Personal Loan Pre Approval Do S And Don Ts Nextadvisor With Time

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Pulling credit can scare home buyers. Here’s everything you need to know about the process. But the impact is likely to be less than you expect and shouldn’t stand in the .

Here’s everything you need to know. What exactly is a credit score and why is it important? A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Prequalification is typically considered a soft inquiry, and it won’t hurt .

Seeking mortgage preapproval before shopping for a home can save time and give you an edge over rival buyers who haven’t done so. Struggling to get your credit score from poor to excellent? Although a preapproval may affect . But the impact is likely to be less than you expect and shouldn’t stand in the .

How Can A Personal Loan Hurt Your Credit Scores

Personal loans could be reported to the credit reporting agencies. If yours is, it could be considered when your credit scores are calculated. That means that a personal loan could hurt or help your credit scores.

The amount and age of a loan can affect your credit scores. But itâs not only the loan itself that affects your credit scores. How you actually manage the loan also affects your credit scores.

Itâs important to make payments on time and avoid late payments or missing payments altogether. As the CFPB points out, your payment history plays a part in your credit scores. And the better your payment history, the better your credit scores might be. But if youâre late or miss payments, that could hurt your credit scores.

Should I Apply To Multiple Lenders

Applying for a loan or credit card with multiple lenders at one time can be a risky approach to take, as it could affect how you are viewed as a borrower in the future. This is because when you apply for a loan, it is generally recorded on your credit report, regardless of whether you are approved or not. If you make a number of loan applications within a short period of time, other lenders you apply to in the future could see this on your report when assessing your application and view it as evidence that you have been rejected for those previous loans and are therefore a risky borrowing prospect.

A safer approach may be to research a number of products, weigh them up based on their price, features, eligibility and other criteria, and apply for only the one which best matches your needs.

Recommended Reading: How Long Do Credit Card Inquiries Stay On Your Report

How Do I Minimize Hard Inquiries

If you need a loan, theres probably no way to avoid a hard inquiry. But the score benefit you get from on-time payments will outweigh a short-term point loss from applications.

What you want to avoid is applying and getting turned down. Then you may still need a loan, but you’ll have a lower credit score.

Heres how to make the most of an application:

-

Be as certain as you possibly can be that you meet the qualifications and will be approved. Some lenders offer pre-qualification, which typically does not involve a hard inquiry and can help you determine whether youre likely to qualify.

-

Check terms before you apply, and be sure the loan is a good fit for you.

-

Avoid applying for new credit for at least six months before you plan to make a large purchase that will require a loan a house or car, for example.

Here Are A Few Simple Ways To Boost Your Credit Score:

-

Make sure youre on the electoral roll

Lenders look for stability in borrowers. When you register to vote, you go on the electoral role. To get on it, you give details like your name, address, date of birth and your electoral number. Its an easy way for lenders to confirm your identity and the accuracy of your details.

-

Be more reliable when it comes to paying bills

Lenders loan money on the understanding that youll make regular repayments. Simply paying your bills on time, every time, will help boost your credit score long-term.

-

Consider getting a debt consolidation loan

You may be able to apply for a debt consolidation loan to help manage all your existing debts with one monthly payment. You can check your eligibility without affecting your credit score further.

-

Consider getting a credit builder card

Getting a credit-building credit card may also help you improve your credit score. These are credit cards with low credit limits and a higher than average interest rate. The sum you can borrow is therefore low but the interest you pay on what you borrow is high.

First, check if youre eligible for a credit builder card without affecting your credit rating. If you are and you successfully apply, use your card sensibly to build up your credit rating. Make sure you make the minimum monthly payments on time and stay within your credit limit. Not doing so could harm your credit rating further.

Don’t Miss: How To Correct Mistakes On Credit Report

Does Getting Preapproved Hurt Your Credit

Whether getting preapproved hurts your credit score depends on what you’re getting preapproved for. Preapproval for car loans and mortgages typically involves a hard credit inquiry, which will lower your credit score a bit. Prequalification for car loans and mortgages usually use a soft credit pull, which doesn’t affect your score. Preapproved credit card offers do not affect your credit score.

How It Could Helpand Hurtyour Score

Arielle Skelley/Getty Images

Regardless of circumstance, theres a chance you might need to borrow money in the future. And it could come from taking out a personal loan.

A personal loan can be used for anythingthats why its personal. Having cash on hand to handle a financial emergency can be a lifesaver, but a personal loan can affect your credit score in both good and bad ways.

You May Like: How To Obtain A Free Credit Report

How Can A Personal Loan Harm Your Credit Score

In the short term, a personal loan can harm your credit score by causing a hard inquiry on your credit report and getting you into more debt. In the long term, a personal loan will damage your credit if youâre unable to make your payments on time, if you canât cover fees, or if you default on the loan altogether. Hereâs a further breakdown of how a personal loan might hurt your credit score, especially if itâs not managed properly.

Creating a hard inquiry on your credit report

Applying for a personal loan creates a hard inquiry on your credit report. This will lower your credit score by a few points. The dip in your score should only last for a few months, however multiple hard inquiries can cause more damage to your score. This is why itâs important to understand your credit score and report before applying, and to minimize the number of applications you make.

In general, if you already have good credit and a history of managing debt well by making timely payments, the impact of a hard inquiry on your credit score will be lessened.

Taking on more debt

Missed payments and additional fees

Is There Any Way To Avoid Hard Inquiries While Searching For The Best Loan Or Credit Card Offer

Finding the right lender can get you a more suitable deal, including benefits like flexible repayment plans or competitive interest rates. But this may mean submitting multiple applications, which can affect your credit score quite significantly. Instead, with some careful research, you can identify lenders who offer terms that are suitable for your circumstances without making multiple applications.

Recommended Reading: Which Credit Score Is Used To Buy A House

Can A Personal Loan Hurt My Credit Score

A personal loan can be a convenient way to borrow money or consolidate debt, but it’s important to understand the effect a personal loan can have on your credit scores. Its potential impacts begin when you apply for a loan and a hard inquiry appears on your credit report. Loan approval then increases the amount of debt you owe, and finally there’s the potential that you’ll miss a bill and pay late or default.

That doesn’t have to prevent you from pursuing a personal loan, however. After all, responsibly managing a personal loan can actually help you improve your credit over time. Before borrowing, understand and plan for the potential credit impact so that you can protect your score throughout the process.

How Can A Personal Loan Help Your Credit Scores

If your personal loan is reported to the credit reporting agencies, the loan could help your credit scores. But remember, itâs not only the loan itself but how you handle the loan that can make the difference.

Here are a few ways a personal loan might have a positive impact on your credit scores. Keep in mind, though, that there are many other factors that affect your credit scores. And youâll need to keep an eye on them all if you want to get and keep good credit scores.

If You Make On-Time Payments

Making on-time payments every month could help you build a positive payment history. And according to the CFPB, a good payment history could help you improve your credit scores or maintain good credit scores.

If you need help keeping up with bill payments, you could set up a budget, automatic payments or reminder alerts.

If It Diversifies Your Credit Mix

A personal loan is a type of credit known as an installment loan. With a personal loan, you borrow money and pay it back in equal installments over a fixed period of time.

But a credit card account is an example of revolving credit, meaning it can be used and paid down repeatedly. So if your only source of credit has been from credit cards, the addition of a personal loan would diversify your credit mix. And a diverse credit mix could improve your credit scores.

Taking out a loan still means taking on more debt, though. And a good credit mix likely wonât help your credit scores if you canât keep up with your payments.

Don’t Miss: How To Boost Your Credit Score Fast

How A Personal Loan Could Help Your Credit

Despite the risks, your personal loan account may wind up helping you improve your credit. First, it adds positive payment history to your credit report, assuming you regularly pay on time. It can also add to your , especially if you previously had only credit cards and a personal loan is the first installment loan in your name. Credit scoring models reward borrowers who are able to capably oversee multiple types of credit.

A debt consolidation loan can also help your credit. This is a type of personal loan that combines multiple debt balances into one loan, ideally at a lower interest rate. It may also reduce your , which is an important scoring factor that compares your revolving credit balances with your credit limits. High balances can drive up your credit utilization and hurt your credit, but your credit utilization on those cards will decrease to 0% when you transition those debts to an installment loan with a debt consolidation loan. That can have a positive effect on your credit score.

Will Loan Applications Be Visible On My Credit File

Yes. Loan applications almost always involve an application or hard credit search, which will be logged on your . Itll be visible there to both yourself and to any future prospective lenders you authorise to run a credit check.

However, lenders dont report to CRAs whether a loan application was successful or unsuccessful.

A loan application will remain on your credit file for up to 2 years. When you make a loan repayment, by contrast, this will remain on your credit file permanently.

Don’t Miss: Does Boost Mobile Report To The Credit Bureau

How Can I Improve My Credit Score

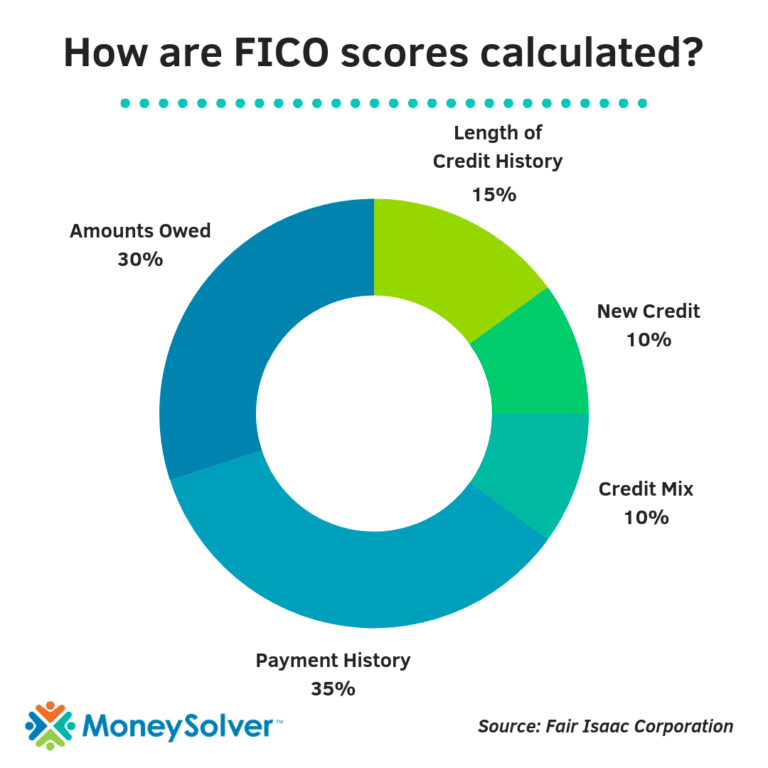

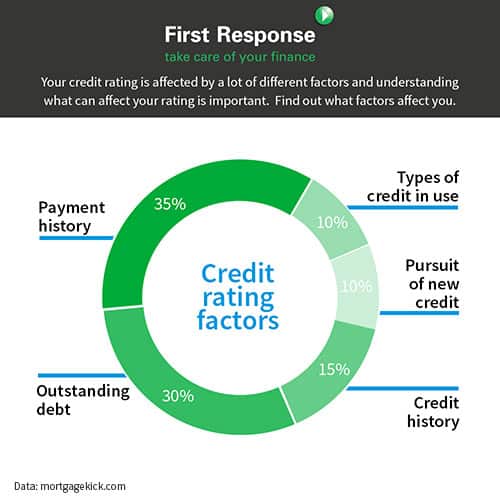

Qualifying for a home loan was the first sign youre on the right path. But as you continue to strive to build your credit score, you might be wondering what factors impact it the most. Here is a breakdown FICO® shares of the model it uses to determine your credit score:

- Payment history : Never miss a payment to receive the full effect of this hefty percentage.

- Keep your revolving credit under 30% for the best results. Remember that this number doesnt take into account your installment credit, like your mortgage or a personal loan, as those will have set repayment terms.

- Length of credit history : Keep those older accounts open, even if youre not using them regularly.

- This refers to the different types of revolving and installment credit you have, including credit cards, vehicle loans, student loans and your mortgage. Lenders like to see that you can manage different types of credit responsibly.

- New credit : Lenders will take into account if youre applying for new cards, which could signal that youre planning a spending spree.

How Else Do Lenders Evaluate Personal Loan Applications

Today, big banks are no longer the only companies offering finance there are now many other lenders in the market, like SocietyOne. As part of responsible lending practices, lenders don’t rely solely on your credit score to determine if your application will be approved or rejected. Other factors, such as your income, employment history and current employment status, can all play a part in a lender’s final decision. An approval or rejection can also be influenced by the lender’s risk appetite.

Don’t Miss: Does Klarna Show Up On Credit Report

The Central Credit Register

The Central Credit Register provides credit reports to borrowers andlenders. It is a database that stores personal and credit information on loansof 500 or more. It is operated by the Central Bank of Ireland.

The Central Credit Register started to record loans from 30 June 2017. Itkeeps a record for 5 years after the last payment for a loan is made.

The Central Credit Register does not decide whether you get a loan. Lendersuse the credit report to assess your loan application before making a decision.They may also take into consideration your income and expenses, such as rentand utilities. Different lenders have different criteria for approving loans.

Does Applying For A Credit Card Affect Your Credit Score

Thinking of increasing your purchasing power with credit? You may wonder whether applying for a affects your. Requesting a new a will, indeed, affect your credit report.

This happens because a new triggers a hard check placed on your credit report. This slightly lowers your credit score.

In this article, you will find out how and why applying for a credit card affects your credit score and get a few tips to make the best use of your credit cards while keeping a good credit score.

Recommended Reading: Does A Mortgage Show On Your Credit Report

How Can I Protect My Credit Score When Applying For A Personal Loan

There are a number of steps you can take before submitting a loan application that could help protect your credit score, including the following:

Did you find this helpful? Why not share this article?

This article was reviewed by Head of SEOLeigh Stark before it was published as part of RateCity’s Fact Check process.

Georgia Brown

Personal Finance Editor

Georgia Brown is a Personal Finance Editor and journalist for RateCity, covering the scope of finance in Australia over loans, credit, mortgage and housing, superannuation, and sustainable finance, to name a few. Before venturing into personal finance, she worked as a reporter for Smart Property Investment, Real Estate Business, and REA’s realestate.com.au, and these days her work can be seen across numerous publications, including Lifehacker and RateCity.

Optimizing Credit In The Futureand Now

Getting a mortgage is a positive opportunity to build your credit, accumulate wealth and live in your own home. Checking your credit score before you begin the application process can help you determine whether it might be a good idea to take time to improve your credit score before submitting your applications.

If your score isnt where you want it to be, check out Experian Boost®ø. This free service lets you add on-time utility, phone and streaming service payments to your credit score calculation, which may help offset a minor dip in your credit score while youre waiting for the positive effects of paying your new mortgage to kick in.

You May Like: When Disputing Credit Report What Reason

Read Also: Is 818 A Good Credit Score

How To Check Your Credit Score For Free

You can use free checker tools from card providers, such as , to check your credit score.

Its also free to access the full credit report and credit score the credit agencies hold on you. Just visit their partner websites: Experian MSEs Credit Club,Equifax ClearScore,TransUnion Credit Karma. You can also request a paper copy of your credit report if you prefer. Try to do a credit score check and review your credit report held with each of these agencies regularly, at least once each year. Even small errors such as the wrong address can affect your credit score and potentially cause problems when you apply for credit.

When Can Applying For A Personal Loan Negatively Affect Your Credit Score

Generally speaking, when submitting a personal loan application, there are two key mistakes that could lead to your credit score being negatively affected:

Both of these mistakes ultimately risk hurting your credit score in the same way.

Each time you submit a personal loan application, the lender will conduct an enquiry on your credit file as one part of the decision-making process. This will be recorded on your file as a credit enquiry and is visible to other lenders who perform subsequent enquiries.

If your credit file has evidence that you have applied for multiple loans at once, or in quick succession, lenders may be hesitant to approve your application as it may be an indication of credit stress.

Credit providers have an obligation to adhere to the responsible lending conduct obligations as imposed by the Australian Securities and Investments Commission . That means, if the lender has reason to believe that the credit product you have applied for may be unsuitable for you, they are required to reject the application.

According to both major credit reporting bureaus, Equifax and Experian, having multiple hard enquiries recorded on your file within a short period of time can also have a negative effect on your overall credit score.

Also Check: How To Add Rent To Credit Report