How Can Credit Scores Affect Mortgage Interest Rates

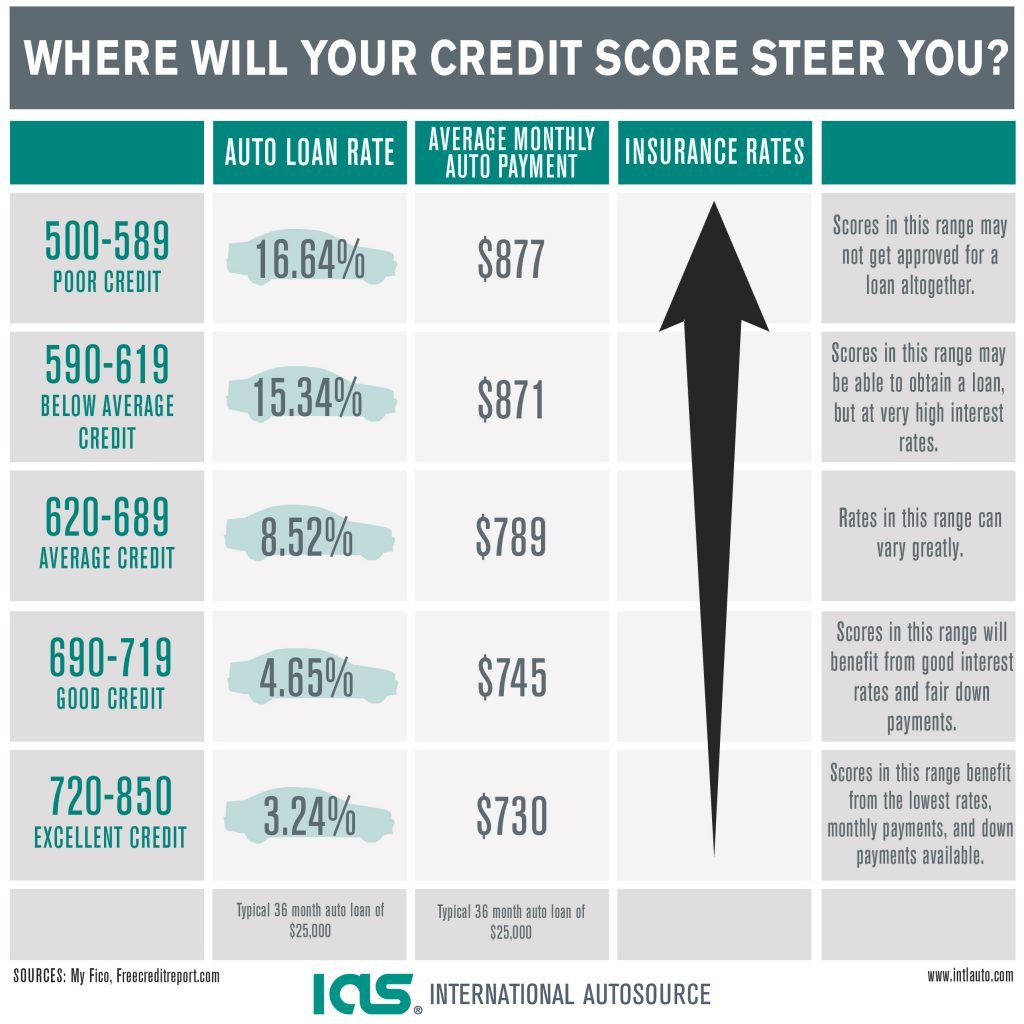

The CFPB points out that your credit scores are a key ingredient in the mortgage qualification process and that higher credit scores generally help you qualify for lower interest rates. To see the potential impact of credit scores on mortgage interest rates, it helps to look at this example:

Letâs say two borrowers apply for a 30-year fixed mortgage for $200,000. Borrower A has a credit score in the 620 to 639 range, while Borrower B has a score between 760 and 850. According to FICOâs home mortgage rate comparison tool, the borrowersâ potential mortgage rates could differ by about 1.5%.

While that may not sound like much, according to the results of that tool, the borrower with the lower credit scoreâBorrower Aâpays $173 more every month. And that extra $173 every month adds up over time.

When Theres No Money Down

The higher your down payment, the more likely you are to qualify for a loan with a low interest rate, too. If you put at least 20% down and want a conventional home loan, you can avoid private mortgage insurance âan added monthly expense to protect lenders in case you default on your loan.

But youâre not required to put that much money down. And sometimes, you can even get a mortgage requiring no money down at all. Just keep in mind that no down payment can have some downsides as well.

With no money down, youâll have higher monthly payments, potentially a higher interest rate and less chance of approval compared to someone who provides more cash up front. VA loans and USDA loans both offer financing for low- or no-down payment loans. Some private lenders offer this tooâbut it will vary depending on the lender.

Can You Get A Mortgage With A Bad Credit Score

It’s possible to get approved for a mortgage with poor credit. But just because you can, it doesn’t necessarily mean you should. As previously discussed, even a small increase in your interest rate can cost you tens of thousands of dollars over the length of a mortgage loan.

If you’re planning on buying a home and you have bad credit, here are a few tips that can help you potentially score a decent interest rate:

- Think about applying for an FHA loan.

- Make a large down payment to reduce the risk to the lender.

- Get preapproved with multiple lenders.

- Consider working with a mortgage broker who may be able to match you with a specialized loan program.

- Pay down large credit card balances to reduce your .

- Work on paying down other debts to reduce your DTI.

- Consider asking someone with good or exceptional credit to apply with you as a cosigner.

There’s no guarantee that these actions will help you qualify for a mortgage loan with good terms, but they can improve your odds.

Don’t Miss: When Do Late Payments Fall Off Credit Report

Other Requirements To Buy A House

Theres more to know than just credit minimums. After all, underwriting guidelines comprise hundreds of pages.

In addition to credit scores, lenders evaluate borrowers based on:

- Down payment: Most loan programs require at least 3% down.

- Income and employment history: Most lenders want to see at least two years of steady income and employment

- Savings: Youll need cash to cover the down payment and closing costs sometimes youll need to have cash reserves left over after paying these costs

- Existing debts: Your debt-to-income ratio compares preexisting debts like student loans, auto loans, and credit card minimum payments against your monthly gross income. The lower your DTI, the better

The size of your loan also matters. When you have lower credit, your loan amount will likely need to stay within FHA loan limits or conforming loan limits.

What Credit Score Is Needed To Buy A House

When you’re considering a home purchase, your credit score will be a significant factor in the loan process. It will determine whether you qualify for a mortgage loan and, equally important, the rate at which you will qualify. Before you begin home shopping, it’s essential to understand what credit score is needed to buy a house, each aspect of your score, and the different types of home loan options.

You May Like: When Does Discover Report To The Credit Bureau

Want To Make Sure You Have The Ideal Credit Score To Buy A House Learn What Credit Score Youll Need And Which Loans Are Best For Certain Credit Ranges

Looking to buy a home? Heres what you need to know about your credit score.

Lenders use your three-digit credit score as a way to predict how likely a borrower is to repay a loan on time. Higher scores signal a great likelihood of repaying a loan lower scores a lower likelihood. Lenders tend to give the best rates to someone with a higher score, though other factors typically play into who gets the best rates.

What is your credit score made up of?

A credit score is composed of a number of factors, though there can be small variances among the percentages that making up a credit score, according to FICO. The factors making up a credit score include ones payment history, unpaid debt, the number of outstanding loans, how long loan accounts have been open, how much available credit is being used and whether bankruptcy has ever been declared.

| Amount owed | 30% |

Need help making sense of this chart? Heres what each term means: The credit mix includes all the types of credit cards, retail accounts, loans and mortgages one has while new credit indicates the opening of accounts . Meanwhile, length of credit history includes how long your accounts have been established and how long its been since youve used certain accounts. Amounts owed reveals how much outstanding debt you have and payment history shows whether youve paid past accounts on time.

What is a good credit score to get a home loan?

What are the various credit score levels?

| Poor credit |

*Source: Experian

Your Credit Report Should Reflect A Good Diversity Of Credit Products

When youre successfully managing a credit card, a line of credit and a loan, potential mortgage lenders are going to see someone who will be capable of handling one more payment every month. If all you have is one credit card, even if youve managed it well and kept it in good standing, your credit report is not going to look as good as it could. Lenders may still wonder what sort of risk you pose as a borrower – will you be able to handle multiple credit products or is one your limit? There is no way of them knowing. If you have poor credit, there are still ways to go about diversifying your credit products. Look into secured cards, secured lines of credit and credit building programs. for more info on those.

Don’t Miss: Is 635 A Good Credit Score

Other Factors That Mortgage Lenders Consider

Anyone who has applied for a mortgage since the 2008 housing crash will tell you that the modern mortgage lender wants to know everything about a borrower short of the number of hairs on their head before giving them a loan.

Not only will they pull your credit report and examine your credit history, but theyll also thoroughly examine every aspect of your finances.

Unfortunately, that means bad credit isnt their only excuse to stick you with a higher interest rate. But on the bright side, it also means that you may get away with an average credit score if your other financial metrics are positive.

Lets take a look at the three most important factors that lenders consider in addition to your credit score.

Average Credit Score Of Credit Karma Mortgage

Here are the top five states with the highest average credit scores among Credit Karma mortgage-holders.

| 682 | $210,273 |

For cities, theres a significant strong, positive correlation between the average mortgage balance and credit score, indicating that credit scores have some predictive measure of mortgage balances. As credit scores increase, so too do mortgage balances.

Also Check: How To Fight Late Payments From Credit Report

How To Check And Understand Your Credit Score

A free credit report does not show a lender enough information to approve you for a mortgage loan. This type of credit report shows what is called “consumer credit.” Consumer credit uses a different scoring model to rate an applicant for a retail credit card or a car loan.

Mortgage lenders pull a different set of scores to paint a more reliable picture of your borrowing habits. This is a credit report that only lenders can run, and most will do it free of charge to earn your business.

So as a borrower, you can’t tell from your free credit report whether you will qualify with a lender. And most lenders won’t pull a more comprehensive credit report until they know you are serious about applying for a loan. In the meantime, your scores help you understand where you might fall on the spectrum as a potential borrower.

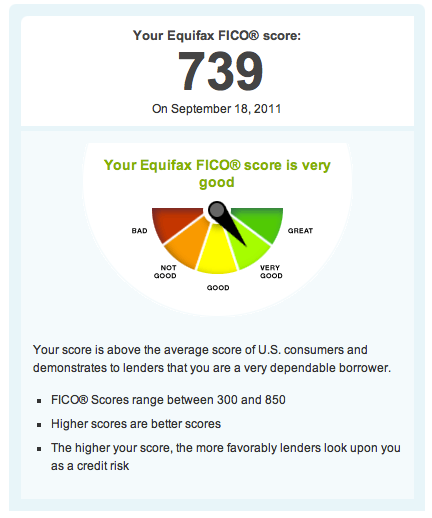

Many lenders use the FICO score, which grades a consumers credit-worthiness on a 300 – 850 range.

- Poor = 579 or lower

- Very good = 740-799

- Exceptional = 800 or higher

A potential borrower with higher credit score is generally viewed as more reliable and less of a risk for lenders the borrower with a lower credit score is seen as higher risk. A better credit score also qualifies you for a lower interest rate on your loan.

How Does My Credit Score Affect My Mortgage Loan

Everybody has a checklist in mind when they start shopping for a house. You probably are thinking hard about size, location and cost but have you given a lot of thought yet to your credit score?

With interest rates rising, banks are tightening their wallets, so its more important than ever to understand exactly what a credit score is and what it means to your future. Unless you have enough money socked away to pay cash for a home, your credit score can be the number one factor that decides whether or not you can afford to buy.

Recommended Reading: Is 850 A Good Credit Score

What Credit Rating Do You Need To Buy A House

Youve spent years saving up your deposit for a new home. Youve waited for the right moment. Now its here. The only thing left is to secure your mortgage. We can help show you how.

If youre thinking of buying a home, youll need a credit rating thats good enough to secure a mortgage. Your credit rating is a snapshot of how youve managed money in the past including past borrowing, repayments, how much of your available credit you routinely use, how many payments youve missed and several other factors to create a score. The higher the score, the better your chance of being offered a better deal on your mortgage.

There are three major credit reference agencies each with a slightly different scoring system. So its a good idea to check your credit rating with all three to find out how you rate. That way, youll know whether youre likely to get a mortgage.

Check Your Credit Score And Reports

Knowing where you stand is the first step to preparing your credit for a mortgage loan. You can check your credit score with Experian for free, and if it’s already in the 700s or higher, you may not need to make many changes before you apply for a preapproval.

But if your credit score is low enough that you risk getting approved with unfavorable terms or denied altogether, you’ll be better off waiting until you can make some improvements.

You can get a free copy of your credit report from Experian, which is updated every 30 days, or from each of the three national credit reporting agencies weekly at AnnualCreditReport.com through December 2022, then every 12 months after that.

Once you have your reports, read through them and watch for items you don’t recognize or you believe to be inaccurate. If you find any inaccuracies, you can ask your lender to update their information with the credit reporting agencies or dispute the items directly with the agencies. This process can improve your score quickly if it results in a negative item being removed.

Recommended Reading: Do Medical Bills Show Up On Credit Report

Why You Should Review Your Credit Report

Accordingly, its important to review your credit report and score prior to looking for a house.

This is because knowing your credit score can simplify hunting for and eventually purchasing a home.

Additionally, having your credit record and score with you, you can:

- Predict your possibility of approval and also your rate of interest.

- Fix any errors or incorrect information in your record prior to you applying.

- Notice anywhere you should improve your general creditworthiness before purchasing.

Recommended Reading: Aargon Collection Agency Reviews

What Credit Score Do I Need To Buy A House

Quick Answer

While credit score requirements vary based on loan type, mortgage lenders generally require a 620 credit score to buy a house with a conventional mortgage.

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

The minimum credit score needed to buy a house can range from 500 to 700, but will ultimately depend on the type of mortgage loan you’re applying for and your lender. While it’s possible to get a mortgage with bad credit, you typically need good or exceptional credit to qualify for the best terms.

Read on to learn what credit score you’ll need to buy a house and how to improve your credit leading up to a mortgage application.

Read Also: How To Delete Medical Collections From Credit Report

Bump Up The Limits On Your Credit Cards

is a term you may want to familiarize yourself with if youre planning to buy a home.

All it means is how much of your total credit limit youre using at any given time.

Some experts say that you shouldnt use more than 30 percent of your available credit but if you really want to improve your score, 10 percent or less is better.

There are two ways to improve your credit utilization:

- pay down your debt

- increase your credit card limits

Paying down debt is preferable because less debt means less strain on your budget.

Lenders also look at how much of your income youre spending on debt repayment each month. If its too high, typically more than 36 to 45 percent, then youll have a hard time getting a home loan.

But paying off credit card debt isnt always a fast process, especially if you also have student loans or a car loan.

Raising your credit limits can be an easier fix to improve your credit utilization.

Many credit card companies let you request a limit increase online. You just plug in your household income, they check your account history and you can have a decision in under a minute.

If thats not an option, you can always call up your credit card companies and ask for a higher limit. Just remember that this tactic only works if youre not adding to your credit card debt.

A good rule of thumb:

Put your credit cards away altogether until after youve bought a home so youre not working against yourself.

The Answer Depends On The Lender And Which Loan Type You Apply For

Your credit scores can be an important factor in the homebuying process. Thatâs because the lender will typically check your credit scores when you apply for a mortgage. A good credit score generally makes you an attractive borrower because it shows youâve managed your credit well. And the better your credit scores, the better chance you may have of being approved for a mortgageâand a lower interest rate.

The minimum credit score needed to buy a house depends on the mortgage program and the lender. According to mortgage company Fannie Mae, a conventional loan usually requires a credit score of at least 620. But you may qualify for a government-sponsored loan with a lower score. Read on to learn more about credit scores and how they impact the homebuying process.

Recommended Reading: How To Know My Credit Score

Order Copies Of Your Credit Report

Get started by ordering copies of your credit report. This way, you can get an idea of everything a lender would see when reviewing your loan application.

First, check to make sure that all the information is 100% accurate. From there, look at where there are weaknesses on your report. Is the amount of debt you owe really high?

Other Factors Lenders Consider

Mortgage lenders don’t just look at your credit score when determining your rate, though. They’ll also consider your debt-to-income ratio how much of your gross monthly income goes toward debt paymentsas well as your down payment and available savings and investments.

So while it’s important to work on your credit score before you apply for a mortgage, avoid neglecting these other important areas of your financial situation.

Also Check: Which Of The Following Does A Credit Score Mainly Indicate

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.