How Credit Scores Work: A Closer Look

Let’s take a look at the credit bureaus, credit scores and do a deeper dive into how they work.

First, the , EquifaxTM, Experian® and TransUnion®, get information about your credit activity and payment history from creditors, such as your credit union or bank, credit card issuer or landlord. Lenders use FICO® scores to determine whether borrowers can qualify for mortgages.

The three credit bureaus update your credit report once every 30 45 days. Your credit score remains an important part of the mortgage process because it helps your lender understand how well you may repay your loan. Lenders typically look for a credit score of at least 620, though it depends on other factors, such as your debt-to-income ratio, cash for a down payment and more. If you have a lower credit score, you may receive a higher interest rate or get denied for a mortgage loan altogether.

Several factors that go into your credit could hurt your credit score, including not paying bills on time, delinquent child support, not paying rent and closing a credit card, to name a few.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

The Mortgage Is In Your Spouse’s Name

If you applied for a mortgage using only your spouses credit history and income, your name does not appear on the loan documents, meaning the mortgage doesnt appear on your credit report, either. This is true even if your name is on the deed. Youll have to refinance the mortgage to add yourself as a co-borrower to have the mortgage reported on your credit report.

Also Check: Syncb/ppc

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

Also Check: Is 672 A Good Credit Score

How Does Your Credit History Affect Getting A Mortgage

Lenders use your credit report to get information on how reliable you have been at paying back debts in the past. When you apply for a mortgage you will have to supply payslips, P60s and bank statements to show how much you earn and what your monthly budget might look like. This shows lenders your current financial situation, but to predict how you might behave in the future they will also look at your credit report.

Your credit history might also affect your mortgage interest rate, in the sense that the types of mortgage you are offered will be affected by how responsibly youve borrowed in the past. Special introductory rates or other attractive mortgage offers might only be available to people whose credit history meets certain criteria.

What Exactly Happens When A Mortgage Lender Checks My Credit

The credit check is reported to the credit reporting agencies as an “inquiry.”

Inquiries tell other creditors that you are thinking of taking on new debt. An inquiry typically has a small, but negative, impact on your credit score. Inquiries are a necessary part of applying for a mortgage, so you can’t avoid them altogether. But it pays to be smart about them. As a general rule, apply for credit only when you need it. Applying for a credit card, car loan, or other type of loan also results in an inquiry that can lower your score, so try to avoid applying for these other types of credit right before getting a mortgage or during the mortgage process. Learn more about credit scores

Recommended Reading: Syncb/ppc Credit Inquiry

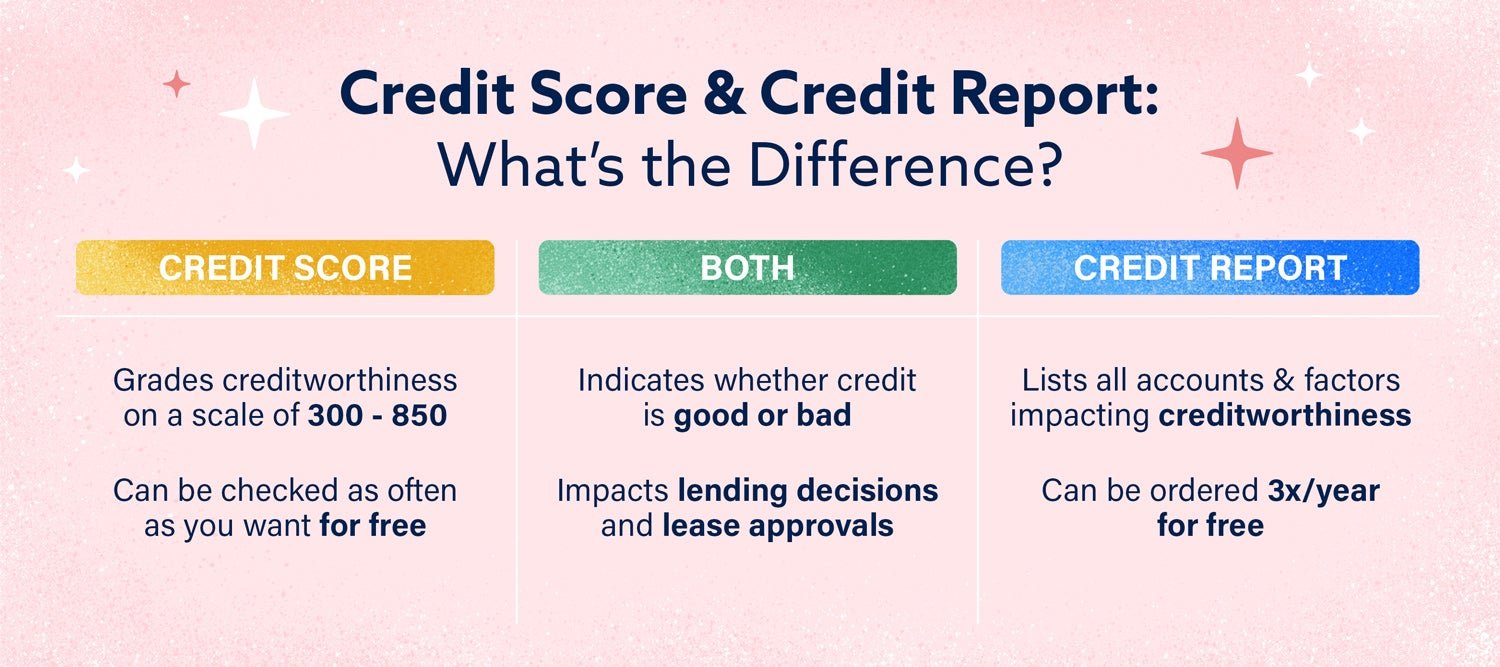

What Is A Credit Report And What Does It Include

Reading time: 3 minutes

Highlights:

- A credit report is a summary of how you have handled your credit accounts

- It’s important to check your credit reports regularly to ensure the information is accurate and complete

A credit report is a summary of how you have handled credit accounts, including the types of accounts and your payment history, as well as certain other information thats reported to credit bureaus by your lenders and creditors.

Potential creditors and lenders use credit reports as part of their decision-making process to decide whether to extend you credit and at what terms. Others, such as potential employers or landlords, may also access your credit reports to help them decide whether to offer you a job or a lease. Your credit reports may also be reviewed for insurance purposes or if youre applying for services such as phone, utilities or a mobile phone contract.

For these reasons, it’s important to check your credit reports regularly to ensure the information in them is accurate and complete.

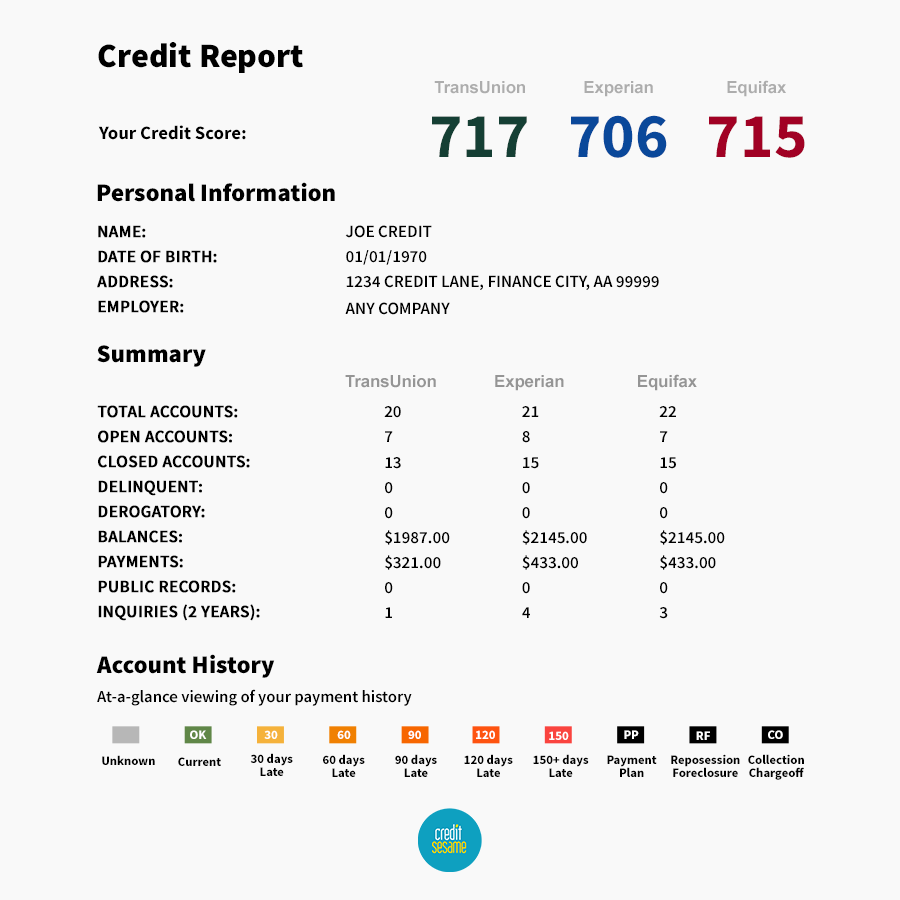

The three that provide credit reports nationwide are Equifax, Experian and TransUnion. Your credit reports from each may not be identical, as some lenders and creditors may not report to all three. Some may report to only two, one or none at all.

Your Equifax credit report contains the following types of information:

- Identifying information

- Inquiry information

There are two types of inquiries: soft and hard.

- Bankruptcies

- Collections accounts

Should You Monitor Your Credit While Mortgage Shopping

You want to know your credit score in advance of shopping around for a mortgage, particularly because you could encounter reporting errors or inaccurate negative information on your credit reports.

Besides reporting errors, several other things could impact your credit score and your mortgage options, including duplicate accounts, incorrect name spellings, fraudulent accounts , incorrect payment statuses and more.

What happens when you or an organization checks your credit? An inquiry gets noted on your credit report. Soft inquiries, such as when you check your own credit score don’t affect your credit scores. However, hard inquiries from a lender trying to make a decision about whether or not to lend to you can affect your score.

You want to check your credit periodically, so you know how creditors are evaluating you. Learn more about checking your credit through Mortgage Missteps: Not Checking Your Credit Score.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

A Mortgage Adds To Your Credit History

Nothing affects credit score more than your payment history.

Mortgages typically require 15 to 30 years of payments, which is plenty of time to polish your score by making on-time payments. It can also eventually contribute to the age of your credit, or how long youve had credit, which may help.

On the other hand, if you miss payments, expect a drop in your credit score.

If Youve Ever Checked Your Credit Scores Its Likely You Got Them Separately From The Three Major Consumer Credit

A mortgage lender trying to figure out if youre creditworthy wants a complete picture of how you use credit. But it can be challenging to put that picture together by looking at a single credit report from one of the three major consumer credit bureaus. Thats because lenders and other creditors may not report to each of the big three, resulting in each bureau having different information for you.

To help solve this, lenders can obtain special compiled credit reports that merge multiple reports into one, giving a more-complete picture of your credit history.

There are two types of compiled credit reports a mortgage lender might pull to evaluate your finances. Theres the so-called tri-merge report: a single, easy-to-read credit report compiled from the individual reports issued by the three major consumer credit bureaus. And then theres the residential mortgage credit report, which compiles at least two reports from the three bureaus and typically offers additional information to help lenders assess how risky a borrower you are.

You May Like: How To Remove Repossession From Credit Report

Can You Just Reopen Your Bankruptcy And Reaffirm The Mortgage

Some clients ask if they can reopen their closed bankruptcy case and reaffirm the debt. In short, this is not possible. To do so, a debtors Discharge Order would have to be vacated because, you will recall, a Reaffirmation Agreement must be filed before entry of the discharge. The Bankruptcy Code simply does not allow a debtor to vacate a Discharge Order to reaffirm a debt.

Putting Off Paying It Off

If you have the option to pay off your mortgage early, you might want to hold off. If you have significant credit card debt, for example, it might make more sense to use the extra money you would have sent to your lender to your credit card providers to reduce that debt. Credit card debt, after all, usually comes with far higher interest rates than mortgage loan debt.

You May Like: Do Lending Club Loans Go On Your Credit Report

Does Having Your Name On A Mortgage Deed Affect Your Credit

Mortgage deeds, deeds of trusts and deeds are three terms often used interchangeably in real estate lingo. In fact, these terms are not synonymous. Each refers to a different instrument you sign in regards to your property. Mortgage deeds or deeds of trust are the loan contracts used to borrow money to purchase your property. The deed is the official paperwork for the property every homeowner receives whether he used a loan or bought the property outright.

How Your Credit Report Works

Your is primarily a record of your payment history on your various credit accounts. These accounts include , car loans, mortgages, student loans and similar debts. Credit reports also include reports on things like bankruptcies and tax liens, and can even include rent or bill payments.

Essentially, your credit report encompasses everything reported to the consumer credit reporting agencies, from payments made to requests for new credit. The three principal credit reporting agencies are Equifax, Experian and TransUnion.

The information in your credit report is used to come up with your credit score. Without a credit history, theres no credit score. However, your creditors arent required to report your payment history to every credit reporting agency. Thats why a credit score can vary depending on which credit reporting agency provides the score.

Also Check: Does Paypal Credit Report To Credit Bureaus

How Long Does A Foreclosure Affect Your Credit

A foreclosure typically affects a credit score for years. In general, most Canadians who have gone through foreclosure usually have to wait anywhere between 7 to 10 years before their credit scores no longer reflect a foreclosure or judgment as a result of foreclosure.

to know how long information stays on your credit report.

Until then, borrowers likely will not be able to secure a conventional loan from a traditional lender. Even after this time period has come and gone, it may still be necessary to provide a lot of paperwork as proof that you are able to carry a loan and make payments on time.

Having said that, there may be certain situations in which lenders may be willing to approve a mortgage after two years of foreclosure or judgment, as long as you are able to demonstrate that you are no longer considered to be a risk. However, these loans will almost certainly come with a higher interest rate compared to conventional loans for prime borrowers simply because of the added risk involved for the lender.

Looking for an alternative to foreclosure? Read this.

Lender Who Does Not Report

Just as your mortgage may not show up if you use owner financing, the same may be true if you use a very small lender. You cannot force any lender to report mortgage information to the credit bureaus, and neither can the bureaus themselves. Some lenders may have a policy to only report problems with accounts, but not report accounts in good standing. Other lenders report to just one credit bureau instead of reporting all three. This is why it’s important to ask about credit reporting policies before getting a mortgage if you want to ensure that it will appear on all three of your credit reports.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Why Do Lenders Need My Credit Report And Score

7-minute readAugust 13, 2021

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

If youre applying for a loan, it makes perfect sense to shop around and see where you can get the best terms. When you call a lender though, theyll likely want to pull your credit to get a look at your report and score before giving you rate information.

The aim of this post is to help you understand why lenders are interested in your credit and what theyre looking for, as well as debunk a few myths around the impact of credit inquiries on your overall score.

What If I Need To Improve My Credit

When youre preparing to buy a house, its a good idea to check all three of your credit reports as issued by the three major consumer credit bureaus essentially creating your own compiled report. Having all three credit reports can give you a good picture of your overall credit health, which can allow you to dispute any errors or investigate any problems you find before a lender sees them.

And because your residential mortgage credit report contains many of the same factors that are in your individual credit reports at the three major consumer credit bureaus, the steps you can take to clean up your reports and improve your credit are the same for an RMCR as they are for an individual report, Morse says.

The consumer credit bureaus may prohibit or frown upon lenders sharing RMCRs with borrowers, but the report contains a lot of useful information on how you look to lenders. And while its not advisable to make an issue of it if the lender says no, it wont hurt to ask the lender for your residential mortgage credit report.

About the author:

Read More

Read Also: Credit Score With Itin Number

What’s In Your Credit Report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO Scores to inform future lenders about your creditworthiness.

Although each of the credit bureausExperian, Equifax and TransUnionformat and report your information differently, all credit reports contain basically the same categories of information.These four categories are: identifying information, credit accounts, credit inquiries and public records.

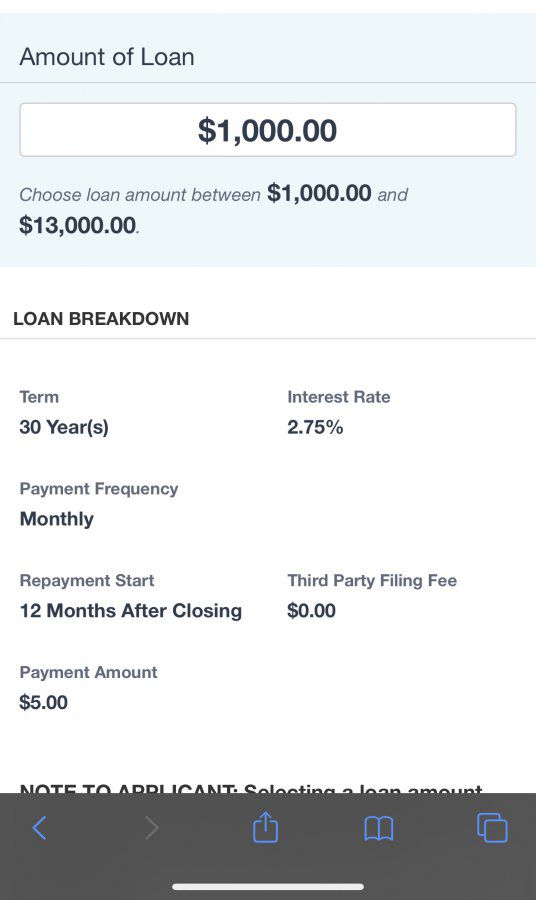

When Are Credit Reports Used In The Mortgage Process

A lender will typically pull and review your credit reports once youve completed your mortgage application. Morse advises against having your reports pulled by the lender when youre just starting the home-buying process, because its considered a hard credit inquiry, which can hurt your credit scores.

Instead, he recommends using a lender whos willing to first talk about your budget and ensure youre financially ready to move forward. That way you can be certain a hard inquiry will be worth it.

Recommended Reading: What Credit Score For Care Credit

Does Shopping Around For A Mortgage Hurt Your Credit

You might have already asked, “Will shopping for a mortgage hurt my credit?” prior to stumbling on this article. If so, good for you! You know you need to protect your credit at all costs.

You can rest easy knowing that you can shop around for a mortgage without hurting your credit. In fact, you can consult as many lenders as you want as long as your last credit check occurs within 14 days of the first credit check. Optimal shopping period time frames are built around FICO® scoring models. FICO® gives you a 14-day grace period for mortgages when they go into one inquiry. In other words, FICO® treats similar loan-related inquiries within 14 days of each other as a single inquiry.

For example, let’s say you shopped for a mortgage with five different lenders over a period of 14 days. FICO® would consider those five hard inquiries as one hard inquiry. A hard inquiry could lower your credit score by a few points. On the other hand, soft credit inquiries won’t affect your score.

You might wonder what would happen to your credit score if you shopped beyond the 14-day time frame. After 14 days, new mortgage quotes will add a soft inquiry to your credit report. Try to avoid adding these inquiries to your credit report and do your shopping within the 14-day window.