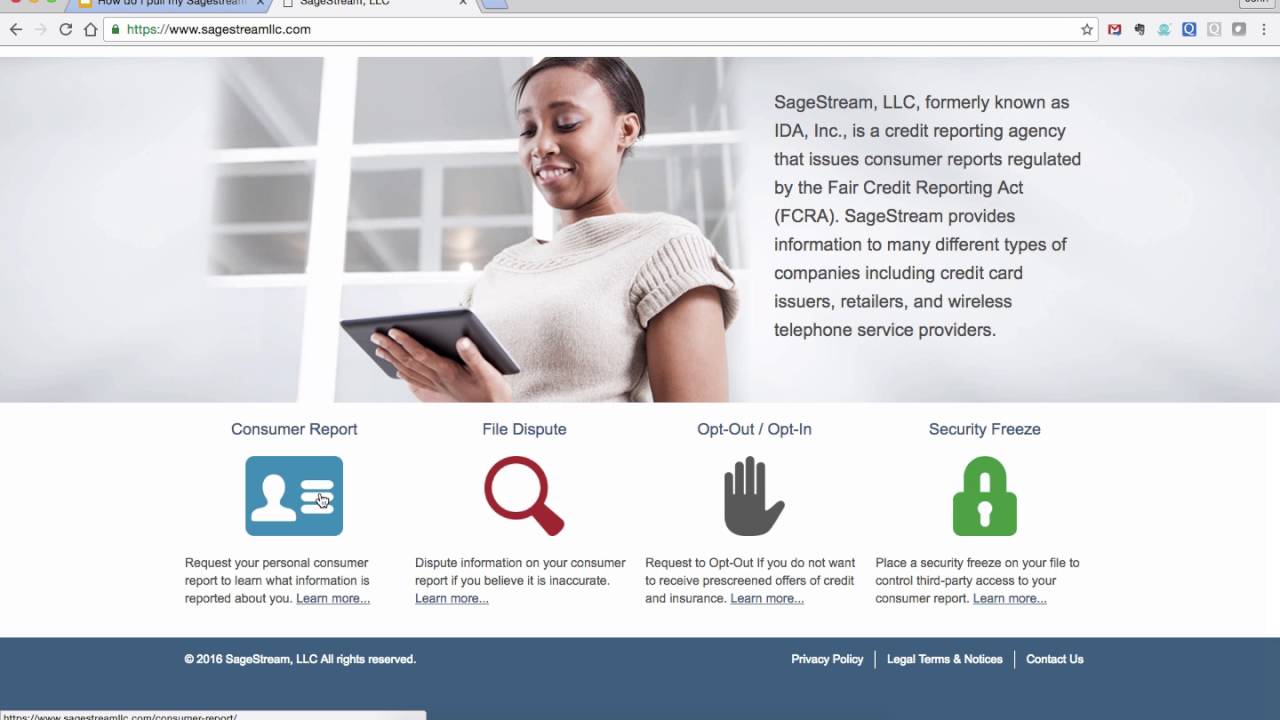

The first step is to get your credit reports from each of the three credit bureausEquifax, Experian and TransUnion. Often, the same information is recorded on all three, but not always, and thats why its important to check all three.

You can typically pull your credit reports for free once per year on AnnualCreditReport.com. However, due to Covid-19, you can order free weekly credit reports until April 20, 2022.

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

You May Like: Speedy Cash Loan Extension

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

How To Pull A Free Annual Credit Report

by Christy Bieber | Updated Sept. 17, 2021 – First published on Dec. 26, 2018

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Checking your credit is important. You want to keep tabs on your credit report so you can catch mistakes if inaccurate information finds its way onto your record. You can also track your debt repayment efforts and can make sure you aren’t a victim of identity theft by watching for accounts you don’t recognize or inquiries from creditors when you didn’t apply for a loan.

Unfortunately, many people don’t check their credit at all, or do so rarely. This is a major mistake, especially when checking your credit is both free and easy since every American is entitled to a free annual credit report from each of the three major credit bureaus.

Not sure how to pull your free annual credit report? This guide will help you to understand exactly how to pull a free annual credit report so you can check your credit without incurring any costs.

You May Like: 611 Credit Score Car Loan

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.

If the information is wrong, you can try to fix it. If the information is right but not so good you can try to improve your credit history.

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

Don’t Miss: How To Remove Hard Inquiries From Credit Report Fast

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

The Importance Of Knowing Your Score

As we mentioned above, you shouldn’t go through life without knowing your credit score. This number is updated regularly. It goes up or down usually every month, but it may even be changed more frequently based on who’s reporting.

Knowing your score means you’re more likely to make better decisions about your finances. Having a lower score may make you more cautious about applying for new credit as there’s a good chance you’ll be denied. If you have a lot of inquiries and very few accounts, your score drops, and lenders may refuse to grant you a new account. On the other hand, knowing you have a higher credit score makes you a more attractive applicant to .

Keep in mind that checking your credit score isn’t the same as checking your . Your credit report provides a detailed history of your financial life, including any accounts you have, how often you’ve paid them on time, any delinquencies, bankruptcy reports, flags and messages, write-offs, and inquiries. The report also includes the dates of any changes to your credit history. You can use this history to account for and report any discrepancies.

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. You’ll have to pay them if you want your credit score. But why pay when you can get your score for free?

Recommended Reading: 779 Credit Score

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Question: What Impacts My Credit Score The Most

Answer: Payment history is the most important factor in calculating your credit scores because it shows how you’ve managed your finances, including whether you’ve made any late payments. Your credit history is also very important as it demonstrates how long you’ve been managing your accounts, when your last payments were made and any recent charges.

Recommended Reading: Report Death To Credit Bureaus

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.

You May Like: Paypal Credit Bureau

What To Remember When You Are Rate Shopping

If you need a loan, do your rate shopping within a focused period such as 30 days. FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which the inquiries occur.

When you look for new credit, only apply for and open new credit accounts as needed. And before you apply, it’s good practice to review your credit report and FICO Scores to know where you stand. Viewing our own information will not affect your FICO Scores.

As a general rule, it is OK to apply for credit when needed. Be mindful of this information so you can start the credit-seeking process with more confidence.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Question: How Is My Credit Score Calculated

Answer: A credit score is calculated using the information in your credit report, so a credit score can change as often as the information in your report changes. There are many different types of credit scores, and it’s normal to have more than one. Scores can vary depending on what type of credit you’re applying for or on what day the score is calculated. TransUnion uses the VantageScore® 3.0 credit score. Get more information about VantageScore.

Generally, scoring models use credit report information that falls under six main categories to calculate a credit score:

Also Check: Opensky Payment Due Date

Check Your Credit Report Regularly

It isn’t common to find inaccurate information on your credit report, but it can happen. To avoid letting fraudulent and other erroneous information go unchecked, make it a goal to check your credit report regularly. Review what’s listed and watch out for anything you don’t recognize.

Also keep an eye on your credit score , and watch out for sudden drops that could indicate fraudulent activity, such as a bogus account opened in your name that’s gone unpaid.

It’s not always possible to prevent identity theft, but as you keep track of your credit history, you’ll be in a better position to stop a difficult situation from getting much worse.

Who Can Request A Copy

- lenders and creditors

- insurance companies

- landlords

- potential employers

If a person denies you credit or increases a charge or fee and if you request it within 60 days you must be told:

- the nature and the source of the information

- the name and address of the consumer reporting agency reporting the information

Don’t Miss: Check Credit Score With Itin

Let Donotpay Help Remove Paid Charge

Writing letters and requesting debt collectors verify debt can be time-consuming and tedious. To save you time and headaches, DoNotPay has an alternate solution that will help you clear paid charge-off accounts from your credit report with minimal effort on your part.

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

Do I Have To Pay For My Credit Report

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

You May Like: How To Remove Hard Pulls From Credit Report

How To Dispute Or Remove Credit Inquiries

Its possible to dispute or remove some credit inquiries from your credit report. If you initiated the hard credit pull by applying for new credit, you cannot remove the credit inquiry from your report. However, if the credit inquiry is the result of identity theft or some other error, you can file a dispute with the credit bureaus and request a hard inquiry removal.

To dispute a credit inquiry, follow the instructions associated with the credit bureau that developed the report.

According to a 2013 Federal Trade Commission study, 5 percent of Americans have errors on their credit reportsbut that doesnt mean every unfamiliar credit inquiry on your credit report is the result of an error. As Experian reminds us, credit inquiries can come from lender names we dont recognize and we often dont realize that applying for a car loan or a mortgage could prompt multiple hard credit inquiries from potential lenders. Think carefully about where those credit inquiries might have come from before filing a dispute.

What Is A Credit Inquiry

Many businesses or lending institutions can request information from your credit report when determining whether you are an ideal applicant for a loan, credit card, or similar account. If you have considered financing a new cell phone, applying for a credit card, or pursuing other types of loans within the past two years, your credit report likely includes legitimate inquiries for each of these items.

There are two kinds of credit inquiry:

| Hard Credit Inquiries | This inquiry typically affects your credit score. It indicates a new loan application, such as mortgage or credit card, and is visible to those who want to check your credit standing. |

| Soft Credit Inquiries | This does not affect your credit score at all. This is recorded when companies offer preapproval offers for credit and loan products. This is only visible to you. |

Also Check: Does Klarna Financing Report To Credit Bureaus

Best For Single Bureau Access: Credit Sesame

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your information often gives you an idea of where your credit stands and whether you need to improve your score. Credit Sesame analyzes your credit information to make recommendations for credit cards, loans, and other financial products, but you dont have to apply if youre not on the market for a new loan.

How Do I Know If I Have Too Many Credit Inquiries

There is no concrete number of how many credit inquiries is too many. If youre concerned about the number of inquiries on your credit report, the first step is to get a free copy of your credit reports. Its not so much about the number of inquiries, but more so the time between them.

For example, if youve applied for five credit cards in a period of three months and have five hard inquiries as a result, its likely to be considered as a negative detail on your report. In contrast, having five hard credit inquiries listed over a period of five years will have far less of an impact or perhaps no impact at all.

What to do if you think you have too many inquiries on your credit report

If youve looked at your credit report and think the number of credit inquiries listed could have a negative impact on your credit score, you can start to improve your credit score in other ways.

Don’t Miss: What Bank Is Syncb Ppc