Don’t Panic If Your Credit Score Drops Slightly With One Of The Agencies It’s Actually What’s On Your Credit Report That Matters

The idea that getting accepted for credit is all based on a simple score given to you by one of the credit reference agencies is false. At best, it’s a guide to roughly how good or bad a risk you are. As we say above, lenders will judge you on three main criteria when you apply for credit:

Yet the first two aren’t factored in to your credit score so it’s based on incomplete information. Plus, different lenders are looking for different things. When you apply, they assess you based on their own ‘ideal customer’ scorecard and each lender is different. Just because one lender rejects you doesn’t mean another will do the same. So bear in mind:

- Rather than thinking “I have a great credit score so I’ll get any credit I apply for”, it’s actually best to check how you stand with different lenders before you apply. A way of doing this is to use our . That way, you’ll have a better indication of which lenders are likely to accept you .

- If you get lots of high percentages then you’re doing reasonably well but NO ONE is ever likely to be accepted for every card or loan. If our calculator shows you’re not likely to be accepted for many cards or loans, see our tips to boost your creditworthiness.

The impact of a slight credit score drop is near meaningless

The Basics: How Credit Works

Your credit reports and score are a reflection of how you’ve managed debt in the past. Your credit reports contain information reported by your creditors that’s used to calculate your score. The three-digit scoreâwhich typically ranges from 300 to 850âevaluates the risk you pose as a borrower. Lower scores mean more risk, and vice versa.

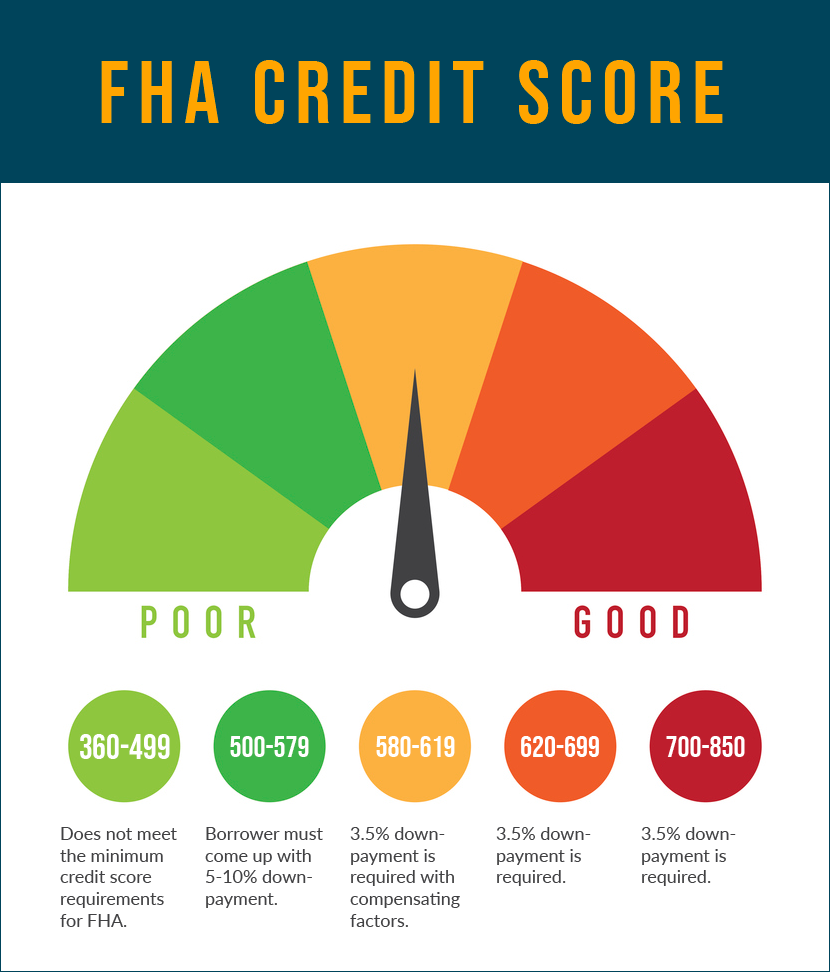

Your credit becomes important when you ask a potential lender to extend you some type of credit. This can happen for small thingsâfor example, your credit reports may be checked if you finance a new cellphoneâand is also required for large purchases, such as taking out a mortgage for a home purchase.

Good credit is something you earn as you show you can manage your debt obligations well. And there are rewards for managing your debts responsibly. When you apply for additional credit with a good credit score, it’s more likely you’ll be approved and may get favorable terms from the lender.

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

Recommended Reading: Is There A Way To Remove Hard Inquiries From Credit Report

Easy Ways To Get An Excellent Credit Score

Getting an excellent credit score may be easier than you think.

Here are 5 easy ways for you to increase your credit score:

Why Your Credit Score Matters

For better or worse, your credit score is the gateway to an array of financial products such as mortgages, auto loans, personal loans, credit cards and private student student loans.

Your credit score also may be used when you apply for insurance, rent an apartment or purchase a cell phone.

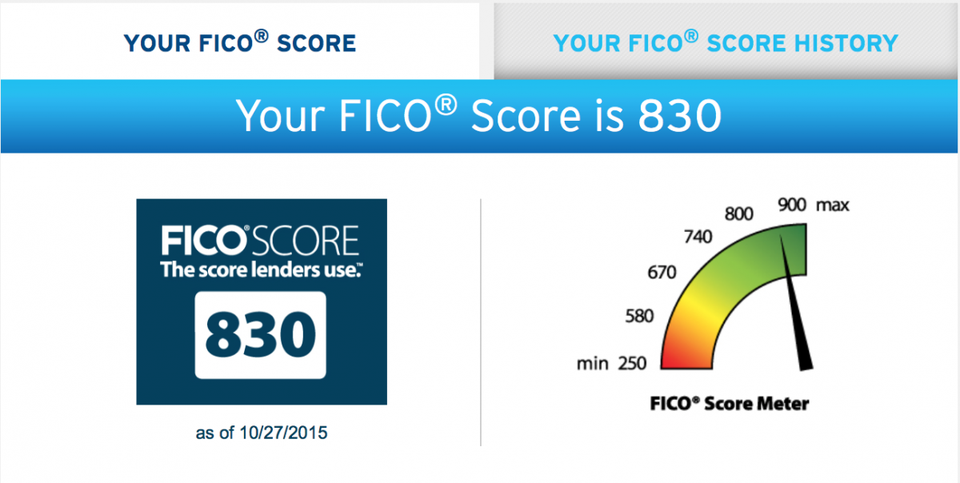

FICO are among the most frequently used credit scores, and range from 350-800 . A consumer with a credit score of 750 or higher is considered to have excellent credit, while a consumer with a credit score below 600 is considered to have poor credit.

5 Ways To Increase Your Credit Score

1. Double check your credit reports for accuracy

It’s essential that you obtain a copy of your credit reports and check it carefully. Why?

The Federal Trade Commission found that 5% of consumers had one or more errors on their credit report.

There are three major credit bureaus: Experian, Equifax and TransUnion.

Each credit bureau collects information on your credit history and develops a credit score that lenders use to assess your riskiness as a borrower. Under federal law, you are entitled to view your credit report every 12 months from each credit bureau. Since each credit bureau may have different information about your credit history, your credit score may vary across the three lenders.

2. Show you have a healthy financial track record

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

Also Check: Aargon Collection Agency Scam

More Credit Card Options

Some of the best credit cards pay generous signup bonuses and rewards, but theyre only available to consumers who have the best credit scores.

With an excellent credit score, you have a much better chance of getting approved for some of the best credit cards on the market. On the other hand, having a low credit score limits your credit card options tremendously.

Being able to qualify for better credit cards can allow you to earn rewards, such as cashback, gift cards, merchandise, and travel.

Having more credit options available to you also means you can avoid predatory lending like payday loans, title loans, and pawnshop loans. These types of short-term lending options have the highest interest rates and often keep borrowers trapped in an impossible cycle of debt.

What Is An Excellent Credit Score

You probably already know that your credit score is a three-digit number based on the information in your credit report, which includes items like your loan payment history and credit card balances. Multiple companies have models that calculate credit scoresFICO and VantageScore, for example, which both operate on a scale from 300 to 850.

Generally speaking, a higher credit score can translate to cost savings, perks and more. Your credit score is a key factor considered by lenders, so a better score can help you get more credit at attractive interest rates . Landlords and employers can also check your credit score as part of their due diligence process. And some of the best reward credit cards are only available to those with the highest scores.

So how high should you aim? Getting a perfect score is extremely difficult, so many credit overachievers strive for a score in the high 700s or 800+. That puts you squarely in the highest range for most credit scoring models .

If youre nowhere close, dont worrythe tips below will still help you improve your credit score over time. You can actually reap many of the benefits listed above with a score thats considered good. But if good doesnt cut it, read on for your roadmap to excellent credit.

You May Like: Mprcc On Credit Report

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

Stability Counts Use Consistent Details Between Applications Don’t Overchurn

Homeowners rather than renters, and those who are employed, rather than self-employed, tend to be more readily accepted for credit.

Some lenders may factor in having a fixed line rather than a mobile number on application forms, though it’s unlikely it’ll affect your score, so don’t go paying to have one installed if you don’t already have one. Having the same employer, bank and address for a while all help too.

Keep personal details the same between applications. It’s crucial to be consistent, even over long periods, when you fill in applications. If you have a number of job titles or phone numbers, try to use the same one on every form. If you use different ones, you might be flagged up by fraud scoring.

Lenders can’t reject you just for this, but they should tell you if National Hunter has been a contributing reason why they declined you for credit.

Don’t Miss: Navy Federal Auto Loan Credit Score

What Affects Credit Scores

There are multiple factors that can affect your credit score. Things like bill-payment history, credit utilization, age of credit accounts and recent credit inquiries can all play a role. The number and types of balances you have can also impact your score.

Itâs important to remember there are different scoring models. FICO® and VantageScore® are two common examples. Each uses their own formula to calculate different scores, so you might see a slight difference between them.

Ultimately, each lender uses their own credit policies to determine an applicantâs creditworthiness. But a good credit score can still mean youâre more likely to qualify for a loan or get a better interest rate.

Lower Monthly Loan Payments

Since loan payments are directly tied to the interest rate, having an excellent credit score can make it easier to afford your mortgage or car loan payments. Consider getting a $25,000, 60-month auto loan. With an excellent credit score above 720, you could qualify for a monthly payment of $462.

A credit score of 640, on the other hand, would give you monthly payments of $538. That amount can make a big difference in your monthly budget.

You May Like: Care Credit Pulls From Which Bureau

Shop Around For The Best Terms

More companies are willing to approve you when you have excellent credit. That means you have the freedom to shop around with different creditors and lenders, and you can ultimately choose the credit card or loan with the best terms.

On the other hand, if you struggle with your credit, your limited options may force you to choose credit products that dont have the best interest rates.

You dont always have to go far to shop around. If you havent opted out of prescreened credit offers, you may receive automatically receive credit card or loan options from creditors and lenders. Or, you can read a few to narrow down your selection.

Dispute Credit Report Errors

A mistake on one of your credit reports could be pulling down your score. Disputing credit report errors can help you quickly improve your credit.

You’re entitled to free reports from each of the three major credit bureaus. Use AnnualCreditReport.com to request them and then check for mistakes, such as payments marked late when you paid on time, someone else’s credit activity mixed with yours, or negative information thats too old to be listed anymore.

Once you’ve identified them, dispute those errors.

Impact: Varies, but could be high if a creditor is reporting that you missed a payment when you didn’t.

Time commitment: Medium to high. It takes some time to request and read your free credit reports, file disputes about errors and track the follow-up. But the process is worthwhile, especially if you’re trying to build your credit ahead of a milestone such as applying for a large loan. If you’re planning to apply for a mortgage, get disputes done with plenty of time to spare.

How fast it could work: Varies. The credit bureaus have 30 days to investigate and respond. Some companies offer to dispute errors and quickly improve your credit, but proceed with caution.

Don’t Miss: How Long Credit Inquiries Stay On Report

Minimise Credit Applications By Using Our Free Eligibility Calculators

The only way to know if you’ll get accepted for a product is to apply. Yet that leaves a footprint on your credit file, and too many of those, especially in a short space of time, can hurt future applications. This is a catch-22, as if you get rejected, or the rate you’re offered is rubbish, you’ll want to keep applying.

These use a soft search to show your odds of acceptance for the top cards , so you can hone and minimise your applications.

You only need to fill in your details once using the eligibility calculator to find your chances for all cards from the card category you click on. The Loans Eligibility Calculator is separate, so if you’re looking for both cards and loans, you’ll need to use both calculators separately.

What are good odds?

Some will find they’re pre-approved for cards or loans. This means that you’ll get that card or loan, subject to the lender’s ID and fraud checks.

Yet if you’re not pre-approved, anything above 70% means you’ve a strong chance of getting the credit . Anything above 50% is also pretty reasonable. Anything below, and you’re taking a chance.

Lower Your Credit Utilization Rate

After your payment history, your debt relative to how much credit you have available is the next most important factor in your credit score. FICO bases 30 percent of your credit score on the Amounts Owed category of your credit reports.

Your credit utilization ratio the relationship between your credit card balances and limits has a big influence here. When you pay down your credit card balances and lower your utilization ratio as a result, your credit score may improve. To quickly determine your current ratio, check out Bankrates credit utilization ratio calculator.

So what is the perfect credit utilization rate? It may vary depending on the scoring system a lender uses. As a rule of thumb, you should aim to pay your credit card balances off in full each month. Asking your credit card issuer for a higher credit limit may also help.

In FICOs systems, less than 10 percent is the optimal target, Ulzheimer says. In fact, people who have the highest average FICO scores have a utilization of 7 percent. VantageScore, on the other hand, looks for a target utilization of 30 percent or below.

I always default to 10 percent because thats going to keep you in the good zone for both of the scoring platforms, Ulzheimer says.

If you struggle with high balances and mounting interest payments on your cards, consider consolidating your debt with a zero percent introductory rate balance transfer credit card. A low-interest personal loan might also be worth considering.

Also Check: Is Paypal Credit Hard To Get

What Is A Credit Report

A credit report is a detailed breakdown of an individual’s credit history prepared by a . Credit bureaus collect financial information about individuals and create credit reports based on that information, and lenders use the reports along with other details to determine loan applicants’ .

In the United States, there are three major credit reporting bureaus: Equifax, Experian, and TransUnion. Each of these reporting companies collects information about consumers’ personal financial details and their bill-paying habits to create a unique credit report although most of the information is similar, there are often small differences between the three reports.

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Read Also: Tax Id Credit Score

Why Does A Good Credit Score Matter

A good or excellent credit score will save most people hundreds of thousands of dollars over the course of their lifetime. Someone with excellent credit gets better rates on mortgages, auto loans, and everything that involves financing. Individuals with better credit ratings are considered lower-risk borrowers, with more banks competing for their business and offering better rates, fees, and perks. Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with criminally high annual percentage rates because of it. Additionally, a poor credit score can affect your ability to find rental housing, rent a car, and even get life insurance because your credit score affects your insurance score.

Stay On Top Of Payments

Paying your bills on time is one way to show lenders that youre responsible with credit. Payment history is the most influential factor with both FICO and VantageScore credit scores. With FICO in particular, payment history is worth 35 percent of your credit score.

You want to avoid things like late payments, defaults, repossessions, foreclosures and third-party collections, says John Ulzheimer, credit expert, formerly of FICO and Equifax. And filing bankruptcy is a horrible idea. Anything that would indicate non-performance of a liability is going to harm your credit score.

Late payments even occasional ones can have a severe negative impact on your credit score. If you need help breaking the late payment habit, automatic payments and an emergency fund could both work in your favor.

Recommended Reading: Paypal Credit Hard Inquiry

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.