Its Unnerving Violating And Downright Infuriating To Have Someone Steal Your Personal Information

In an age of frequent data breaches, identity theft can happen to anyone. And if its happened to you, youre probably wondering what to do after identity theft to clean up the mess.

Identity theft happens when someone steals your personal information and fraudulently uses it for their personal gain. In many cases its for financial gain, such as opening accounts or making purchases, but it can come in other forms too.

Fortunately, you can take steps to get things back on track. Here are six straightforward steps you can take today.

Identity Theft Victim Steps To Take

If you believe your information may have been stolen and used fraudulently, it can be hard to know what to do and where to report it. So, here are a few things to consider if you believe you’re a victim of identity theft:

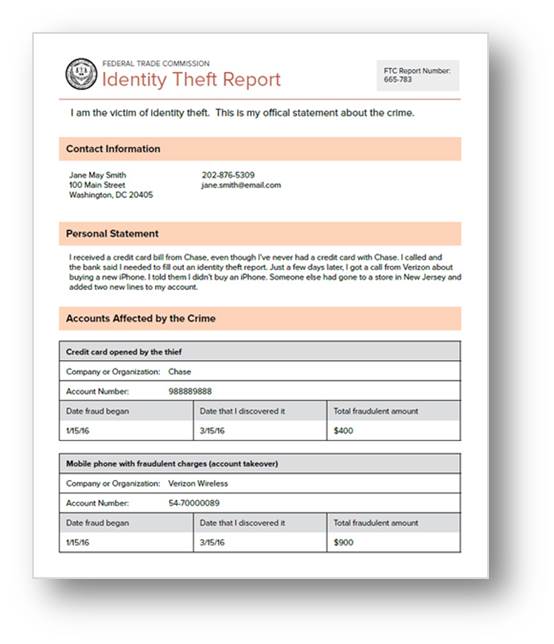

The FTC advises you to keep a record of the calls you make and the people you speak to, and keep copies of any letters you send or receive. Its also a good idea to keep a written record of other actions you take, such as closing accounts or disputing charges.

How Long Do Hard Inquiries Stay On Your Credit Report

Hard inquiries stay on your file for two years. However, they only impact your score for the first 12 months. They have no impact on your score after that point. Additionally, not all hard inquiries impact credit scores. For example, if you’re comparing loan rates during a short period of time , scoring models will round up all hard inquiries under a single one.

Recommended Reading: Credit Bureau Death Notification

Am I On The Hook For The Money

Per the Fair Credit Billing Act, most credit card companies have protections for those affected by identity theft, like zero-liability policies. The law also sets the maximum liability for unauthorized charges at $50.

Fraudulent ATM, debit cards and electronic transfers are protected under the Electronic Transfer Fund Act. However, it’s important to act fast to avoid charges. If you report your debit or ATM card as lost or stolen before anyone uses it, you’re off the hook for any fraudulent charges. Otherwise, if you report your card as lost or stolen within two days of learning of the loss or theft, your maximum liability for any unauthorized charges will be $50. If you report the card as lost or stolen between two days after learning of the loss or theft, but less than 60 days after your statement is sent to you, your liability is $500. If you report a card lost or stolen more than 60 days after your statement is sent to you, your liability is unlimited.

If you are a victim of identity theft, consider keeping a security freeze or fraud alert on your credit reports while you work to undo any damage. Being vigilant against signs of identity theft and catching the theft or fraud early can help keep the damages to a minimum.

Should You Freeze Your Credit

If youre seeking an extra layer of protection, you may want to consider freezing your credit reports. A freeze will:

Help block new lines of credit

Provide further protection from thieves getting credit in your name

Limit access to your credit report

While a fraud alert requires businesses to verify your identity before extending a new line of credit, a credit or security freeze prevents anyoneeven youfrom obtaining new credit until the freeze is lifted. While fraud alerts last for 90 days or seven years, most credit freezes hold until you release them.

If youre an identity theft victim, the sooner you take the necessary steps to stop fraudsters from continuing to use your identityand resolve the issues resulting from being victimizedthe better.

Get LifeLock Identity Theft Protection 30 DAYS FREE*

Criminals can open new accounts, get payday loans, and even file tax returns in your name. There was a victim of identity theft every 3 seconds in 2019°, so dont wait to get identity theft protection.

Start your protection now. It only takes minutes to enroll.

You May Like: What Does Cls Mean On A Credit Report

Could It Hurt My Credit Scores

Unfortunately, being a victim of identity theft means your may be negatively impacted. Thieves could open new lines of credit or credit cards in your name — and fail to pay the bills. As debt accumulates and payments are missed, your scores may be negatively affected, because of the payment history associated with the accounts or the increase in your credit utilization. Learn more about what actions can affect credit scores.

After you report the fraud, you can work with collection agencies and banks to get any fraudulent collection accounts, late payments and balances removed from your credit reports. You can also file a dispute with the three nationwide credit bureaus. Visit our dispute page to learn how to file a dispute with Equifax.

Was Your Identity Stolen Remain Calm And Follow These Steps To File A Police Report

If your personal information has been compromised, you may need to file a police report for identity theft.

The sooner you report identity theft, the faster you can prevent further damage to your financial reputation.

However, victims of identity theft are often surprised to hear that filing a police report is only required in certain situations.

Filing an Identity Theft Report with the Federal Trade Commission should be your top priority.

In this guide, you’ll learn when you should file a police report if your identity was stolen.

Read Also: Can You Remove Hard Inquiries From Your Credit Report

Protect Your Identity Online With Avast Breachguard

No one is immune to identity theft. With companies increasingly vulnerable to data breaches, safeguarding your information online isnt easy. But with the right tools, you can bolster your security and minimize your risk.

Avast BreachGuard a comprehensive data-leak monitoring tool will help you check to see if your personal info or passwords have leaked, and it will help you take the necessary steps to secure your data. BreachGuard will also help you remove your personal information from data brokers databases, to help your data stay private. Get Avast BreachGuard and keep your identity and your personal data safe.

Requesting A Fraud Alert By Phone

If you prefer reaching out by phone, you can call to request a 90-day fraud alert, but not an extended alert. Your call will likely be answered and handled by an automated system, so dont expect to speak with someone. When you call, be ready to provide your Social Security number, mailing address to which your bills are delivered, and birthdate.

Don’t Miss: 779 Credit Score

S To Recoup From Identity Theft And Credit Card Fraud

It is entirely possible to recover from credit card fraud and identity theft, especially if you catch it immediately. But you have to address it quickly and get in touch with the right providers to take corrective measures. Heres how to handle identity theft and credit card fraud if you are a victim.

If Your Mail Was Stolen Or Your Address Changed By An Identity Thief

Notify the Postal Inspector if you think an identity thief has stolen your mail or filed a change of address request in your name. To find the nearest Postal Inspector, look in the white pages of the telephone book for the Post Office listing under United States Government. Or go to the Postal Inspection Services Web site at www.usps.gov/websites/depart/inspect.

Don’t Miss: How To Report Tenant To Credit Bureau

When Should I Consider A Credit Freeze

You might consider a credit freeze if you know your information has been exposed in a data breach. Why? Cybercriminals may have accessed your personal information, which could be used to commit financial fraud.

Often, the exposed information which might include personally identifiable information like your name, address, date of birth, and Social Security number is sold on the dark web. If you think youve been a victim of identity theft, a credit freeze might be a smart move.

Other examples? You might also consider freezing your credit if you start to receive bills for credit accounts you didnt open. For instance, it could be a medical bill you dont recognize. Or you might receive calls from a collection agency seeking payment on a credit line you never opened. These are signs that youre a victim of identity theft.

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. Its also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item youd like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file. However, even if the lender tells you that the item would be retracted, be sure to follow up by checking your report and verifying that they did, in fact, remove the item.

You May Like: Repo Removed From Credit Report

Two: Freeze Your Credit Reports And Place Fraud Alerts

Once you have a better idea of how thieves are using your stolen information, you can take steps to prevent further damage. If you discover red flags on your credit reports, like unauthorized inquiries or accounts you didnt open, its wise to place fraud alerts with the three credit reporting agencies. You may want to consider freezing access to your credit information as well.

As A Victim Of Fraud Or Identity Theft You Have The Right To:

- Request the credit reporting company to block information from your credit report that was the result of identity theft. You must provide an identity theft report from a law enforcement agency to request a block

- Dispute information you believe is incorrect

- Request a fraud alert be placed on your credit report

Also Check: Credit Monitoring Services Usaa

Request And Review A Copy Of Your Credit Report

After placing the fraud alerts, request a free copy of your credit report from each agency. Since each agencys report may differ, its important to look at all three to help ensure youre not missing anything important. Review the reports carefully to make sure there are no new occurrences of identity theft. If you place your fraud alert online, they should send you an email or prompt you to view your credit report online for free.

How Does Tax Identity Theft Happen

Generally, tax identity theft — and all identity theft, for that matter — occurs after a person’s sensitive information has become public or fallen into the wrong hands. This often happens due to security breaches or digital data hacks.

Tax identity theft often occurs in February and early March, as thieves must file the fraudulent returns before the real taxpayers file their legitimate ones. Fortunately, the IRS has taken steps to reduce identity theft from many angles. The agency has hired more employees dedicated to stopping fraud, implemented additional safeguards, and changed many of the standards used to file and authorize returns.

Despite these efforts, tax identity fraud does still occur. It’s important everyday Americans are prepared should it happen.

Don’t Miss: How To Delete Inquiries

Contact Lenders If Youve Received Any Bills Statements Or Demand Notices

If youâve received any suspicious mail through the door like bills or statements, then it can be a good idea to contact that specific lender directly to let them know you didnât open the account. They can begin their investigation at this stage and if you havenât checked your yet then this is the time to do so.

Report The Fraud To The Three Major Credit Bureaus

You can report the identity theft to all three of the major credit bureaus by calling any one of the toll-free fraud numbers below. You will reach an automated telephone system and you will not be able to speak to anyone at this time. The system will ask you to enter your Social Security number and other information to identify yourself. The automated system allows you to flag your file with a fraud alert at all three bureaus. This helps stop a thief from opening new accounts in your name. The alert stays on for 90 days. Each of the credit bureaus will send you a letter confirming your fraud alert and giving instructions on how to get a copy of your credit report. As a victim of identity theft, you will not be charged for these reports. Each report you receive will contain a telephone number you can call to speak to someone in the credit bureaus fraud department.

Experian 1-888-397-3742

Recommended Reading: Can Klarna Affect Your Credit Score

Resources For Protecting Your Identity

How to request a free Fraud Alert on your credit files:In order to ensure you are issued free credit reports, contact the credit bureaus DIRECT LINE for reporting fraud.

| Name | Web site |

| Equifax | |

Instruct them to flag your file with a fraud alert including a statement that creditors should get your permission before opening any new accounts in your name.

| Other helpful resources |

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesnt eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit youre currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean youre using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, youll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.

You May Like: Kohls Credit Bureau Reporting

The Road Ahead: Rebuilding Your Credit And Finances

The IRS says it typically takes 120 days or less to address cases of identity theft, but due to “extenuating circumstances” caused by the COVID-19 pandemic, the IRS’s identity theft inventories have increased dramatically. It’s taking them 260 days on average to resolve identity theft cases.

This doesn’t even include the time and resources needed to address other consequences of identity theft, such as unauthorized loans, credit cards, and purchases. Depending on how deep the theft goes and how available your personal information was, the financial ramifications can often last months or even years.

The important thing to do is to remain vigilant. This means:

In some cases, you may want to involve a lawyer — especially if your investments, retirement accounts, mortgage, or other major financial products have been affected. They can help you traverse the legal issues that crop up with creditors, lenders, and financial institutions along the way.

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently annually, if not more often so you can catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major credit bureaus once a year. However, because of the pandemic, all three bureaus are offering free weekly reports until April 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to request and check your reports from all three bureaus since its not uncommon for each one to get different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance, or employment based on your credit in the past 60 days

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- Youre a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

Other ways to get your credit report

Each of the major bureaus offers credit monitoring services that include access to your report and your score, among other benefits.

Experian

TransUnion

You May Like: How To Check Credit Score Usaa