How To Solve Common Credit Issues When Buying Ahouse

If your credit score orcredit history is standing in the way of your home buying plans, youll need totake steps to improve them.

Some issues like errorson your credit report can be a relatively quick fix and have an immediateimpact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally 6-12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Here are tips on solvingsome of the most common credit issues faced by home buyers.

What Credit Score Is Needed To Buy A House In 2020

The credit score needed to buy a house in 2020 varies.

If youre not planning on putting any money down or paying cash upfront, then youll be taking out a pretty substantial loan for your new home. To determine if you qualify for a loan, consider using a free credit score check, as credit score is one of the most important factors in determining mortgage lending decisions. In fact, just a half a point difference in credit scores can mean tens of thousands of dollars more over the term of your loan.

Still confused? Lets back up even more.

Get Up To Speed With Payments

Late payments also negatively affect your credit score. Make a financial plan to catch up and stay caught up with your payments. Consider different payment strategies like the avalanche method and snowball method to effectively pay off your debt. Depending on your situation, you may also want to consider consolidating your debts or settling some of your debts.

Recommended Reading: How Bad Is A 500 Credit Score

What Does A Fico Score Of 8 Mean

FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score. There are also industry-specific versions of credit scores that businesses use. For example, the FICO Bankcard Score 8 is the most widely used score when you apply for a new credit card or a credit-limit increase. 1.

Lower Your Credit Utilization

Try to re-work your budget to pay off your credit card balances and other debt. This will lower your and ultimately increase your credit score.

Is your available line of credit really small? Ask an existing creditor to extend your maximum amount on one of your current credit cards. This will also lower your credit utilization.

Recommended Reading: 824 Credit Score

Want To Buy A House Heres The Credit Score Youll Need To Do It

Andy Smith is a Certified Financial Planner , licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

Your credit score plays a major role in your ability to secure a mortgage loan. Not only does it impact your initial qualification for a loan, but it also influences your interest rate, down payment requirements, and other terms of your mortgage.

Are you considering buying a house, and making sure your credit is ready? Heres what you need to know.

Is 645 A Good Credit Score To Buy A House

If your credit score is a 645 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. … With a 645 score, you may potentially be eligible for several different types of mortgage programs.

Also Check: Credit Score Needed For Sapphire Preferred

Whats The Average Credit Score For People With Mortgages In Your State

While its common for mortgage lenders to look at FICO scores in their application review process, we turned to Credit Karmas vast collection of VantageScore 3.0 data to get a broad picture of the credit health of people getting mortgages.

Below, you can see the average TransUnion VantageScore 3.0 credit score of homeowners in each state who recently opened a mortgage.

In general, people in the Northeast or on the West Coast who got mortgages had VantageScore 3.0 credit scores averaging 720 or above on the higher end of the spectrum.

On the flip side, the Gulf Coast, Midwest and Southern coastal states tended to have some of the weakest average credit scores .

| State |

|---|

| 41 |

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

Read Also: Check Credit Score With Itin

What Credit Score Do You Need To Buya House

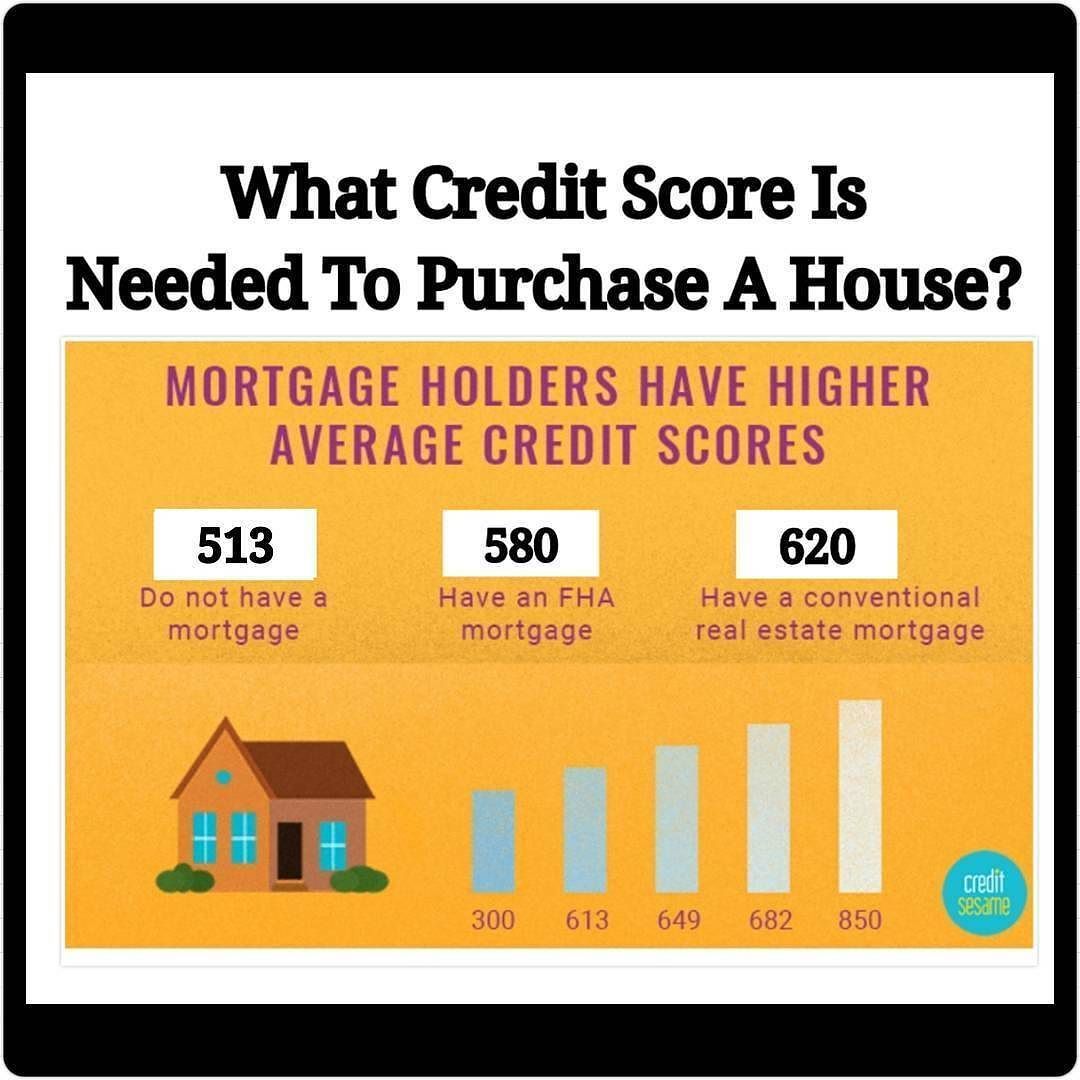

You dont need perfect or even good credit to buy a house. In fact, the minimum credit score to get a mortgage is 580 which is considered only fair.

Remember, mortgage lenders dont look at your credit score in a vacuum.

They also look at your credit report, debts, and down payment. The stronger you are in these areas, the more likely you are to get away with a low credit score.

The downside to lower credit is that youll pay a higher interest rate. But many buyers with low scores choose to buy now and refinance for a better rate when their credit improves later on.

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Don’t Miss: 830 Credit Score Mortgage Rate

Can I Get A Mortgage If My Credit Score Is Low

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

Financial Prerequisites For Buying A House

A Tea Reader: Living Life One Cup at a Time

Whether youre in a buyers or a sellers market, you’ll want to buy a home as soon as you come across the right one. But it’s not always that simple. There are many financial issues that will determine whether you’ll be able to purchase the house, as well as the terms of your mortgage.

Understanding this information well in advance may help you make better decisions and will make your mortgage approval process to go smoothly and quickly.

Read on to find out more about how you’ll need to be positioned financially before you sign your real estate contract.

Read Also: What Happens If You Don’t Pay Speedy Cash

What To Watch Out For

Now may not be the best time to purchase a home if you have a poor credit score or, at the very least, the minimum credit score to buy a house with a conventional loan.

If you also dont have enough of a down payment or youre worried about how youll pay your mortgage every month, its worth it to wait.

The 2008 housing crash happened because lenders were giving out subprime mortgages or non-traditional mortgages for people with poor credit scores and these people often defaulted on their loans, leading to foreclosures.

You dont want this to happen to you, so make sure that you are in good financial standing before you decide to try to buy a home.

Do your research on the real estate market in the area where your dream home is located, and see if its gone up in value over time. Ask realtors their opinions about homes in the community and whether or not they believe prices will continue to rise.

Note: You may want to also take a look online to see what people are saying about the real estate market in the area. Realtors do have an interest in getting you excited to buy, and some may have rose-colored glasses when it comes to current market trends.

Moving into a home of your own is exciting, but do your due diligence first. Then, you can have peace of mind that youve made the right decision for your financial future.

Whats The Minimum Credit Score You Need By Mortgage Loan Type

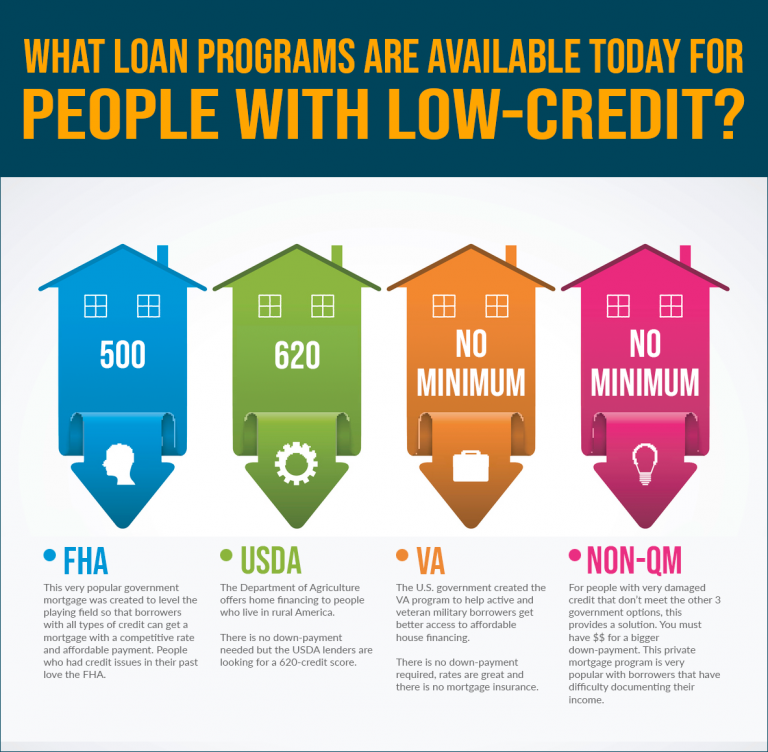

Before we dive into the average credit scores for recent homebuyers, you may be wondering what the minimum credit score is for a mortgage in 2020. The answer is that it depends on the type of mortgage.

Below is a breakdown of the minimum FICO ®scores typically required, based on type of mortgage loan Federal Housing Administration loans , U.S. Department of Veterans Affairs loans, or conventional loans through a private lender that are insured through Freddie Mac or Fannie Mae.

| Type of mortgage loan | |

|---|---|

| VA loan | No minimum credit score |

Note that the minimum scores listed above are for FICO credit scores, specifically this is the scoring model mortgage lenders typically turn to when considering applications.

Don’t Miss: Usaa Free Credit Score

Home Possible / Homeready Loans

Fannie Mae and Freddie Mac created low down payment home loan programs for low-income first-time homebuyers. To be eligible for the HomeReady or Home Possible mortgage programs your income must be below 100% of the area median income. They require just a 3% down payment with a minimum 620 credit score.

Other Factors That Affect Mortgage Qualification

Your credit score is one part of getting a mortgage, but its not the only part. Your lender considers many facets of your finances, including:

- Income: How much you earn is a major factor. Lenders want to make sure you can afford to make payments on time every month.

- Job history: A stable job shows lenders you can reliably pay your home loan. Job-hopping, a break in work and self-employed individuals might have a harder time getting a mortgage compared to those who have worked for the same employer for a few years.

- Down payment: The higher your down payment, the smaller your home loan will be. This means youre less risky to lenders.

- DTI: A lower DTI means lenders you shouldnt have any problems making payments on your home loan.

- Cost of home: The higher the home price, the harder it can be to secure the full loan amount you want with a bad credit score.

- Derogatory marks on your credit: Derogatory marks on your credit can result from delinquency, defaults and bankruptcies. The more you have, the harder your chances of securing a mortgage can be.

Read Also: How To Fix A Repossession On Your Credit

Can You Buy A House With Low Credit Score

For those who want to get a credit report , we recommend , because it is totally free and provides reliable identity theft protection. Get your credit score in minutes.

If you require financing to buy a home, getting approved with a lower credit rating will be challenging. But, that does not mean that it will be impossible to do. Some lenders specialize in dealing with poor credit borrowers, even for mortgages, but low credit home loans come at a premium.

You might want to consider increasing your credit rating before applying for a home loan. Otherwise, you can expect to pay a lot more than even someone with average credit its also possible that your low credit score will cause your loan application to get turned down.

When applying for a mortgage, make sure to consider where to go for the loan. As a borrower with a low credit score, most banks will reject you on the spot as they typically have a minimum score that must be met to qualify. Meanwhile, credit union banks are more likely to look past your credit score issues and consider your qualifications based on your current debts and expenses and your recurring incomes.

What Kind Of Loan Can I Get With A 680 Credit Score

80/10/10 loans might be available with a credit score of 680, but it will be easier to get one with a score in the 700s. Home equity loan or home equity line of credit : Home equity financing may be available with a 680 credit score. But many lenders set their own minimums starting at 700 or higher.

Read Also: Repo Removal Letter

Whats Considered Good Credit For A Mortgage

Although its possible to buy ahouse with only fair credit, youll get a lower mortgage rate and better loanterms with a higher score.

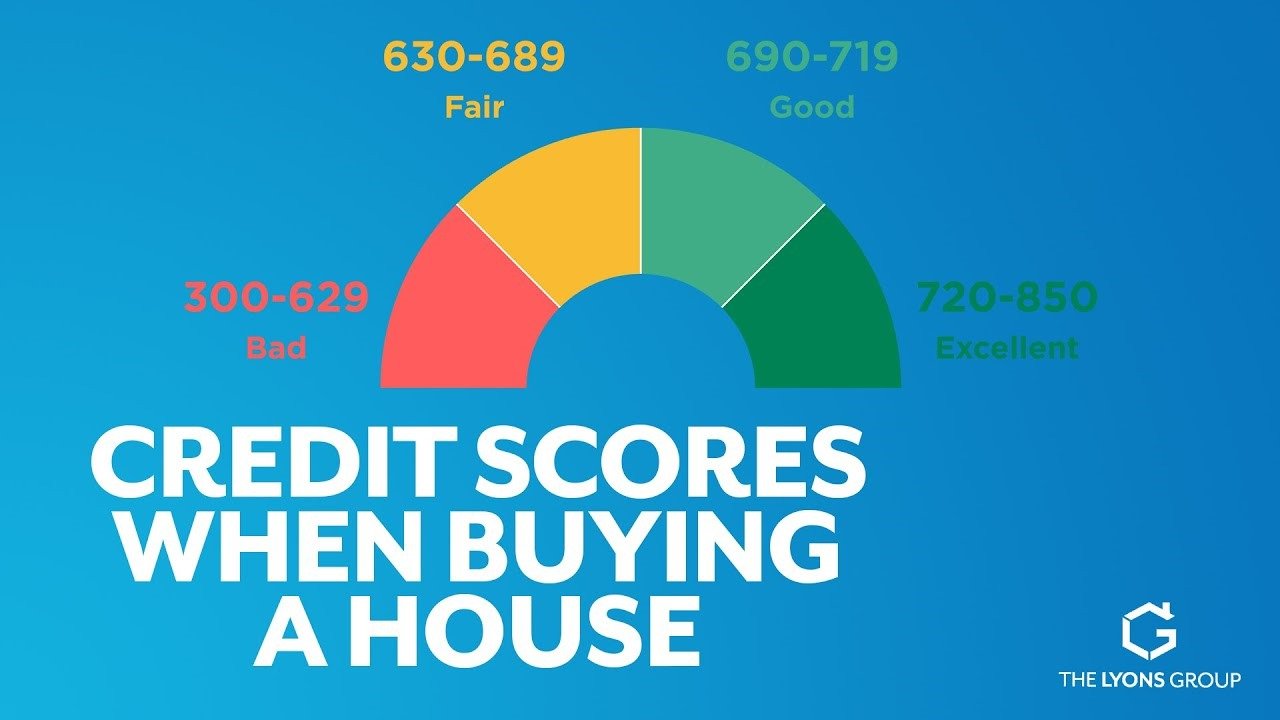

So whats considered good creditfor a mortgage? FICOs credit tiers are a good starting point, as FICO is thestandard scoring model used by mortgage lenders.

- Exceptional credit:800-850

- Fair credit: 580-669

- Poor credit: 300-579

Fortunately, you dont need anexceptional score in the 800-850 range to get a prime mortgage rate. Mosthome buyers dont have credit anywhere near that high.

In fact, the average credit score for closed mortgage loans in 2020 was just under 750.

Fannie Mae and Freddie Mac give the best rates to borrowers with scores above 740

Mortgage lenders understand thatperfect credit is not the norm, and they arent expecting sky-high scores.

Fannie Mae and Freddie Mac, the agencies that back most home loans, give the best rates to borrowers with scores above 740 which means the average buyer in 2020 qualified for prime rates.

How Your Credit Score Affects Your Mortgage

Your credit score can have a positive or negative impact on your mortgage. A high credit score will work in your favour, while a low score or no credit history will work against you. This is because your credit determines how much of a risk you are for defaulting on your mortgage loan.

If your credit score indicates that you dont have a lot of debt and make regular, timely payments, youll have a higher credit score and will be seen as low-risk. If you have lots of debt and pay your bills late, youll have a lower score and will be seen as high-risk.

Understandably, banks dont want to lend lots of money to someone they deem as potentially unlikely to pay it back. If they do, it will be at a much higher interest rate that reflects that risk. Those higher interest rates mean higher mortgage payments and a larger cost over time.

Also Check: How To Remove A Repo From Credit Report

Improving Your Credit Score

Theres a lot that goes into determining your credit score, including your repayment history, the total balances on your accounts, how long youve had those accounts, and the number of times youve applied for credit in the last year. Improving in any of these areas can help increase your score.

You can:

- Pay down your existing debts and credit card balances

- Resolve any credit issues or collections

- Avoid opening new accounts or loans

- Pay your bills on time, every time

You should also pull your credit report and check for any inaccuracies you might see. If you find any, file a dispute with the reporting credit bureau, and include the appropriate documentation. Correcting these inaccuracies could give your score a boost.