Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

Get A New Bank Account If You Need One

The first thing I had to do after filing for bankruptcy was to open a new bank account. I was with Bank of America and I had a credit card with them too. The credit card account was included in my bankruptcy so I was no longer in good standing with them.

I opened an account at a local, regional bank and was good to go.

How Long Do Derogatory Marks Stay On Your Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Derogatory marks on your credit are negative items such as missed payments, collections, repossession and foreclosure. Most derogatory marks stay on your credit reports for about seven years, and one type may linger for up to 10 years. The damage to your credit score means you may not qualify for new credit or may pay more in interest on loans or credit cards.

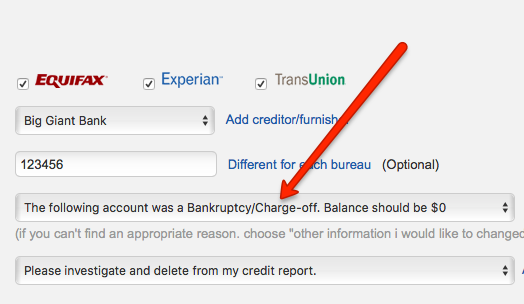

If the derogatory mark is in error, you can file a dispute with the credit bureaus to get negative information removed from your credit reports. You can see all three of your credit reports for free on a weekly basis through April 2022.

If the derogatory marks are not errors, you’ll need to wait for them to age off your credit reports.

If you are not in a position to pay your bills, learn how to limit the damage to your finances.

Heres how long derogatory marks stay on your credit reports click to learn how to recover:

Read Also: Les Schwab Credit Score

Is My Credit Going To Be Bad As Long As A Bankruptcy Shows Up

Myth: You might as well not even try because youll have poor or bad credit as long as the bankruptcy is on your record.

The truth: Yes, bankruptcy tanks your credit score in the short term. But how much a bankruptcy impacts your credit score depends in part on how old the record is. Like many other types of items reported on your credit file, bankruptcies lose some power over time. Thats especially true if you start managing credit and debt in a more positive way while youre waiting for the bankruptcy to fall off your report.

Some ways to help positively impact your score after bankruptcy can include:

- Adding new credit, such as secured credit cards or small installment loans, to offset the negative information on your credit report.

- Making on-time payments for all debt, new and old.

- Keeping your credit card balances under 30% utilization.

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Recommended Reading: Does Opensky Report To Credit Bureaus

Can I Remove A Bankruptcy From My Credit Report On My Own

It is possible to pursue removing a bankruptcy from your credit report on your own, and some people have managed to do so. However, it is a time-consuming, labor-intensive process that many people find complicated, confusing, and frustrating.

We encourage you to learn as much as you can about credit report disputes and credit repair processes, then count the real cost of DIY credit repair before committing to handling this important task on your own.

People who have needed to remove a bankruptcy from their credit reports have achieved success by working with a provider like Lexington Law Firm. If other questionable negative items are affecting your credit report and score, we can help you challenge those as well.

Contact us today for a free personalized credit report consultation to find out how we can help you meet your credit goals.

Reviewed by Vincent R. Mayr, Supervising Attorney of Bankruptcies at Lexington Law. by Lexington Law.

What If I Need A Loan Or Credit Card Immediately After Bankruptcy

Luckily, most mortgage companies provide FHA loans for scores of 560-600. Traditional financing options often require a score of 600 or higher.

There are options for buying high-cost necessities after filing bankruptcy claims. Secured credit cards and loans exist for those facing bankruptcy. You can look into credit builder loans or other financing options specially built for people after bankruptcy.

You May Like: Navient Credit Dispute

How Long Do Collections Stay On Your Credit Report

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.

Difficulties You May Face Before A Bankruptcy Falls Off Your Credit Report

Before a bakruptcy is removed from your credit report, you may face the following problems:

- Unsecured credit card applications will not be approved

- Loan applications will not be approved

- Payment of higher interest rates

- Payment of higher insurance premiums

- More difficult time finding a job

- More difficult time getting approved to rent an apartment

- Difficulty taking out a loan to buy a home

Also Check: Speedy Cash Collections

How Long Does Bankruptcy Affect My Credit Report

There are two main credit reporting agencies in Ontario: Equifax and Trans Union. Information about your bankruptcy or consumer proposal is reported to these agencies by the Office of The Superintendent of Bankruptcy , not your trustee. The OSB will advise these agencies when you file a bankruptcy or proposal and when you receive your discharge.

If you file ANY of a bankruptcy, consumer proposal, debt management plan or do a debt settlement, a not will appear on your credit report that can negatively impact your credit. In general:

- a first bankruptcy will remain on your credit report for six years or seven years after you are discharged

- a consumer proposal (or debt management or debt settlement plan will remain on your credit report for three years after all of your payments are completed.

Bankruptcy does not mean you cannot borrow for six or seven years. This just means that the note will remain on your report, however there are many other factors that affect your ability to get credit.

If you have a job, and if you have a down payment or security deposit, it is possible to repair your credit sooner. Many people are able to buy a car or a house in less than seven years after their bankruptcy ends, if they are able to save money and begin repairing their credit. Here are some ways you can improve your credit after filing for bankruptcy:

Can I Apply For Credit

After your bankruptcy has ended, there is no restriction on applying for loans or credit. Its up to the credit provider to decide if they will lend you money.

Your credit reportwill continue to show your bankruptcy for either:

- 2 years from when your bankruptcy ends or

- 5 years from the date you became bankrupt .

It can take time to rebuild your credit rating.

For more information regarding your credit report, contact a credit reporting agency. Information about credit reporting agencies is available at ASIC’s MoneySmart.

You May Like: Carmax For Bad Credit

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Read Also: Does Paypal Credit Report To Credit Bureaus

Where Can You Get Financial And Legal Support With Bankruptcy

If you are in financial difficulty and are concerned you may be heading for bankruptcy, it is a good idea to seek advice. Free advice is available from a financial counsellor through the National Debt Helpline on 1800 007 007. The NDH helps consumers find individual counsellors and organisations near to them. The NDH also offers information and resources on what your rights are if you are experiencing financial hardship.

Community legal services and legal aid agencies, as well as consumer credit legal services, may be able to help you if you need legal help to assist with bankruptcy matters. Free advice and support is available to eligible Australians, with services offered across states and territories in Australia. AFSA maintains a list of state and territory legal assistance services available to support Australians.

The National Self-Representation Service can also assist if you cannot afford legal representation, but need to attend Federal Court or Federal Circuit Court. The service is provided by LawRight in Queensland Legal Aid WA in Western Australia JusticeNet in South Australia and the Northern Territory and Justice Connect in New South Wales, Victoria, Tasmania and the Australian Capital Territory.

Cover image source: TypoArt BS .

Additional reporting by James Hurwood. This article was reviewed by our Sub Editor Tom Letts before it was published as part of our fact-checking process.

Follow Canstar on and for regular financial updates.

About the author:

How Long Does Bankruptcy Stay On Your Credit Report

Myth: Bankruptcy ruins your credit foreveror at least an entire decade.

The truth: Bankruptcies are considered public records, which is how theyre reported on your credit. The public record associated with a Chapter 7 bankruptcy will remain on your credit report for as long as 10 years. That time period starts on the date you file the bankruptcy petition.

Chapter 13 bankruptcyis different. It involves paying some money back to your creditors and typically take three to five years. However, it only stays on your creditfor around seven years from the petition filing date. That means that within two to four years after successfully finishing a Chapter 13 bankruptcy, it will fall off your credit.

Featured Topics

You May Like: Sync Ppc On Credit Report

Returning To Good Credit After Bankruptcy

A personal bankruptcy filing will affect your credit report for a certain amount of time depending on how you file:

- Chapter 13 bankruptcy stays on your credit report for 7 years after final discharge

- Chapter 7 bankruptcy stays on your credit report for 10 years after final discharge

Having a bankruptcy on your record for 7-10 years does not mean it will take you this long to repair your credit score or get out of debt.

Right away, the “final discharge” releases you from personal liability in most debts. You need this bankruptcy discharge before you can take steps to build toward better credit, otherwise, you will continue to have large debts.

Once the process starts, you can decide what choices to make to rebuild your credit.

What Are The Consequences Of Bankruptcy

According to AFSA, bankruptcy can affect:

- your income, employment and business

- your ability to travel overseas

- your ability to get credit in the future

- your assets, such as your home if you own one

- some, but not all, of your debts

If you declare or are declared bankrupt, a trustee will manage your bankruptcy, and they will seek to ensure fair and reasonable outcomes for you and your creditors. The trustee may be able to claim and sell your assets and possessions, using the proceeds to repay money you owe. While a vehicle can be kept if its value is up to an indexed amount , a trustee can claim any houses or property you own as assets as part of proceedings.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How Bankruptcy Is Removed From A Credit Report

Oct 7, 2021Bankruptcy

When people file Chapter 7 and 13 bankruptcies, theyre usually focused on filling out all of the necessary paperwork and after all is said and done, on rebuilding their credit. They rarely think much about when and how the bankruptcy falls off their credit report. Its been almost 10 years since I filed Chapter 7. What do I need to do to get it removed from my credit on the 10-year anniversary?

In the above situation, usually the debtor doesnt need to do anything to have their Chapter 7 bankruptcy removed from their credit report. Why? Because, Chapter 7 and 13 bankruptcies and all of the included or discharged debts are deleted automatically after a specified period of time passes.

How Long Does A Bankruptcy Stay On Your Credit Report

When consumers have more debt than savings and are faced with mounting bills and saddled with other ones such as student loans, filing for bankruptcy might be the only option. However, if you are considering filing for bankruptcy it’s important to consider the long-term consequences.

One of these consequences is the impact bankruptcy can have on your credit. Depending on how you file, the bankruptcy could remain on your credit report for seven or as long as 10 years. People who have exhausted all their options and can not get another job or increase their income are faced with few choices.

Filing for bankruptcy often remains the only viable choice for some individuals. People who are considering filing for bankruptcy should first consult with a non-profit credit counseling agency or attorney to see if it is the right choice for them.

The law states that consumers must also seek pre-filing bankruptcy counseling. The counseling helps people learn about several options other than bankruptcy, such as settling with creditors, entering into a debt management plan or simply not paying the debt.

You May Like: Syncb/ppc Account

A Fresh Start: Robbed

A chapter 7 bankruptcy is known as a “fresh start” bankruptcy because individuals are liquidating their assets and discharging all of their debts in a relatively short period of time there is not a repayment plan. A chapter 13 bankruptcy is known as a “wage earner” bankruptcy or a “reorganization.” It involves payments to a trustee over a three to five year period, paying a portion of the debtors debts back, and discharging the balance at the completion of the plan. So how are debt supposed to be reported during a bankruptcy and after the debts are discharged?

Debts that are discharged, whether discharged in a chapter 7 bankruptcy or a chapter 13 bankruptcy, should be reported with a $0.00 balance after the discharge is entered. Furthermore, as the automatic stay of creditors prohibited the lawful collection of the debts as soon as the bankruptcy case was filed, generally a creditor or debt collector may not continue to report the account or trade-line as “past due” once the bankruptcy has been filed. If your creditors or debt collectors, however, continue to report the debts listed in your bankruptcy schedule as pastdue or with a balance due after your receive your bankruptcy discharge, they are robbing you of your fresh start….and a a result your have been damaged: you have been robbed of your fresh start. In such case, LeavenLaw and its fair credit attorneys will be happy to help you with your case.