Monitoring Your Credit Report

To maintain your good credit score, you need to know how credit scores are calculated. When you are aware of the 5 factors you can use that knowledge to understand how your finances will be read.

If you monitor these credit details, you can manipulate your credit score into reflecting your best financial habits. Paying your bills on time, keeping your old credit cards, and keeping your credit balances as low as possible are all reachable goals to keep your credit score high.

Keeping an eye on your credit lines and credit report will help you notice when elements are slipping.

Get Your Credit Score From A Credit Bureau

Thanks to the Fair Credit Reporting Act , the three major Equifax, Experian and TransUnion are required to provide you with a free credit report once per year, upon request. But they arent legally required to provide your credit score.

Still, you can get your credit score from all three bureaus, though it wont be free in every case.

Equifax and Experian will provide you with your credit score for free, while TransUnion requires you to sign up for a monthly subscription that includes a bulk of other services.

All three credit bureaus have several subscription tiers and product packages, so if all youre trying to do is check your credit score, be sure youre selecting the most barebones option available. Otherwise, youll be shelling out for unwanted add ons.

Here are the most basic plans at all three bureaus:

The free plans from Experian and Equifax also come with basic credit tracking features and tips to boost your score. TransUnions basic plan includes similar credit tracking and educational features, as well as identity theft insurance, credit monitoring for all three bureaus, and more.

The free credit scores from Experian and Equifax are updated monthly. TransUnions plan says credit score updates are available daily.

Will I Be Penalized For Shopping Around For The Best Interest Rate

A common misconception is that every inquiry decreases your credit score. This is not true. While an inquiry is recorded on your personal credit report every time you, one of your creditors or a potential creditor obtains your credit report, the presence of inquiries has only a small impact on your credit score. Many types of inquiries have absolutely no impact. Most scoring models take appropriate steps to avoid lowering your score because of multiple inquiries that might occur as you shop for the best car or home loan terms.

Read Also: Pre Approval Hurt Credit Score

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Keep Track Of Your Spending

For some people the bills arent the problem, it’s the small transactions that quickly start taking over their credit cards. Small transactions are just as significant as big ones, as they can seem like a non-issue that is easy to forget, but in reality, they take up your whole credit card bill.

Monitoring your own spending will allow you to see how much money you actually have left to spend, and can stop you from accidentally buying more than you can pay back.

We suggest figuring out how much money you half left after bills and then dividing that amount by how many weeks you have left until your next payday.

This amount becomes your weekly allowance. Count every dime you spend, and when a new week begins, you will have a new allowance to start over with.

Having small goals can help you manage your money and track your spending without too much pressure.

Also Check: Zebit Reviews Bbb

Can Checking My Credit For Free Impact My Score

Feel free to check your credit score for free using one of the many ways mentioned earlier as they will not impact your credit score. Only a hard check affects credit scores. Checking your own score or accessing your credit report is considered a soft check that has no impact on your score, no matter how often you access your report.

Your credit score will take a hit if you make a credit application such as a mortgage or credit card. This is especially true if theyre performed in quick succession. This gives the impression that you are short on cash and may not be able to make payments.

Examples Of Soft Inquiries

The following are examples of what constitutes a soft inquiry. Remember that a soft inquiry only occurs when there isn’t an application for a new line of credit, loan, or other borrowing arrangement.

- Checking your own credit. This will result in a soft pull on your account. Since it’s a personal attempt to find your score, it’s not seen as a risky action.

- A current creditor checks your credit. If you have a credit card or loan, then your creditor may want to keep tabs on your credit score. Again, since this is not a new lender peeking into your financial history, it won’t hurt your score.

- Auto insurers can look at your credit score. Your auto insurance provider may initiate a soft pull on your credit score if they’re looking to set or adjust your premiums. Since the mid-1990s, many insurers have been using credit scores to determine a motorist’s likely level of risk, stemming from a belief that a higher credit score correlates to safer driving.

Don’t Miss: How Long Does Carmax Pre Approval Take

Use A Business Credit

As with personal credit scores, several websites are dedicated to providing business credit services. Each site is a little different and may have its own preferred credit scoring model. Here are the basics.

- : To evaluate your businesss creditworthiness, uses its own proprietary business credit scoring system. The company offers free trials but the length and details are on a case-by-case basis. Its website does not provide upfront pricing information and requires a consultation to determine the price of a subscription.

- Data Axle: For $17.95 per credit report or for $195 per month, Data Axle will provide your businesss Experian Intelliscore Plus score along with credit-monitoring and data-analytics services.

- Nav: With Nav, you can create a free account to access your businesss credit grade, which is based on data from three major business credit reporting agencies . The free grade is on an A to F scale and isnt the same as your credit score, but it provides a high-level snapshot. To get your actual business credit scores, youll have to enroll in a subscription. Plans start at $29.99 per month.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

You May Like: Attcidls

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that youre using at any given time. After payment history, its the second most important factor in FICO credit score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, then a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there, you can work on whittling that down to 10% or less, which is considered ideal for improving your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online youll just need to update your annual household income. Its possible to be approved for a higher limit in less than a minute. You can also request a credit limit increase over the phone.

Do Not Close Old Credit Accounts

The longer we stay with a credit account, the more likely the APR will grow. New credit cards offer the best APR deals, but after a couple of years, the rates increase.

A lot of people close down their accounts when this change happens and search for a new account to get the best APR deals again.

Although this might seem like a smart move, when you close down an account you are closing the good payment history you have gathered.

We mentioned before that the length of your payment history is a key factor in your credit score. If you close down an account, that 20-year history which makes you look low-risk is closed down too – the data goes with it.

As long as keeping the account doesnt harm your spending ability, you should keep your old accounts open to show off your payment history.

Recommended Reading: How Often Does Capital One Report To The Credit Bureaus

What Does A Credit Score Mean

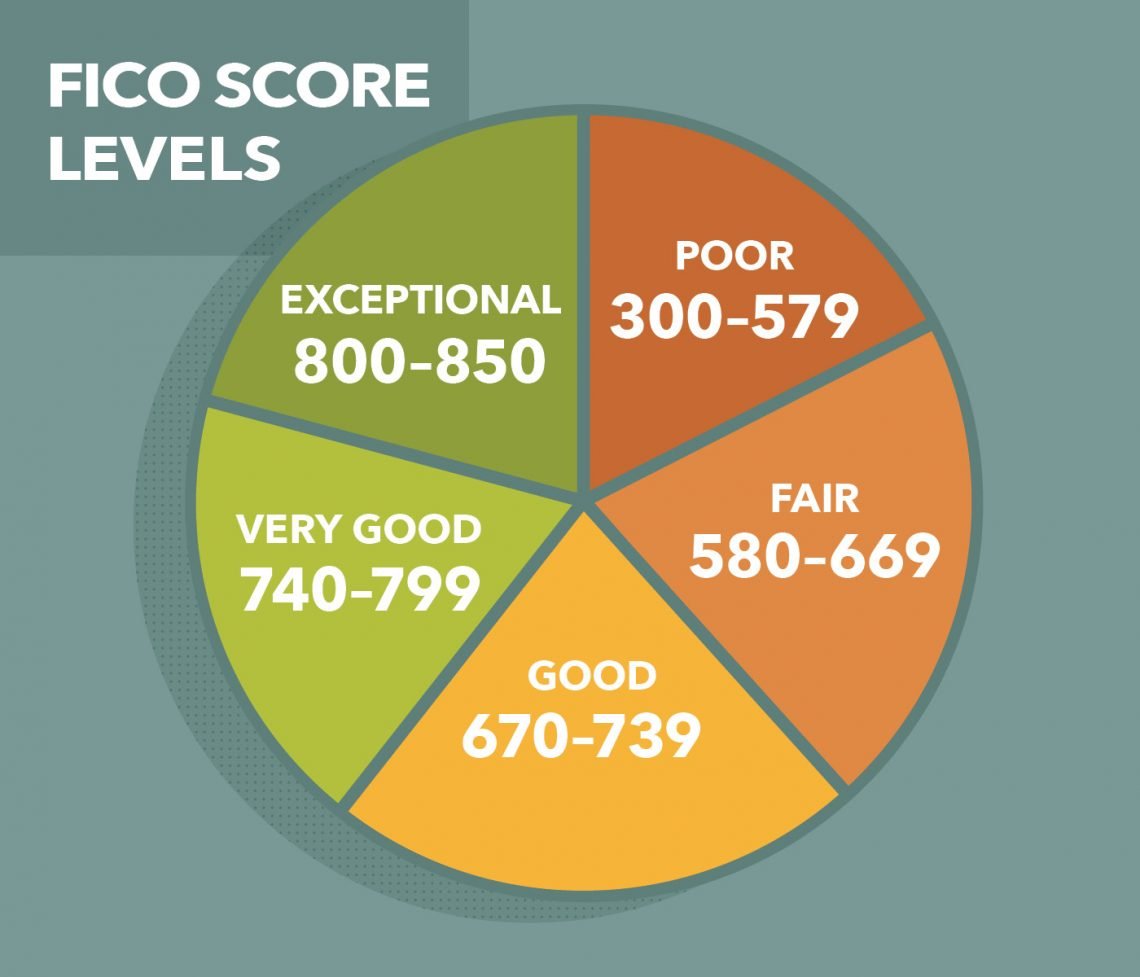

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

How To Check Your Credit Score Rating

To check my credit rating, you can order a report from Equifax and examine it thoroughly. If your credit score rating is lower than you would prefer, you can take steps to improve it. While an average credit rating is okay for some loans, you can spend time improving on it and increase your chances of being successful for larger loans . An instant credit check can be completed through Equifax, and itll only take a few minutes. After youve entered your details into our online credit checking form, we may request you to upload documents to help identify you and get the correct report. The number of documents required may vary as youll need to meet the conditions of a standard 100-point identity check.

A bad credit score may impact your ability to secure the loan youd prefer. However, there are some specialist lenders who will loan money to people with a below-average credit rating. When you check your credit rating, itll show you where you currently stand, and you can consider if you need to follow advice from an expert on how to improve it.

You May Like: What Is A Good Business Credit Score

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

What Do Credit Scores Mean

Because there are so many credit scoring models in existence, you likely have multiple scores. If you pull your score from one site or product, it will likely be slightly different from one you find through another product.

So don’t get hung up on one particular score or even the exact number. Instead, pay attention to what range you fall in. Most websites and card issuers will offer some context behind the score in addition to the number.

That information will typically include where you stand and whether your score is poor, fair, good, very good or exceptional. You will also likely find information about why your score is what it is. Your score range can help you understand how lenders view your creditworthiness and what types of credit products you’re likely to be approved for.

Don’t Miss: Aargon Collection Agency Ripoff

How To Check My Credit Score

Before we dive in, you should know that you actually have several different types of . FICO scores and VantageScores are by far the most common ones and these are further broken down into other versions that are used by separate lending industries. The best way to think of them is as brand names. FICO scores and VantageScores are the Walmarts and Targets of credit scores, if you will.

Checking your credit score often is a smart money move. Doing so wont affect your score at all simply looking at your own credit is whats referred to in terms as a soft inquiry. In contrast, when youre applying for a loan and the lender pulls your credit information, thats called a hard inquiry, and that may affect your score temporarily.

Whats more, it is becoming easier to check your credit score. In some cases, its automatic. In many cases, its free. Sometimes companies will still try to get you to pay for your credit score. Its not a scam per se, but with all the free options out there, were hard pressed to find a legitimate reason youd need to pay anymore.

Here are several ways to check your credit score.

Purchase Your Business Credit Score From A Credit Bureau

Experian, Equifax and Dun & Bradstreet are the three main business credit bureaus. Each bureau offers different plans and subscriptions that allow you to view your businesss credit score.

Business credit reports and scores through Experian are available for purchase per report or via a monthly subscription. For $39.95, you can pull a one-time business credit report that includes Experians proprietary Intelliscore and Financial Stability Risk Rating scores. Or you can opt for an annual subscription for $189 that includes unlimited access to business credit reports and credit scores, as well as additional credit-monitoring and identity-protection services.

For $99.95, you can buy a business credit report from Equifax that includes your companys payment-index score , as well as other risk-related scores. Equifax doesnt have a business subscription plan but instead offers a discounted rate if you buy the reports in batches of five.

Lastly, Dun & Bradstreet offers several subscription tiers that allow you to access your businesss credit scores. The company offers a 14-day free trial that includes four D& B business scores and ratings along with basic monitoring and credit alerts. After the trial, you can choose between a $15-per-month or a $39-per-month plan both come with additional business credit scores and monitoring services.

You May Like: How Long For Collections To Fall Off Credit Report

Review Your Report & Dispute Any Errors

Reading your credit report is one of the most vital steps when it comes to building credit and maintaining it. While reviewing your report, make sure your personal and account information is accurate.

Common credit reporting errors to look for include the following:

- Incorrect name or address

- Paid accounts that are listed as open

- Account balance or credit limit errors

- Accounts that dont belong to you

If you spot an error, dispute it with each credit bureau that lists it on your report or the creditor that reported it. The investigation will typically take 30 days to complete. Once its over, the credit bureau will remove the information if it finds that it is in fact an error.

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Also Check: Do Evictions Show On Your Credit Report