What Credit Score Is Needed To Buy A House

For most loan types, the credit score needed to buy a house is at least 620. However, a higher score significantly improves your chances of approval. Borrowers with scores under 650 tend to make up just a small fraction of closed purchase loans.

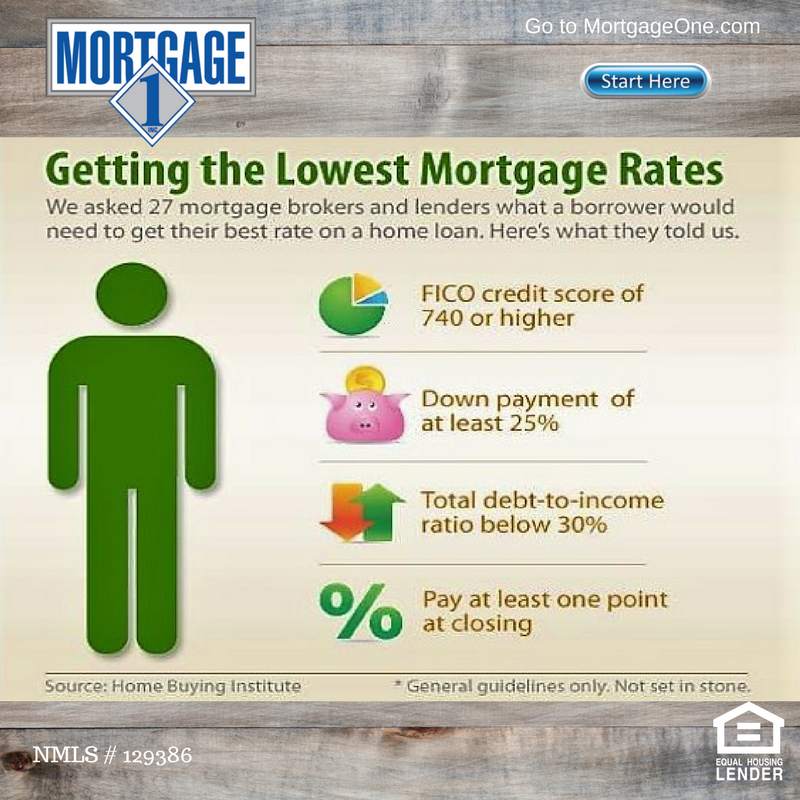

Applicants with scores of 740 or higher generally get the lowest interest rates.

If your credit score is on the low side, it may make sense to work on building it up before buying. Due to current economic uncertainty, many lenders have raised minimum credit score requirements on loans, even those that allowed for lower scores in the past.

What Is Considered A Good Credit Score

Each CRA assesses your credit history a bit differently and uses a unique scoring system. Heres a rough guide to what the three biggest consider a good credit score:

- Experian 881 to 960

- TransUnion 604 to 627

- Equifax 420 to 465

If youre looking to access the very best mortgage rates, you could try and bump your credit score up into the excellent category:

- Experian 961 to 999

- Equifax 466 to 700

Minimum Credit Score Needed For An Insured Mortgage

On July 1, 2020, Canada Mortgage and Housing Corporation increased the minimum credit score requirement on insured mortgages from 600 to 680. This represented a significant jump, and the response from industry experts was mixed. Many felt that the new benchmark was too restrictive and would result in too many Canadians not entering the housing market.

CMHC’s minimum score applies to at least one borrower on a mortgage. This makes the situation a bit more flexible for couples, as only one borrower needs to exceed the 680 threshold.

Recommended Reading: How To Add A Tradeline To Credit Report

How Can I Reduce My Chances Of Being Rejected For A Mortgage

As well as taking the steps above to build a strong credit history, there are other ways to get yourself in the best financial shape for a mortgage:

- Avoid applying for anything that requires a hard credit search at least 12 months before applying for a mortgage.

- Try and keep your credit use below 25%. This will show youre responsibly using things like a credit card or overdraft.

- Keep making credit payments on time. If youre having problems, contact your lender immediately and discuss other options that could help you avoid a negative mark on your credit record.

Once youve built up your credit score to the best level you can achieve, contact a mortgage broker so that they can find you the best available mortgage deal and interest rates.

What Credit Score Do You Need To Buy A House

Your credit score is a very important consideration when youre buying a house, because it shows your history of how youve handled debt. And having a good credit score to buy a house makes the entire process easier and more affordable the higher your credit score, the lower mortgage interest rate youll qualify for.

Lets dive in and look at the credit score youll need to buy a house, which loan types are best for certain credit ranges and how to boost your credit.

You May Like: How To Request Credit Report

What Is The Minimum Credit Score I Need To Get A Mortgage

There isnt a set number that will automatically make you eligible for a mortgage. This is partly because getting a mortgage depends on much more than your credit score, and partly because agencies and lender may use wildly different scoring systems, so the numbers simply arent comparable.

That said, its always the case that the higher your credit score, the better your chances are of securing a mortgage offer and getting access to attractive interest rates. However, if your credit score isnt considered at least decent, its likely youll struggle to get a mortgage.

Currently there are three major credit reference agencies : Experian, Equifax and TransUnion . Each of these uses their own unique credit scoring system. Experians system ranges from 0-999, and anything below 721 is considered poor. TransUnion scores borrowers from 0-710 and also has five rating bands , and any score less than 566 is considered poor. Equifax has a scale which runs from 0- 700 and anything below 380 is poor. So you can see how very different the scales are.

If youre below a particular threshold that is considered good, you should focus on building your score as much as possible before applying for a mortgage.

Even With The Credit Score For A Mortgage Are You Ready To Buy That Home

Sometimes, its just not the right time to buy a home. This is a step that cant really be reversed. Youre locking yourself into many, many years of monthly payments you will have to make or destroy your credit and lose your home. Even if you lose your job, hurt yourself, or go through other life-altering traumas, you will still on the hook for the monthly payments on your mortgage.

The new rules and obstacles in our way to home-ownership are there for a reason: to protect us from defaulting on our mortgage. But none of these new rules and regulations can protect your credit score if you jump into something so huge without considering everything. An organized, prepared home-buyer is far more likely to reach the end of their mortgage still a homeowner and with a great credit score. The keys to responsible home buying are patience and preparation. With enough patience and preparation, you wont be held back by anything.

Before you leap into this, head over heels, youve got to make sure youre ready. Do you have a backup plan? Do you have an emergency fund, should something bad happen? Taking the time before leaping into home-ownership, to make sure you have something to fall back on, will give you security and protect your investments while making sure your credit score does not suffer.

Don’t Miss: Is 700 A Good Credit Score

Can I Get A Mortgage With A Fair Credit Score

Yes! You can get a mortgage with a Fair credit rating. Generally, mortgage lenders like applicants to have a high credit rating, but they all have different lending criteria. If youre thinking of getting a mortgage and want a clear view of how mortgage lenders will see you, it could be worth signing up for checkmyfile*. checkmyfile shows data from across four of the major UK credit reference agencies Experian, Equifax, TransUnion and Crediva.

When you apply for a mortgage, a mortgage lender will do a thorough check on your credit report. checkmyfile lets you see what they will see, so youll know exactly how your credit appears and what kind of score you have. Once you have a clear view of your credit history and how each of the major credit reference agencies have rated you, youll know how likely most lenders will be to offer you a mortgage.

Read more in our Guide: Checkmyfile Explained.

*Heads up, when you click through to our affiliate links, we may earn a small commission at no extra cost to you. We only recommend sites we truly trust and believe in.

What Is A Good Credit Score

As previously mentioned, credit scores range from 0 to 999. Certain ranges are considered to be different in terms of how good the score is. According to Experian , a credit score of 721-880 is classified as fair or okay. If your score is between 881 and 960, it is considered a good score. And if you manage to score in the 961-999 range, you have an excellent score and will be able to access the best possible deals on mortgages, credit cards and loans.

The scores for the other main credit reference agencies are a little different:

You May Like: How To Get Rid Of Late Payments On Credit Report

Compensating Factors Can Help If You Have Bad Credit

You dont need perfect finances across the board to secure mortgage approval. You can often qualify if youre weak in one area like credit score but stronger in other parts of your financial life. These offsets are known as compensating factors.

If your credit score is weak but you have a stable income, a lot in savings, and a manageable debt load, youre more likely to get mortgage-approved.

Similarly, you have a good chance at loan approval if you have a higher credit score but youre only average in those other factors.

The key is to understand that lenders look at your personal finances as a whole not just your credit score.

How Can My Fico Scores Affect My Mortgage Interest Rate

When a loan officer gets your mortgage application, they may use a pricing grid to figure out how your credit scores affect your interest rate, says Yves-Marc Courtines, a chartered financial analyst with Boundless Advice. Generally, higher scores can mean a lower interest rate, and vice versa.

From there, a mortgage loan officer will likely look at the rest of your loan application to decide whether your base interest rate needs any adjustments. For example, if youre making a smaller down payment, you may be given a higher interest rate, says Courtines.

A banks pricing grid may change on a daily basis depending on market conditions. However, heres an example of what you might expect your base interest rate to be, based on your credit score, on a $216,000, 30-year, fixed-rate mortgage.

| FICO® score range |

|---|

Source: myFICO, November 2020.

You May Like: Does An Overdraft Affect Your Credit Rating Ireland

What Credit Score Do You Need To Get A Mortgage

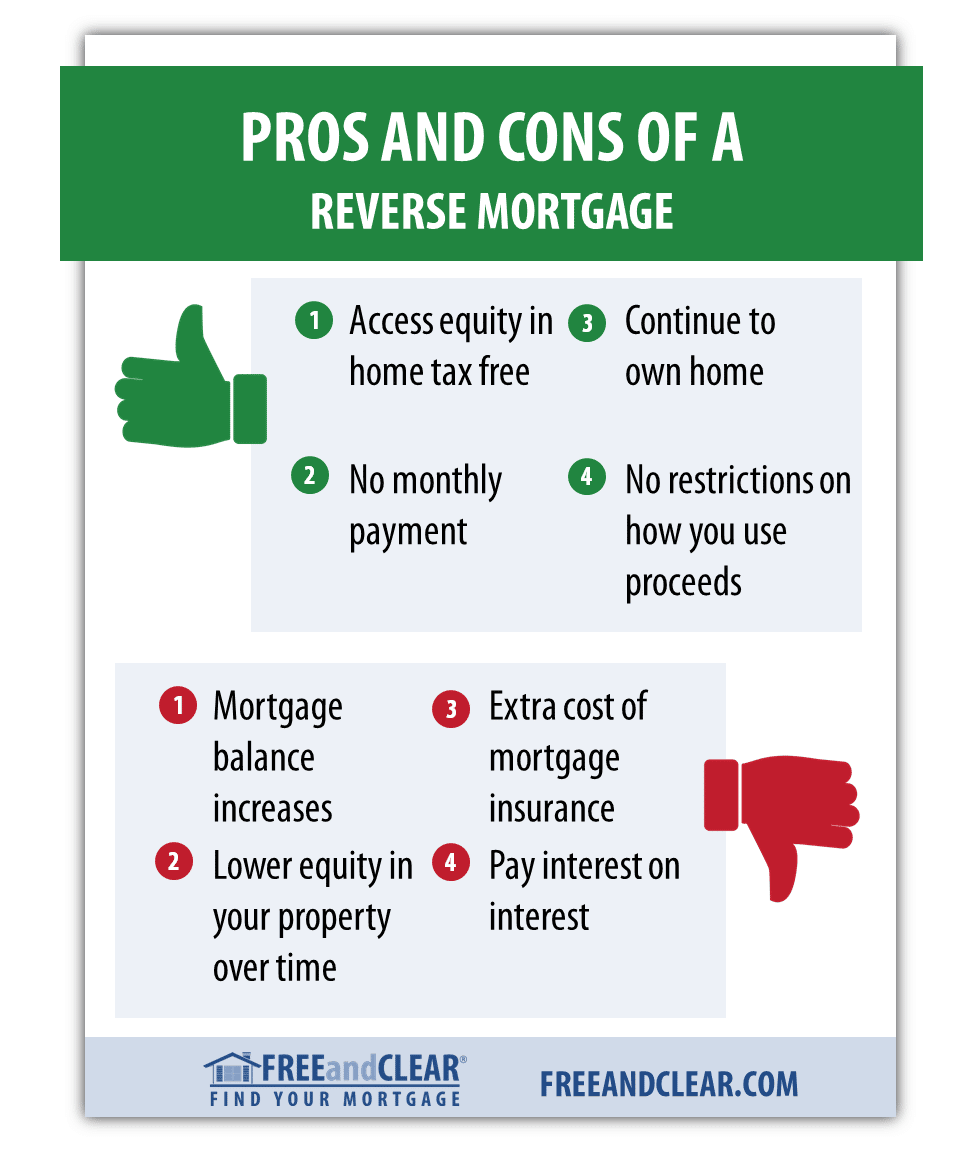

Major banks generally require a credit score above 600.Private mortgage lendersmight not have any credit score requirements, depending on the lender. Second mortgages andhome equity line of credits also require good credit scores. Having a low credit score may mean that your application is denied, your mortgage rate can be higher, or the amount that you can borrow may be reduced.

You will need a credit score above 600 if you are looking to get an insured mortgage. Mortgage default insurance is required for high ratio mortgages, which is for those with a down payment less than 20%, or your mortgage lender may require mortgage insurance even if you make a greater down payment due to your financial situation.

Mortgage default insuranceis usually issued by theCanada Mortgage and Housing Corporation . CMHC mortgage default insurance requires you or a co-borrower to have a credit score of at least 600. Other private mortgage insurance providers include Canada Guaranty and Sagen.

Can I Get A Home Loan With A 450 Credit Score

A credit score of 450 is categorised differently depending on the credit checking agency youre using. For example, a credit score of 450 on Experian or TransUnion is categorised as Very Poor, which means youll have less options available to you when you apply for a mortgage than you would if you had an Excellent rating. But, there are specialist mortgage lenders who will consider your application. You just need a specialist broker. We can help with that. Get in touch and get matched to the perfect mortgage broker for you now.

If your credit score is 420 and youre with Equifax, youre categorized as having an Excellent rating, so shouldnt struggle to get a mortgage from most lenders.

Read Also: How To Build Up Credit Rating Fast

Do I Need A Credit Score To Get A Mortgage

Most mortgage lenders will want you to have some credit history before theyll be willing to offer you a mortgage. But there are specialist mortgage lenders who will consider you with a very low or even no credit score. It’s fairly common for someone to not have a credit score, for example you might have never taken out any kind of credit , or maybe youre still living at home with parents so havent yet had a chance to build a credit profile.

Generally, itll be specialist lenders wholl be willing to consider your no credit mortgage application. Our Mortgage Experts can help you find one, and make your application look as good as possible.

Read more about getting a mortgage with no credit history in our Guide.

Can I Get A Mortgage If My Credit Score Is: : :

Because credit reference agencies have different scoring systems, it can be hard to understand what credit score you need to get a mortgage. Generally, most lenders prefer a high credit score categorised as being good or excellent than a low credit score categorised as being fair or poor.

For example, a high credit score if you check your credit score with Experian would be between 881 and 999. If you checked with TransUnion, a high credit score 604 to 710. And if you checked with Equifax, a high credit score would be anywhere between 410 and 700.

If you have a fair or poor credit score, you can still get a mortgage, but youll have less options of mortgage lenders willing to give you a mortgage. Read our Guide on How to improve your credit score before you apply for a mortgage if you want to know how to improve it before applying. If you need to get a mortgage soon and are worried you wont be able to due to a poor credit score, get in touch with us for expert bad credit mortgage advice.

Don’t Miss: How To Clear Inquiries From Your Credit Report

How To Improve Your Credit Score To Buy A House

Before you look at houses, its smart to check your credit score and pull your credit reports from the three major credit agencies. Addressing credit issues early on can help you raise your score before you apply for a mortgage.

If your credit score isnt great, there are still options. Instead of settling for the mortgage rates you currently qualify for, consider postponing homeownership and working to boost your credit score and improve your options. Here are some quick tips to help:

What Are Fico Scores And How Do I Get Mine

Your FICO® scores are credit scores. Its a sort of grade based on the information contained in your . Unlike the grades you were given in school A through F base FICO® scores generally range from 300 to 850. And the higher, the better.

Because there are three major consumer credit bureaus , each with its own version of your credit report, you can also have different credit scores. For example, you can have a FICO® score based on your Equifax® credit report, a FICO® score based on your Experian® credit report, and a FICO® score based on your TransUnion® credit report. To further complicate things, you can also have VantageScore® credit scores from each bureau.

Additionally, FICO also creates many different credit-scoring models for lenders in different industries. So your base FICO® scores may not be the same ones a mortgage lender sees if they request your mortgage-specific FICO® scores, for example.

You probably dont need to worry about all these nuances when buying a home, but you should still have an idea of what your scores look like. You can get your VantageScore® 3.0 credit scores from Equifax and TransUnion for free on .

If you want to see your FICO® scores, however, you can easily buy them online from the MyFICO website, and possibly find them for free from your bank or credit card issuer.

Read Also: Is 689 A Good Credit Score

What Credit Score Do You Need For A Mortgage

Get to know how to improve your credit score to secure a good mortgage deal.

So, youâve given up countless weekends to the property search, the Rightmove tab is still open as you read this, youâve appointed a mortgage advisor and now, youâre looking to get that all important mortgage deal.

Which, whether you realise it or not, is where your credit score comes in. When you first apply for a mortgage, lenders will consider several factors, including your income, outgoings and credit score. Your credit score is often something of a silent partner in the house buying process â that is, unless your credit history throws up an obstacle.

A good credit score is an indicator to lenders that you are responsible with your money, therefore itâs likely to get you a better mortgage deal. While a lower credit score indicates that you may be more of a risk in the eyes of lenders, which will impact the mortgage deals available to you â and may mean youâre not accepted for a mortgage at all.

Here, we look in a little more detail at what credit score you need for a mortgage.

Whatâs a good credit score for a mortgage?

The âgood credit scoreâ vs. âbad credit scoreâ axis is defined slightly differently by each credit reference agency and lender. Usually, the score ranges from 300 at the lower end to 900+ at the excellent end of the scale.

Whatâs a low credit score for a mortgage?

Why might you be refused a mortgage?

How does a mortgage affect your credit score?

Gather The Documents Needed For Your Mortgage Application

Your finances are in good shape and you know how much you can borrow. Now here comes the real work.

Lenders require quite a bit of documentation as part of the mortgage approval process, so itâs a good idea to gather everything up before youâre ready to apply. Hereâs what youâll need:

Income verification. First, youâll need to prove you have the income to support your mortgage payment. Lenders will likely want to see tax returns for the last two years, as well as recent W-2 forms or pay stubs. If youâre self-employed, youâll need to verify your income with 1099s or profit and loss statements from the past couple of years instead.

If you receive income from alimony or child support, youâll also be expected to provide court orders, bank statements and legal documentation that shows youâll continue receiving that income.

Proof of assets. In addition to income, additional assets can help you secure a mortgage. Expect to provide bank statements for checking and savings accounts, retirement accounts and other brokerage accounts from the past 60 days.

List of liabilities. Lenders may also ask you to provide documentation related to outstanding debts, such as credit card balances, student loans or any existing home loans.

Don’t Miss: How Long Do Credit Inquiries Stay On My Report