What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Your Habit Can Make Good Credit Score

Having a good credit score is the best way to save money on your mortgage, car loan, credit cards, and other interest rates. But how do you get there? All it takes is responsible financial choices with money, credit, and debt to achieve that. it may sound hard, but if you consistently follow the habits listed, then you can get your credit score up. It is important to understand these habits that will not only improve your finances but also increase your credit score over time.

You May Like: What Credit Score Do Dealerships Use

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

How To Run Your Own Background Check

When applying for jobs, you give employers permission to perform a background check on you. Once they complete this process, you may consider asking the employer or for the results to help you understand and review the information provided. However, if you are interested in running a background check on yourself, you can use the following steps to conduct this process effectively:

Don’t Miss: Do Credit Checks Affect Your Credit Score

Can Skipping Bill Payments Affect Your Credit Score

Are your monthly bills coming due and you just dont have the money to pay for all of them? This is a fairly common scenario and likely, you make a decision to forgo one or more of the bills. This ends up affecting your credit score in a negative way.

In order to understand how skipping bill payments can affect your credit score, you need to understand how your credit score is calculated. Before that, get to know about the impact of skipping monthly payments on your credit score.

File A Dispute With The Credit Reporting Agency

Once you have your report, look through each account and see if there are creditors or accounts you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, dispute them directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Also Check: How To Get Medical Collections Off Credit Report

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

Don’t Miss: Does National Grid Report To Credit Bureaus

Request A Change To Your Credit Report

If you believe there is inaccurate, incomplete or out-of-date information inyour credit report, you can apply to amend the information held on the CentralCredit Register.

If you believe you have been impersonated by another person, you have theright to place a notice of suspected impersonation on your report.

Add a statement to your credit report

It is possible to add a personal statement to your credit record to clarifyit. This is known as an explanatory statement.

For example, if you have had significant expenses due to relationshipbreakdown, bereavement, illness or another cause, you may add these details toyour record.

The statement must be factual, relevant to the information in the creditreport, and under 200 words. It should not contain information that couldidentify another individual .

You can get more information in the factsheet Placingan explanatory statement on my credit report .

The statement is added to your credit report and it can be viewed when yourdata is accessed. However, lenders do not have to take your statement intoaccount when assessing you for a loan.

How Much A Rapid Rescore Costs

Lenders pay a fee to credit-reporting agencies to request updates to your credit reports, but the borrower typically doesn’t pay a fee for the service. Under the FCRA, lenders aren’t allowed to charge a fee to borrowers for disputing errors on a credit report. However, nothing is freeyou’ll pay for your lenders capabilities in the interest rate and closing costs of the loan.

Recommended Reading: What Credit Score Is Needed To Buy A Home

What Kind Of Cheek To Run

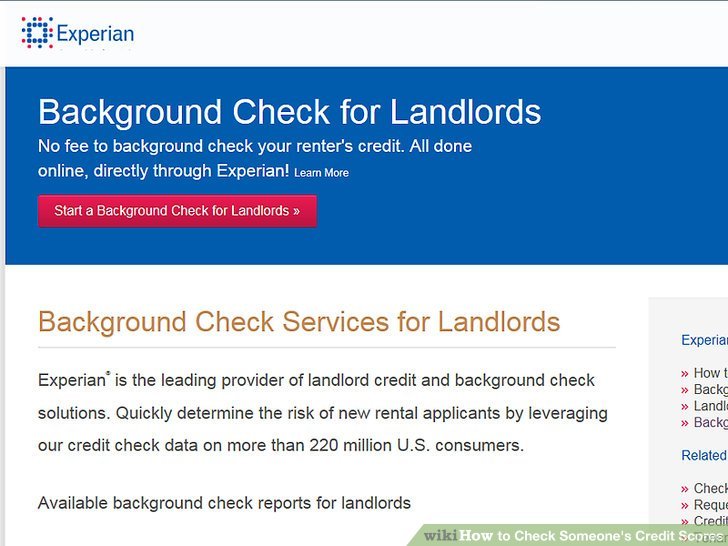

Here are some factors to consider when selecting a commercial service for a self background check:

You want to ensure your preferred option is of likely standard with what a potential landlord or employer will use.

These guidelines will help narrow your options to the most reliable pick:

- Seek a provider that offers background check services to landlords and employers.

- Do not trust services that do not meet the U.S FCRA standard

Review Your Report & Dispute Any Errors

Reading your credit report is one of the most vital steps when it comes to building credit and maintaining it. While reviewing your report, make sure your personal and account information is accurate.

Common credit reporting errors to look for include the following:

- Incorrect name or address

- Paid accounts that are listed as open

- Account balance or credit limit errors

- Accounts that dont belong to you

If you spot an error, dispute it with each credit bureau that lists it on your report or the creditor that reported it. The investigation will typically take 30 days to complete. Once its over, the credit bureau will remove the information if it finds that it is in fact an error.

You May Like: How Long Does Repossession Stay On Credit Report

How To Remove Negative Items From Your Credit Report Yourself

First, it’s important to know your rights when it comes to your credit history. Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the bureaus find that the information you disputed doesnt belong in your record or is outdated, they are obligated to remove it.

Common credit report errors include payments mistakenly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number or identifying information.

Bear in mind that correct information cannot be removed from your credit report for at least seven years. So, if your score is low due to down because of accurate negative information, youll need to repair your credit over time by making payments on time and decreasing your overall amount of debt.

Here are some tips to help you repair your credit history:

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Read Also: How To Increase My Credit Score Quickly

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Does Your Credit Score Go Down When You Check It

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

The Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

Don’t Miss: How To Get Credit Report Without Social Security Number

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

What Is A Background Check

A background check represents a pre-employment screening process used by employers. They can perform background checks themselves or use a third-party screening service. This process inspects candidates’ background information using public records and other resources to verify their identity and the information they provided to the employer. They want to ensure that the individuals they plan on hiring provide accurate information and align with company policies or values.

A background check often represents one of the final steps in the hiring process, assuring employers that they have made the right decision.

Related: The Hiring Process: What To Expect at Every Stage

Read Also: What Is Syncb Ntwk On Credit Report

Free And $1 Credit Reports

Prior to the Fair and Accurate Credit Transactions Act of 2003, there were dozens of impostor websites on the internet promising to give you a free annual credit report. These sites would request your credit card information and enroll you in a trial membership to a .

If you didn’t remember to cancel the trial, your credit card would be charged for a full period of the credit monitoring service. These gimmicks still exist, although now most of them offer your credit report for $1, rather than for free. The legitimate website for ordering your free annual credit report doesn’t require a credit card and doesn’t ask you to sign up for any trial subscription.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

You May Like: How To Read Equifax Credit Report

Cnbc Select Reviews Credit Report Basics And How You Can Get A Free Credit Report So You Can Start Monitoring Your Credit Now

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We earn a commission from affiliate partners on many offers, but not all offers on Select are from affiliate partners.

Monitoring your credit report is a smart and simple way to be proactive about your finances. Checking your credit report regularly can help you spot fraud early and ensure the correct information is reported to the credit bureaus. There are many resources available so you can get a free credit report as often as once a month.

Below, CNBC Select reviews credit report basics and different ways you can get a free credit report, so you can start monitoring your credit now.

Your Mileage May Vary

Rapid rescoring is often a successful strategy, but it can backfire or fail to produce the results you and your lender expect. In some cases, your credit score may drop if you take actions that hurt your credit before you request a rescore. Before moving forward, discuss the details with your lender .

Steer clear of scams by avoiding third-party rapid-rescoring companies that promise to quickly raise your score by disputing negative items that are correct. This isn’t how rapid rescoring works, and legitimate lenders and companies will never make this pledge.

Recommended Reading: What Credit Score Does Chase Use