Who Has Access To Your Credit Reports

Although not many people can access your credit report, a few individuals and institutions who legitimately requires it may have access to it. If a company has a genuine business requirement with you, it is safe to assume that they have access to your credit report and score. Hereâs a list of some of the institutions and individuals that have access to your credit report.

Banks â Quite naturally, banks can gain access to your to gauge your credit worthiness. You donât necessarily have to have a credit card for banks to have access to it. Your credit worthiness may be examined if youâre applying for a loan or even opting for an overdraft facility as this is considered to be a line of credit as well.

Anyone willing to loan you money will have to determine your credit worthiness before they put their faith in you. Credit card issuers and mortgage lenders are amongst a few that fall in this category. Determining your credit worthiness helps the creditor gauge if youâre capable of repaying the loan and helps the creditor determine the terms and conditions of the same. Generally, the better your credit score, the more likely you are to get a loan approved and attain favourable terms when it comes to repayment and interest rates.

Insurance Companies â Statistically, it shows that individuals with poor are more likely to file a claim. Insurance companies often measure your credit worthiness to determine how much they need to charge you for a new policy.

Avoid Applying For New Cards

Applying for too many new credit cards and lines of credit can halt any hard work youve done to improve your credit score. Each time you apply for credit, the application involves checking your credit report, which temporarily hurts your score. This happens because applying for credit may indicate that youre low on funds and cant make all of your payments.

Getting a new card can help decrease your utilization ratio, but thats after it initially drops your score. Overall, a new card can improve your score, but consider opening new accounts sparingly. Veteran financial planner Lee Huffman recommends waiting six months between applying for new lines of credit.

Impact: Low. This method wont boost your score, but it should prevent it from dropping unnecessarily.

Potential speed for results: Fast. You wont see the negative effect of a hard inquiry if you dont apply for new credit.

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

You May Like: How To Put A Credit Freeze On Your Credit Report

Dont Apply For Multiple New Credit Lines

Opening a new credit line increases your credit limit, but every application for a new credit line creates a hard inquiry on your credit report. Hard inquiry is a detailed analysis of your credit profile to assess how much risk you possess as a borrower.

As hard inquiry is reflected on your credit report for two years, multiple hard inquiries in a short span of time can negatively impact your credit score. Hard inquiry resulting in rejection of loan application is an extremely negative event.

Does Getting A New Credit Card Hurt Your Credit

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age youngerboth of which could lower your score. For those in the , adding a new credit card will most likely lower your score in the short term but lead to a stronger credit score in the long term.

Also Check: How To Get Paid Collections Off Credit Report

Regularly Monitor Your Credit

Sometimes, derogatory marks show up on your credit report and lower your score without you even realizing it. One way to get notified is to set up . This will alert you to negative items and even let you know if you may be a victim of identity theft or fraud. Credit monitoring will alert you to:

- Bankruptcies and other public records

- Address changes

- Changes to your credit score

Impact: High. In the case that youre a victim of fraudulent activity or you acquire some derogatory marks on your credit reports, it can be very beneficial to your credit if you notice and address these issues.

Potential speed for results: Fast. When youre alerted to errors on your reports, you can immediately get to work addressing them and making sure they dont affect your credit for long.

Improve Your Credit Score Quickly With These Tips

Your credit isn’t set in stone you can improve it in as little as a few months.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

We are an independent publisher. Our advertisers do not direct our editorial content. Any opinions, analyses, reviews, or recommendations expressed in editorial content are those of the authors alone, and have not been reviewed, approved, or otherwise endorsed by the advertiser.

To support our work, we are paid in different ways for providing advertising services. For example, some advertisers pay us to display ads, others pay us when you click on certain links, and others pay us when you submit your information to request a quote or other offer details. CNETs compensation is never tied to whether you purchase an insurance product. We dont charge you for our services. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear.

You May Like: How Long Does A Dispute Take On Credit Report

Request A Higher Credit Limit

One key move you can make is to request a higher limit on your current card. If youre looking for ideas on how to increase credit scores, this is a good one.

The idea is to up the ceiling on purchase limit, but spend less each month so that credit utilization ratio improves. Note that this may result in a “hard inquiry” of your credit report, which could result in a brief drop of your credit rating. You may find youre on the way to your best credit score ever!

Become An Authorized User

If a relative or friend has a credit card account with a high credit limit and a good history of on-time payments, ask to be added as an . That adds the account to your credit reports, so its credit limit can help your utilization. Also called “,” authorized user status allows you to benefit from the primary user’s positive payment history. The account holder doesnt have to let you use the card or even give you the account number for your credit to improve.

Make sure the account reports to all three major credit bureaus to get the best effect most credit cards do.

Impact: Potentially high, especially if you are a credit newbie with a thin credit file. The impact will be smaller for those with established credit who are trying to offset missteps or lower credit utilization.

Time commitment: Low to medium. You’ll need to have a conversation with the accountholder you’re asking for this favor, and agree on whether you will have access to the card and account or simply be listed as an authorized user.

How fast it could work: Fast. As soon as you’re added and that credit account reports to the bureaus, the account can benefit your profile.

Don’t Miss: What Is The Official Credit Report Site

These Two Things Hurt Your Credit Score The Most

One of the most useful features of a credit card is the convenience of paying as well as getting the security. Thanks to these two factors, we have been witnessing a massive growth of credit cards.However, even though come with the convenience of buy now pay later, you have to make sure to be particular the repayments. A bad repayment history takes a toll on your credit score in a big way. Letâs understand how is your credit score calculated:

⢠35% – Payment History

⢠15% – Age of Credit History

⢠10% – Type of Credit

⢠10% – Credit Inquiries

All the aforementioned factors affect your credit score but the payment history and credit utilisation hamper your credit score the most. Let us now understand how credit cards impact these two factors.

It must be noted that improving your credit score take time and patience and it cannot happen overnight. You have to follow certain discipline and work towards your financial goals to achieve the desired credit score.

Your Credit Score May Be With You For Life But A Bad One Doesnt Have To Be

Posted August 2022

Tags: , , , personal finance , low interest , , secured loan , loan

First things first: what is a credit score? A credit score is a number between 0 and 1,000 that indicates how credit-worthy you are, and how likely you are to pay your bills on time. Your score is created by the way you pay your bills. In really simple terms people who pay their bills on time will have higher credit scores than people who pay their bills late or not at all.

Heres why:

Among other things, a credit score weighs your positive credit history against the negative. If a lender finds that youre financially irresponsible, have large amounts of debt, have missed Buy Now Pay Later payments, or carry maxed-out credit cards, youll have a tough time obtaining finance. And, if youre even approved for personal finance, its likely youll have to pay higher interest than you might have otherwise.

However, theres no need to throw in the towel just yet.

There is a silver lining.

With the right techniques and strategies, there are many ways to boost your credit score helping to improve your chances of being approved for your next loan and often saving you money on interest.

Today were helping you to live your best financial life by sharing 4 of the easiest ways to improve your credit score, which will help you to:

- Improve your chances of getting a loan

- Save $$$ by gaining access to lower interest rates

Read Also: How To Get Rid Of Bankruptcy On Credit Report

Take Care Of Negative Items First

Negative items are like an anchor weighing down your credit, and they can decrease the impact of the other tips. If you have any derogatory marks like collection accounts, paying them off can improve your score, if you can negotiate such an agreement with the collection agency. Other negative items include bankruptcies, missed or late payments, and foreclosures.

Sometimes, these negative items are reported in error, too, so make sure the marks are legitimate before paying them off. If theres an error, you can dispute a negative item and possibly get it removed from your credit report. And if you cant get negative items removed from your reports, they should drop off on their own after seven to 10 years have passed .

Impact: High. Depending on where your credit score starts, a derogatory mark can make it drop by a significant number of points, so you may see a big increase if any of these items are removed.

Potential speed for results: Too variable to say. If a negative item is removed, you may see a change in your score within 30 to 45 days, which would be considered a fairly quick result. However, it can take many months to complete the dispute process or negotiate with a creditor to get a negative item removed, so it depends on your specific case.

Factors That Affect Your Credit Scores

As we mentioned above, there are several factors that go into determining your credit scores.

Also Check: Is 655 A Good Credit Score

How Your Credit Score Is Calculated

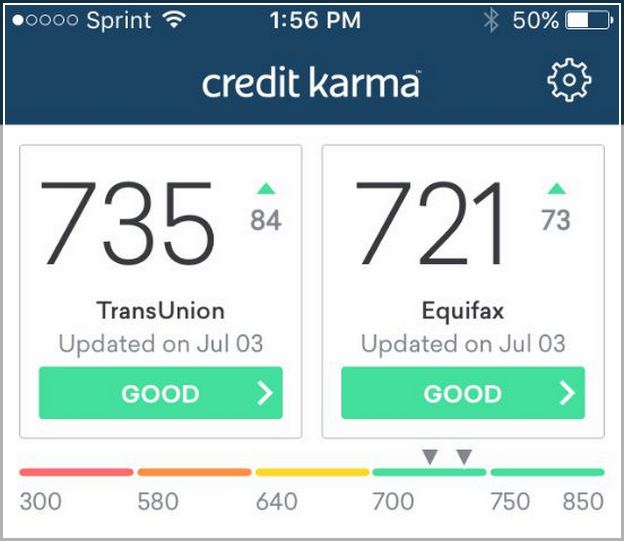

Your credit score is calculated based on the information in your credit report. Each person has three credit reports — one from each major credit bureaus, Experian, Transunion and Equifax — and each score might range slightly. However, FICO, the most widely used credit scoring system, uses the same formula to determine a credit score regardless of which credit report it is using.

There are five categories that affect your credit score:

- New credit : This refers to new credit cards, loans, mortgages or other lines of credit opened.

- Length of credit history : The longer you’ve had a line of credit, the better.

- There are two types of credit — revolving credit and installment credit . You want a healthy mix of both.

- How much debt you hold versus how much credit is available to you. A good credit utilization rate is 30% or below — to calculate yours divide your total credit used by your total credit limit. If you have $3,000 in credit card debt and have access to $10,000 in credit, your utilization rate would be 30%.

- Payment history : This captures your history of making payments on time.

Pay Off Any Existing Debt

To reduce your credit utilization ratio quickly and improve your score, use the debt avalanche or debt snowball method to pay down existing debt:

- With the debt avalanche method, you focus on paying off your highest-interest debt first, followed by the debt with the next highest interest rate, and so on. However, be sure to make the minimum payments on any other cards in the process to avoid any penalties.

- The debt snowball method, on the other hand, focuses on paying off your smallest balances first while still meeting the minimum payment requirements for your other cards. This method is meant to help build momentum as you get a sense of achievement from paying off one card after another.

Recommended Reading: Why Does Your Credit Score Go Down

Avoid Applying For New Lines Of Credit

Now may not be the best time to apply for a new credit card or buy a house. These actions require a hard credit pull, and too many hard inquiries can lower your overall score.

What’s more, getting a second credit card if you’re already dealing with debt and overspending may not be the smartest move. Instead, focus on shoring up your current accounts and improving your score as much as possible before applying for a new card.

If you still plan to apply for a new card, don’t make the mistake of applying for a bunch at once. You might think applying for a bunch of cards increases your chances of at least one of the companies approving your request. But it can hurt you.

Every credit card application you make triggers a hard credit inquiry, which may cause your credit score to take a slight hit, typically less than five points. If you apply for multiple cards, those hits add up.

While these actions can’t guarantee a certain score 30 days from now, they are all great steps in the direction of that 850 score.

The key to improving your credit score is to be as consistent as possible and patient! While it may take some time, you’ll definitely be in a better place than you were a month ago.

Be Patient And Persistent To Your Approach

A credit score doesnt improve overnight and it requires consistent effort to repair the credit report and improve it.

Therefore, you need to be patient and continue to monitor your credit report, your different credit lines, spending pattern and ensure timely payment of a debt. Over time, it will help to boost your credit score and improve your creditworthiness.

Increasing your CIBIL score is an uphill task but can be achieved with the help of planning and discipline.

Don’t Miss: How To Dispute Things On My Credit Report